Analyzing EUR/USD - Economic Data and Monetary Policy

Delve into how recent economic indicators and policy shifts in the U.S. and Eurozone are molding the trajectory of the EUR/USD currency pair amid fluctuating market conditions | That's TradingNEWS

Comprehensive Market Analysis: Navigating the EUR/USD Currency Dynamics Amidst Economic Shifts

Introduction to the Current Forex Climate

The EUR/USD pair has witnessed notable fluctuations, underpinned by recent economic data from both the U.S. and the Eurozone. This detailed analysis explores the undercurrents influencing the pair, presenting a case for its potential bullish trajectory as it navigates through pivotal economic releases and monetary policy adjustments.

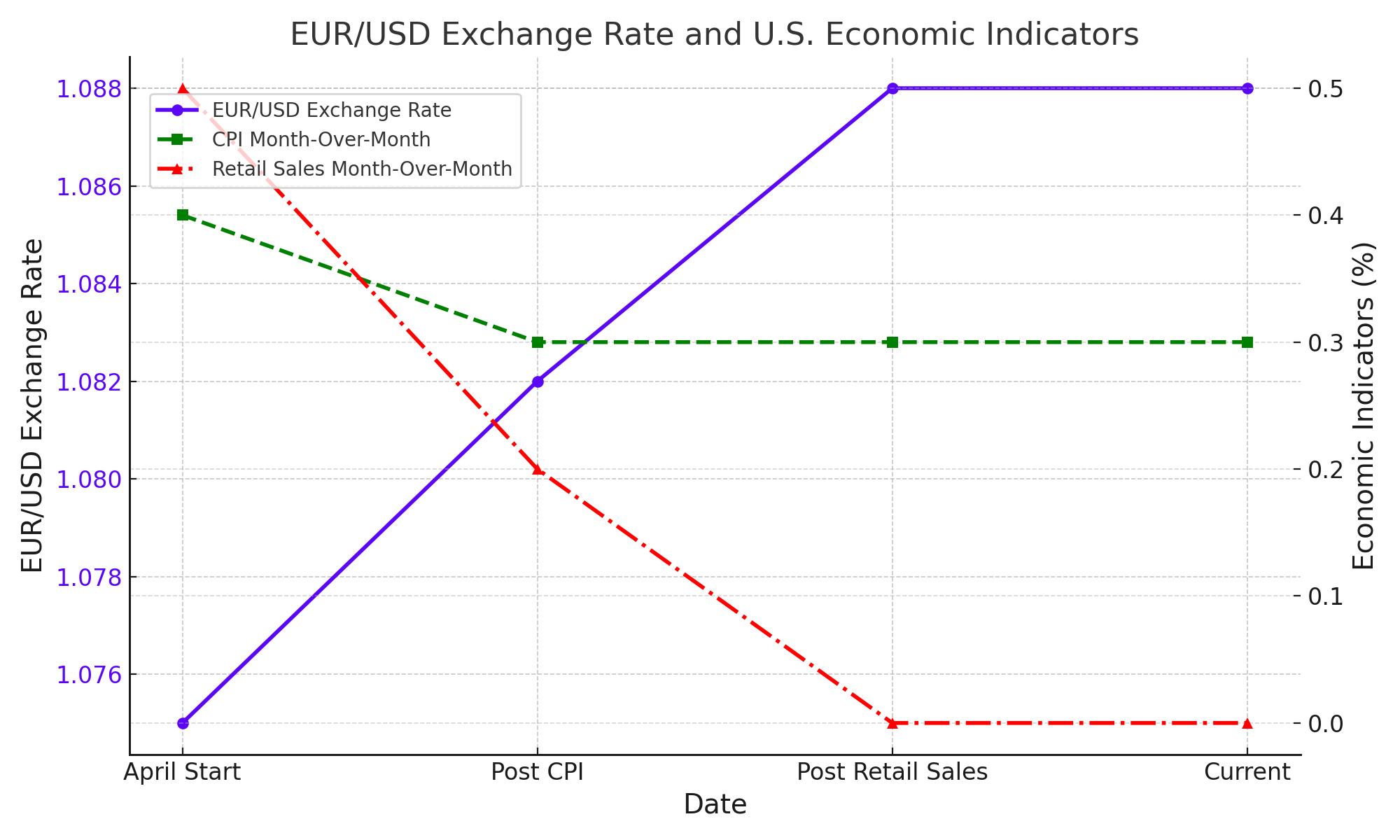

Impact of U.S. Economic Indicators on EUR/USD

Recent U.S. economic data has had a profound impact on the trajectory of the EUR/USD pair. The Consumer Price Index (CPI) and Retail Sales figures came in lower than expected, signaling potential slowdowns which could lead the Federal Reserve to consider rate cuts in 2024. Notably, the CPI moderated to 0.3% month-over-month in April, aligning with a subdued retail environment where sales were stagnant, missing the forecasted 0.4% increase. These factors collectively fostered a softer U.S. Dollar, reflected in the drop of the U.S. Dollar Index (DXY) to around 104.20, as Treasury yields declined with the 2-year and 10-year benchmarks at 4.71% and 4.32% respectively.

Eurozone's Economic Resilience and Monetary Policy Outlook

Conversely, the Eurozone displayed resilience with its GDP expanding by 0.3% quarter-on-quarter, indicating recovery from previous contractions. This economic stability supports the Euro and introduces expectations for a policy convergence between the ECB and the Federal Reserve. The anticipation of the ECB potentially lowering rates in its forthcoming June session juxtaposes rising speculations of the Fed initiating rate cuts by September, thereby fostering a bullish outlook for the Euro.

Technical and Market Sentiment Analysis

Market sentiment towards EUR/USD remains cautiously optimistic as it consolidates gains, trading around the 1.0880 mark. The currency pair benefits from an improved risk appetite, bolstered by the weakening Dollar and favorable shifts in the Eurozone's economic outlook. Technical indicators suggest a sustained bullish bias, with the EUR/USD maintaining strength above critical support levels and showing potential for testing higher resistance points in forthcoming sessions.

Anticipated Economic Events and Their Implications

Looking ahead, investors are closely monitoring the upcoming U.S. Producer Price Index (PPI) and statements from Federal Reserve officials, which could provide further clues on the future direction of U.S. monetary policy. A hotter-than-expected PPI may temper expectations for immediate Fed rate cuts, potentially strengthening the Dollar temporarily. Conversely, softer inflation figures could validate forecasts of easing U.S. interest rates, reinforcing bullish momentum for the EUR/USD pair.

Strategic Investment Considerations

For traders and investors, the current environment presents a nuanced landscape where strategic decisions must weigh the interplay of economic indicators, central bank policies, and technical setups. The EUR/USD pair offers a dynamic investment avenue within the forex market, driven by macroeconomic trends and speculative currents.

Conclusion

As the EUR/USD pair maneuvers through economic data releases and monetary policy updates, its trajectory will likely embody the broader economic narratives unfolding within the U.S. and Eurozone. Stakeholders are encouraged to stay abreast of economic developments and adjust their strategies accordingly, capitalizing on the insights provided by real-time analyses and market sentiment indicators.

Read More

-

JIVE ETF Near $90: International Value Rally That Still Looks Investable

17.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI And XRPR: Deep 60% Drawdown Or Rare $8.51 Entry After $1.3B Flows?

17.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: Can the $3 Henry Hub Floor Survive Spring?

17.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY Tests 153 Support as BoJ April Hike Talk Lifts Yen

17.02.2026 · TradingNEWS ArchiveForex