Alibaba Group Holdings Ltd (NYSE:BABA): A Comprehensive Analysis

Overview: Reassessing Alibaba's Market Position

In the current financial landscape, Alibaba Group Holdings Ltd (NYSE:BABA) presents an intriguing case for investors. Following a tumultuous period marked by regulatory challenges and internal restructuring, the company now appears as a potential value play, poised for a rebound in 2024. This analysis examines Alibaba's financial health, market positioning, and future prospects.

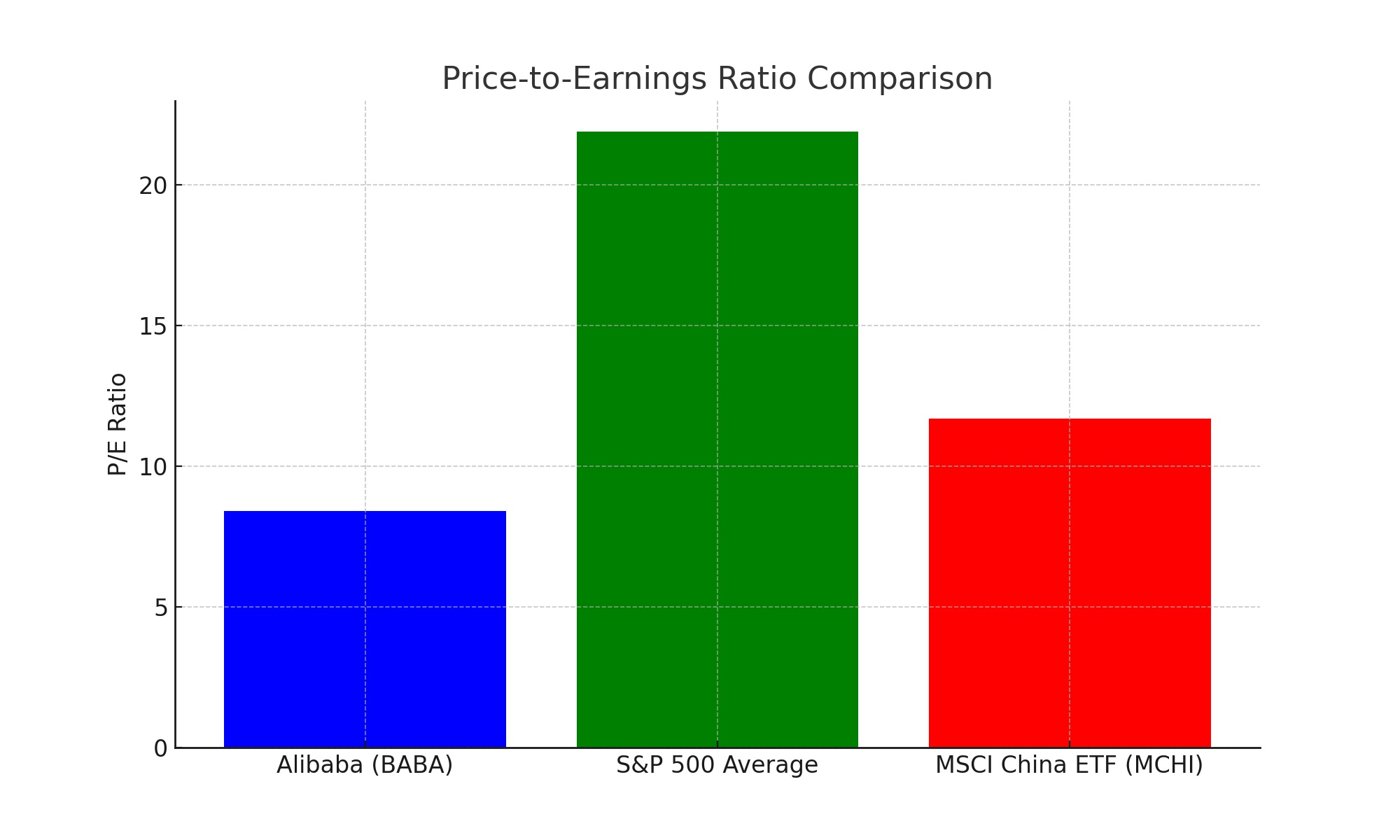

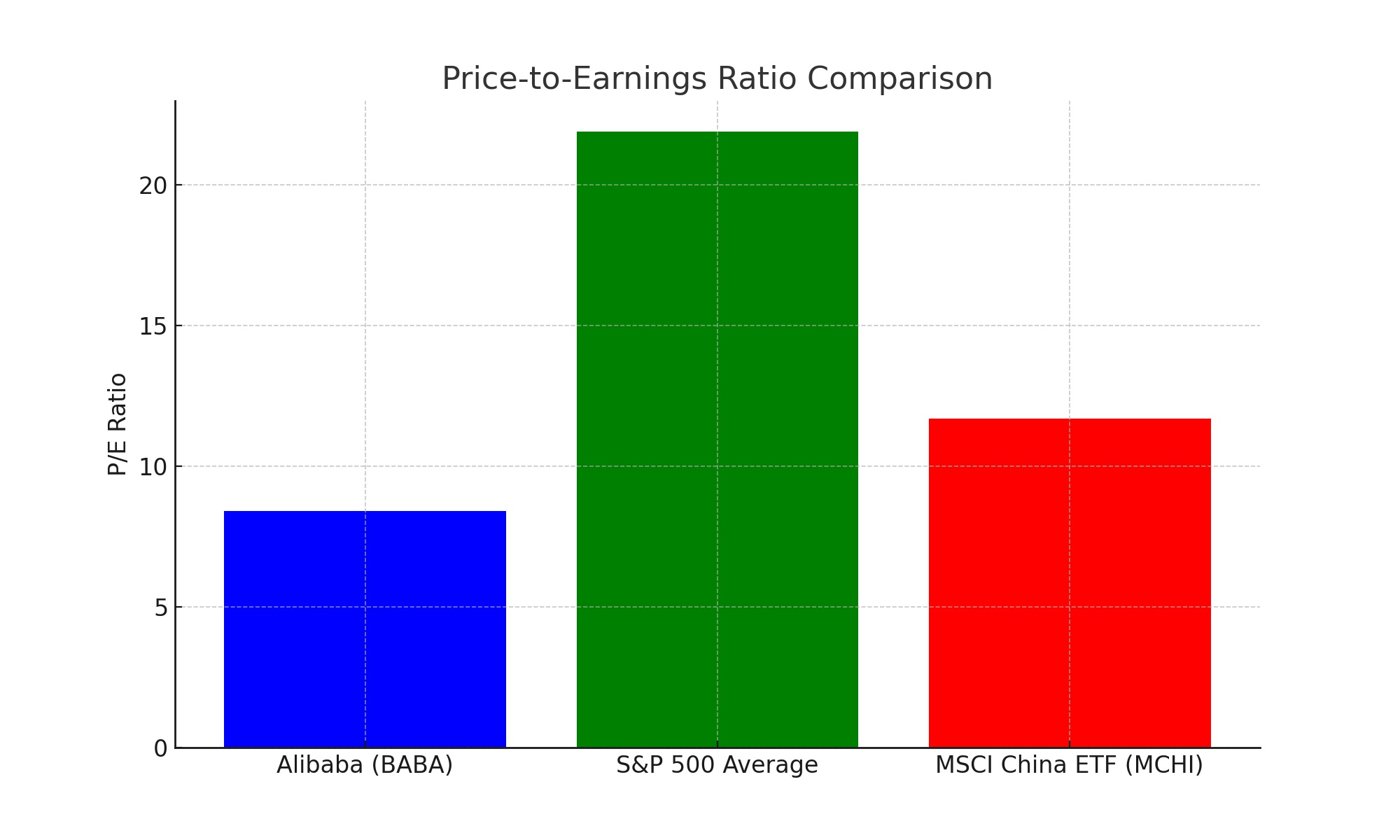

Valuation: A Comparative Study

At a price-to-earnings ratio of 8.4, Alibaba's stock is markedly undervalued, especially when contrasted with broader market benchmarks. The S&P 500's average P/E ratio stands at 21.9, while the iShares MSCI China ETF (NASDAQ:MCHI) averages at 11.7. This disparity in valuation highlights Alibaba's potential as an investment, considering its significant drop from a market cap of $800 billion in 2020 to below $200 billion today.

Corporate Restructuring and Leadership Changes

Alibaba's strategic shift, including the appointment of a new CEO and Joseph Tsai's elevation to chairman, alongside a restructuring into six distinct business units, indicates a renewed focus on agility and innovation. These changes, aimed at boosting accountability and autonomy, could be pivotal in navigating the company through its current challenges.

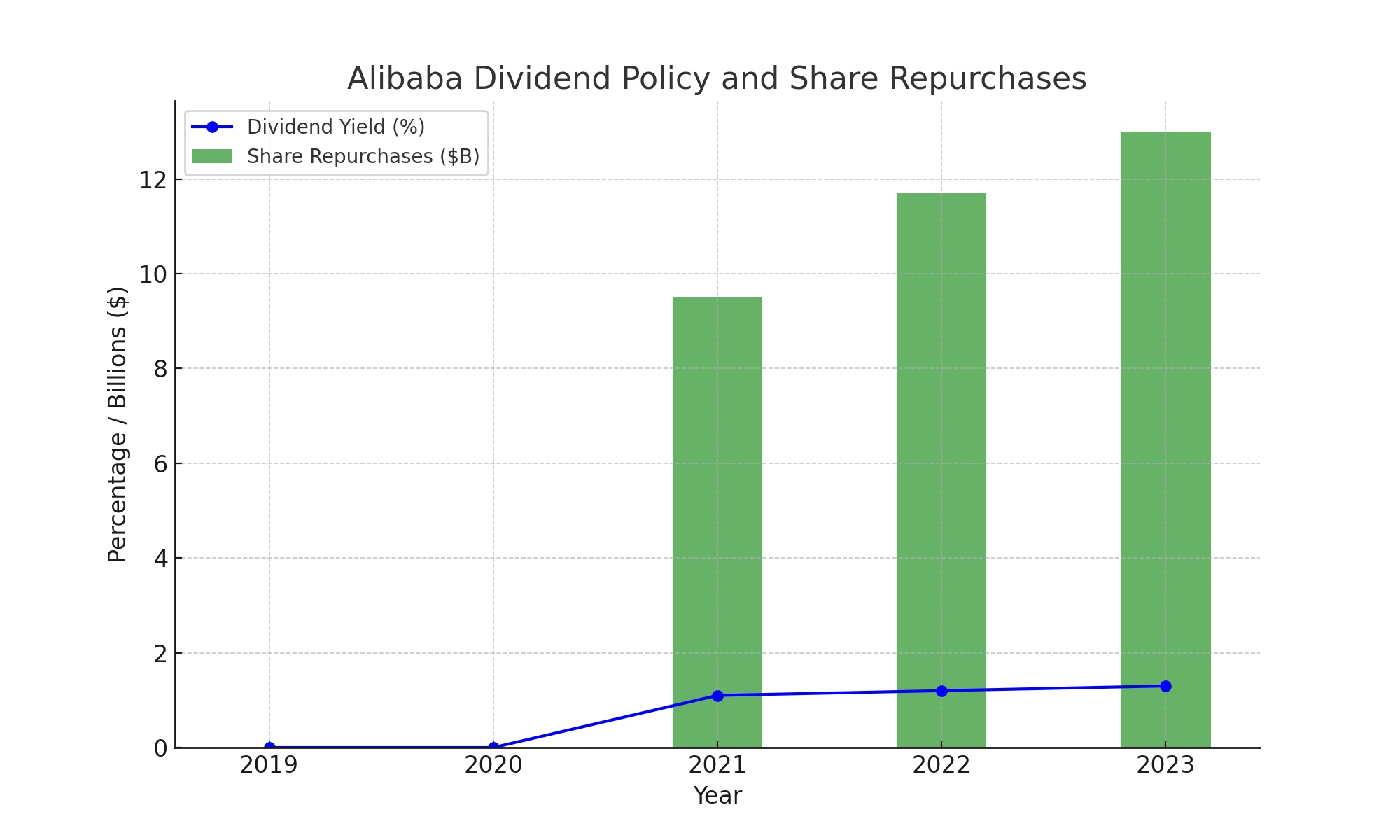

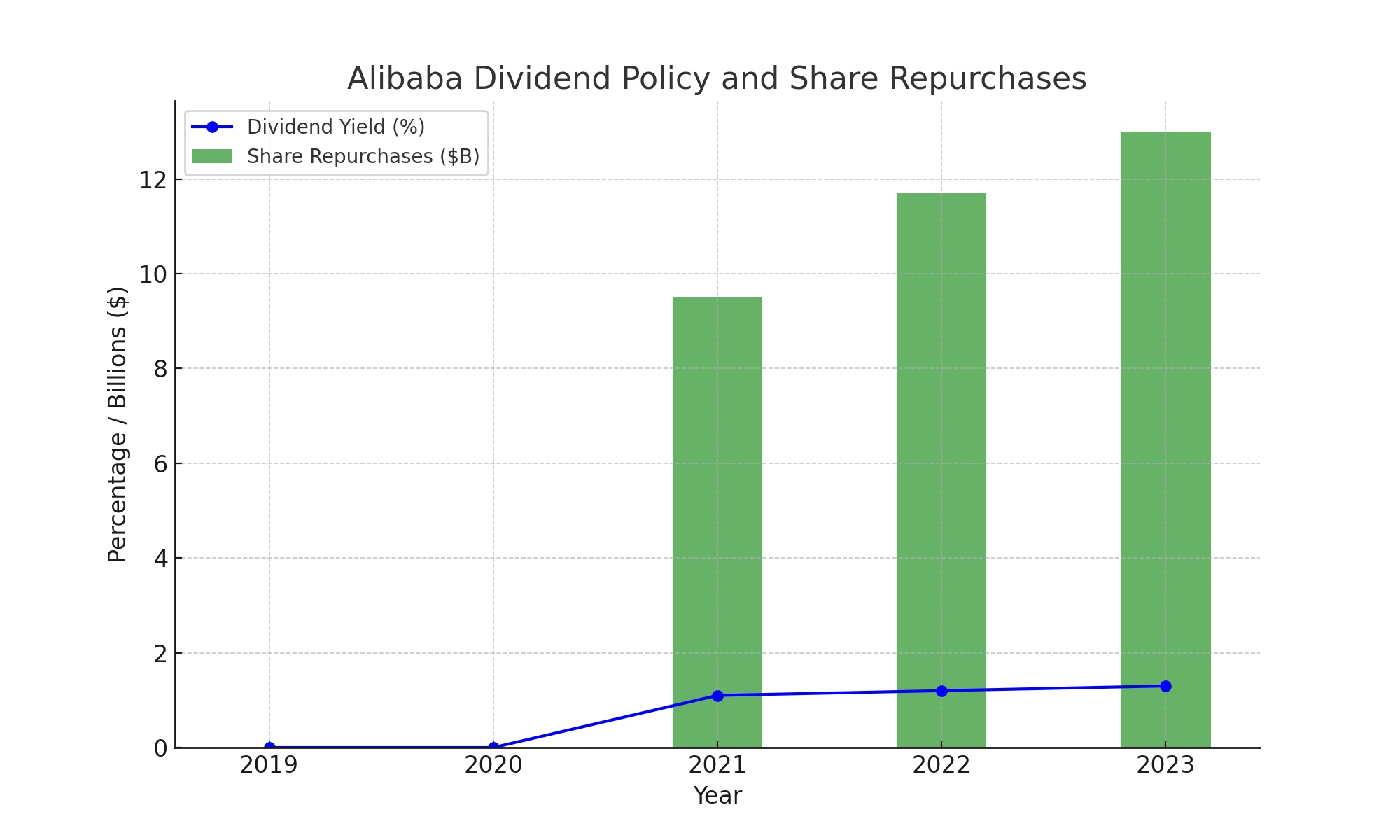

Dividend Policy and Share Repurchases

The initiation of a dividend payout, currently at a yield of 1.3%, coupled with a significant share repurchase program (with $9.5 billion bought back in 2023 and an additional $11.7 billion authorized), signals a shift towards shareholder value creation. These financial maneuvers are crucial in enhancing investor confidence and suggesting a potential undervaluation of the stock.

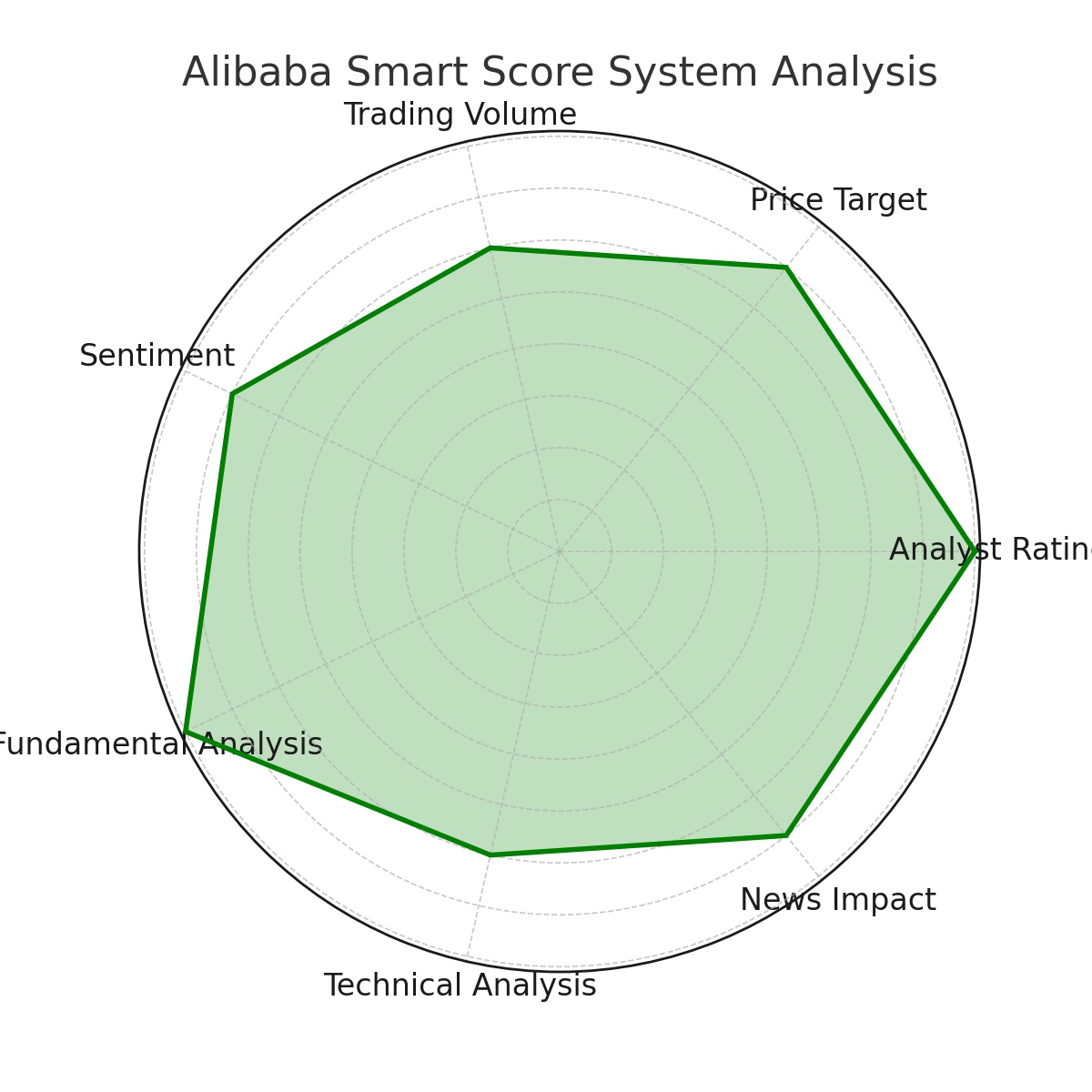

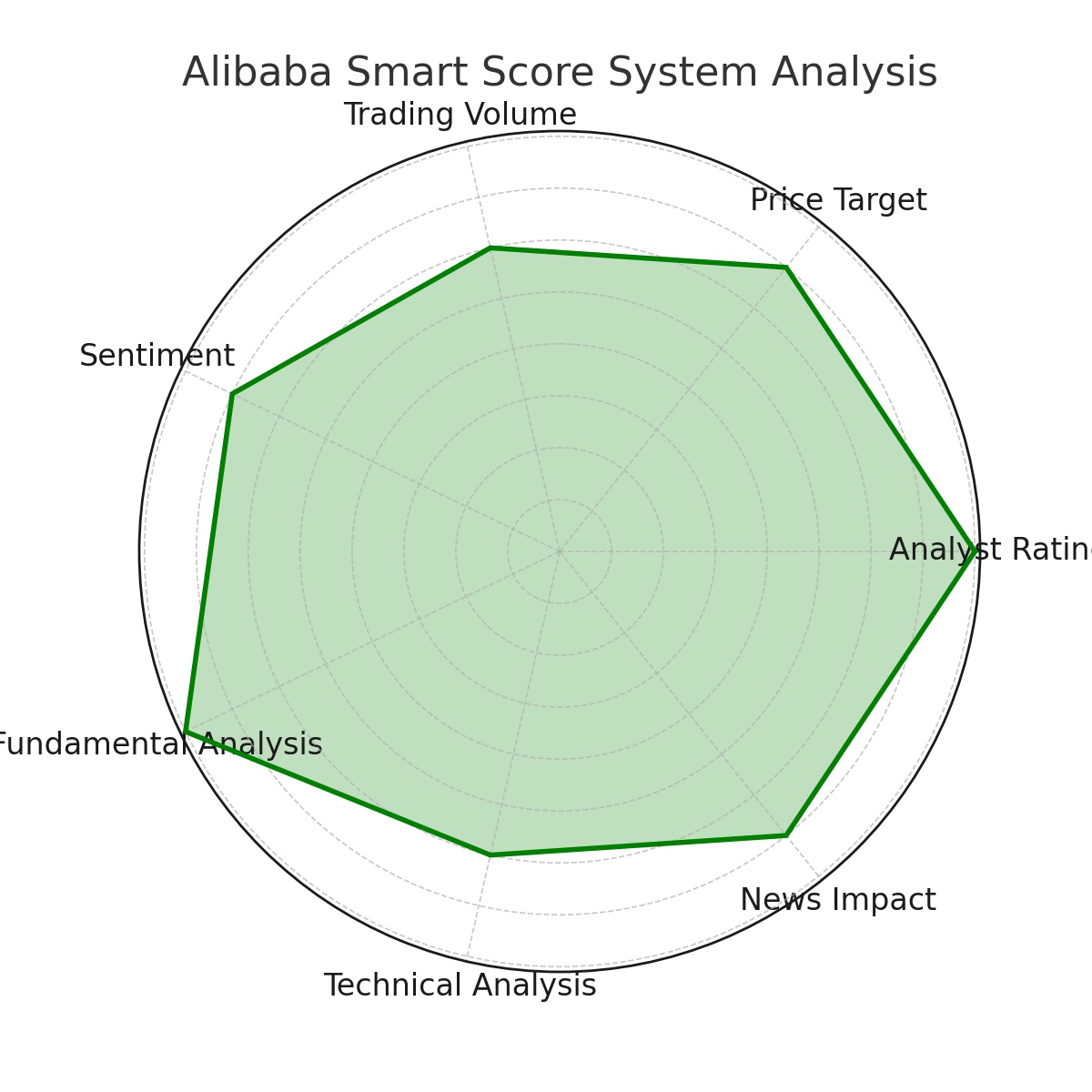

Wall Street's View and Smart Score System

BABA enjoys a Strong Buy consensus rating from Wall Street analysts, with an average price target implying significant upside potential. Moreover, TipRanks' Smart Score system assigns Alibaba an Outperform-equivalent rating of 8, further affirming its potential for market outperformance.

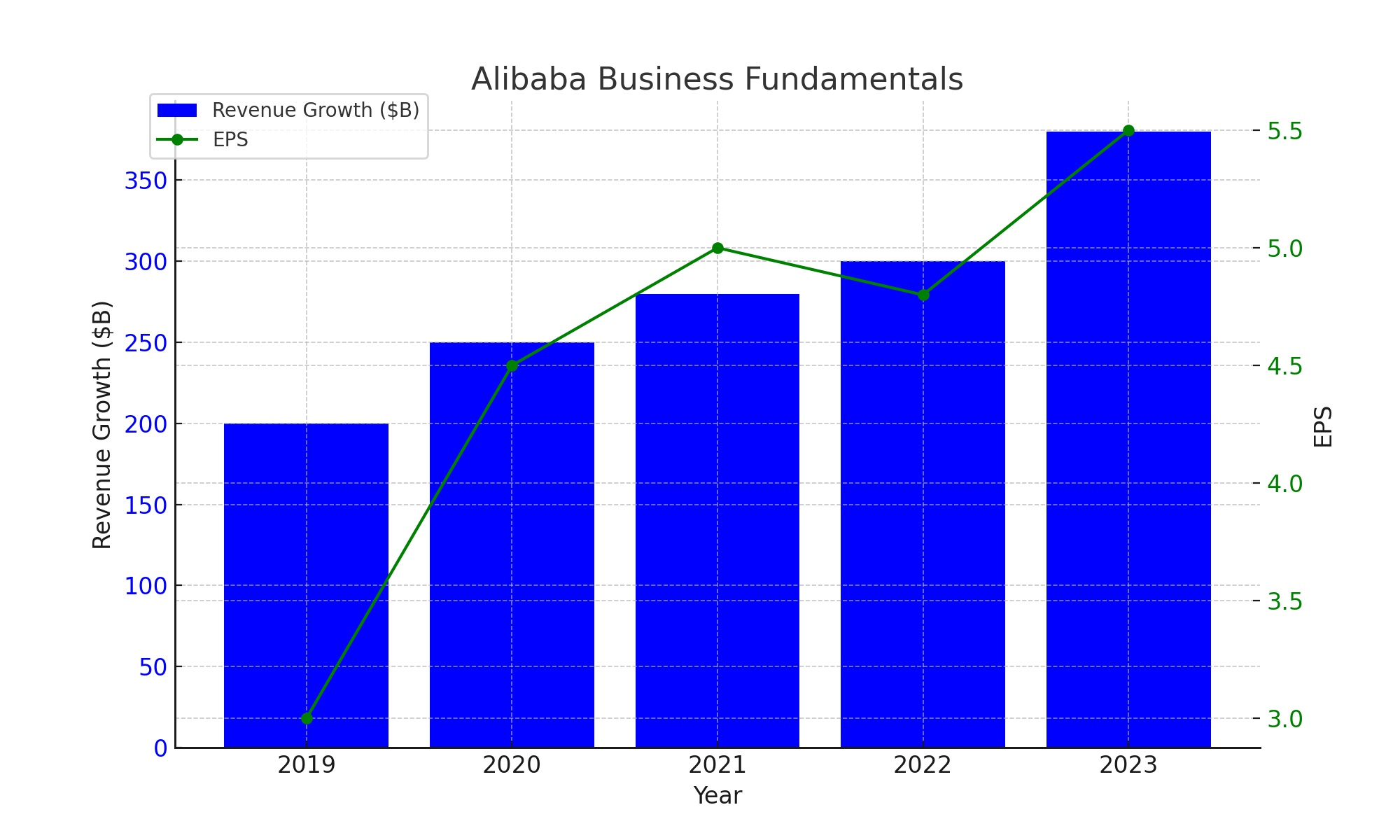

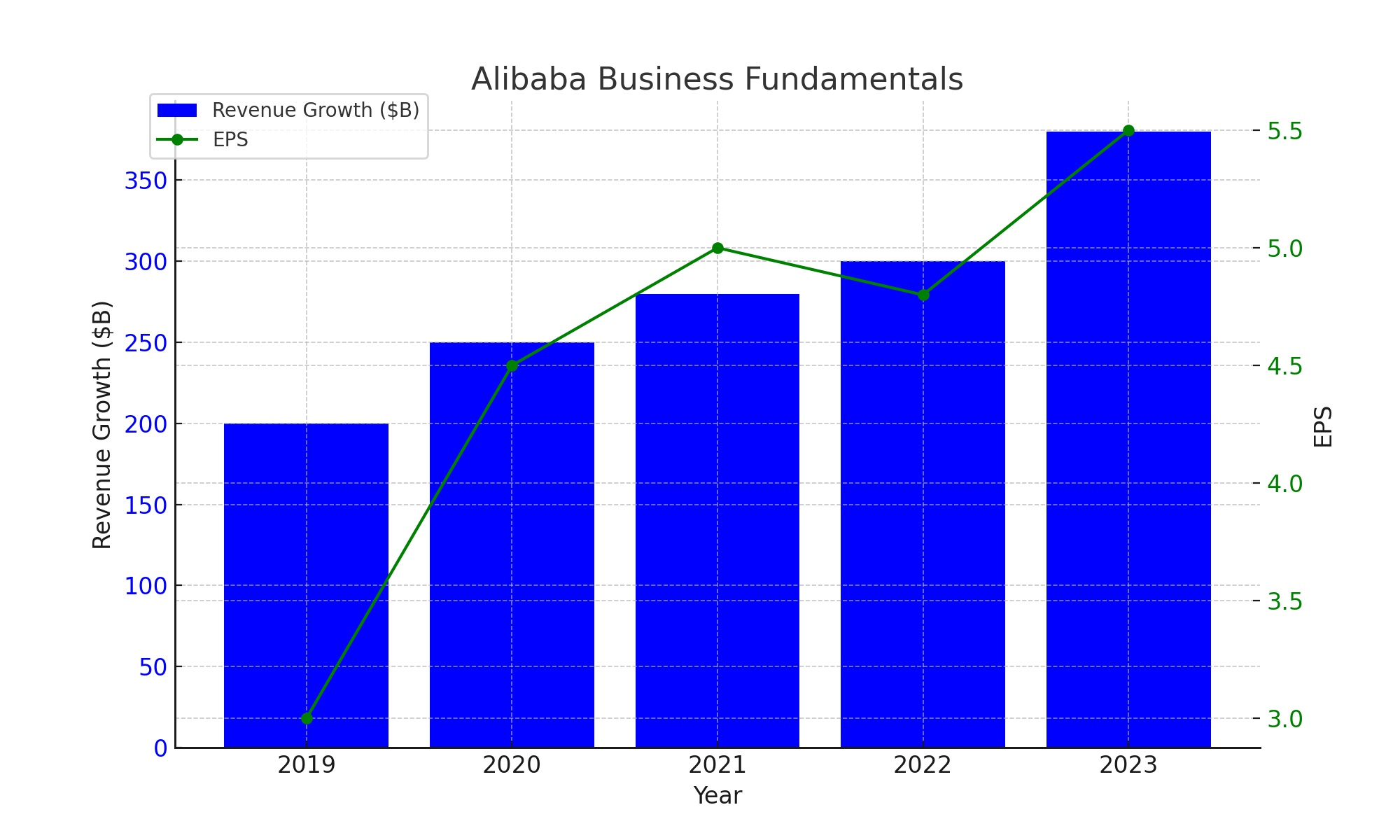

Exploring Alibaba's Business Fundamentals

Despite the setbacks, Alibaba's business fundamentals remain stable. Its revenue, although facing some growth challenges, is up 38% since its stock peak, and its earnings per share are on a recovery trajectory. The company's diversification into AI integration in cloud and e-commerce sectors, along with China's technological advancements, present additional growth opportunities.

International Expansion and Market Dynamics

Alibaba's presence in the global dropshipping industry and its strong foothold in Southeast Asia suggest avenues for international revenue growth. However, emerging competition and the broader economic landscape in China pose risks that need careful consideration.

Financial Performance and Projections

Analyzing Alibaba's recent financial performance reveals a decline in EPS and net margin, affected significantly by regulatory actions. However, the company's cloud intelligence group and logistics operations continue to show promise. The potential for spin-offs in these sectors could lead to substantial investor payoffs, albeit resulting in a smaller corporate footprint.

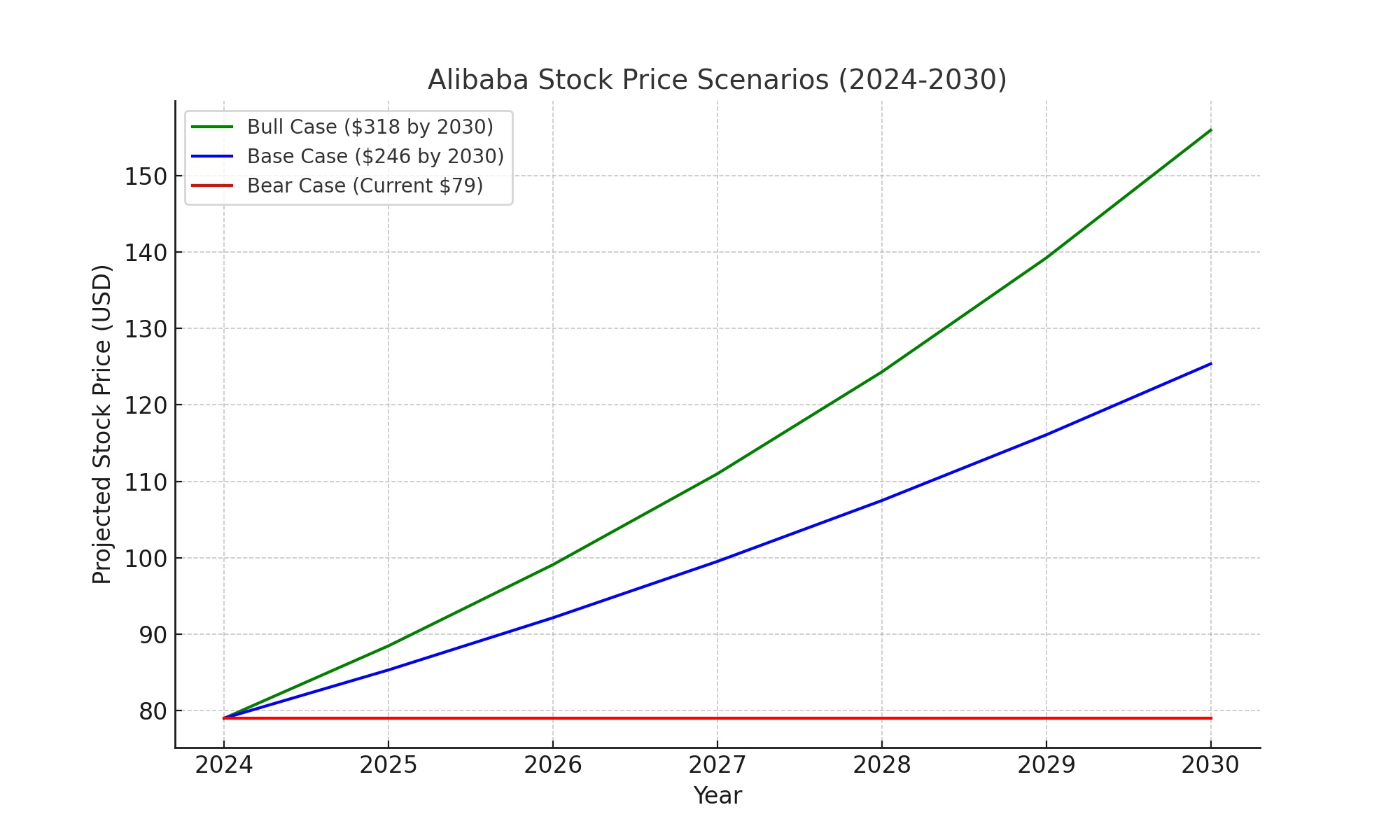

Price-to-Earnings Trends and Future Stock Projections

Alibaba's P/E multiple has experienced volatility, currently hovering around 17.2x. Projecting forward, assuming an 18x multiple and factoring in average EPS growth, the base-case scenario for Alibaba's stock in 2030 is approximately $246. This projection, however, hinges on the company's ability to navigate regulatory challenges and capitalize on its core competencies.

Potential Scenarios: Bull, Base, and Bear Cases

- Bull Case: Assuming a P/E multiple of