Strategic and Financial Analysis of Booking Holdings Inc. (NASDAQ:BKNG)

Overview of Booking Holdings' Market Position

A Leader in Online Travel Services

Booking Holdings Inc., under the ticker NASDAQ:BKNG, orchestrates a vast array of travel-related services through its portfolio of brands including Booking.com, Priceline.com, KAYAK, Agoda, Rentalcars.com, and OpenTable. With operations spanning over 220 countries, the company has cemented its position as a global leader in the travel industry, servicing millions of customers annually. Despite fierce competition from entities like Expedia and Airbnb, Booking Holdings distinguishes itself through superior customer service and an innovative loyalty program, maintaining its status as the go-to platform for travelers and service providers alike.

Strategic Economic Moat

The company's economic moat is fortified by its expansive scale, trusted brand identity, and the beneficial network effects of its platform. Booking Holdings' strategy of operating multiple brands allows it to capture a diverse customer base, further strengthening its market reach and reinforcing its competitive advantage.

Financial Performance and Growth Prospects

Robust Financial Indicators

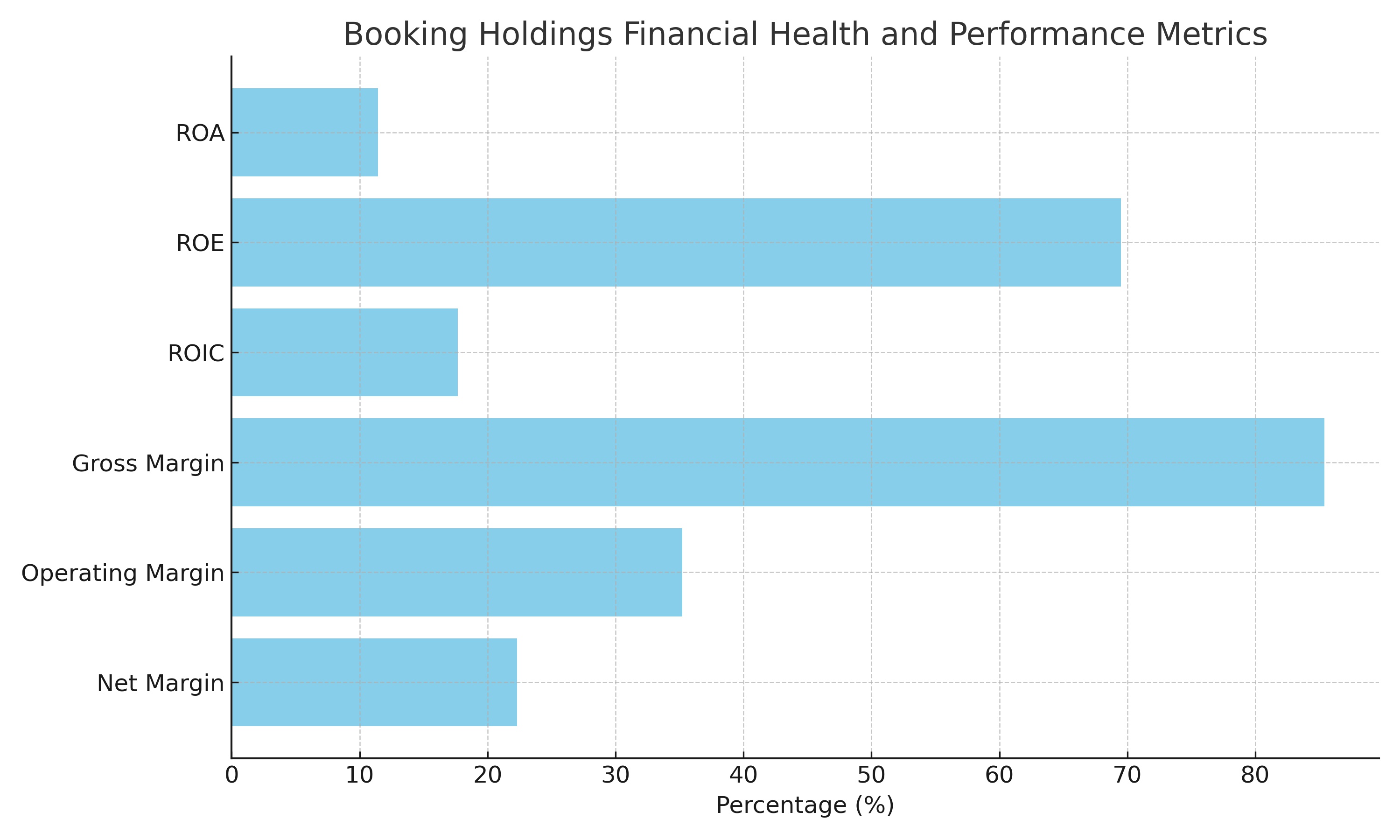

Booking Holdings has showcased impressive financial metrics, with a 5-year average ROA of 11.45%, ROE of 69.50%, and ROIC of 17.68%. These figures not only outperform chief competitor Expedia but also indicate Booking Holdings' effective capital utilization and profitability. The company's WACC stands at approximately 12%, signaling that it generates returns well above its capital costs.

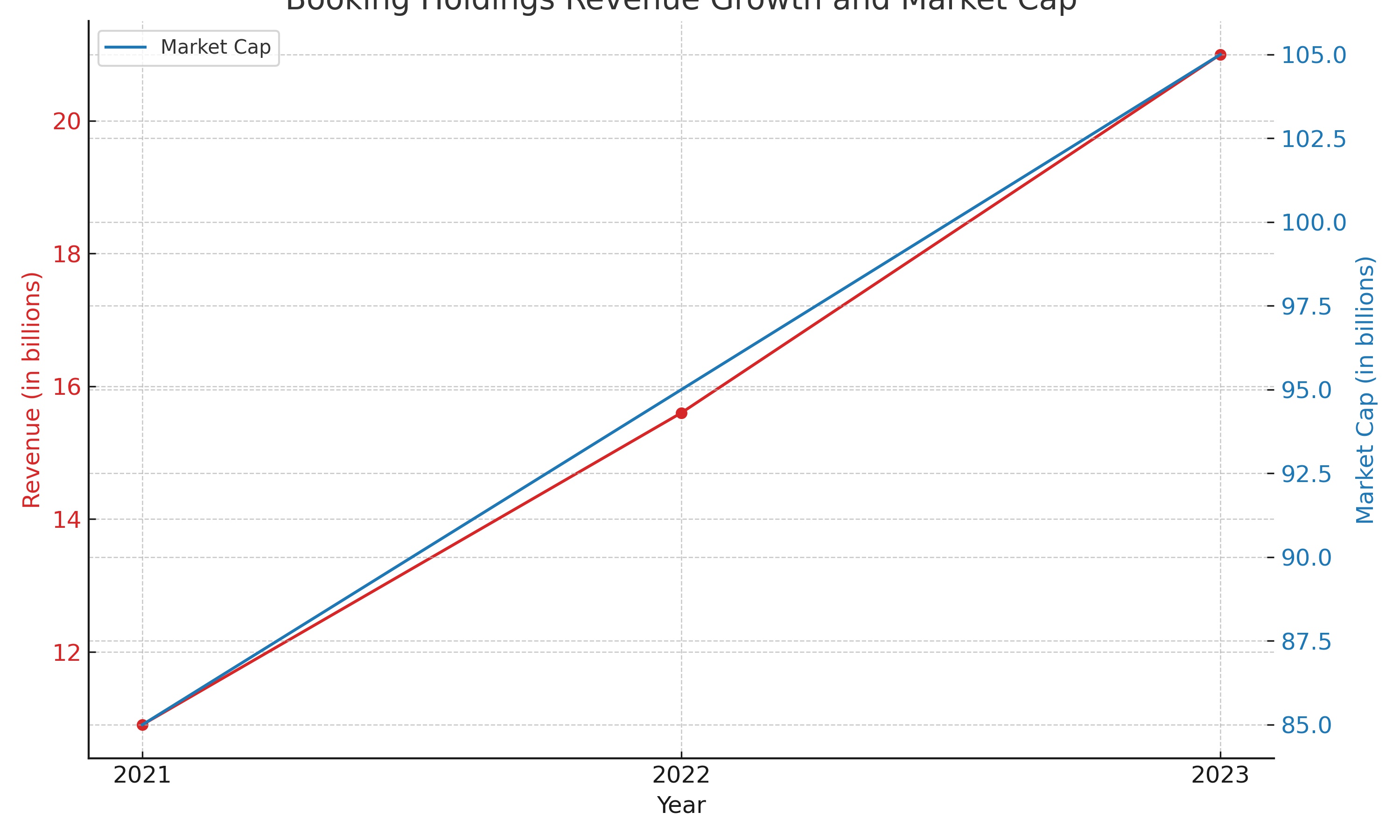

For the latest quarter of FY23, Booking Holdings reported a 21% increase in revenue year-over-year, underscoring its growth momentum. This performance is part of a broader trend, with the company enjoying a 57% YoY revenue growth and a net income surge of 127% YoY for the nine months leading up to the end of Q3. These statistics paint a picture of a company on an upward trajectory, with a market capitalization reflecting growing investor confidence.

Valuation and Analyst Perspectives

Despite its stellar performance, Booking Holdings' current market valuation suggests the stock is fairly priced, offering limited margin of safety for value-focused investors. Analysts, however, remain optimistic, with a consensus rating of "Moderate Buy" and a target price suggesting potential upside. This optimism is grounded in the company's consistent operational success and strategic expansions.

For an in-depth stock analysis, click here.

Navigating Cyclicality and Valuation

Cyclicality of the Travel Industry

The inherent cyclicality of the travel industry poses a unique challenge to Booking Holdings. Economic downturns and global crises, such as pandemics, can significantly impact consumer and corporate travel spending, affecting the company's revenue streams. While Booking Holdings has historically demonstrated resilience and adaptability, investors should remain cautious of external factors that could temper growth or impact profitability in the short to medium term.

Valuation Concerns

As of the latest financial disclosures, Booking Holdings' market valuation reflects a high level of investor confidence, underscored by a PE ratio that signals the stock might be trading at a premium compared to historical averages. This valuation implies high expectations for future growth and profitability, which the company must meet to justify its current stock price. Investors should consider the possibility of market adjustments should Booking Holdings' performance not align with these lofty expectations.

Insider Transactions and Institutional Holdings

Insight from Insider Activities

Recent insider transactions offer a glimpse into the confidence level of those closest to the company's operations. Significant sales or purchases by executives can signal their belief in the company's future prospects. For Booking Holdings, a balanced approach by insiders, with strategic sales and acquisitions, suggests a level of optimism tempered by realism about the company's future growth trajectory and stock valuation.

Institutional Investor Confidence

A strong presence of institutional investors in Booking Holdings' shares indicates a general consensus of the stock's appeal to large-scale financial entities. This confidence from institutional investors can provide a stabilizing effect on the stock price, but it also means that any significant shifts in their positions could impact the market's perception and the stock's performance.

Strategic Growth Opportunities

Expansion into New Markets

Booking Holdings' continued focus on expanding into new markets and diversifying its service offerings presents significant growth opportunities. By capitalizing on emerging travel trends and consumer preferences, especially in the post-pandemic era, Booking Holdings can further solidify its market position and drive revenue growth. Strategic acquisitions and partnerships, particularly in untapped regions or innovative travel tech segments, could provide additional avenues for expansion and profitability.

Leveraging Technology and Data Analytics

Investing in technology and data analytics remains a critical strategy for Booking Holdings to enhance user experience, optimize pricing strategies, and improve operational efficiencies. The company's ability to harness AI, machine learning, and big data can lead to more personalized customer experiences and higher conversion rates, thereby increasing market share and driving revenue growth.

Conclusion and Investment Outlook

Booking Holdings Inc. (NASDAQ:BKNG) embodies a compelling investment proposition, with its strategic market dominance, diversified brand portfolio, and solid financial performance. However, the company operates in a highly cyclical industry, and its current valuation necessitates careful consideration by potential investors. The balance between growth prospects and market risks, alongside strategic initiatives aimed at expansion and technological innovation, will be crucial in determining Booking Holdings' long-term success.

That's TradingNEWS