Comprehensive Analysis of Currency Movements as 2023 Closes

Analyzing Major Pair Movements: USD/JPY, GBP/USD, and Gold Price Trajectories | That's TradingNEWS

Analyzing the U.S. Dollar's Retreat and Major Currency Movements as 2023 Ends

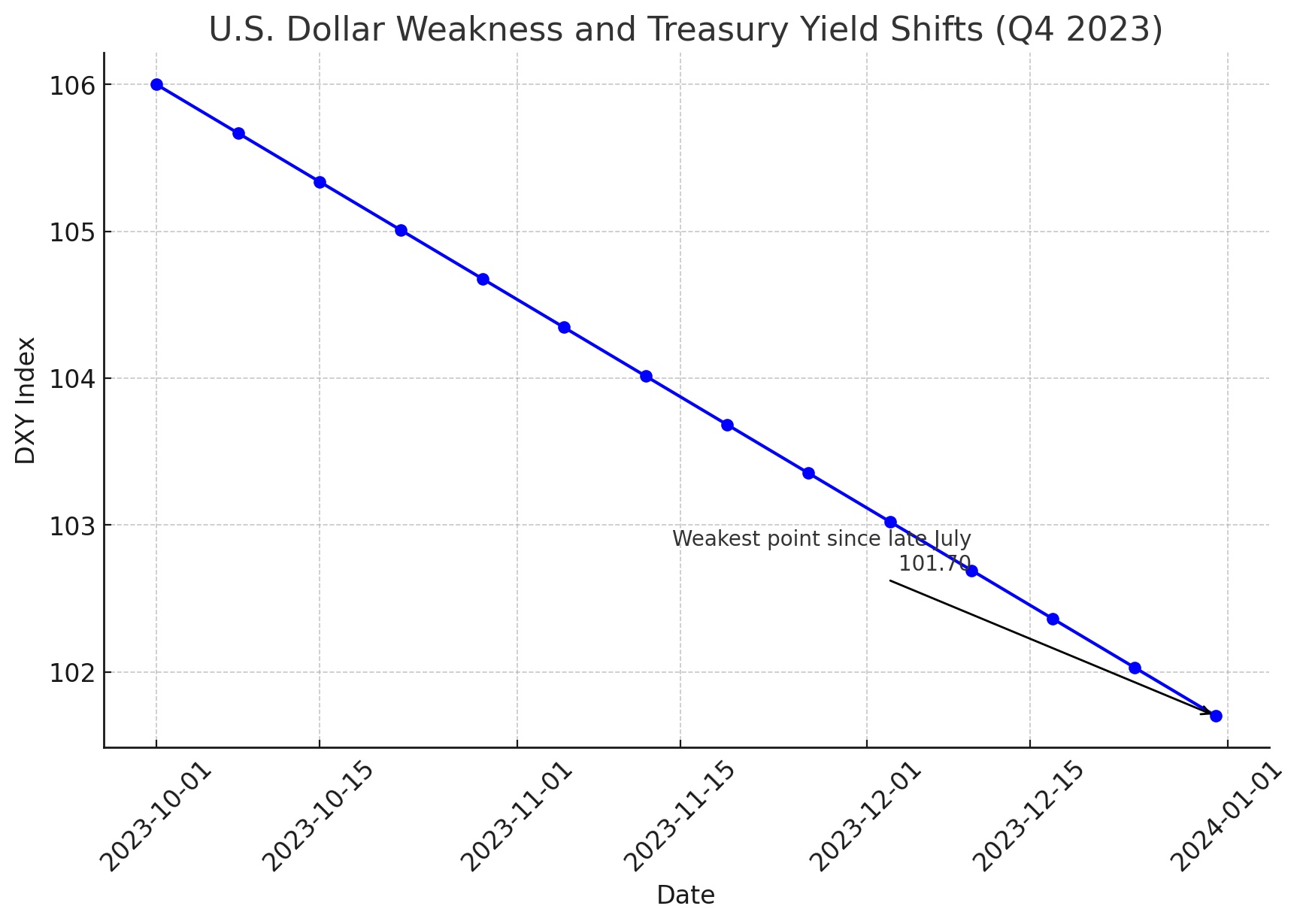

U.S. Dollar Weakness and Treasury Yield Shifts

The U.S. dollar, gauged by the DXY index, has experienced a notable decline, marking its weakest point since late July at 101.70. This downward trend, evident in the fourth quarter with a 4.21% drop and a 1.75% decrease in December, has been influenced significantly by the substantial pullback in government bond yields. The yields, having peaked in late October, reflect the market's reaction to the Federal Reserve's dovish pivot, suggesting discussions of rate cuts and signaling a 75 basis-point easing in 2024.

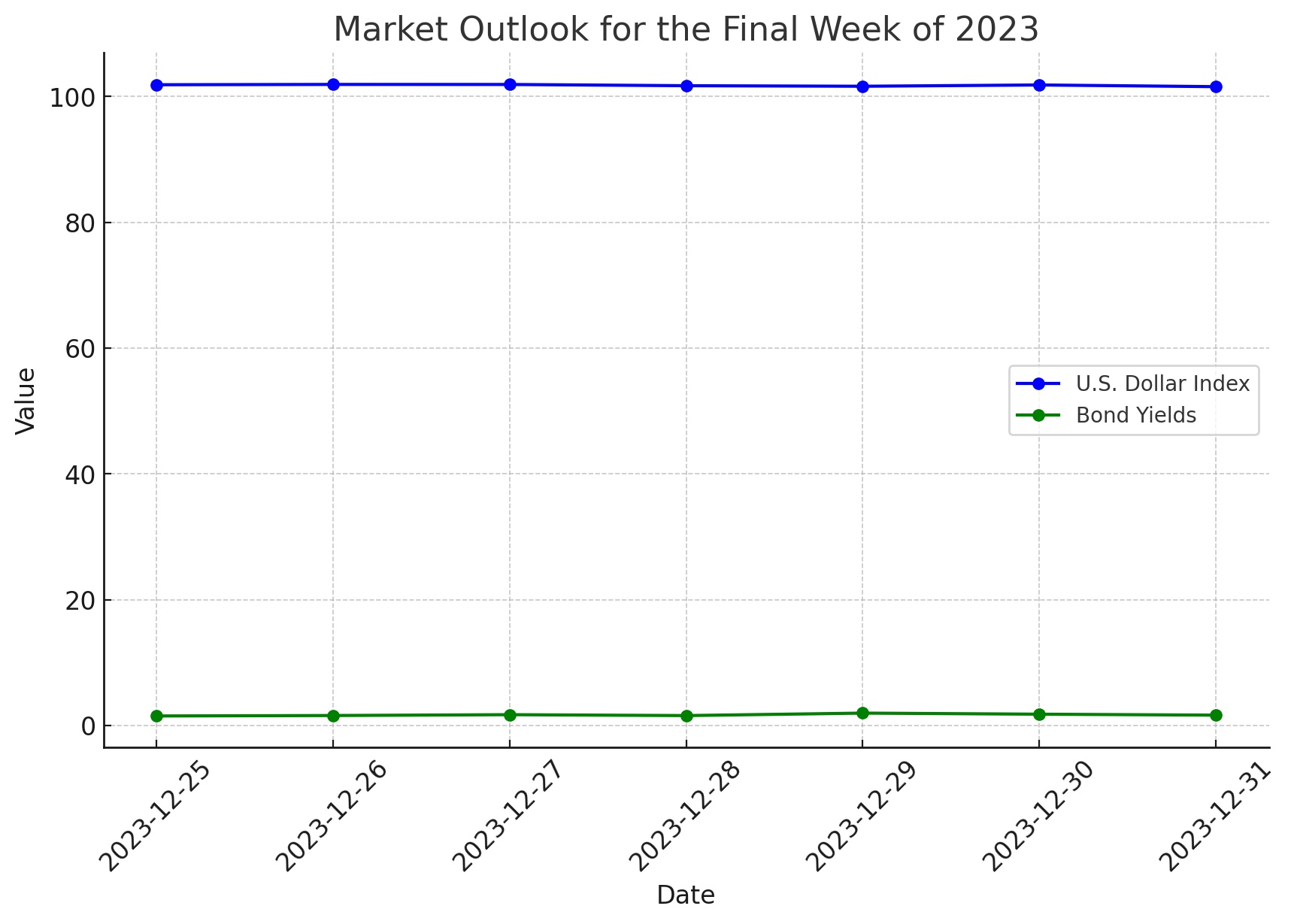

Market Outlook for the Final Week of 2023

As the year draws to a close, the absence of high-impact economic releases might lead to the consolidation of recent trends, particularly the weakening U.S. dollar and falling yields. However, reduced liquidity during the holiday season could amplify price swings, necessitating caution among traders.

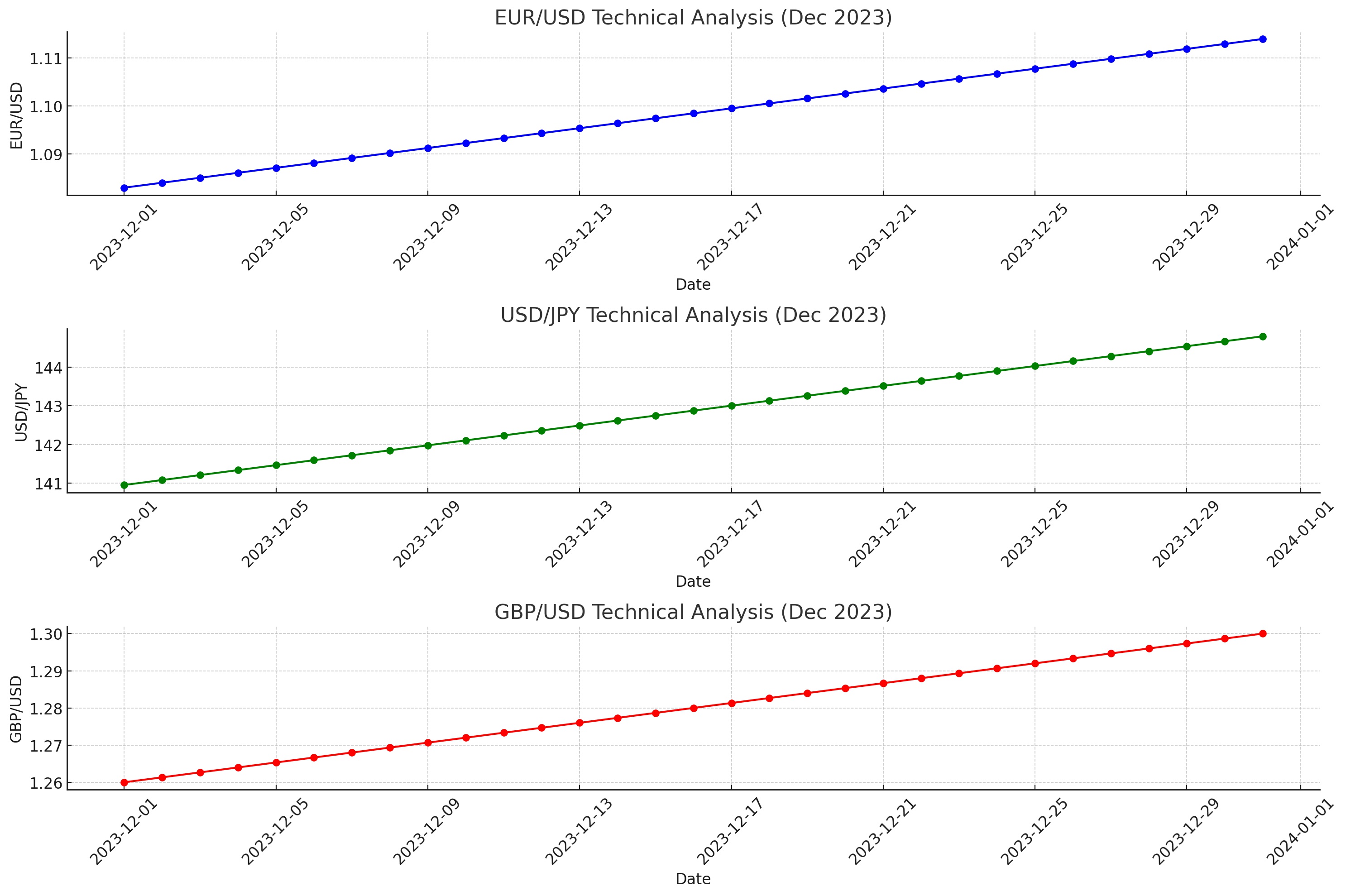

EUR/USD Technical Analysis: A Bullish Bias

The EUR/USD pair faces a crucial resistance zone between 1.1000 and 1.1025. A decisive breach of this barrier could propel the pair towards 1.1085 and subsequently 1.1140. Conversely, failure to maintain this momentum could see the pair retracting to initial support at 1.0830, with a further potential drop towards 1.0770.

USD/JPY and GBP/USD Movements

The USD/JPY pair, having failed to reclaim its 200-day SMA, could experience selling pressure, potentially leading to a decline towards 140.95. Alternatively, a rise above its 200-day SMA could confront resistance at 144.80. The GBP/USD, meanwhile, encounters resistance near 1.2727 to 1.2769. A bullish breakout could lead to targets at 1.2800 and 1.3000, while a bearish reversal might find support around the 1.2600 area.

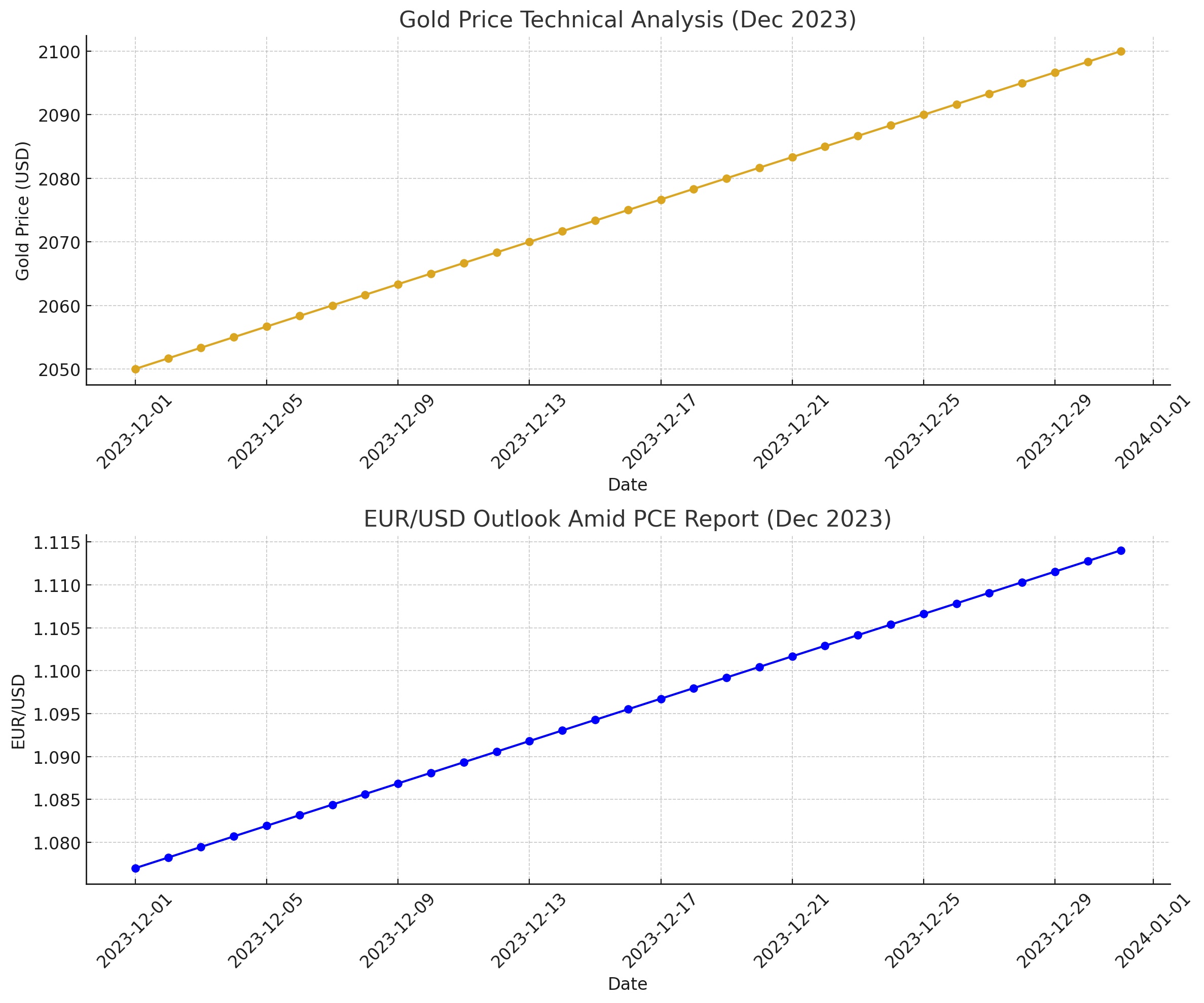

Gold's Trajectory in Light of Economic Data

Gold (XAU/USD) has been trading near three-week highs, buoyed by expectations of a Fed rate cut in March 2024. The upcoming U.S. Personal Consumption Expenditure (PCE) data could significantly impact gold prices, with a lower-than-expected PCE potentially leading to a further rise in gold prices.

EUR/USD Outlook Amid PCE Report

The Euro has shown strength against the U.S. dollar, particularly after a weaker-than-expected U.S. GDP report. The pair's movement now hinges on the upcoming PCE report, which could either strengthen or weaken its current bullish trend.

Gold Price Technical Analysis

Gold’s technical analysis indicates a potential for further gains if resistance at $2,053 is broken. However, support levels at $2,050 and $2,010 must be maintained to prevent a bearish momentum resurgence.

Conclusion

As 2023 nears its end, the U.S. dollar's trajectory, alongside movements in major currency pairs like EUR/USD, GBP/USD, and gold prices, presents a complex picture. With the Fed's dovish stance and economic data releases playing pivotal roles, the market is poised for potential shifts in trends, emphasizing the need for traders to stay vigilant and informed.

That's TradingNEWS

Read More

-

GPIQ ETF Price Forecast: Can a 10% Yield at $52 Survive the Next Nasdaq Selloff?

09.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Price Forecast: XRPI at $8.32, XRPR at $11.86 as $44.95M Inflows Defy BTC and ETH Outflows

09.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Forecast: Will The $3.00 Floor Hold After The $7 Winter Spike?

09.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Back Under 50K While S&P 500 and Nasdaq Push Higher as Gold Reclaims $5,000

09.02.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast: Can Bulls Clear 157.5 Without Triggering a 160 Intervention Line?

09.02.2026 · TradingNEWS ArchiveForex