Comprehensive Financial Review of Harley-Davidson NYSE:HOG 2024 Outlook

Analyzing Revenue Trends, Market Challenges, and Investment Opportunities for Harley-Davidson in 2024 | That's TradingNEWS

Detailed Financial Analysis of Harley-Davidson, Inc. (NYSE:HOG)

Stock Overview and Historical Performance

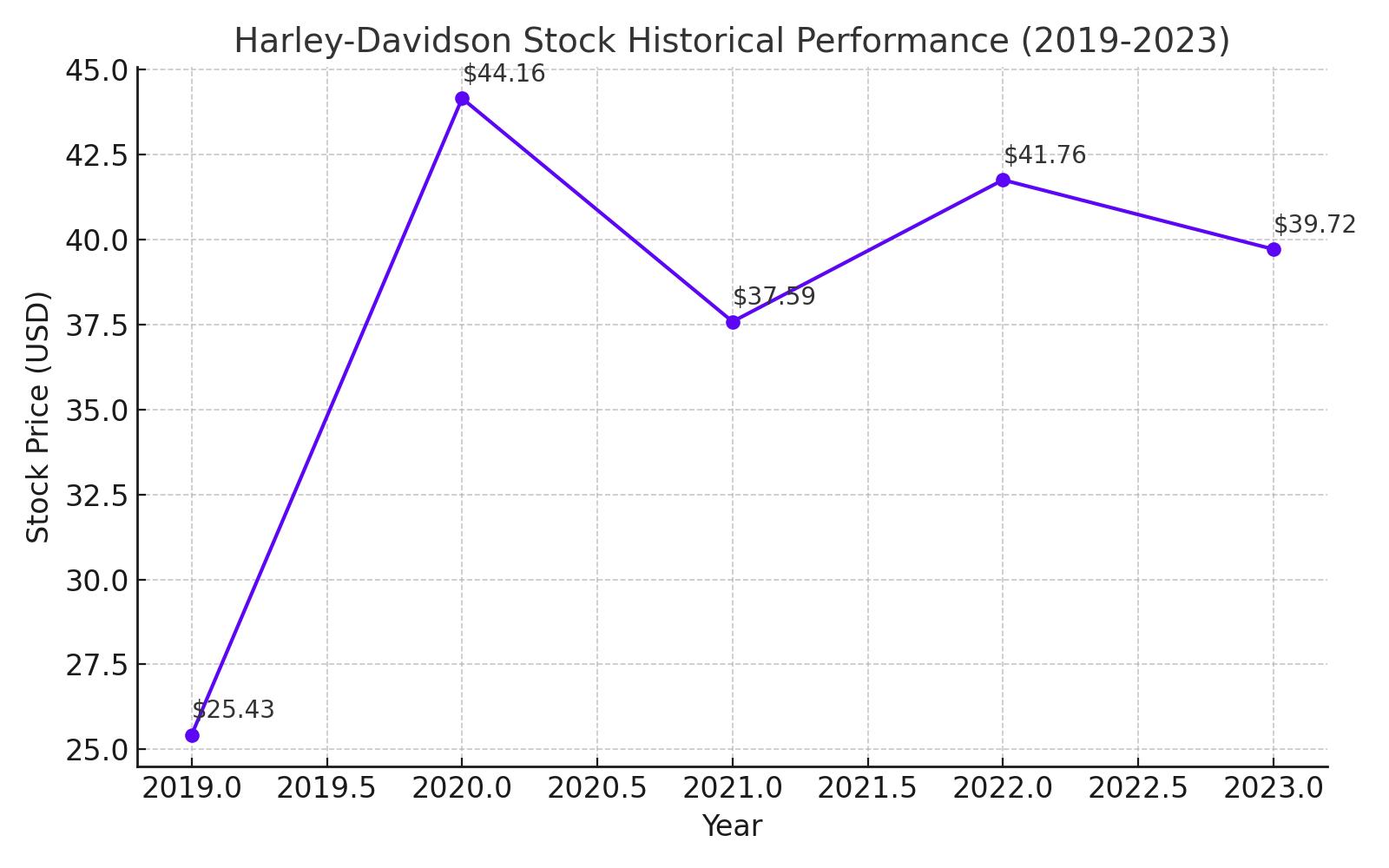

NYSE:HOG has shown a relatively stable yet stagnant performance over the last five years, with the stock price fluctuating between a low of $25.43 and a high of $44.16. Most recently, the stock has been trading around $39.72, reflecting a cautious market sentiment given the broader industry challenges and internal corporate hurdles.

Financial Health and Recent Earnings

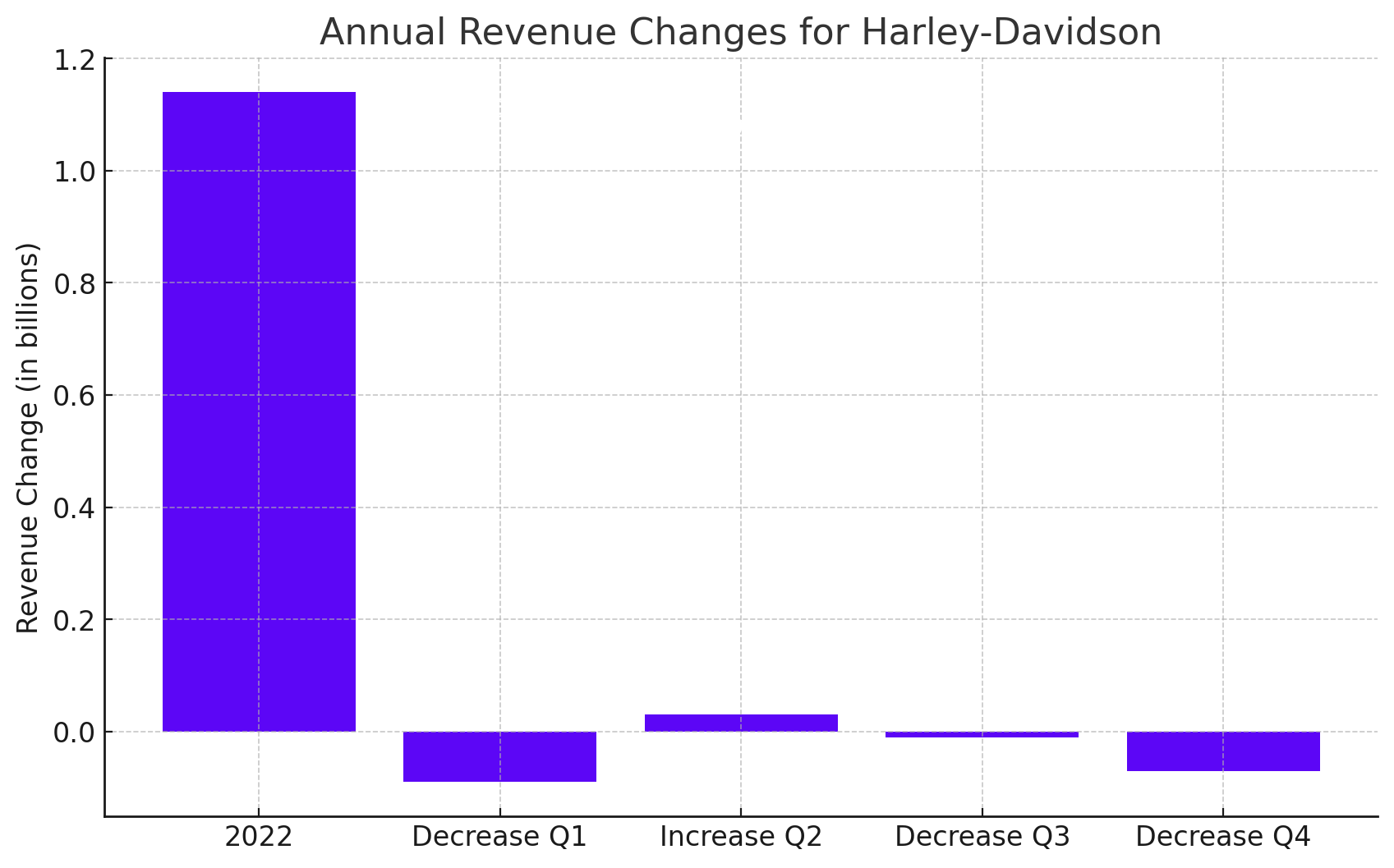

In the fourth quarter, Harley-Davidson reported a decrease in total revenues to $1.05 billion, a 7.9% drop year-over-year from $1.14 billion. Despite the decline, this figure surpassed the consensus expectations by $175 million. For the full year of 2023, revenues saw a marginal increase of 1% from 2022, indicating some resilience amid economic pressures.

Segment Performance Breakdown

- Motorcycle Sales: There was a significant contraction in Q4 motorcycle sales, with revenues falling to $583 million from $666 million the previous year, a decline of approximately 12.5%. The total units shipped decreased to 29.5k from 34.0k, reflecting a decrease of around 13.2%.

- Parts and Accessories: Revenue from this segment fell by 14% due to lower retail motorcycle volumes.

- Apparel and Licensing: These segments also saw declines, with apparel revenues dropping 21% to $57 million and licensing revenues down 27% to $8 million.

Geographic Sales Insights

- North America: Sales dropped by 9% in this key market, affected partly by high interest rates and product transitions.

- EMEA: A significant decline of 22% was observed, with particular weaknesses in France and Germany.

- APAC: Experienced a 10% drop, with notable weaknesses in Australia and New Zealand.

- Latin America: Contrary to other regions, this market saw a 46% increase, primarily driven by growth in Brazil and Mexico.

Operational and Financial Challenges

Harley-Davidson's gross margin decreased by 360 basis points in the fourth quarter due to a combination of lower volumes, increased sales incentives, and heightened manufacturing costs. Operating margin also saw a reduction of 2.1 percentage points. These margin pressures contributed to a reduced net income of $26 million, or $0.18 per share, down from $0.28 per share in the same period last year.

Forward-Looking Projections

For 2024, Harley-Davidson's management anticipates continued challenges, with revenue and operating income potentially declining by single-digit percentages. They forecast an earnings per share (EPS) range for the year between $4.20 and $4.70, suggesting a potential decline from the $4.87 reported in 2023.

Market Valuation and Trading Strategy

With a current P/E ratio of 8.24 and a forward P/E estimate near 7.5, Harley-Davidson presents a potentially undervalued investment in terms of earnings potential. However, investors should be cautious of potential multiple compression if the company fails to reverse the negative trends in sales and margins.

Investment Considerations for Harley-Davidson, Inc. (NYSE:HOG)

Current Market Valuation and Investment Outlook

Harley-Davidson's current trading price of $39.72 reflects a price-to-earnings (P/E) ratio of 8.24, which is lower than the industry average, suggesting potential undervaluation. However, given the company’s recent performance and market conditions, the valuation also reflects significant uncertainties and challenges the company faces. The forward P/E ratio near 7.5, based on projected earnings per share (EPS) for 2024 of between $4.20 and $4.70, underscores this cautious market sentiment.

Strategic Analysis and Future Projections

Looking ahead, the company's strategic initiatives, particularly around the LiveWire electric bike segment and outreach to younger demographics, are pivotal. However, these efforts have yet to significantly impact financial results. The company expects a flat to slight decline in revenue and operating income for 2024, indicating that substantial growth may still be on the horizon.

Bearish and Bullish Scenarios

Bearish Perspective: Given the flat revenue projections and ongoing margin pressures, there is a risk of continued underperformance. High financing rates and a slow penetration into new market segments could exacerbate these issues. If these trends persist, further multiple compression could occur, pushing the stock price towards the lower end of its recent range near $25. This scenario would make Harley-Davidson a potential sell or high-risk hold, especially for risk-averse investors.

Bullish Perspective: On the optimistic side, any reduction in financing rates or a successful market repositioning could significantly improve sales, particularly in younger demographics and new geographical markets. Should these efforts materialize into solid financial results, there is an upside potential with the stock moving towards the $40 mark or higher, aligning with a bullish case for a speculative buy.

Investment Recommendation: Hold with Cautious Monitoring

Given the mixed signals from the financial performance and strategic efforts, a hold recommendation is appropriate for current investors with a keen eye on market dynamics and company updates. Potential investors should look for signs of improvement in quarterly results and strategic execution before committing. Traders, however, may find short-term opportunities between the $25 to $40 trading range, exploiting the stock's volatility for potential gains.

Monitoring Key Metrics

Investors should monitor changes in:

- Revenue growth, especially from new models and market segments.

- Margin improvements from operational efficiencies.

- Updates on the adoption and financial impact of the LiveWire electric bikes.

- Macroeconomic factors that may affect financing rates and consumer spending.

By keeping a close watch on these metrics and market conditions, investors can better time their decisions to buy, sell, or continue holding Harley-Davidson shares. For more detailed analysis and real-time tracking, visit Harley-Davidson's stock profile on Trading News for up-to-the-minute data and insights.

That's TradingNEWS

Read More

-

Google Stock Price Forecast - AI Capex Shock, Cloud Breakout and What $313 Really Prices In

12.02.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast: XRP-USD Stuck Between $1.34 Support And $1.50 Ceiling

12.02.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: WTI Around $63 And Brent $68 Trapped Between Oversupply And Gulf Risk

12.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Jones Holds 50,000 While S&P 500 Steadies and Nasdaq Sinks on Cisco & AppLovin Rout, CPI Looms

12.02.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - GBPUSD=X Stalls Around 1.3630 as Weak UK GDP Meets Robust US Jobs Data

12.02.2026 · TradingNEWS ArchiveForex