Amazon in 2023: Growth, AI Ventures, and Regulatory Challenges

Unpacking Amazon's Financial Resilience, AWS Dominance, and Strategic Moves in Artificial Intelligence Amidst Antitrust Scrutiny | That's TradingNEWS

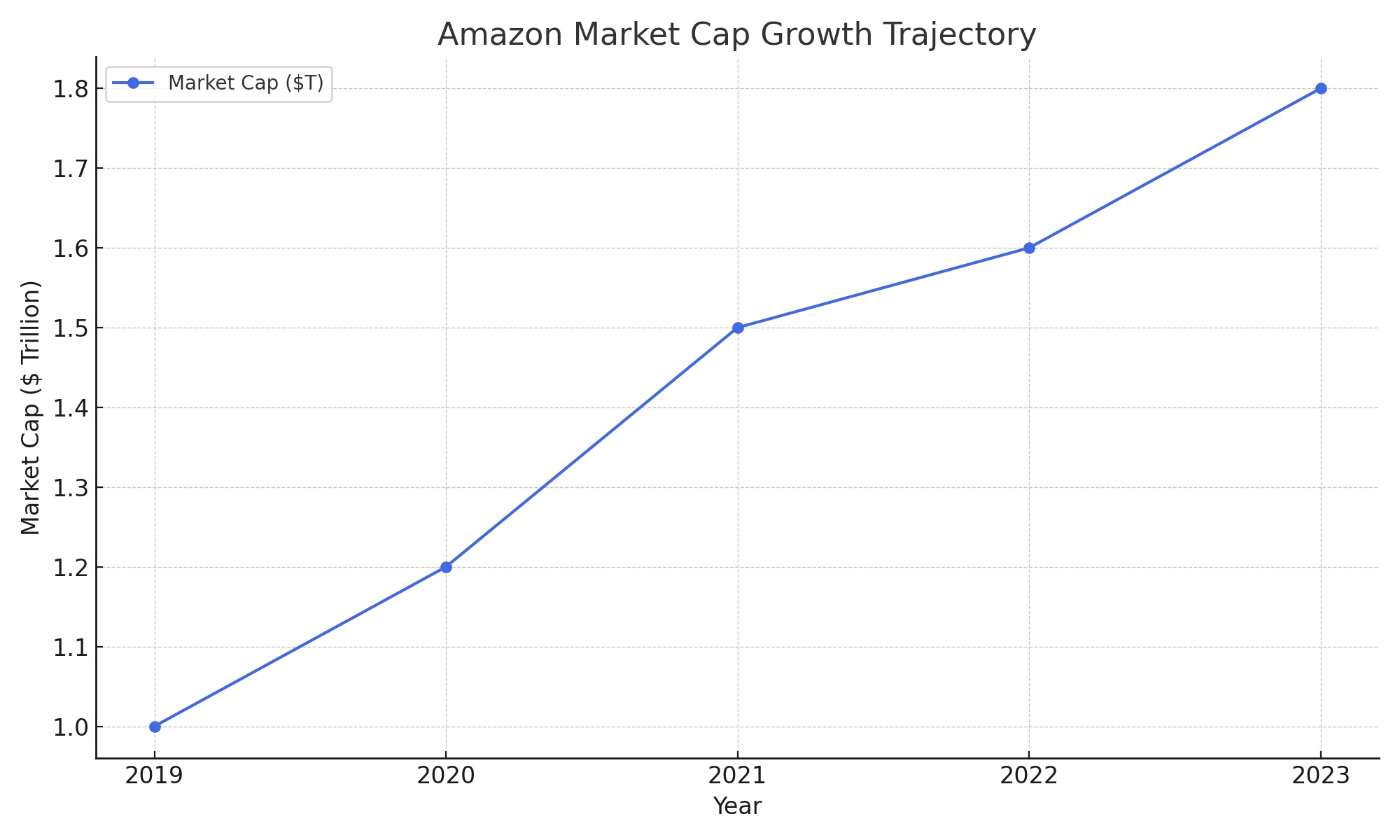

Amazon's Market Valuation and Growth Trajectory

Amazon.com, Inc. (NASDAQ:AMZN), with its market cap nearing the $1.8 trillion mark, remains a colossus in the realms of e-commerce and cloud computing, courtesy of Amazon Web Services (AWS). The Seattle-based behemoth's expansion into generative artificial intelligence (AI) and a burgeoning advertising venture underscores its relentless pursuit of innovation. However, Amazon finds itself at a crossroads, contending with significant antitrust challenges from the U.S. government, raising questions about its future trajectory.

NASDAQ:AMZN Recent Financial Performance and Wall Street's Outlook

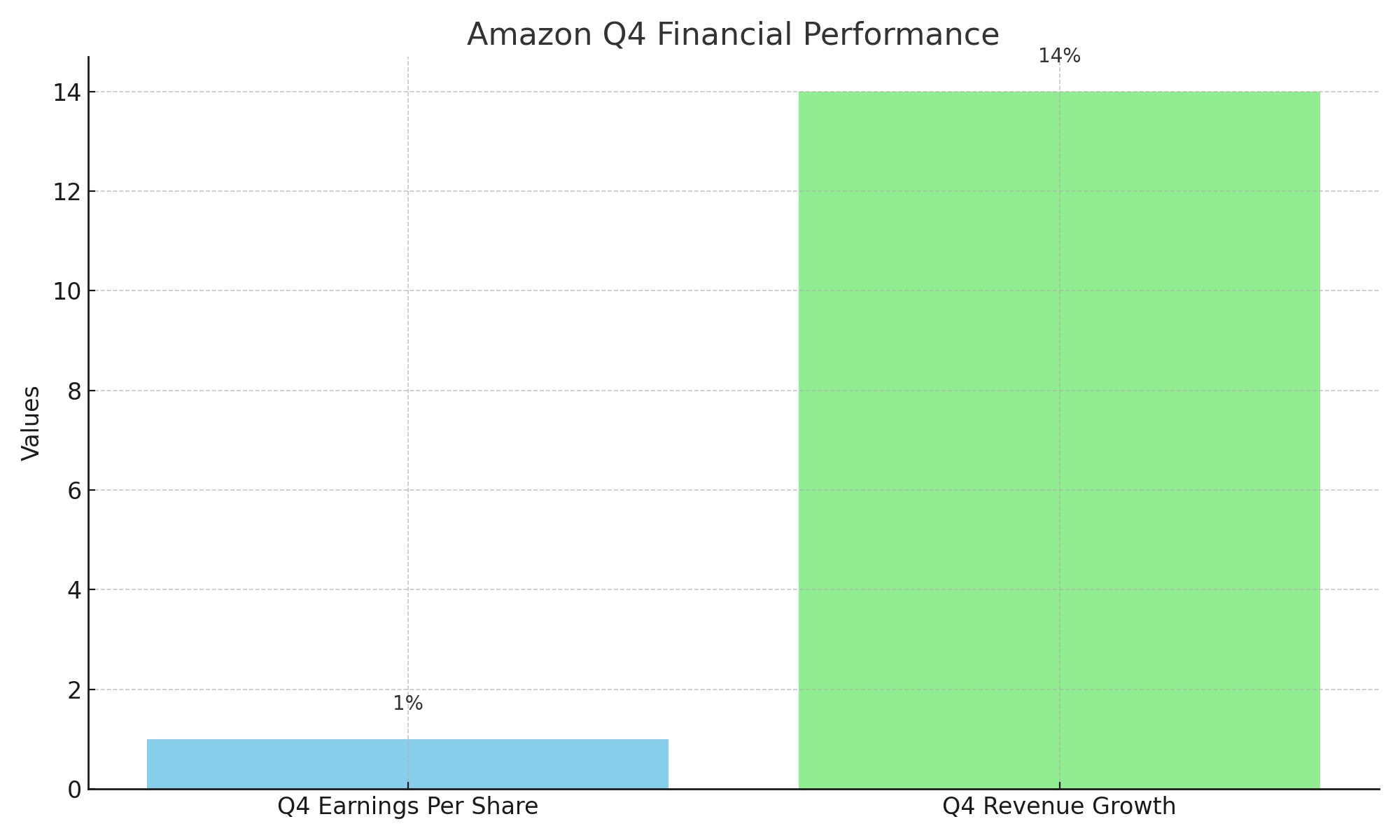

Amazon's stock is on the cusp of surpassing its 2021 peak, signaling a potential rebound after a tumultuous 2022. A notable surge followed the company's Q4 earnings report, which unveiled a 14% revenue boost, surpassing analysts' expectations. This positive momentum has led to an overwhelming consensus among Wall Street analysts, with 98% advocating a buy rating and projecting a 12-month target price of $206 for AMZN stock, suggesting nearly 20% growth potential.

NASDAQ:AMZN Q4 Earnings: A Deep Dive

Amazon's Q4 earnings report was a revelation, with the company posting earnings of $1 per share on $170 billion in sales, exceeding the forecasted figures. This 14% year-over-year sales growth, coupled with a substantial increase in earnings from the previous year, highlights Amazon's robust performance, especially within its AWS and North American retail divisions. AWS continued its dominance in the cloud sector, matching revenue expectations and showcasing a year-over-year growth of 13%.

Retail and Advertising: Pillars of Profitability

The standout performance of Amazon's North American retail division, which flipped from a $240 million loss to a $6.5 billion operating income, cannot be overstated. This turnaround is attributed to a strategic overhaul of the U.S. fulfillment network, enhancing product delivery efficiency. Moreover, the advertising segment, with a 27% year-over-year growth to $14.7 billion, emerges as Amazon's fastest-growing sector, significantly contributing to the company's profit margins.

AWS and the Cloud Computing Arena

AWS's sales growth improvement in Q4 has assuaged some concerns about the cloud-computing behemoth's trajectory. Despite facing a slowdown in growth last year, AWS's market leadership remains unchallenged, accounting for a significant portion of Amazon's operating income. The impending generative AI revolution and competition from Microsoft and Google in the cloud space underscore the need for Amazon to continuously innovate and defend its cloud supremacy.

Generative AI: Amazon's Strategic Maneuvers

Amazon's venture into generative AI, including its investment in Anthropic and the launch of Amazon Bedrock, signifies its commitment to staying at the forefront of AI development. The introduction of new AI services and collaborations, particularly in the business sector, is expected to generate substantial revenue in the coming years. However, the competitive landscape, with Microsoft and Google making significant strides in AI, poses challenges that Amazon must navigate to maintain its industry leadership.

Antitrust Concerns: A Looming Threat

Amazon's looming antitrust battle with the FTC and state attorneys general marks a critical juncture in its history. The allegations of market power abuse and price inflation have put Amazon's business practices under scrutiny. While the outcome remains uncertain, Amazon's defense against these allegations will be crucial in shaping its regulatory landscape and future growth prospects.

Technical and Financial Analysis NASDAQ:AMZN

Amazon's technical indicators reflect its strong market performance and investor confidence. With a Relative Strength Rating of 91 and a Composite Rating of 98, Amazon demonstrates superior market performance and technical strength. The Accumulation/Distribution Rating of A further indicates a positive trend in institutional ownership, highlighting sustained investor interest.

Conclusion

As Amazon navigates through multifaceted challenges and opportunities, its adaptability, innovation, and strategic foresight will be key determinants of its continued success. The convergence of AWS's cloud dominance, a thriving advertising business, and ventures into generative AI presents a promising yet complex future. Amid regulatory scrutiny and competitive pressures, Amazon's journey will be emblematic of the evolving digital economy, demanding close observation by investors and market analysts alike.

For an in-depth exploration of Amazon's financials, strategic initiatives, and market positioning, interested parties are encouraged to access comprehensive stock profiles and insider transaction data through trusted financial platforms like Trading News and Amazon's Stock Profile.

Read More

-

VOO ETF Price Forecast - VOO Near $623 as S&P 500 Pullback Tests the Rally

05.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Meltdown: XRPI And XRPR Hit New Lows As XRP Dumps Toward $1.16

05.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast – Henry Hub Tests the $3.00–$3.50 Floor After $7.50 Winter Spike

05.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast – Dollar–yen rebounds from 152 toward 158 as election risk lifts pair

05.02.2026 · TradingNEWS ArchiveForex