A Detailed Look at the 2024 Cryptocurrency Market Trends and Predictions

From Bitcoin's Price Trajectory to Tether's Regulatory Challenges: Navigating the Evolving Crypto Ecosystem in 2024 | That's TradingNEWS

Analyzing the 2024 Crypto Market: Trends, Predictions, and Challenges

Evolving Accounting Standards for Cryptoassets

2024 is poised to witness significant advancements in crypto accounting standards. The Financial Accounting Standards Board's introduction of the first crypto accounting rule under Generally Accepted Accounting Principles marks a pivotal moment. This rule allows firms to report crypto assets at fair market value and mandates additional disclosure, setting the stage for more comprehensive regulations. However, its limited scope—excluding assets like wrapped tokens, stablecoins, and NFTs—indicates room for future expansion in regulatory frameworks.

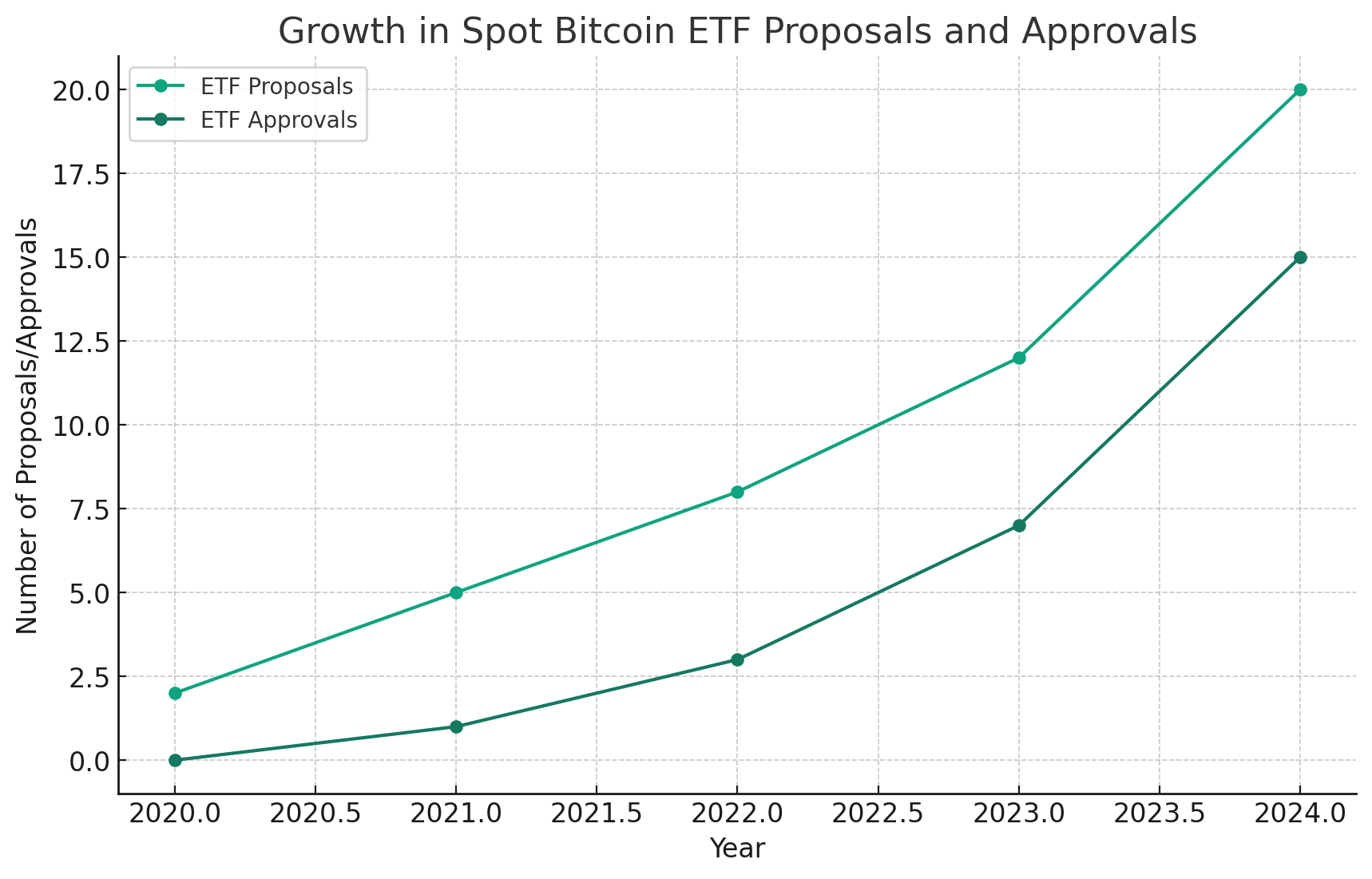

The Emergence of a Spot Bitcoin ETF

The likelihood of a spot bitcoin ETF approval in 2024 is increasingly high, with proposals from major firms like Wisdom Tree and Blackrock under SEC review. An ETF would not only legitimize bitcoin for a broader audience but also spur greater transparency and reshape conversations around cryptoassets in the payments sector. The approval is anticipated to be a significant boon for the industry, fostering maturity and reducing unfounded rhetoric.

Tether's Regulatory Crossroads

Tether, amid escalating regulatory scrutiny and a high-risk label from S&P, faces a critical year. Despite its prominence in the DeFi sector and as the most liquid stablecoin, USDT is challenged by transparency concerns and U.S. regulatory pressures. 2024 might be a decisive year for Tether to address these concerns or risk increased delisting from exchanges.

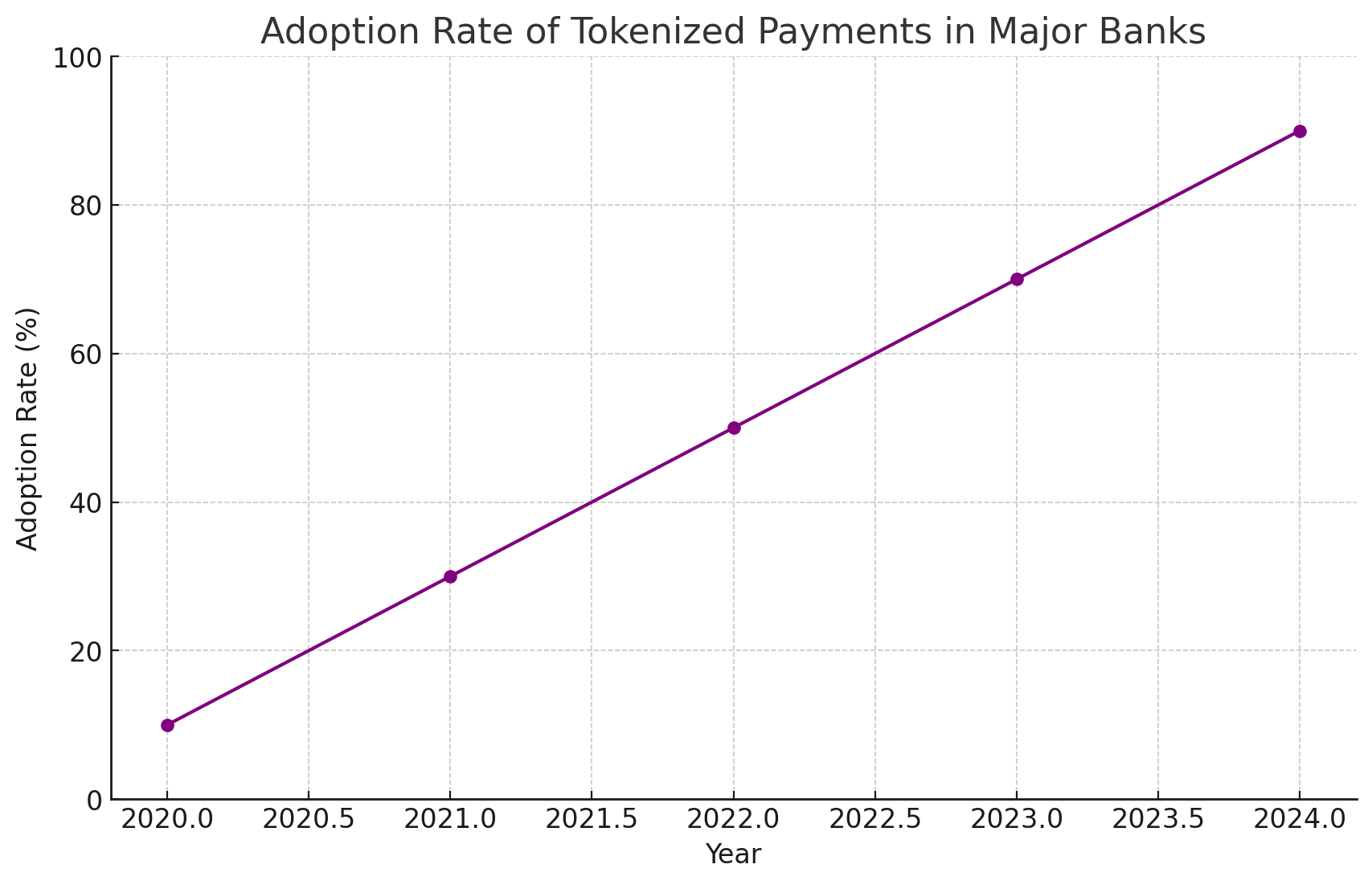

Tokenized Payments and U.S. Banks

Major financial institutions, including J.P. Morgan, are expected to further embrace tokenized payments in 2024. This progression illustrates the growing recognition of the business case for tokenized payments among traditional financial entities. The expansion of such services by companies like PayPal underscores a broader adoption trend in the financial landscape.

Bitcoin's Price Trajectory

Predictions for Bitcoin's price in 2024 vary widely, with some analysts forecasting a rise to over $60,000. This projection is based on factors such as institutional adoption and evolving market dynamics. However, it's important to approach these predictions with caution due to the inherent volatility of the crypto market.

Impact of a Bitcoin ETF on Institutional Capital

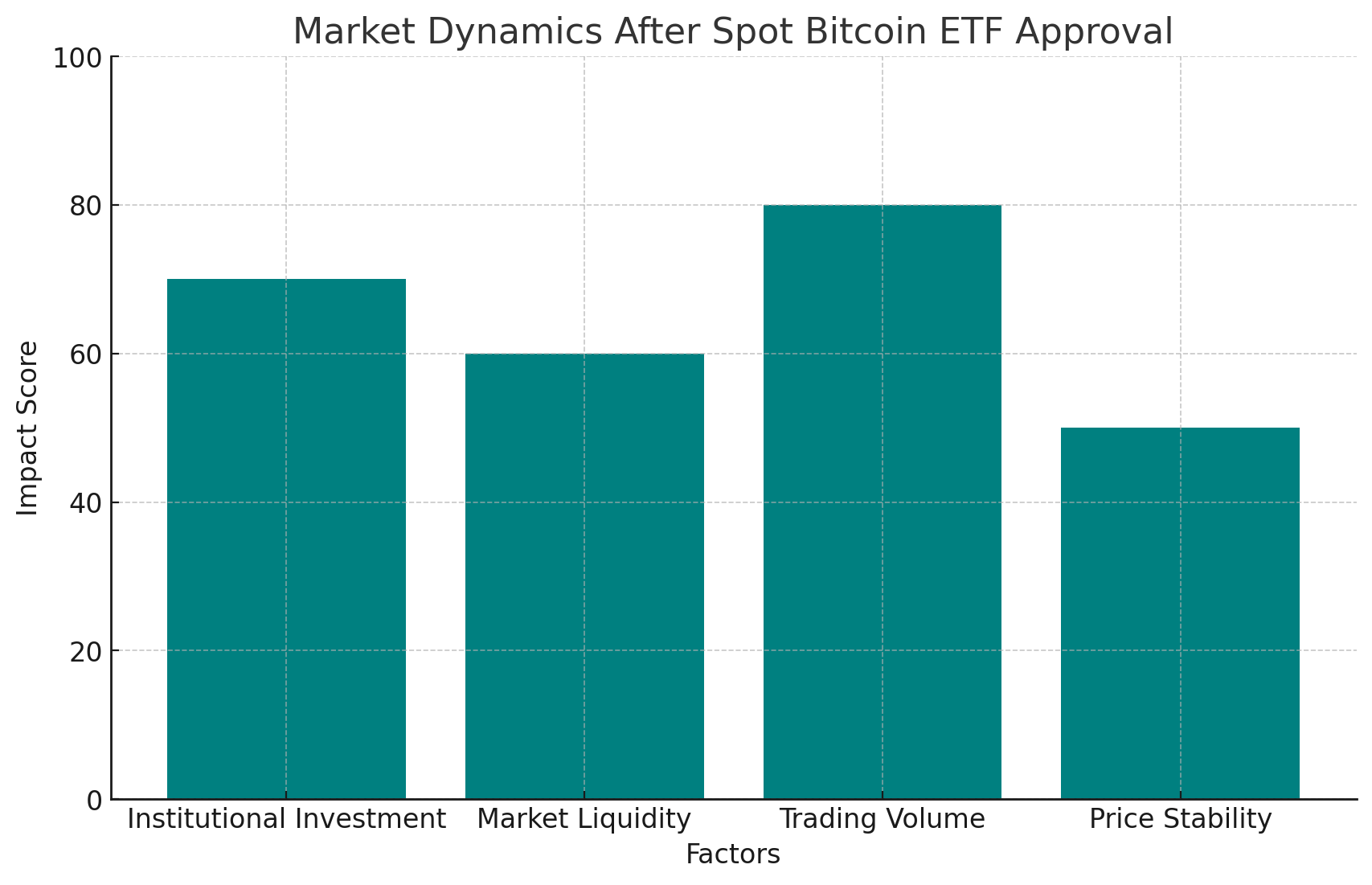

The potential approval of a spot Bitcoin ETF, with a 90% probability according to Bloomberg, could significantly influence Bitcoin's value. It would pave the way for regulated U.S. corporate entry into crypto, attracting major trading firms and enhancing market liquidity. An ETF could also transform cryptocurrency exchange operations, leading to more competitive trading costs.

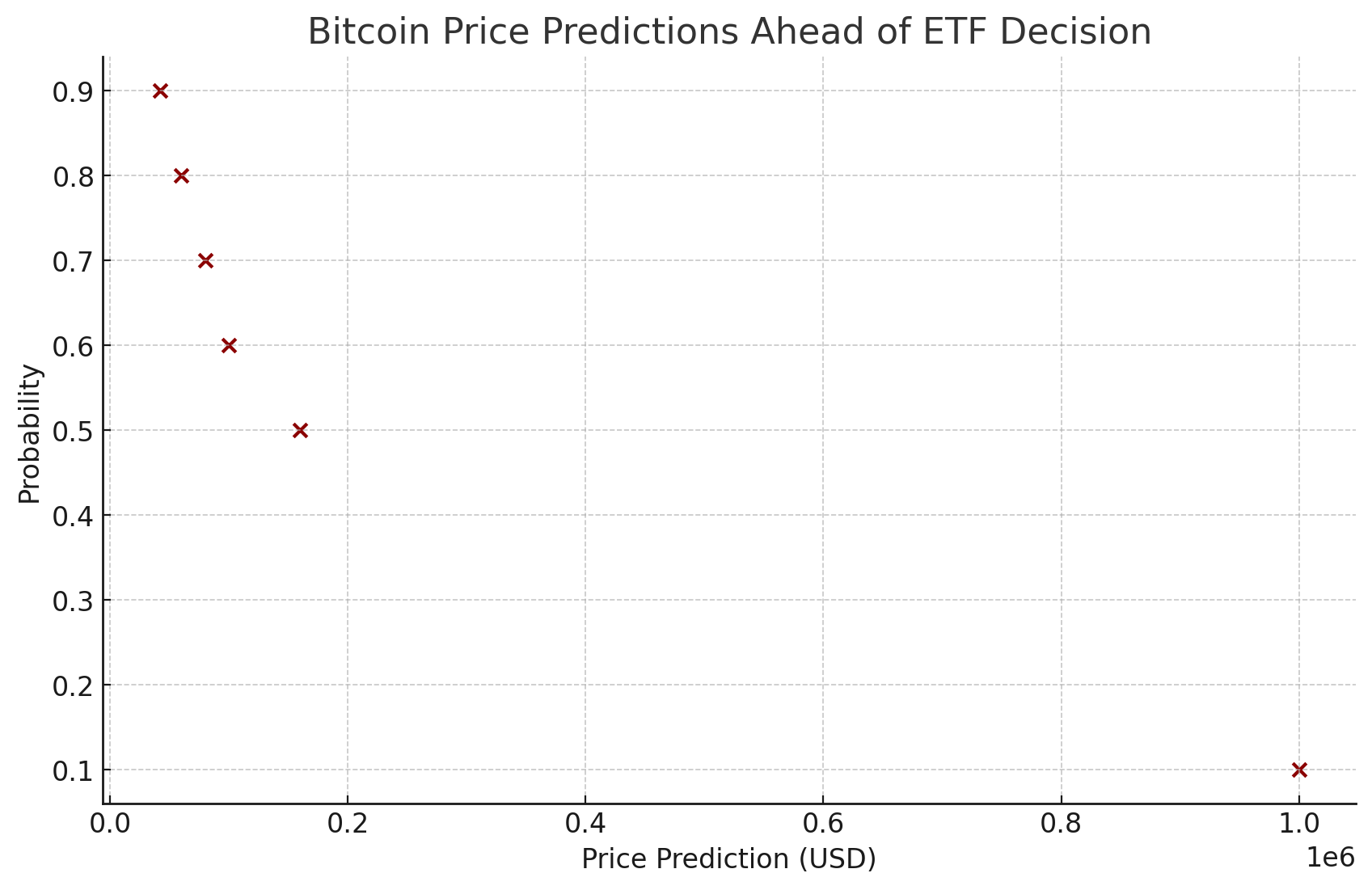

Bitcoin's Price Ahead of ETF Decision

Experts offer a range of price predictions for Bitcoin, from a conservative $42,000 to an ambitious $1 million. These forecasts consider factors like institutional influx, supply constraints, and the upcoming Bitcoin halving event. However, the speculative nature of these predictions necessitates a cautious approach from investors.

Anticipated Market Dynamics Post-ETF Approval

The approval of a spot bitcoin ETF, especially from entities like BlackRock and Fidelity, is expected to catalyze a surge in institutional investment. This influx could lead to unprecedented price increases, with some industry veterans predicting Bitcoin reaching $1 million.

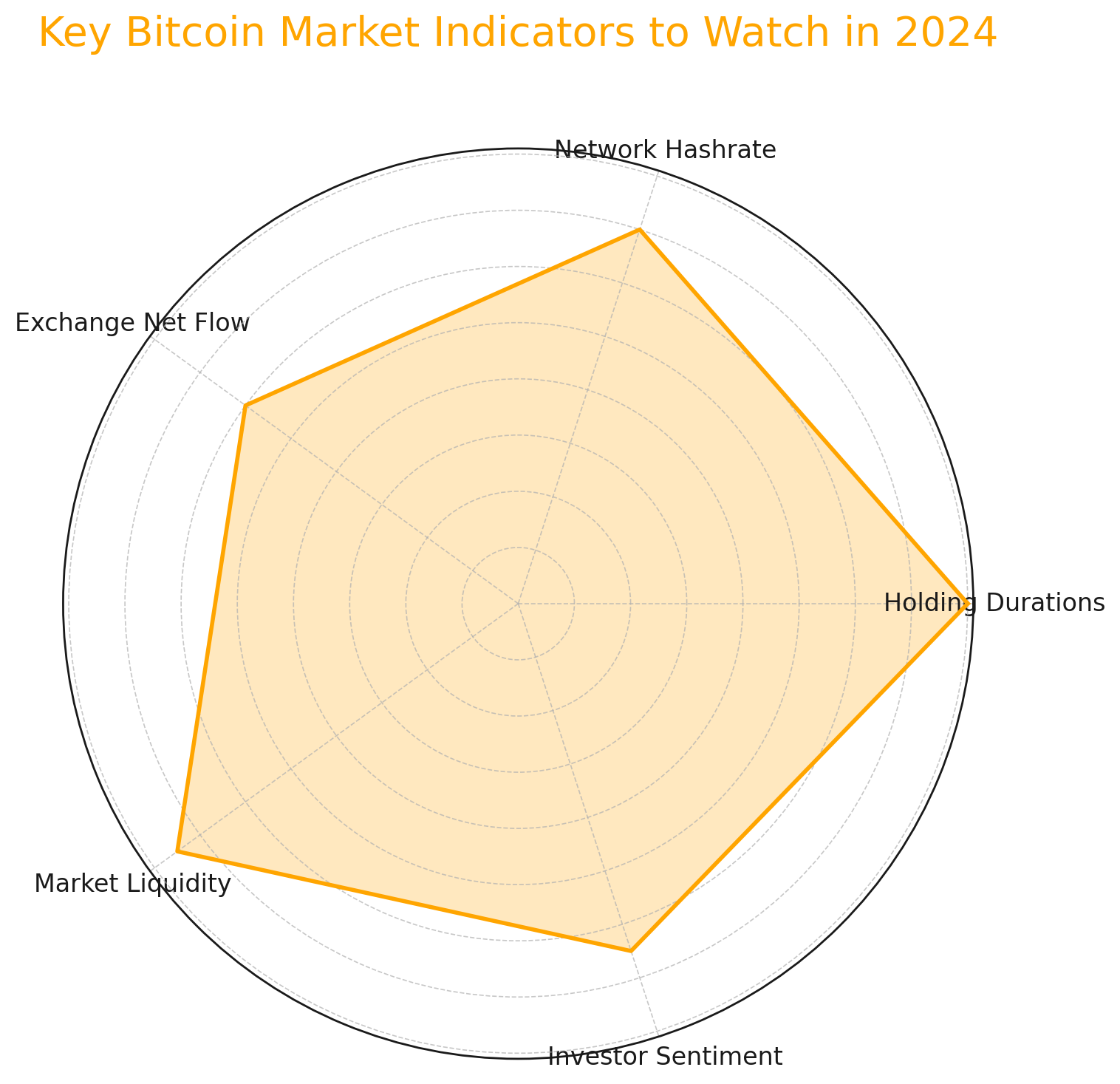

Key Market Indicators to Watch

The distribution of Bitcoin holding durations, network hashrate, and exchange net flow are critical indicators for market dynamics. A majority of Bitcoin addresses are held by long-term 'Holders', suggesting stability. The rising hashrate enhances network security and asset scarcity, while the negative net flow from exchanges could decrease selling pressure.

Bitcoin's Current Market Sentiment

As of now, Bitcoin maintains a price around $42,600, with a neutral market sentiment indicated by the Relative Strength Index (RSI). The 50-Day Exponential Moving Average (EMA) suggests a potential bullish trend in the short term.

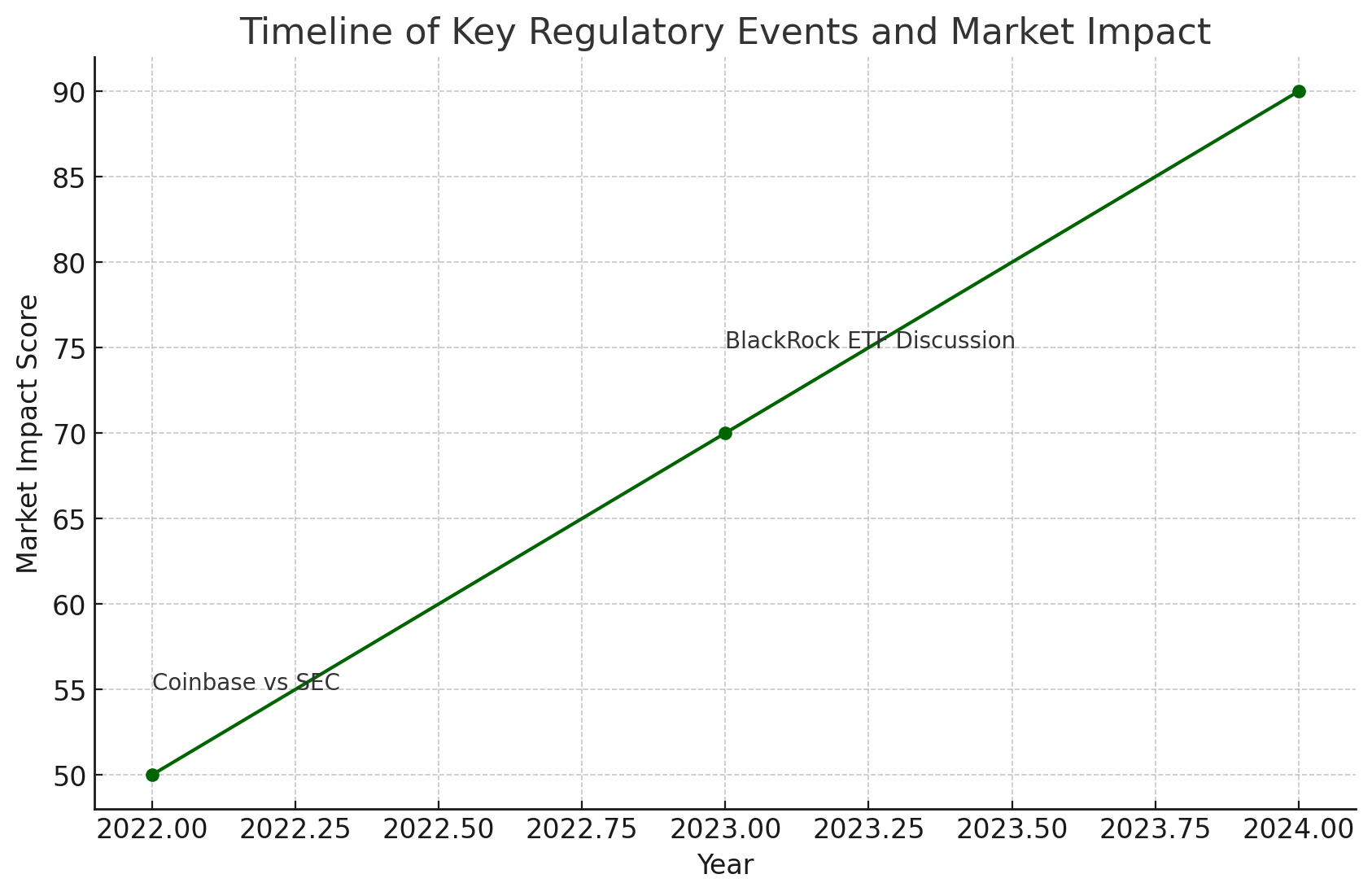

Regulatory Battles and Market Implications

Coinbase's legal challenge against the SEC for regulatory clarity and BlackRock's discussions regarding a Bitcoin ETF highlight the ongoing regulatory battles in the crypto space. These developments are crucial in shaping the market's future and investor sentiment.

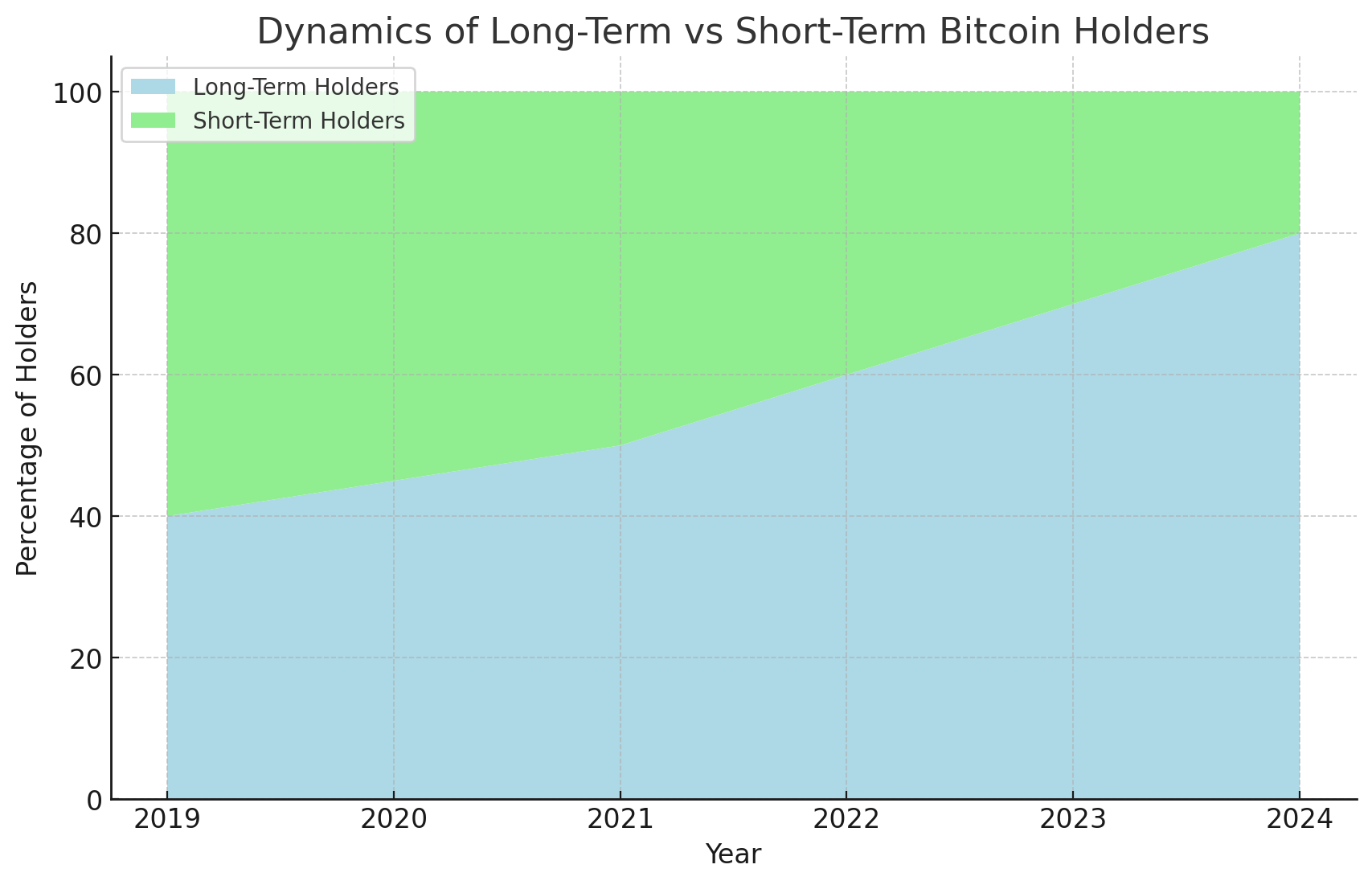

Long-Term Holder Dynamics and Market Recovery

Glassnode reports a significant increase in Bitcoin held by long-term holders in 2023, indicating a shift towards profitability for investors. This trend, coupled with the anticipation of Bitcoin halving and ETF approvals, sets the stage for potential market rallies in 2024.

Technical Analysis and Future Outlook

Bitcoin's technical analysis shows an uptrend with sustained levels above $42,000. The potential to breach resistance levels in the $44,700 to $45,300 range could open targets towards $48,000, reflecting an optimistic market outlook for 2024.

Summary

The year 2024 promises to be a transformative period for the crypto market, with advancements in regulatory frameworks, the potential introduction of a spot Bitcoin ETF, and increasing institutional involvement. However, the inherent volatility and regulatory uncertainties in the crypto space necessitate a cautious and well-informed approach from investors.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex