Vision Pro Sales Projections and Impact

Analysts have projected that Vision Pro could sell approximately 400 units in 2024, contributing significantly to Apple's revenue. With a projected free cash flow (FCF) margin of 20% for Vision Pro, compared to Apple's overall FCF margin of 26%, the new product line is expected to generate substantial additional cash flows. By 2027, the cumulative impact of Vision Pro sales and continued innovation in this line could significantly increase Apple's enterprise value and, consequently, its intrinsic value per share.

Expanding Apple's Ecosystem

Vision Pro is not just a standalone product; it is a strategic expansion of Apple's ecosystem. By integrating Vision Pro with other Apple devices and services, the company aims to create a seamless user experience that encourages consumers to stay within the Apple ecosystem. This strategy not only drives hardware sales but also boosts revenue from services like Apple Music, Apple TV+, and iCloud, which are critical to Apple's long-term growth strategy.

Financial Performance and Shareholder Value

Consistent Revenue and Earnings Growth

Apple's financial performance over the past decade has been marked by consistent revenue and earnings growth. From fiscal 2016 to 2023, Apple's adjusted revenue grew at a compound annual growth rate (CAGR) of 15%, with adjusted gross margins expanding from 60.5% to 74.7%. Adjusted earnings per share (EPS) increased at a CAGR of 21% during this period. For fiscal 2024, analysts project a 44% increase in revenue and a 12% rise in adjusted EPS, driven largely by the integration of AI and the full year of Vision Pro sales.

Strategic Share Buybacks

Apple's share buyback program has been a significant driver of shareholder value. By reducing the number of outstanding shares, Apple has effectively increased the value of remaining shares. Since its last stock split in 2020, Apple has reduced its share count at a rate of approximately 3% per year. This buyback strategy is expected to continue, further enhancing shareholder returns.

Valuation Metrics and Comparison

Price/Earnings (P/E) Ratio

Apple's current P/E ratio stands at 32, higher than its historical average but justified by its robust growth prospects and strong market position. Compared to other tech giants, Apple's valuation remains competitive. For instance, Alphabet (NASDAQ:GOOG) and Microsoft (NASDAQ:MSFT) have forward P/E ratios of 23.33 and 37.74, respectively.

Regulatory and Competitive Risks

Regulatory Challenges

Apple faces regulatory scrutiny in both the EU and the US, particularly around issues of antitrust and privacy. These regulatory challenges pose risks to Apple's business model, particularly if they require significant changes to how Apple operates its ecosystem. However, Apple's strong management team, led by Tim Cook, has a proven track record of navigating such challenges successfully.

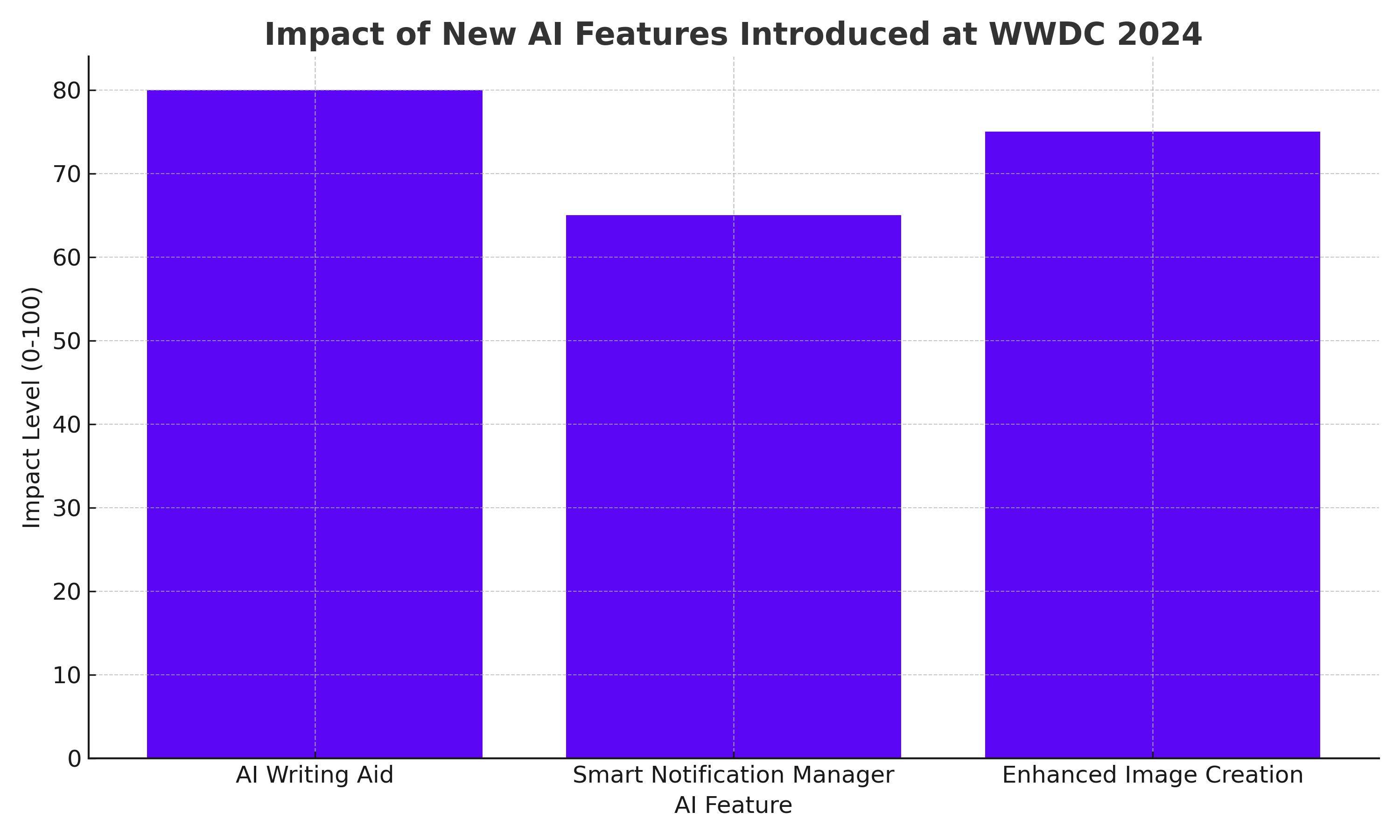

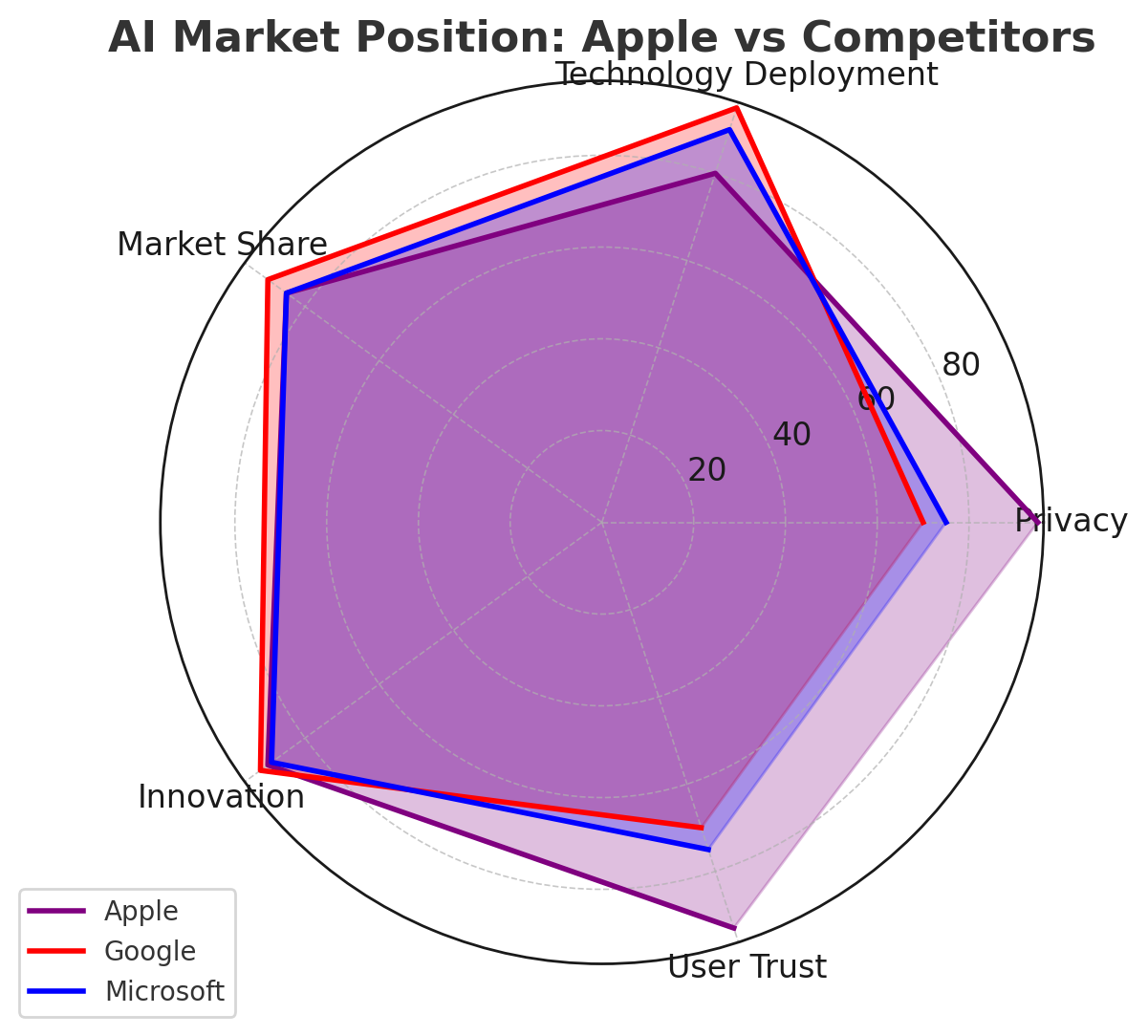

Competition in AI and Technology

While Apple is a leader in many aspects of consumer technology, it faces stiff competition in the AI space from companies like Google and Microsoft. These competitors have made significant advancements in AI, potentially outpacing Apple in certain areas. However, Apple's unique approach to AI, emphasizing privacy and on-device processing, provides a competitive edge that may attract privacy-conscious consumers.

Strategic Partnerships and Innovations

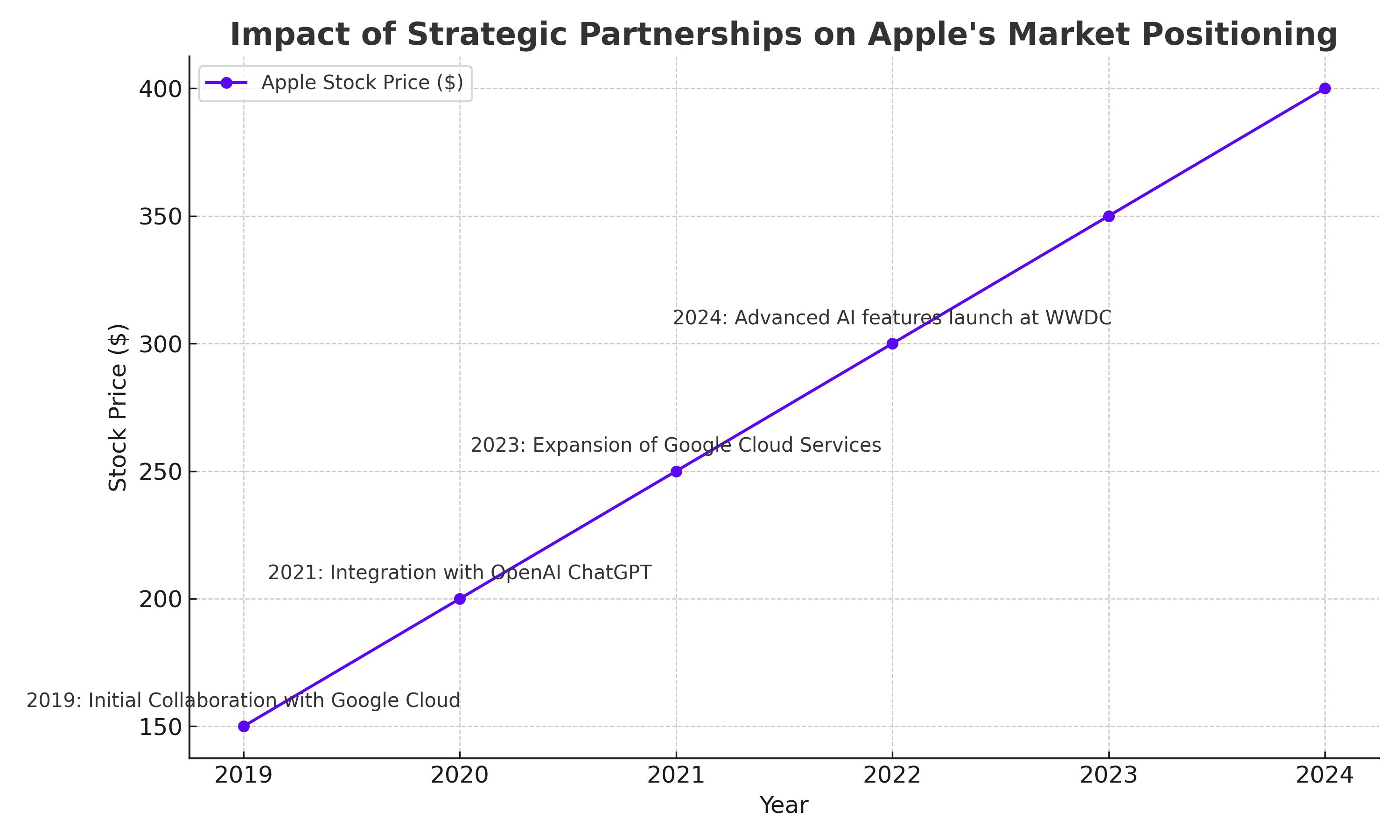

Collaboration with OpenAI and Google

Apple's strategic partnerships with OpenAI and Google are pivotal in its AI strategy. By leveraging Google's cloud infrastructure and integrating OpenAI's ChatGPT, Apple enhances its AI capabilities without compromising on privacy. This collaboration allows Apple to offer advanced AI features while maintaining its commitment to user data protection.

Innovation in Product Development

Apple's commitment to innovation extends beyond AI and Vision Pro. The company continually invests in research and development (R&D) to drive product innovation across its portfolio. This includes advancements in iPhone, iPad, Mac, and Apple Watch, as well as new ventures into health technology and augmented reality (AR).

Conclusion

Apple (NASDAQ:AAPL) stands out as a robust investment with its strategic focus on privacy-centric AI integration, innovative product development, and strong financial performance. The Vision Pro product line, strategic partnerships, and consistent share buybacks position Apple for sustained growth. Despite regulatory challenges and competitive pressures, Apple’s unique approach and strong market position make it a compelling buy for long-term investors. For real-time stock information and detailed analysis, visit Apple's real-time chart.

Investment Decision: Buy

Based on the comprehensive analysis of Apple's financial health, strategic initiatives, and market positioning, the recommendation is to buy Apple (NASDAQ:AAPL) shares. The company's innovative AI integration, robust ecosystem expansion, and solid financial fundamentals provide a strong foundation for continued growth and shareholder value.

That's TradingNEWS