AMC Stock NYSE:AMC Surges Amid Meme Stock Resurgence

Analyzing Retail Investor Impact, Debt Challenges, and Market Dynamics for AMC Entertainment (NYSE:AMC) | That's TradingNEWS

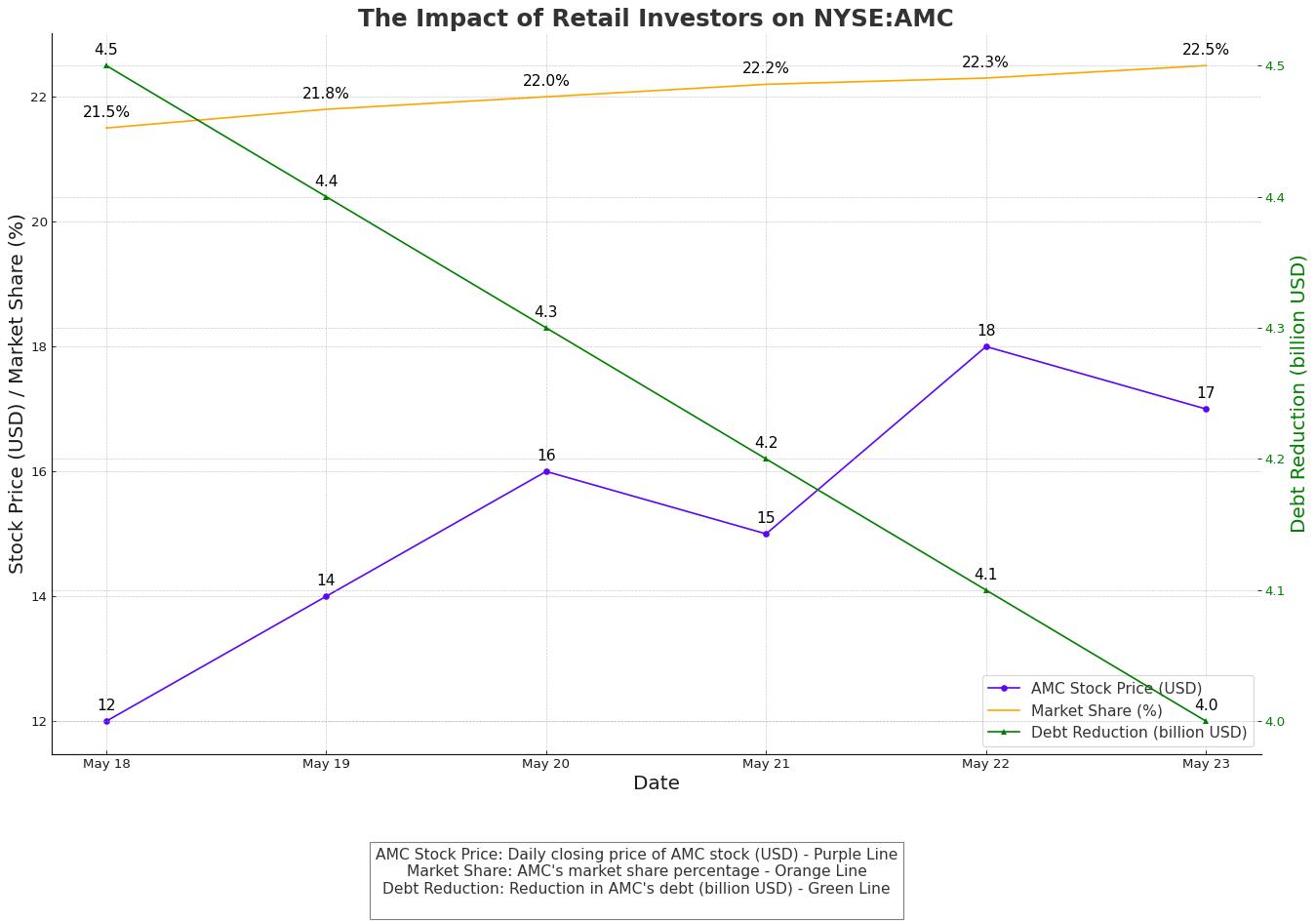

The Impact of Retail Investors on NYSE:AMC

AMC Entertainment (NYSE:AMC) has recently witnessed a substantial surge in its stock price, driven predominantly by the resurgence of meme stock mania. This surge was significantly influenced by the return of prominent retail investor Keith Gill, known as Roaring Kitty. His reappearance on social media ignited a wave of buying activity, propelling AMC shares to impressive heights. On May 12, 2024, Roaring Kitty posted for the first time in nearly three years, which many interpreted as a signal to buy, leading to a 74.4% increase in AMC’s stock price the next day. This activity highlights the substantial impact that retail investors can have on stock prices, especially in the age of social media.

AMC's Strategic Financial Moves

In response to this renewed interest, AMC quickly took advantage of the rally by completing a $250 million at-the-market (ATM) equity program launched in March. This program allowed AMC to issue shares directly into the market at prevailing prices, thereby raising significant capital. Additionally, AMC announced a strategic move to issue Class A stock in exchange for notes, aiming to reduce its highest-interest payment-in-kind (PIK) loan by $168.9 million. These financial maneuvers were designed to strengthen AMC’s balance sheet and reduce its debt burden. However, these actions received mixed reactions from investors, leading to a subsequent correction in the stock price.

Addressing AMC's Debt Burden

Debt remains a significant challenge for AMC Entertainment. During a recent earnings call, the company hinted at the possibility of renegotiating the terms of its $2.9 billion debt due in 2026. Analyst Alicia Reese from Wedbush expressed optimism about this potential outcome, citing AMC's history of successfully renegotiating debt terms. Since the beginning of 2022, AMC has managed to reduce its debt by $1 billion. Despite this progress, AMC still faces a substantial remaining debt of $4.4 billion. The company's ability to continue this trend of debt reduction will be crucial to its financial health and long-term viability.

Market Share and Revenue Growth Prospects

Despite these financial challenges, AMC has managed to grow its market share to 22.5% in 2023. Analyst Alicia Reese believes that there is potential for further growth, particularly through theater upgrades in AMC's European circuit. These upgrades could drive revenue growth by increasing per-screen averages. However, Reese also notes that AMC is unlikely to pursue these upgrades until it has made significant progress in right-sizing its balance sheet. This focus on debt reduction means that other growth opportunities may be overshadowed in the near term.

Insider Transactions and Institutional Activity

AMC has experienced significant activity from institutional investors. The Swiss National Bank, for instance, increased its holdings in AMC by 29.6% in the fourth quarter, now owning 390,891 shares valued at $2.392 million. Similarly, Amalgamated Bank raised its stake in AMC by 223.3%, acquiring 19,818 additional shares to hold a total of 28,695 shares valued at $176,000. For more details on insider transactions, visit AMC Insider Transactions. Institutional ownership remains robust, with notable investors such as Victory Capital Management and Russell Investments Group also increasing their stakes.

Regulatory and Market Dynamics

A significant regulatory development for AMC was the Delaware Supreme Court’s decision to uphold the company’s stock conversion plan. This plan involves converting AMC Preferred Equity (APE) units into common shares, a move initially met with shareholder resistance due to concerns about dilution. The approved plan also includes a one-for-ten reverse stock split, which will further affect the stock dynamics. This strategic maneuver allows AMC to raise capital more efficiently without requiring direct shareholder approval, thereby providing the company with greater financial flexibility.

Financial Performance and Analyst Ratings

For the recent quarter, AMC reported a revenue of $1.10 billion, surpassing analyst estimates of $1.06 billion. Despite this revenue beat, the company posted a net loss, underscoring its ongoing financial struggles. Analysts have mixed views on AMC's prospects. Citigroup, for instance, has given the stock a sell rating, while B. Riley and Wedbush have maintained neutral ratings. The consensus target price for AMC stands at $4.68, suggesting limited upside potential. This mixed sentiment reflects the challenges AMC faces in balancing debt reduction with growth initiatives.

Future Outlook and Investor Sentiment

The future of NYSE:AMC hinges on its ability to effectively manage its debt and raise capital. The company’s strategies to navigate financial challenges while leveraging the momentum from retail investors will be crucial. Investors will be closely watching AMC's debt management efforts and its ability to maintain market share. For real-time updates and detailed stock analysis, visit AMC Real-Time Chart.

That's TradingNEWS

Read More

-

Google Stock Price Forecast - AI Capex Shock, Cloud Breakout and What $313 Really Prices In

12.02.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast: XRP-USD Stuck Between $1.34 Support And $1.50 Ceiling

12.02.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: WTI Around $63 And Brent $68 Trapped Between Oversupply And Gulf Risk

12.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Jones Holds 50,000 While S&P 500 Steadies and Nasdaq Sinks on Cisco & AppLovin Rout, CPI Looms

12.02.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - GBPUSD=X Stalls Around 1.3630 as Weak UK GDP Meets Robust US Jobs Data

12.02.2026 · TradingNEWS ArchiveForex