Bank of America NASDAQ:BAC Financial and Market Analysis

Understanding BAC's Market Position, Financial Health, and Growth Prospects Amidst Evolving Economic Trends | That's TradingNEWS

Comprehensive Financial Analysis of Bank of America (NASDAQ: BAC)

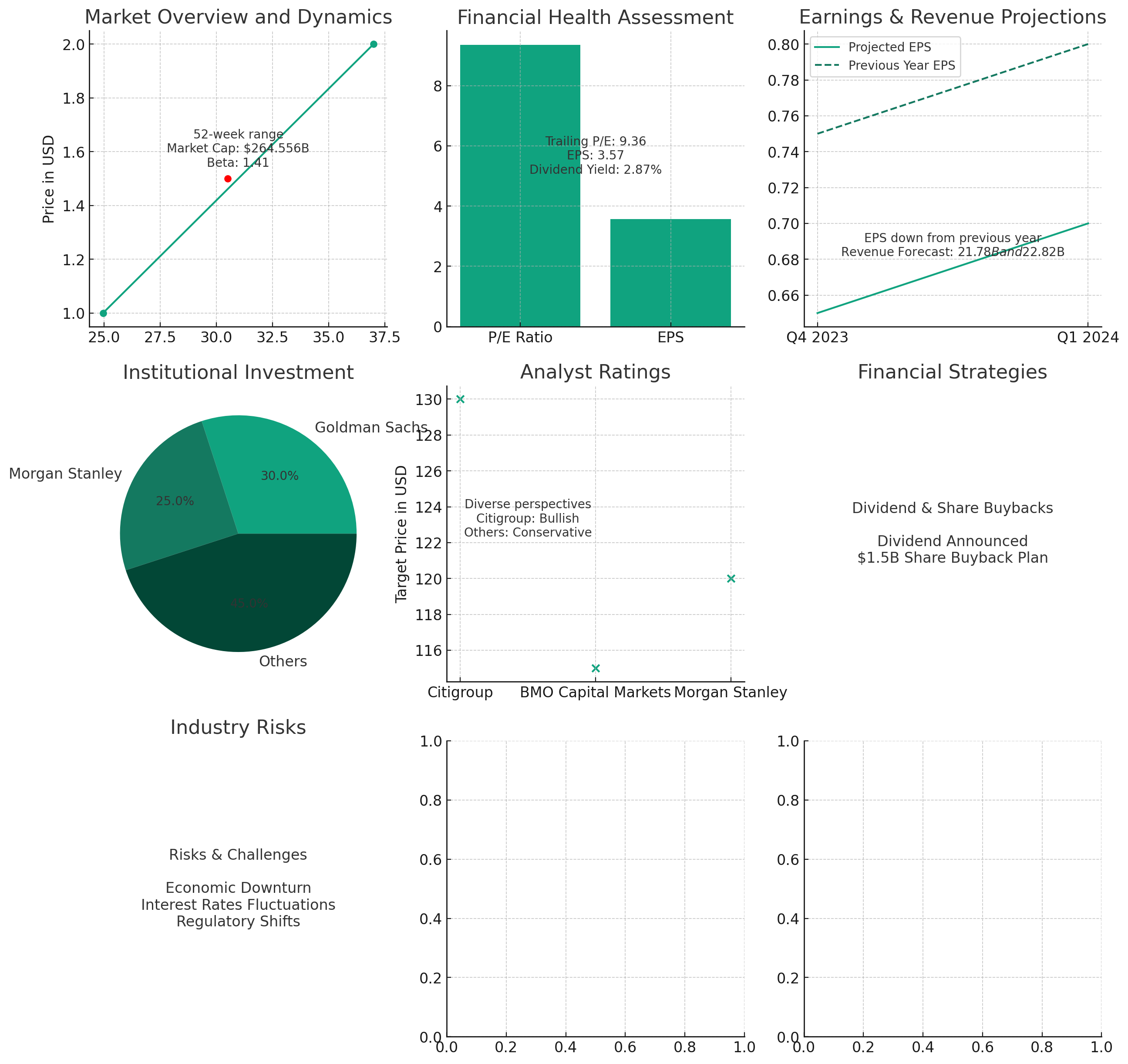

Market Overview and Dynamics

Bank of America (BAC), a titan in the banking industry, holds a prominent place on NasdaqGS. With a robust market capitalization of $264.556 billion and a Beta of 1.41, BAC is a barometer for economic and sector-specific trends. The stock price's 52-week range, spanning from $24.96 to $37.00, demonstrates the stock's active engagement with market forces and investor sentiment.

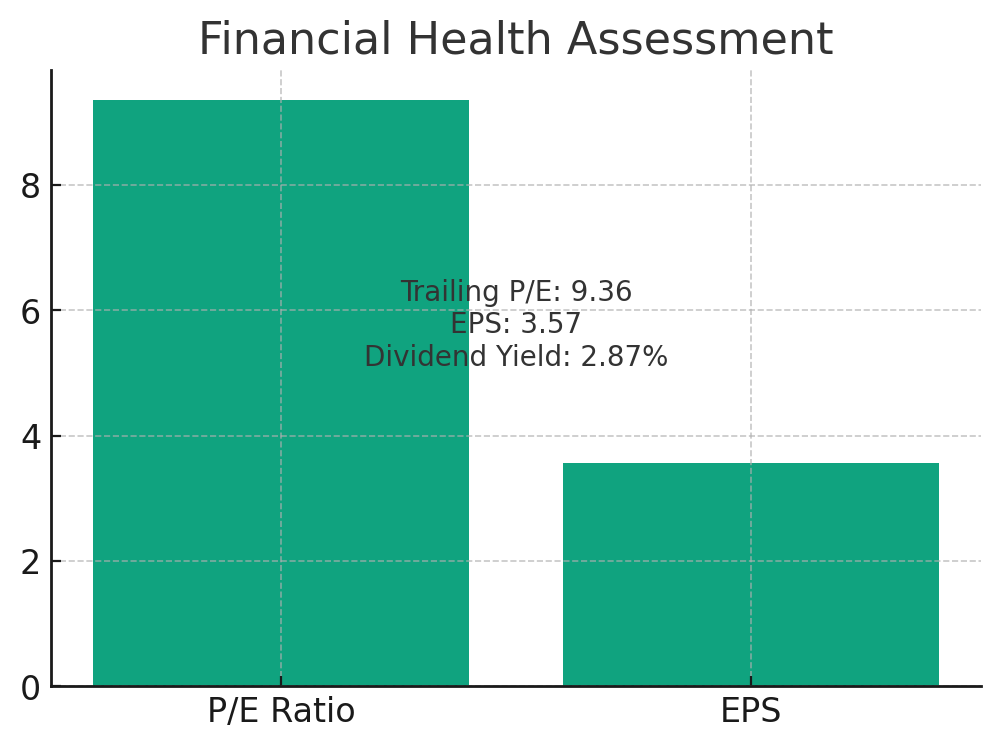

In-Depth Financial Health Assessment

Bank of America's financial stature is exemplified by its trailing Price-to-Earnings (P/E) ratio of 9.36, signifying its profitability relative to current earnings. Its Earnings Per Share (EPS) of 3.57 underlines this profitability amidst market volatilities. The eagerly awaited earnings date set for January 12, 2024, is a focal point for analysts and investors alike. Further bolstering its investment appeal is the forward dividend yield of 2.87%, marking BAC as an attractive option for dividend investors.

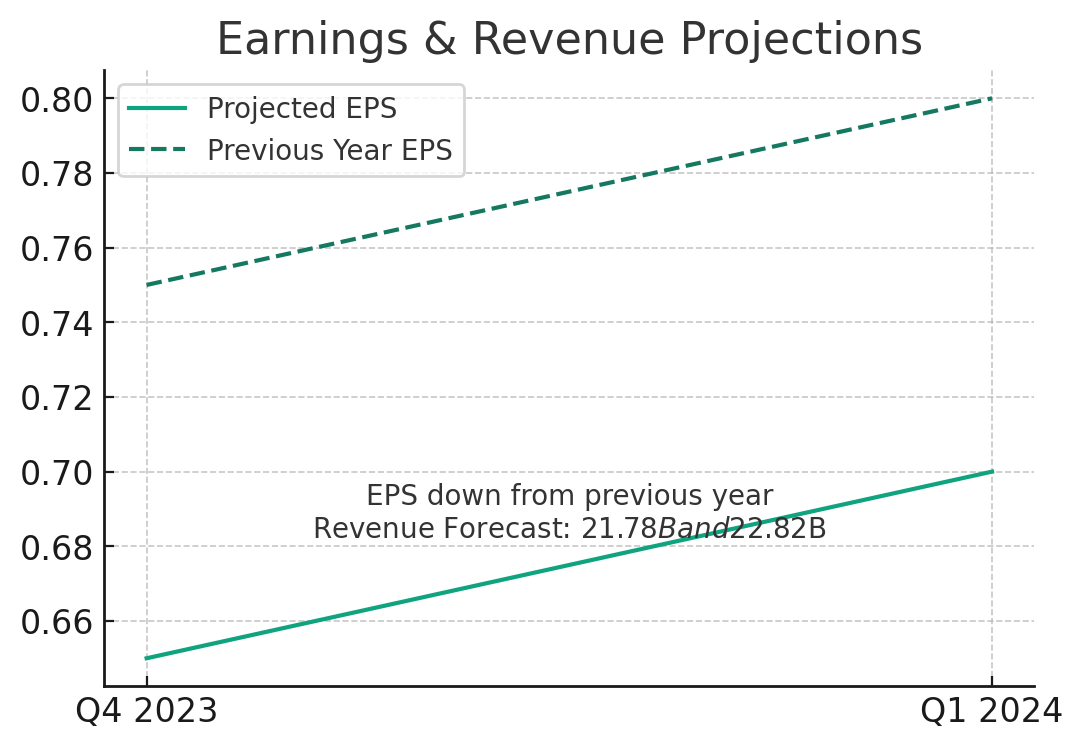

Earnings and Revenue Projections: A Closer Look

For the upcoming quarter ending in December 2023, analysts predict an EPS of $0.65, with the following quarter (Mar 2024) estimated at $0.70. These figures represent a downtrend from the previous year's EPS, indicating industry headwinds. The revenue forecast stands at $21.78 billion for the current quarter and escalates slightly to $22.82 billion for the next. However, this represents a year-over-year sales decline of -11.60% and -13.50%, respectively, hinting at challenges in revenue growth.

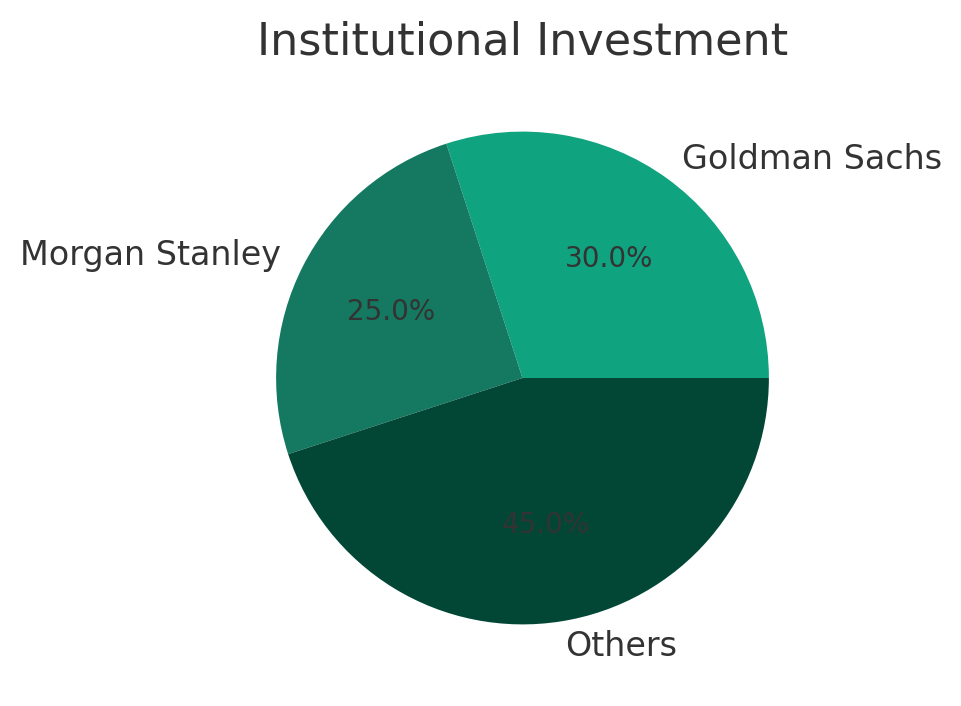

Insights into Institutional Investment

BAC's investment landscape shows a mix of conviction and strategic positioning, with significant stake increments by major players like Goldman Sachs Group Inc. and Morgan Stanley. Such movements by key financial institutions signal a solid belief in BAC's strategic direction and future market potential.

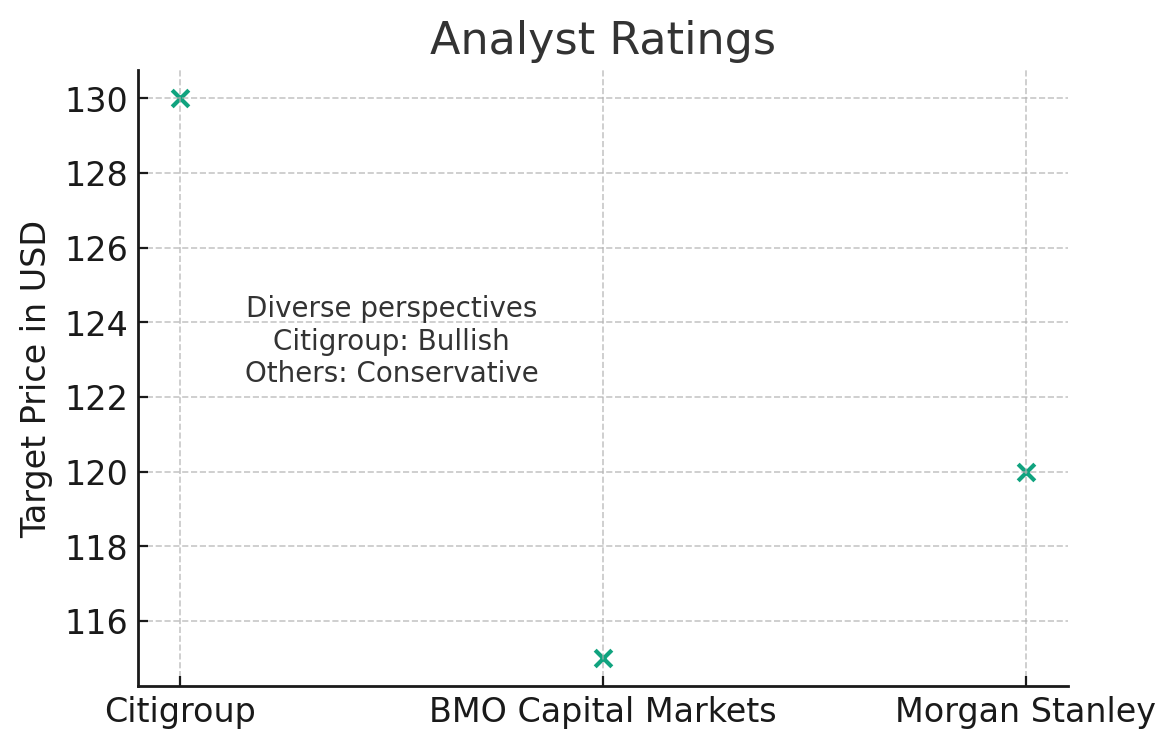

Analyst Ratings: Diverse Perspectives

The spectrum of analyst opinions on BAC varies. Citigroup's upgrade from "neutral" to "buy," with a target of $130.00, indicates a bullish outlook. Conversely, BMO Capital Markets and Morgan Stanley adopt a more conservative stance, setting lower target prices. This array of views underscores the complexity and nuances of the banking sector, as well as BAC's unique positioning within it.

Dividend Strategy and Share Buyback Initiatives

BAC's recent dividend announcement, coupled with a substantial $1.50 billion share buyback plan, reflects management's confidence in the company's valuation and future growth prospects. Such strategic financial decisions often indicate strong corporate health and a forward-looking management approach.

Navigating Industry Risks and Challenges

Despite its robust financials, BAC operates in a challenging environment. The banking sector is intricately linked to global economic trends and policy shifts. The looming possibility of a U.S. economic downturn could exert additional pressure on banking operations and profitability. Furthermore, fluctuating interest rates and regulatory shifts pose significant variables that could impact BAC's business model.

Strategic Evaluation for Long-Term Growth

BAC's consistent performance is a cornerstone of its valuation. Yet, potential economic shifts and market volatilities call for a nuanced investment strategy. The company's response to these challenges, through strategic decisions and adaptation, will be pivotal for its sustained growth and market position.

Concluding Investment Perspective

Potential investors in Bank of America must engage in a comprehensive analysis of the broader banking landscape and BAC's strategies to navigate these waters. While BAC showcases solid fundamentals, the evolving market conditions and economic uncertainties suggest a measured and informed approach to its stock in the short to medium term.

For detailed, up-to-the-minute stock analysis and insights on insider transactions, visit BAC's Real-Time Chart and Stock Profile on TradingNews.com.

That's TradingNEWS

Read More

-

Alphabet Google Stock Price Forecast - GOOGL Around $320 Leverages AI and Gemini Momentum Toward a $360 Target

07.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD at $2.21 on 25% 2026 Rally as Bulls Target $3.00

07.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast - WTI at $56 and Brent at $60 as Trump’s Venezuela Oil Grab Hits Crude Markets

07.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Holds 49,000 Record as Venezuela Oil Deal Slams Crude and Rotates Flows Into AI, Refiners and Bitcoin Plays

07.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Clings to 1.35 as Dollar Wobbles Below 99 Into ISM and NFP

07.01.2026 · TradingNEWS ArchiveForex