Bitcoin Soars Above $50,000: Remarkable Rally

Exploring the Catalysts of Bitcoin's Surge and the Impact of ETFs, Market Trends, and the Anticipated Halving Event on Its Future Trajectory | That's TradingNEWS

Bitcoin's Meteoric Rise: Analyzing the Surge Beyond $50,000

Bitcoin's resurgence to breach the $50,000 mark has captured the attention of the cryptocurrency world, signifying a robust vote of confidence from investors and traders alike. This significant uptick, marking the first instance since 2021 that Bitcoin has attained such heights, prompts a deeper dive into the confluence of factors propelling this rally.

The Catalysts Behind the Surge

Spot Bitcoin ETFs: A New Dawn

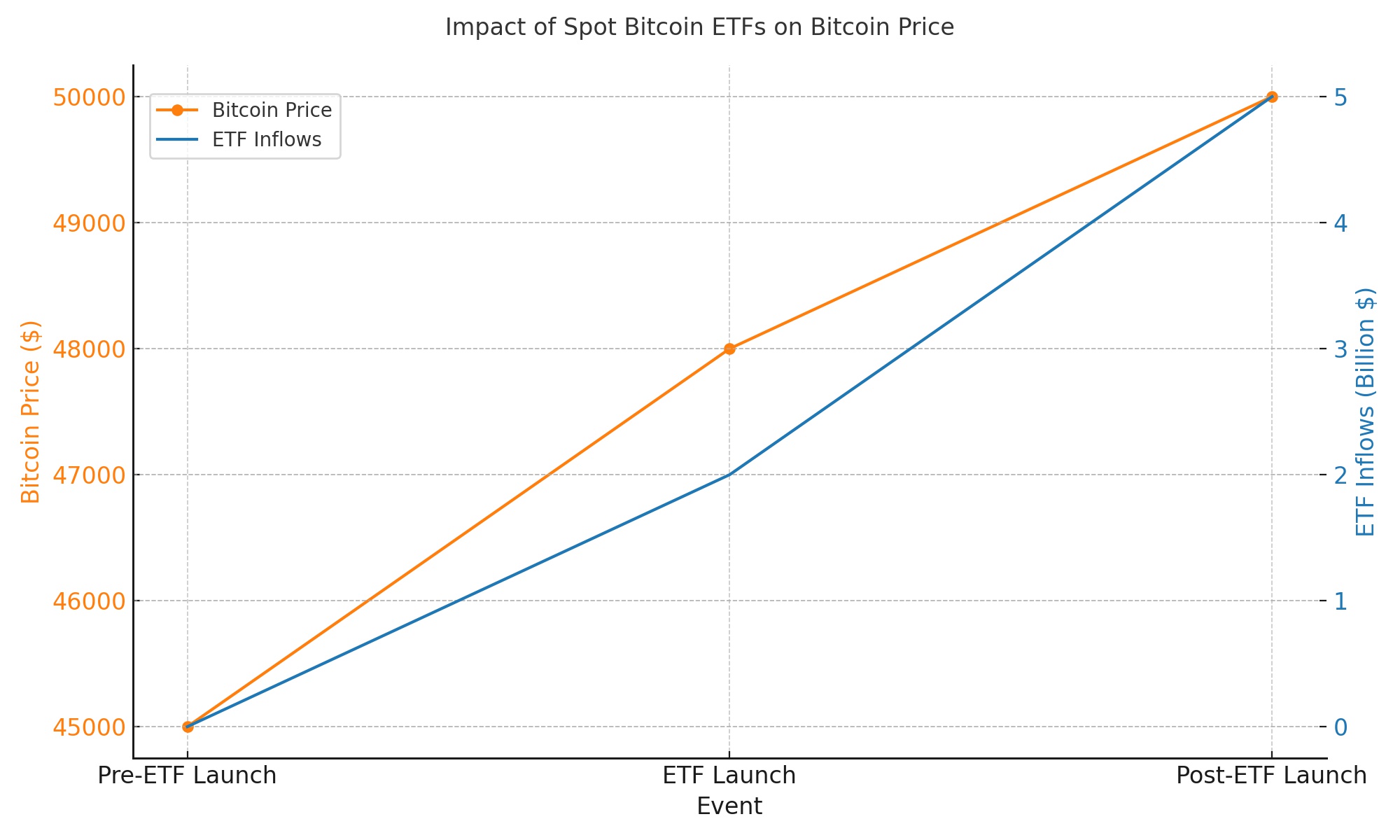

A key driver behind Bitcoin's recent rally has been the substantial inflows into spot Bitcoin Exchange-Traded Funds (ETFs). With billions of dollars directed towards Bitcoin ETFs this year, these instruments have played a pivotal role in enhancing investor confidence. The successful launch of these ETFs, particularly those by financial behemoths BlackRock and Fidelity, marks a watershed moment in the integration of cryptocurrency into mainstream finance. Despite initial post-launch dips, sustained inflows underscore a growing organic demand for Bitcoin, reshaping the investment landscape.

Futures and Options Market Trends

The bullish sentiment in Bitcoin is further underscored by trends in the futures and options markets. These markets have been indicative of strong investor confidence, with bullish options outpacing bearish ones, signaling a market consensus that anticipates further gains.

The Halving Horizon

Bitcoin's halving event, a quadrennial adjustment to the reward miners receive, is on the horizon for April. This event is anticipated to further constrict the supply of Bitcoin, potentially catalyzing another uptick in its value. Historical patterns post-halving events have seen Bitcoin's value surge, with analysts predicting a target price range between $150,000 to $200,000 by mid-next year, painting a bullish outlook for Bitcoin's trajectory.

Market Dynamics and External Factors

The role of macroeconomic conditions, including anticipations around central bank interest rate decisions, has been significant. The expectations of a dovish pivot by central banks could make risk assets like Bitcoin more appealing. Furthermore, the enduring appeal of Bitcoin ETFs has introduced new capital into the market, with the ETFs by BlackRock and Fidelity amassing billions in assets, showcasing unprecedented success in their launch period.

Technological and Regulatory Milestones

The regulatory landscape has also seen developments, with the SEC's approval of spot Bitcoin ETFs reversing a long-standing policy. This regulatory milestone, coupled with technological advancements within the Bitcoin network, has fostered an environment conducive to growth. Additionally, the Bitcoin network's upcoming halving event is poised to further influence its valuation, tightening supply amidst growing demand.

Institutional and Retail Integration

The integration of Bitcoin into institutional and retail portfolios has been facilitated by the advent of Bitcoin ETFs. These financial instruments have democratized access to Bitcoin, allowing investors to gain exposure without the complexities of direct cryptocurrency ownership. This ease of access is anticipated to broaden Bitcoin's investor base, potentially stabilizing its price dynamics over the long term.

A Glimpse into the Future

As Bitcoin navigates through these multifaceted dynamics, the path forward appears promising yet peppered with uncertainties inherent to the cryptocurrency market. The combined influence of technological advancements, regulatory clarity, and macroeconomic factors will likely dictate Bitcoin's trajectory. With the halving event on the horizon and the sustained success of Bitcoin ETFs, the stage is set for a fascinating chapter in Bitcoin's evolution.

Conclusion

Bitcoin's recent performance is a testament to its resilience and the growing recognition of its value proposition in the digital age. As the cryptocurrency continues to weave itself into the fabric of global finance, its journey will undoubtedly be one to watch, marked by volatility, innovation, and an expanding ecosystem that challenges traditional financial paradigms.

That's TradingNEWS

Read More

-

Google Stock Price Forecast - AI Capex Shock, Cloud Breakout and What $313 Really Prices In

12.02.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast: XRP-USD Stuck Between $1.34 Support And $1.50 Ceiling

12.02.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: WTI Around $63 And Brent $68 Trapped Between Oversupply And Gulf Risk

12.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Jones Holds 50,000 While S&P 500 Steadies and Nasdaq Sinks on Cisco & AppLovin Rout, CPI Looms

12.02.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - GBPUSD=X Stalls Around 1.3630 as Weak UK GDP Meets Robust US Jobs Data

12.02.2026 · TradingNEWS ArchiveForex