Canaan NYSE:CAN Analysis: Understanding Recent Market Activity and Financial Trends

Comprehensive Review of Canaan Inc.'s Trading Surge, Financial Performance, and Institutional Investments - Navigating Future Prospects and Challenges | Taht's TradingNEWS

NYSE:CAN: A Comprehensive Analysis

Options Trading Surge

Canaan Inc. (NASDAQ:CAN) witnessed a notable increase in options trading on a recent Tuesday. Traders acquired 2,871 call options, a surge of 213% over the usual volume of 917. This spike signifies heightened investor interest or speculation about future stock movements.

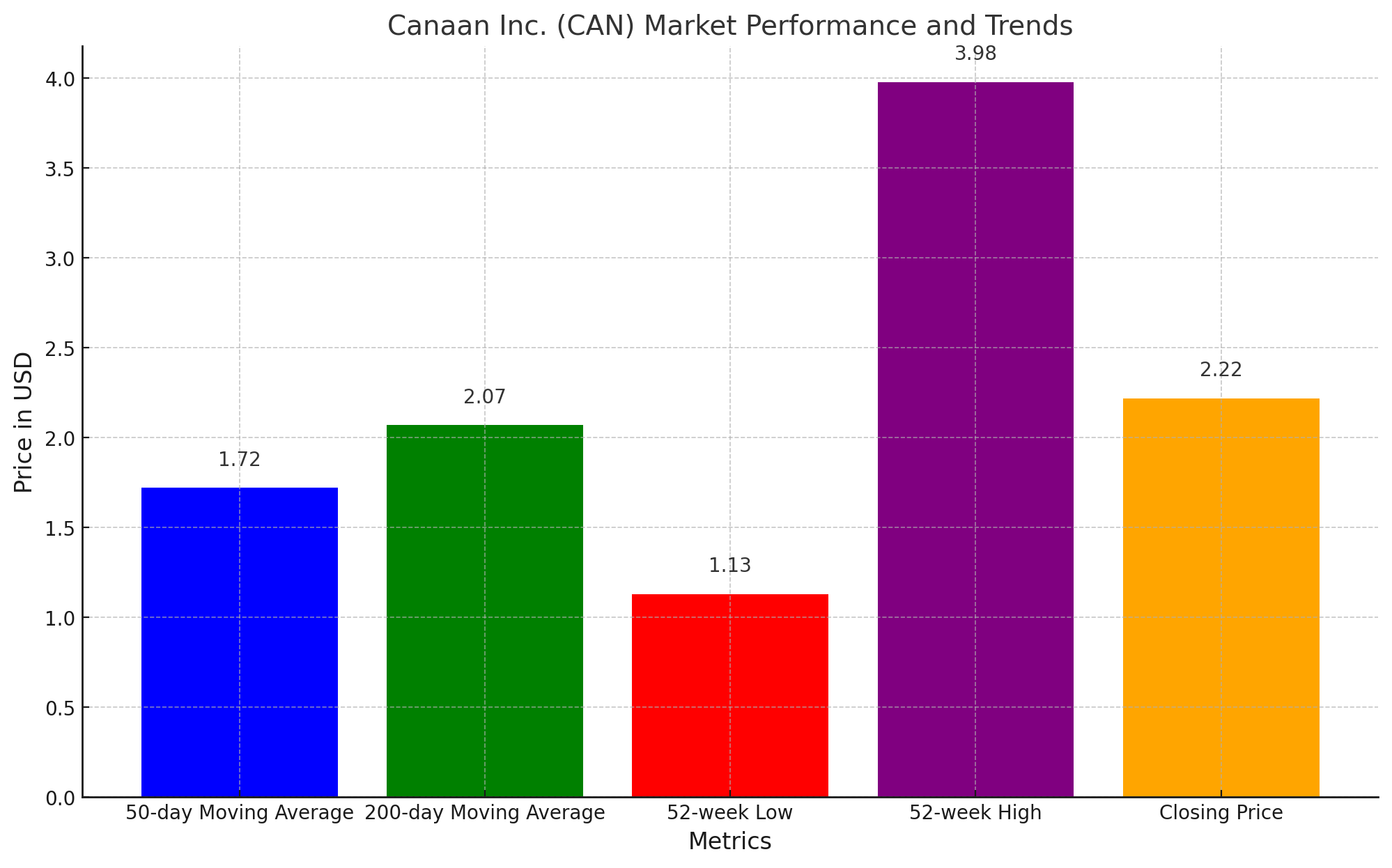

Market Performance and Trends

CAN's stock price experienced a slight uplift of 0.7%, closing at $2.22. This movement occurred amidst a trading volume of 15.9 million shares, significantly higher than the average of 3.1 million. The stock has fluctuated within a 52-week range of $1.13 to $3.98, with current moving averages at $1.72 (50-day) and $2.07 (200-day).

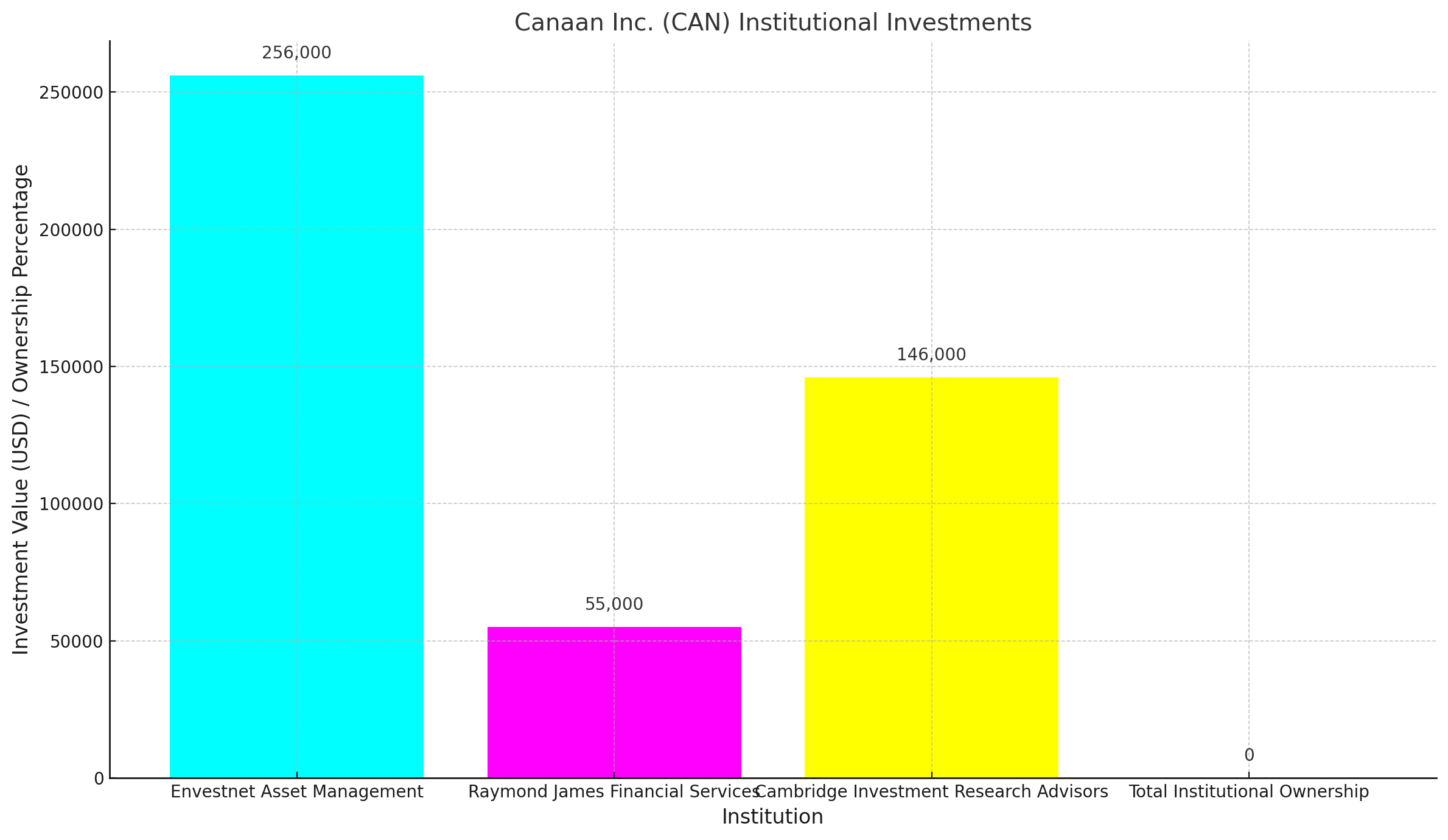

Institutional Investments

Institutional activity has been robust. Envestnet Asset Management initiated a new position worth approximately $256,000. Other notable entries include Raymond James Financial Services ($55,000) and Cambridge Investment Research Advisors, who increased their holdings by 22.7%, now owning 26,810 shares valued at $146,000. Overall, institutional and hedge fund ownership stands at 17.37%.

Corporate Overview

Canaan Inc. specializes in integrated circuit (IC) final mining equipment for Bitcoin, primarily in China. The company's recent stock closing at $2.23 and a pre-market increase of $0.06 reflect a balanced investor sentiment, supported by an overall score of 62 from InvestorsObserver, indicating a moderately strong value proposition in its price range.

Q2 2023 Financials: A Mixed Bag

Q2 2023 for Canaan was a period of contrasts. Despite a significant 44.2% increase in computing power sold (6.1 million Thash/s), the revenue of $73.9 million, although higher than Q1’s $55.2 million, was notably lower than the $245.9 million year-over-year. Mining operations revenue saw a notable increase, reaching $15.9 million, a 43.3% rise from the previous quarter.

Regulatory and Market Challenges

The company faces regulatory issues in Kazakhstan, leading to the temporary shutdown of significant computing power. A legal dispute in the US further complicates its operational landscape. Additionally, the broader market conditions, including a 30% reduction in the market cap of publicly listed crypto miners, present ongoing challenges.

Financial Health Indicators

Canaan's financial health shows mixed signals. The company holds a market cap of approximately $490.9 million, with a high beta of 2.98, indicating volatility. However, it currently operates at a loss, with an EPS of -0.4700. Key metrics such as the PE Ratio and Profit Margin are in negative territories, suggesting the need for strategic reassessments.

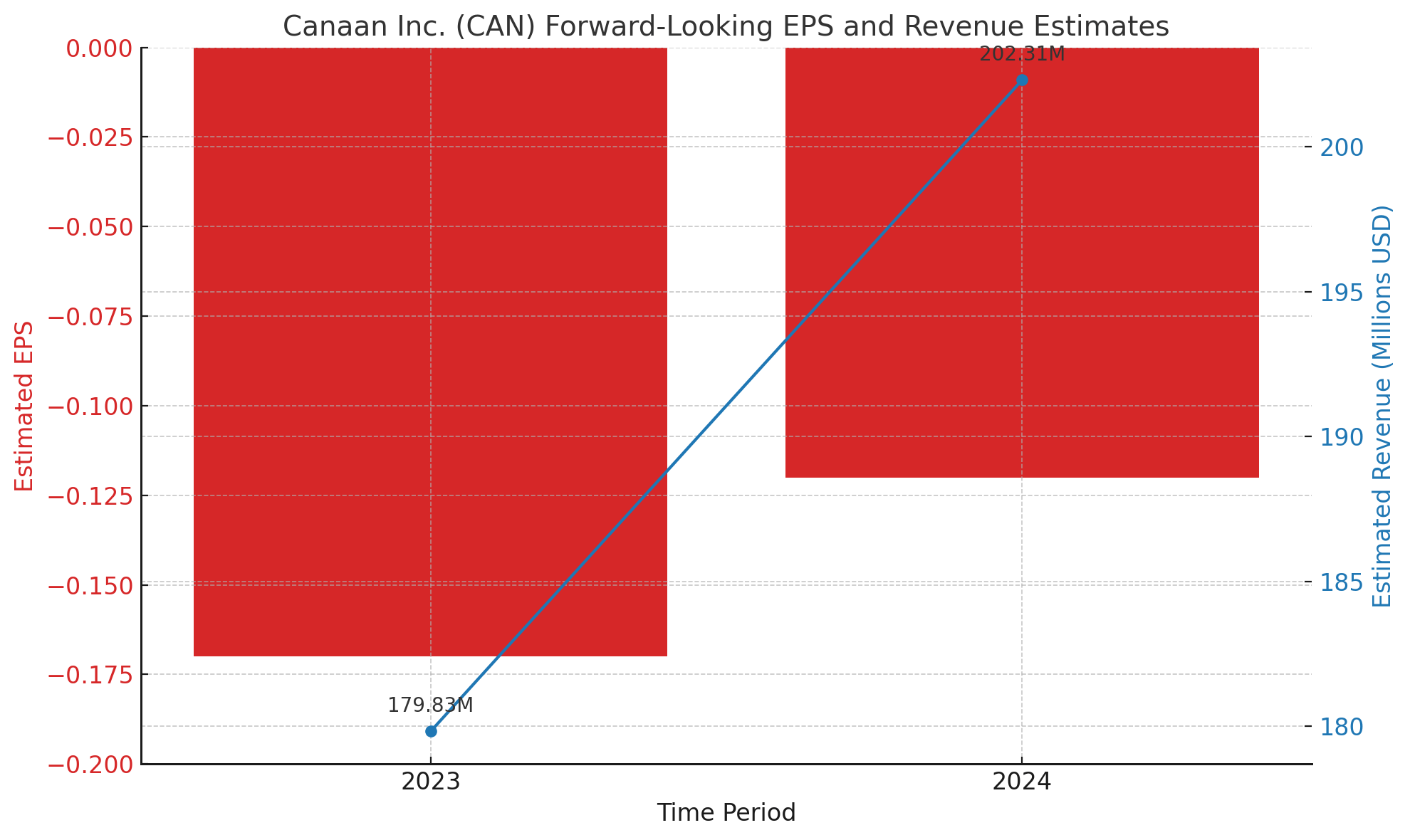

Forward-Looking Estimates

Analysts project a challenging near future for Canaan. The current quarter (Dec 2023) estimates indicate an EPS of -0.17, with a similar trend expected in the following quarter (Mar 2024). Revenue estimates for the current and next year are $179.83M and $202.31M, respectively, reflecting cautious optimism for a gradual recovery.

Investor Considerations

Potential investors should weigh Canaan's volatile market performance, mixed financial health, and the challenging regulatory and market environment. The company's strategic expansion into new markets, like Africa and South America, and its robust computing power growth are positive indicators, but they must be evaluated against the backdrop of a fluctuating cryptocurrency market and internal operational challenges.

Strategic Outlook

Canaan’s future depends on its ability to navigate the complex regulatory landscape, optimize operational efficiencies, and capitalize on new market opportunities. Investor confidence may hinge on the company's adaptability to these dynamic conditions and its strategic decisions in the coming quarters.

For detailed stock analysis and real-time charting, visit TradingNews.com. For insights into insider transactions and stock profile, refer to TradingNews.com Insider Transactions and Stock Profile.

That's TradingNEWS

Read More

-

JIVE ETF Near $90: International Value Rally That Still Looks Investable

17.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI And XRPR: Deep 60% Drawdown Or Rare $8.51 Entry After $1.3B Flows?

17.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: Can the $3 Henry Hub Floor Survive Spring?

17.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY Tests 153 Support as BoJ April Hike Talk Lifts Yen

17.02.2026 · TradingNEWS ArchiveForex