Comprehensive Financial Review of Steel Dynamics NASDAQ:STLD Stock

In-depth Analysis of Market Performance, Financial Metrics, and Strategic Directions of NASDAQ: STLD, a Leader in the Steel Industry | That's TradingNEWS

Steel Dynamics, Inc. (NASDAQ: STLD) - Comprehensive Financial Analysis

Market Dynamics and Company Overview

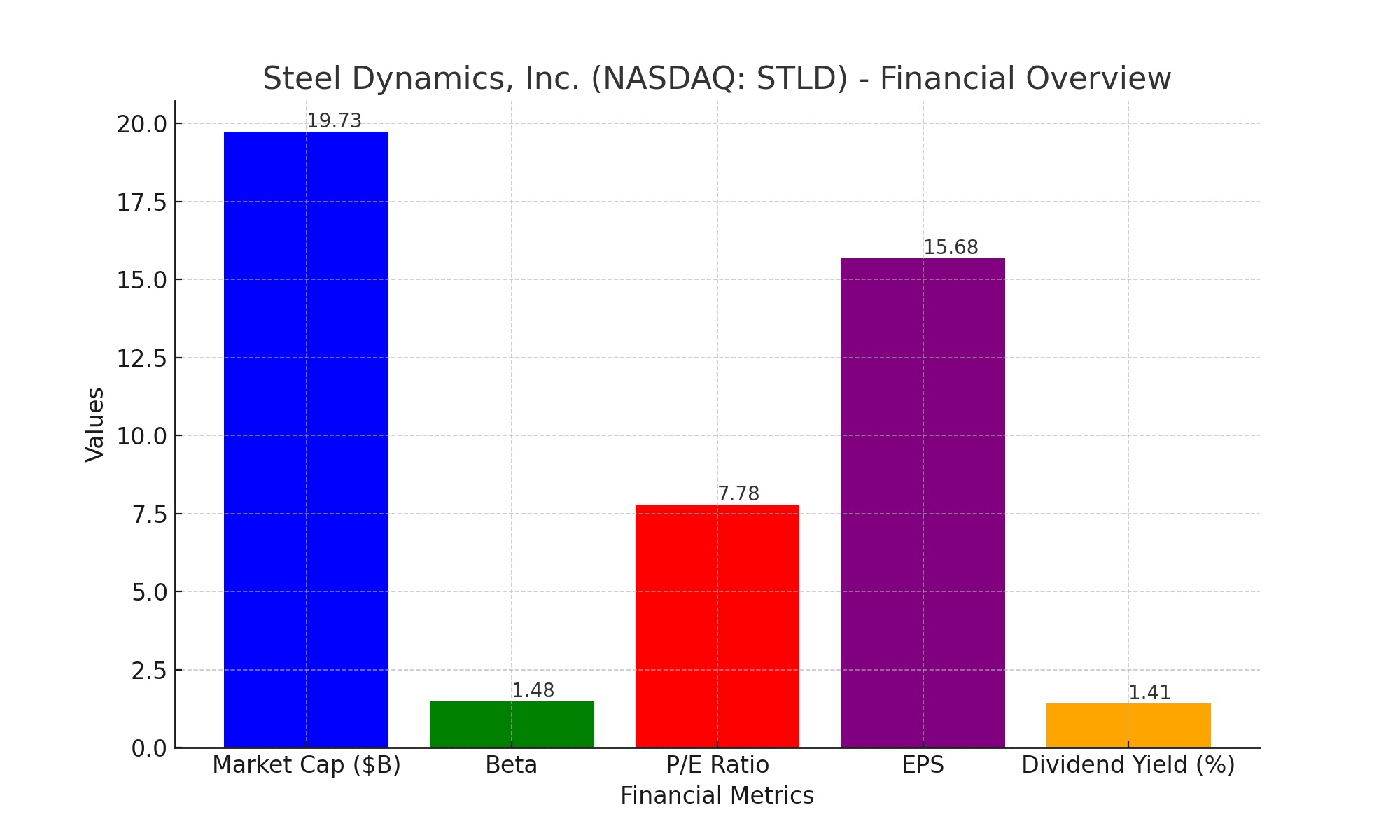

Steel Dynamics, Inc. (STLD), a significant player in the steel industry, trades on the NasdaqGS. With a market cap of $19.733 billion and a Beta of 1.48, STLD exhibits notable market volatility, reflecting its sensitivity to economic and industry-specific trends. The company's stock price fluctuates within a 52-week range of $90.55 to $136.46, indicating considerable investor interest and market activity.

Financial Performance and Earnings Analysis

STLD's performance in the stock market is underlined by a trailing P/E ratio of 7.78 and an EPS of 15.68. This robust EPS highlights the company's profitability in the tumultuous steel market. The upcoming earnings date on January 23, 2024, is highly anticipated by investors and analysts alike. The forward dividend yield of 1.41% further adds to its attractiveness as a dividend-paying stock.

Earnings and Revenue Estimates

For the current quarter (Dec 2023), analysts forecast an EPS of $2.55, with projections for the subsequent quarter (Mar 2024) at $3.14. These estimates suggest a decrease compared to the year-ago EPS, reflecting challenges in the steel industry. Revenue estimates stand at $4.06 billion for the current quarter and $4.48 billion for the next, with year-over-year sales growth projected to decline by 16.00% and 8.40%, respectively.

Institutional Investment Insights

Institutional investments in STLD reveal a mixed sentiment, with significant stake increases by prominent investors such as Goldman Sachs Group Inc. and Morgan Stanley. The involvement of major financial players indicates a strong belief in STLD's market potential and strategic direction.

Analyst Ratings and Market Projections

Wall Street analysts offer diverse views on STLD's future. Citigroup's upgrade from "neutral" to "buy" and a price target of $130.00 showcases optimism. In contrast, BMO Capital Markets and Morgan Stanley present more conservative views, with lower price targets. These varied opinions reflect the complex nature of the steel market and STLD's positioning within it.

Dividend Announcements and Share Buyback Plans

The company's recent dividend declaration and a share buyback plan of $1.50 billion highlight management's confidence in STLD's valuation and future performance. Such financial maneuvers often indicate a company's strong financial health and a positive outlook from its management.

Risks and Challenges in the Steel Industry

Despite the robust financials, STLD operates in a challenging environment. The steel industry is subject to global production shifts, particularly in Asia and Africa, and US manufacturing trends. The anticipated economic recession in the US could further pressure steel prices and production. Moreover, the fluctuating prices for hot-rolled steel and steel fabrication products could impact the company's profitability.

Strategic Analysis and Investment Thesis

STLD's strong performance, especially in the Steel Fabrication segment, is a key driver of its current high valuation. However, the potential economic downturn and the declining prices in specialty steel products necessitate a cautious approach. The stock's current valuation might not be sustainable in the face of these market headwinds.

Conclusion

Investing in Steel Dynamics requires a careful analysis of the broader steel market and the company's strategic responses to these challenges. While the company shows strong fundamentals, the potential for price declines in the US steel market and specialty steel products, coupled with a looming economic recession, suggests a cautious approach to STLD's stock in the near term.

For more real-time analysis and detailed insights on insider transactions, visit STLD Real-Time

Chart and STLD Stock Profile.

That''s TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex