Comprehensive Financial and Market Analysis of PepsiCo NASDAQ:PEP

Investigating PepsiCo's Earnings Projections, Market Position, and Strategic Growth Opportunities for Investors | That's TradingNEWS

Analyzing PepsiCo's Financial Stability and Market Position

Market Presence and Financial Health

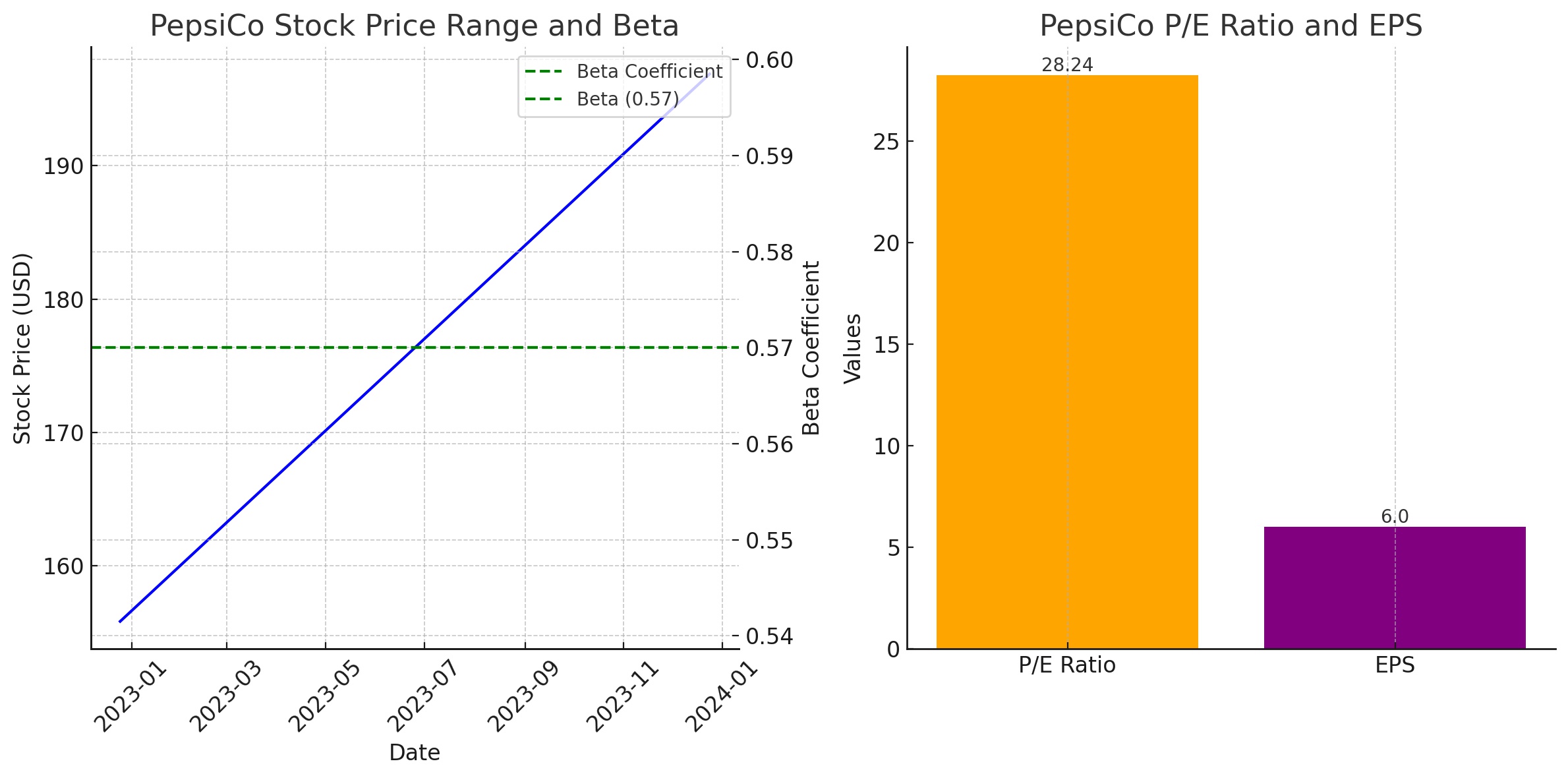

PepsiCo (NASDAQ: PEP) stands as a formidable entity in the consumer goods industry with a substantial market capitalization of $232.929 billion. This market presence is reinforced by its stock price, which ranges between $155.83 and $196.88, showcasing robust investor engagement. PepsiCo's moderate market volatility is indicated by a Beta of 0.57. Its financial soundness is further evidenced by a Price-to-Earnings (P/E) ratio of 28.24 and an Earnings Per Share (EPS) of $6.00.

Earnings and Revenue Projections

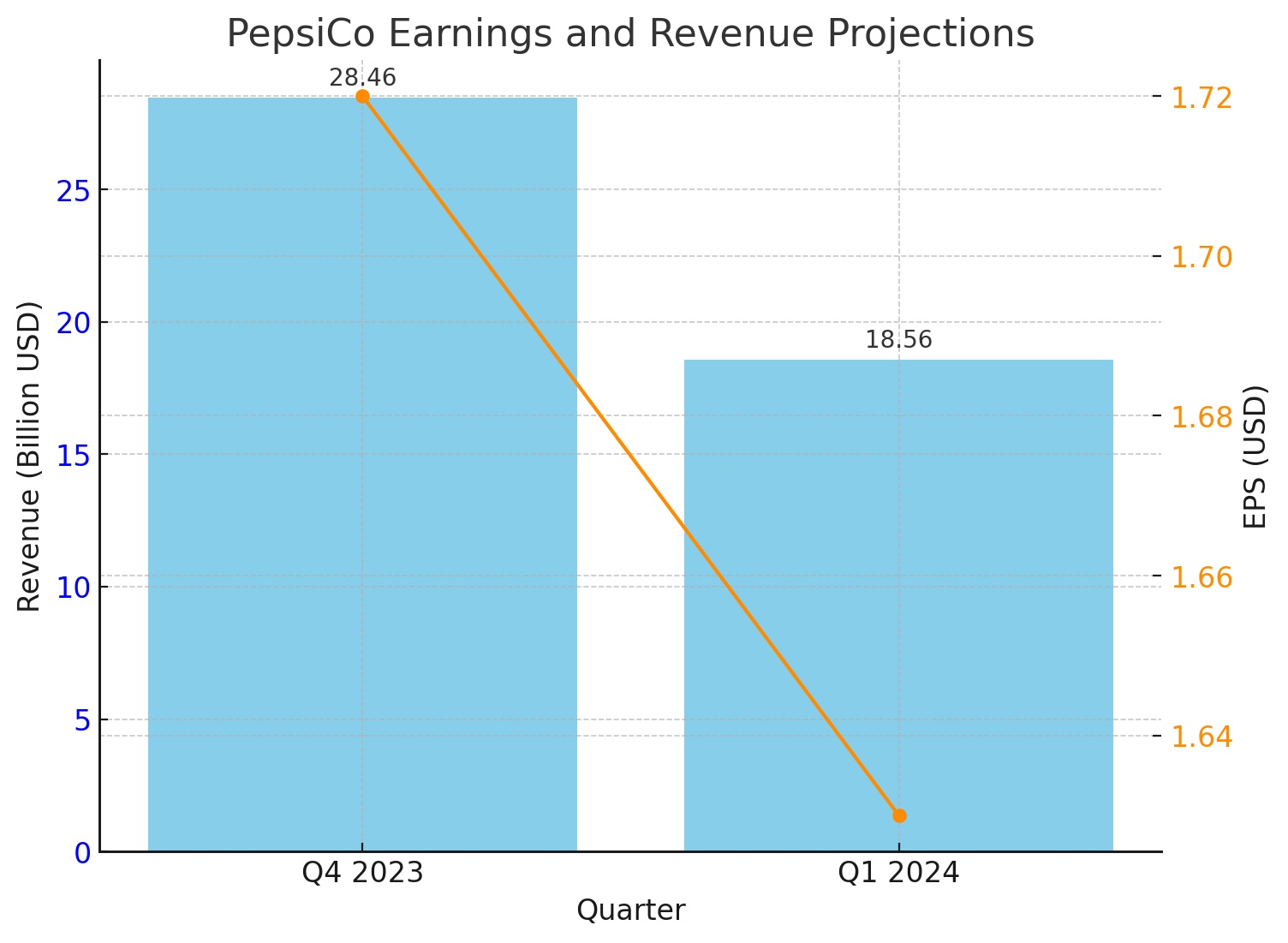

Looking ahead, PepsiCo is projected to achieve an EPS of $1.72 for the current quarter ending December 2023 and $1.63 for the subsequent quarter. These figures point to a strong earnings outlook. Revenue forecasts are equally promising, with estimates of $28.46 billion for the current quarter and $18.56 billion for the next, reflecting PepsiCo's dynamic financial trajectory.

Institutional Confidence and Market Sentiment

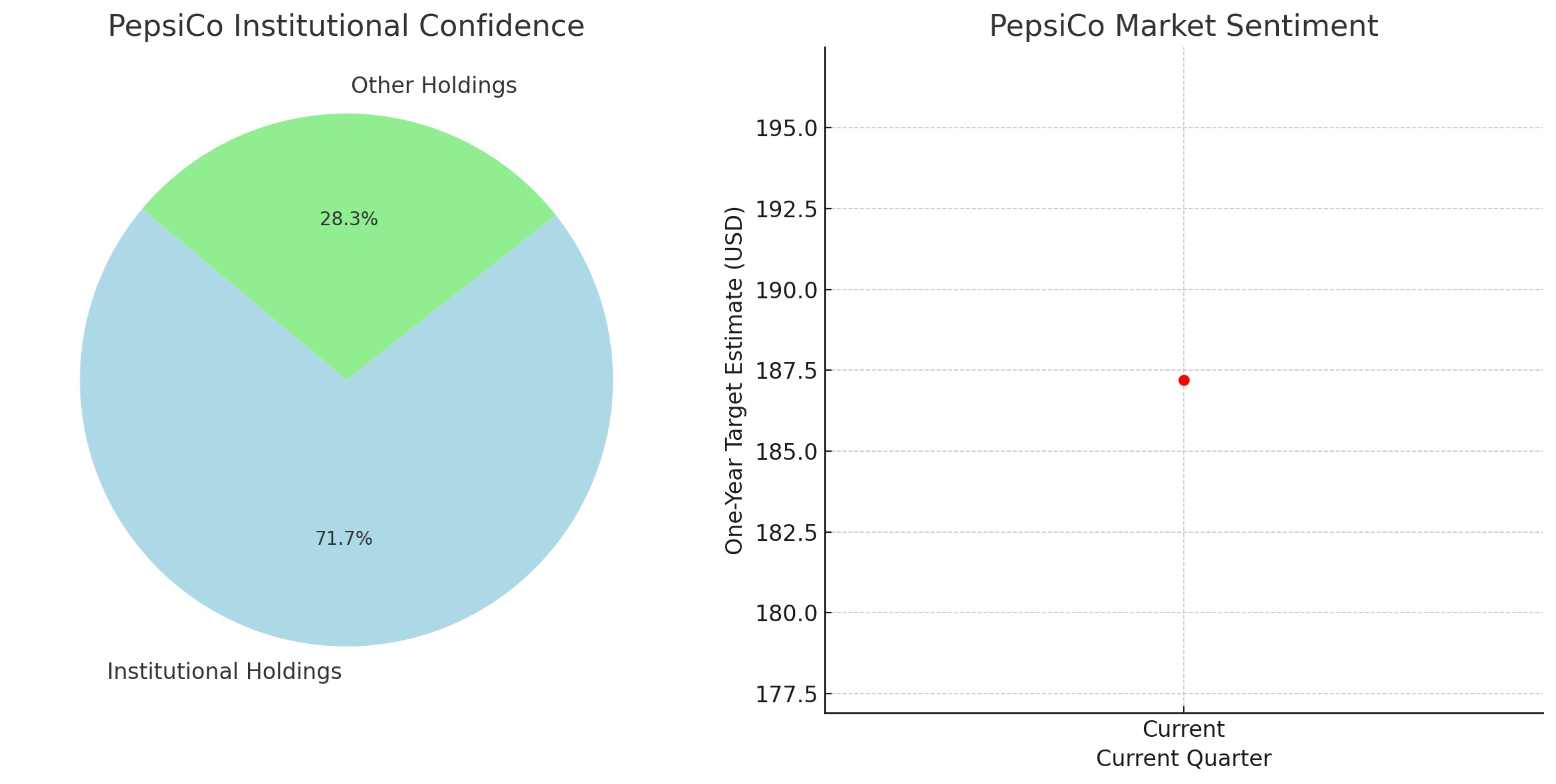

A significant portion of PepsiCo's stock, 71.73%, is held by institutional investors, highlighting the market's confidence in the company's strategic direction. The one-year target estimate of $187.20 suggests a cautiously optimistic market outlook.

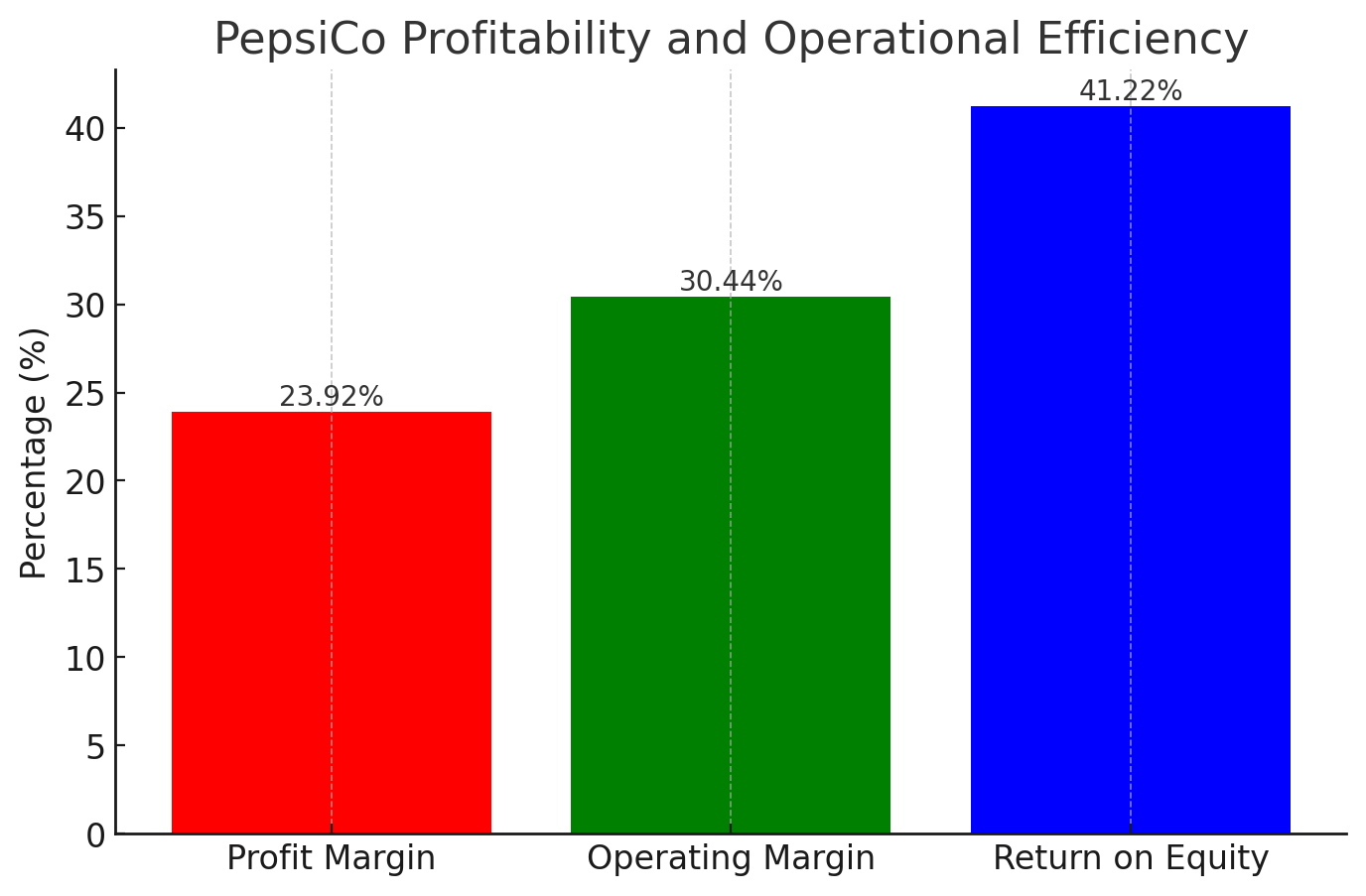

Profitability and Operational Efficiency

PepsiCo boasts a profit margin of 23.92% and an operating margin of 30.44%, signaling its efficiency in revenue conversion and profitability. The return on equity of 41.22% further underscores its effective use of capital.

Growth Forecasts and Strategic Outlook for PepsiCo (NASDAQ: PEP)

PepsiCo's future growth trajectory presents a complex picture. Short-term projections indicate strong earnings, with a potential moderation in performance. However, the outlook for 2024 and beyond points to recovery and growth, highlighting the company's adaptability in the evolving retail landscape.

Diversified Portfolio and Global Presence

PepsiCo’s global footprint and diverse product range play a critical role in its market resilience. The company's ability to innovate and adapt to changing consumer trends is key to maintaining its competitive edge in the consumer goods sector.

Navigating Industry Challenges

PepsiCo faces various challenges, including market competition and shifting consumer preferences. Its strategic responses, including a focus on digital innovation and customer-centric initiatives, are vital in sustaining its leadership position.

Financial Analysis and Operational Resilience

An in-depth analysis of PepsiCo’s financials reveals a company adept at maintaining profitability and operational efficiency. The company's robust balance sheet, with a debt-to-EBITDA ratio close to 2x, and a consistent capital allocation policy, including significant stock repurchases, demonstrate financial prudence and commitment to shareholder value.

Investment Analysis and Valuation of PepsiCo Inc. (NASDAQ: PEP)

Assessing PepsiCo's Market Valuation PepsiCo's current market capitalization of $232.929 billion and a trailing Price-to-Earnings (P/E) ratio of 28.24 position it strongly in the competitive consumer goods market. This valuation, reflecting robust earnings of $6.00 per share, suggests significant investor confidence in its business model and future prospects.

Investor Considerations and Market Dynamics

Investors considering PepsiCo as part of their portfolio need to weigh several factors. The company's stock, showing moderate volatility with a Beta of 0.57, is subject to market fluctuations. Despite this, PepsiCo's strategic focus, reflected in its forward dividend yield of 2.92% and consistent performance in challenging market conditions, underscores its resilience and adaptability.

Future Growth Prospects and Analyst Expectations

Looking forward, PepsiCo is projected to maintain strong earnings, with an EPS forecast of $1.72 and $1.63 for the upcoming quarters. These projections, along with revenue estimates of $28.46 billion and $18.56 billion for the respective quarters, indicate a positive growth trajectory. However, the anticipated 6.60% to 18.00% sales growth for the current year signifies potential challenges ahead.

Rationale Behind the Investment Outlook

Given PepsiCo's current market performance and future growth estimates, the investment outlook leans towards a cautious optimism. The company's ability to navigate through industry challenges, embrace digital transformation, and capitalize on its market position makes it a potentially lucrative investment. However, potential investors should be mindful of the risks associated with the consumer goods sector, including competitive pressures and evolving consumer preferences.

Recommendation: Buy, Sell, or Hold

In light of the comprehensive analysis, PepsiCo currently presents a 'Buy' recommendation for investors. The company’s strong market position, coupled with its operational resilience and strategic initiatives, offers a stable investment opportunity. However, the mixed signals in growth projections and the evolving consumer goods landscape suggest a need for careful monitoring of the stock’s performance.

Read More

-

JIVE ETF Near $90: International Value Rally That Still Looks Investable

17.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI And XRPR: Deep 60% Drawdown Or Rare $8.51 Entry After $1.3B Flows?

17.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: Can the $3 Henry Hub Floor Survive Spring?

17.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY Tests 153 Support as BoJ April Hike Talk Lifts Yen

17.02.2026 · TradingNEWS ArchiveForex