Bitcoin's Path to $500,000: An In-Depth Analysis of the 2025 Surge Prediction

Unpacking PlanB's $500K Bitcoin Forecast: Halving Impact and Market Trends Shaping the Future of Cryptocurrency | That's TradingNEWS

The Potential Surge: Bitcoin's Path to $500,000

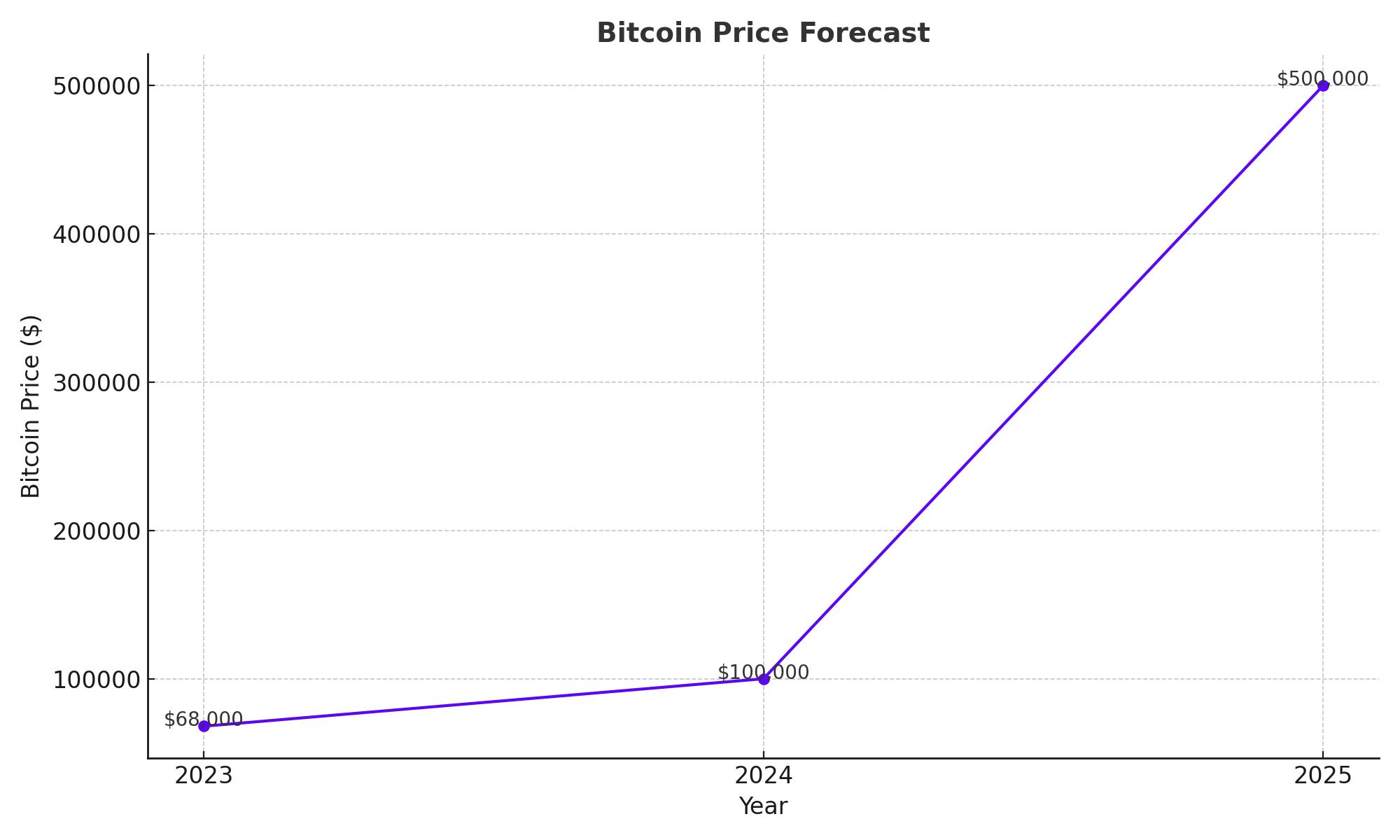

PlanB's Bold Forecast:

PlanB, an influential figure in the cryptocurrency analysis arena, projects an audacious price of $500,000 for Bitcoin by the year 2025. This prediction hinges on the significant event of the Bitcoin halving expected in 2024—a phenomenon that historically triggers substantial price surges due to reduced supply. Drawing from past patterns observed during the halvings of 2012, 2016, and 2020, PlanB anticipates a similar bullish outcome. Specifically, he suggests that Bitcoin could initially rally to $100,000 by the end of the current year, setting the stage for further exponential growth.

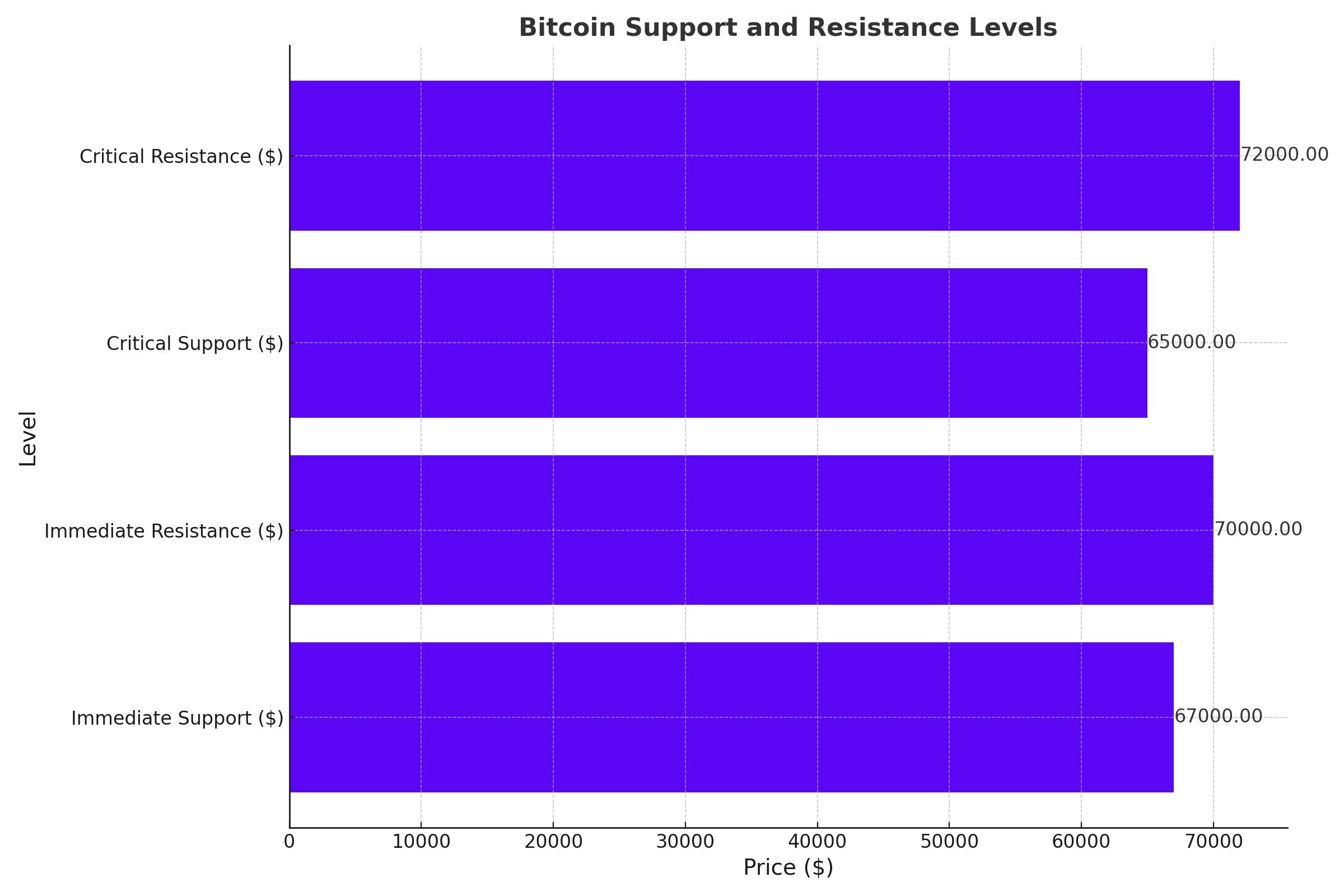

Current Market Dynamics and Technical Support:

Bitcoin's present market status shows strong support in the $68,730 to $70,833 range, according to IntoTheBlock data. This foundation is crucial as it provides a springboard for the potential rally to $80,000 by the end of June, progressing towards $100,000 by year's end. Galaxy Digital’s CEO, Mike Novogratz, aligns with this optimistic trajectory, positing that a breach above $73,000 could rapidly accelerate the climb to six figures.

The Halving Effect:

The 2024 halving is expected to slash the number of Bitcoins awarded to miners by half, effectively diminishing the new supply and potentially driving up the price if demand remains steady or increases. This event has traditionally been a catalyst for bullish runs, and the expectation for 2024 is no different. The Stock-to-Flow (S2F) model, which PlanB champions, specifically ties Bitcoin’s value directly to its scarcity, which is measurably impacted by halvings.

Investor Sentiment and Market Indicators:

The current sentiment in the Bitcoin community is robust, with long-term holders continuing to accumulate, suggesting a prevailing belief in higher future prices. This is further underscored by a significant drying up of Bitcoin reserves on exchanges—a signal often associated with bullish market conditions. Additionally, technical indicators like the Relative Strength Index (RSI) are nearing overbought territories at 70, which often precedes price pullbacks, suggesting that investors should be cautious of potential volatility.

Economic Influences and Risks:

While the enthusiasm for Bitcoin's potential post-halving surge is palpable, external economic factors such as global monetary policies, inflation rates, and geopolitical tensions could significantly influence market dynamics. For instance, aggressive rate hikes by the Federal Reserve could strengthen the dollar and temporarily dampen Bitcoin's appeal as a hedge asset.

Macro View and Strategic Considerations:

As Bitcoin approaches its next halving, the broader financial community remains keenly interested in how it will affect the asset’s price. Strategic investors might consider leveraging the post-halving supply squeeze by increasing their holdings pre-halving. However, the necessity for risk management strategies, including diversification and setting stop-loss orders, becomes more pronounced given Bitcoin’s historical price volatility post-halving events.

Conclusion: Navigating the Bullish Projections:

Investors eyeing the potential rise in Bitcoin's value to $500,000 must consider both the historical precedence and the unique factors of the current economic landscape. While PlanB’s predictions provide a compelling narrative supported by data-driven models, market participants should maintain a balanced approach, staying abreast of both on-chain metrics and global economic indicators that could sway Bitcoin’s path dramatically.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex