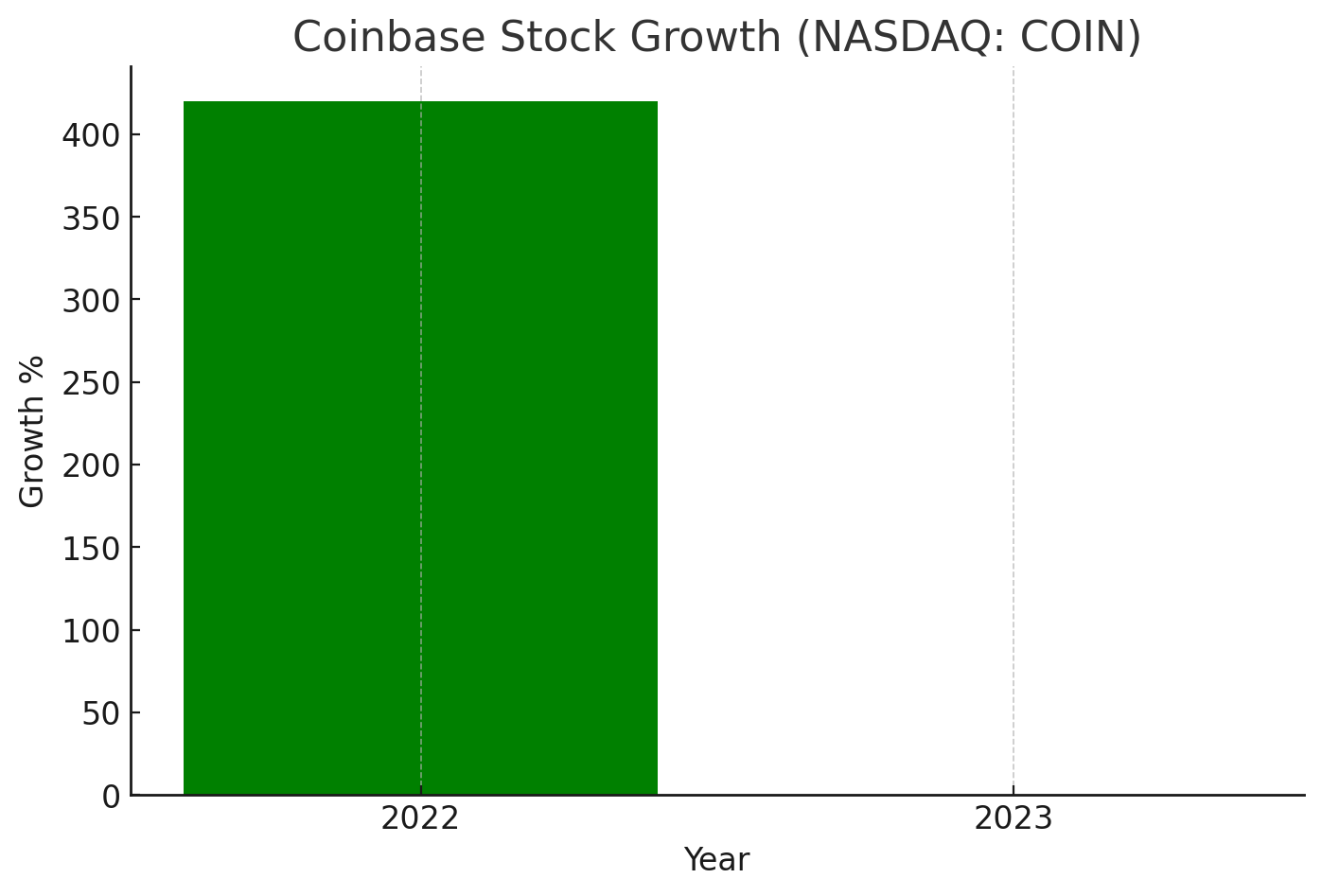

Coinbase's Exponential Growth in the Crypto Sphere

NASDAQ: COIN has witnessed a meteoric rise, marking an impressive 420% gain and reaching a 52-week peak of approximately $179. This growth trajectory, while partly influenced by the broader cryptocurrency market, primarily stems from Coinbase's own strategic initiatives. The company's expansion into a comprehensive financial platform and international growth efforts are instrumental in this success.

Coinbase's Strategic Expansion: Going Global

Coinbase's international expansion is noteworthy. The firm has successfully penetrated the European market, securing multiple licenses across Ireland, Germany, Italy, Spain, and France. With the upcoming implementation of MiCA regulation in 2024, Coinbase is positioned to capitalize on uniform crypto asset platform operations throughout Europe.

Coinbase vs. US SEC: A Battle for Regulatory Clarity

Coinbase is actively engaged in a legal dispute with the US SEC. The company advocates for clearer digital asset regulations, with a crucial hearing scheduled for January 17, 2024. A positive outcome could significantly impact the crypto space and set a precedent for digital token classification in the US.

Coinbase's Asian and South American Ventures

The Asian market, particularly Singapore, has been a focal point for Coinbase since 2015. The firm's recent full operational license in Singapore and partnerships with local banks enhance its service offerings in the region. Additionally, expansion into South America broadens Coinbase's global footprint.

Coinbase and the Anticipated Spot Bitcoin ETF

Coinbase is strategically positioned as the custodian for numerous spot Bitcoin ETF applications, including those from Grayscale, ARK 21Shares, and BlackRock. Approval of these ETFs could significantly enhance Coinbase's influence in the crypto custody sector.

Financial Highlights and Challenges

Coinbase's Q3 transaction revenue showed a decline, primarily due to decreased crypto asset volatility. However, the last quarter of 2023 saw a pickup in CEX volume, hinting at a potential surge in trading activity and revenue for Coinbase, especially with the prospect of a spot BTC ETF approval.

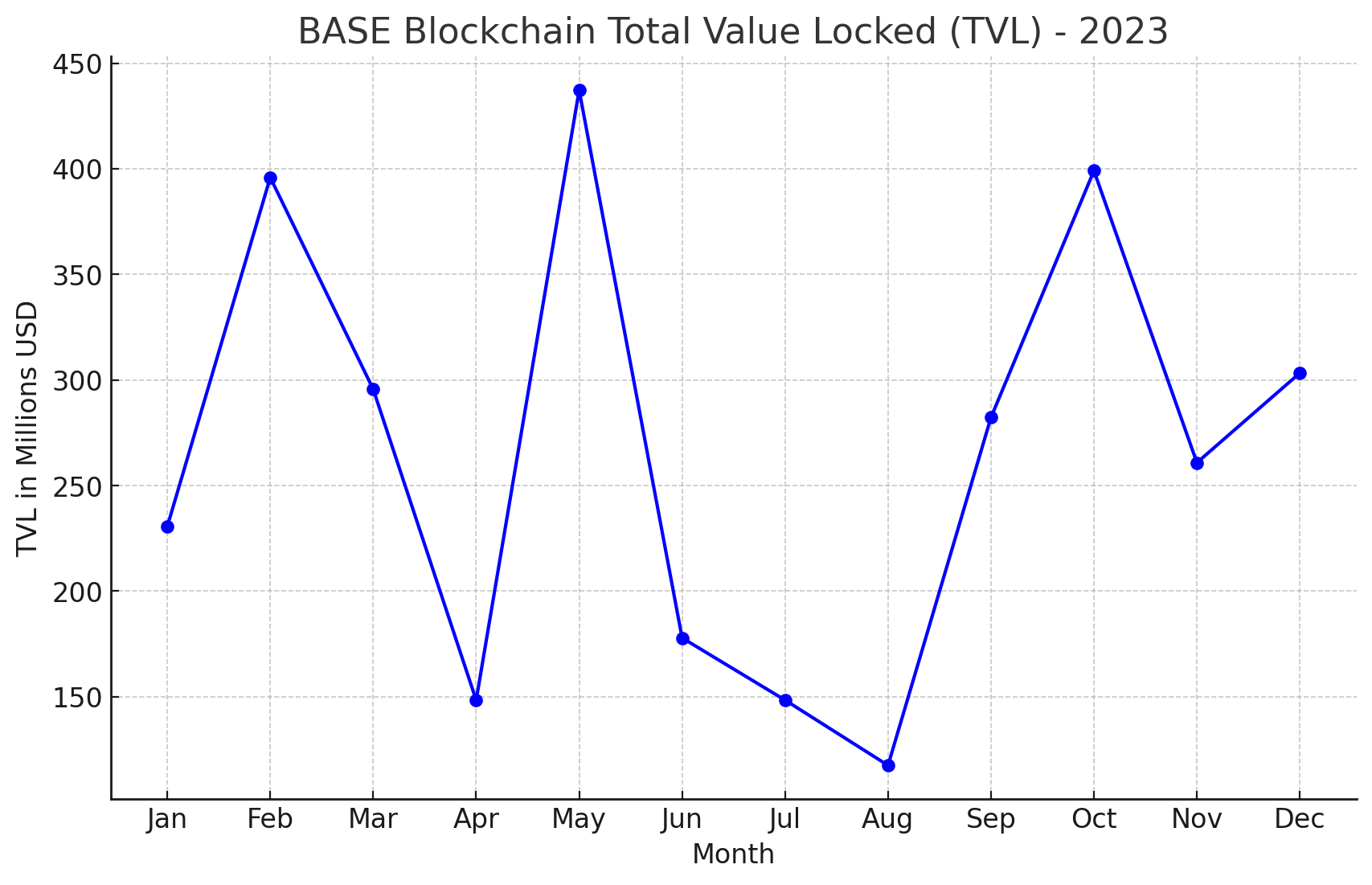

Coinbase's BASE Blockchain Performance

BASE, Coinbase's blockchain, has shown steady growth in Total Value Locked (TVL), although it still trails behind Layer-2 chains like Arbitrium and Optimism. Continued development in this segment is key to Coinbase's future revenue and market positioning.

Navigating Risks and Market Volatility

Coinbase's stock, like many crypto-related stocks, is susceptible to market volatility and security risks. The anticipation of a spot BTC ETF approval remains speculative, and any delays or denials could impact Coinbase's projected revenue streams.

The Bullish Case for Coinbase in 2024

Several factors contribute to a positive outlook for Coinbase in 2024. These include expected post-halving price gains in the crypto market, the potential approval of spot Bitcoin ETFs, and Coinbase's ongoing global expansion. The company's commitment to regulatory clarity and compliance positions it as a preferred platform for institutional investors.

Coinbase's Valuation and Industry Positioning

COIN's valuation remains a point of interest, with the stock currently trading below its all-time high. Its proactive approach to regulatory compliance and strategic global expansion are compelling reasons for its potential dominance in the crypto exchange market in 2024.

A Glimpse into Coinbase's Future

Looking ahead, COIN could experience volatility diverging from traditional valuation metrics. The crypto industry awaits the SEC's decision on spot bitcoin ETFs, with significant implications for institutional investment in the crypto space.

In Conclusion: A Pivotal Year for Coinbase

Coinbase's strategic initiatives, regulatory efforts, and expansion into new markets position it as a formidable player in the crypto exchange landscape. As the industry anticipates regulatory developments and the potential approval of spot bitcoin ETFs, COIN stands at the forefront of these transformative changes.

For real-time analysis and insights on Coinbase, visit Coinbase Real-Time Chart and explore insider transactions at Coinbase Insider Transactions.

That's TradingNEWS