Crude Oil Prices Rebound Amidst Market Volatility

Despite recent declines, crude oil futures show resilience with bullish prospects driven by robust demand growth, OPEC+ production cuts, and technical market indicators | That's TradingNEWS

Crude Oil Market Analysis: A Bullish Outlook Amidst Current Volatility

Recent Price Movements

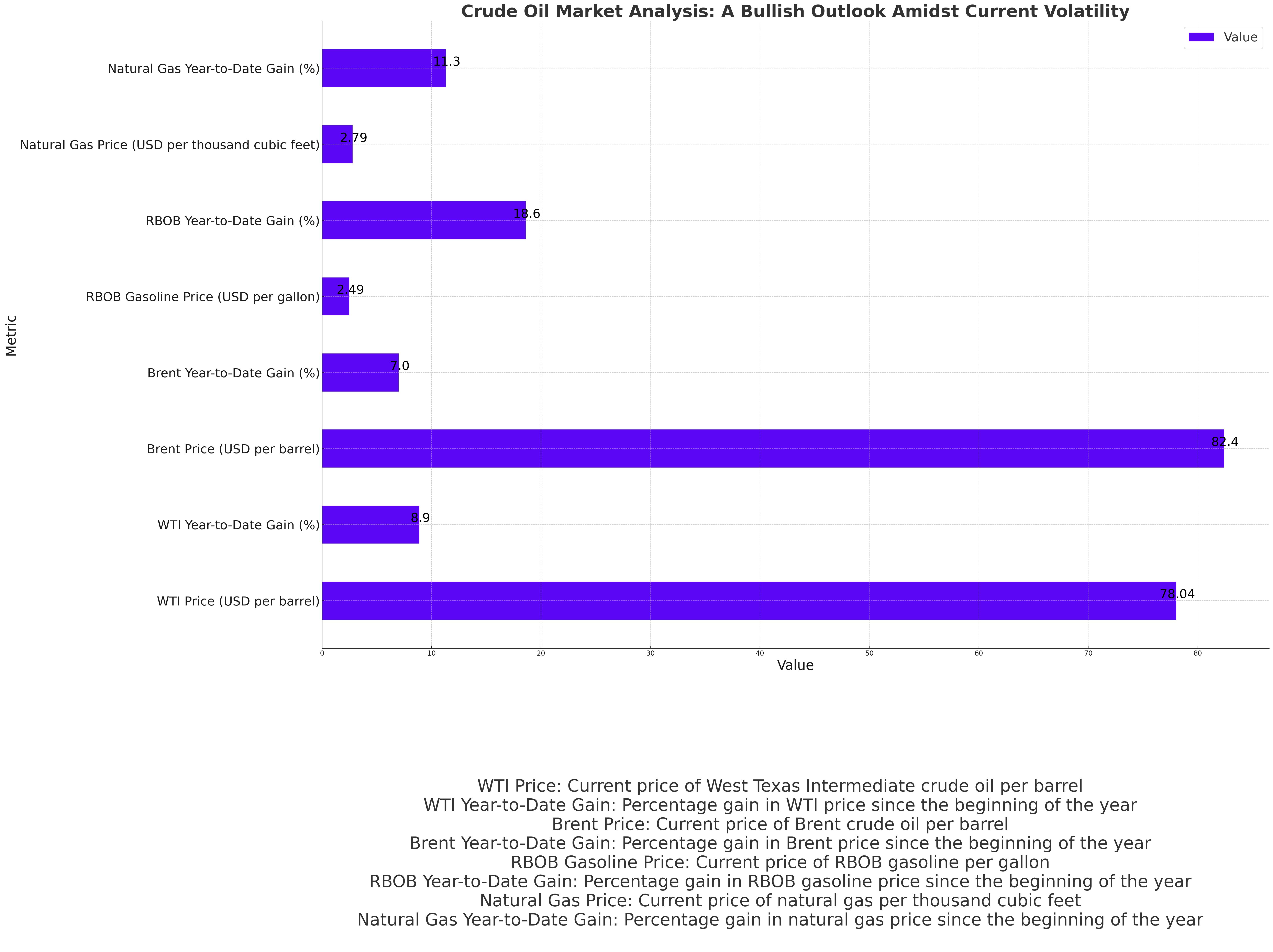

Crude oil futures saw a rebound on Thursday after a three-day decline. U.S. crude oil (West Texas Intermediate) for July delivery rose by 0.6% to $78.04 per barrel, marking a year-to-date gain of 8.9%. Brent crude, the global benchmark, also increased by 0.6% to $82.40 per barrel, reflecting a year-to-date rise of 7%. Despite these gains, both U.S. crude and Brent are set to end the week with losses of 2.4% and 1.8%, respectively.

Current Energy Prices

- West Texas Intermediate (WTI): $78.04 per barrel, up 0.6%

- Brent Crude: $82.40 per barrel, up 0.6%

- RBOB Gasoline (June contract): $2.49 per gallon, up 1.1%, with an 18.6% year-to-date increase

- Natural Gas (June contract): $2.79 per thousand cubic feet, up 11.3% year-to-date

Market Dynamics and Supply Concerns

Oil prices have been constrained within a $3 range since their April highs. This stagnation is partly due to easing fears of a broader conflict in the Middle East, shifting traders' focus back to fundamental supply and demand factors. The potential for higher-for-longer interest rates in the U.S. has also contributed to market caution, with concerns that such rates could dampen economic growth and, consequently, oil demand.

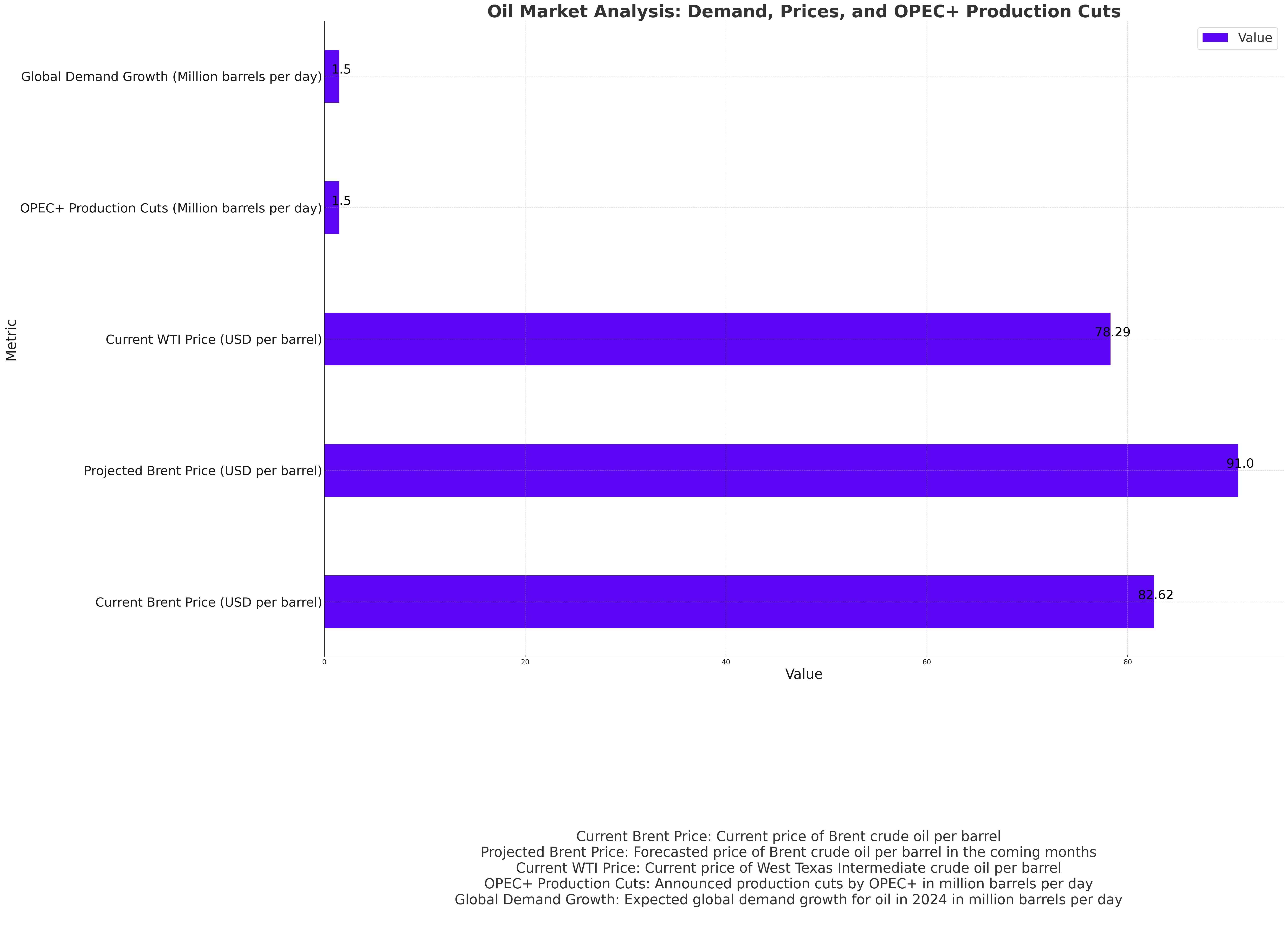

UBS commodity analyst Giovanni Staunovo noted that a buildup in global oil inventories, particularly following a mild winter in parts of the Northern Hemisphere, has added to these concerns. However, UBS projects a deficit in the oil market and forecasts Brent crude rising to $91 per barrel in the coming months, driven by healthy demand growth of 1.5 million barrels per day in 2024, above the long-term average of 1.2 million barrels per day.

OPEC+ and Production Adjustments

Oil prices received a boost early Thursday following Russia's announcement that it would present a plan to compensate for exceeding its OPEC+ production quota in April. Brent crude rose by 0.88% to $82.62, and WTI crude increased by 0.93% to $78.29. This development comes ahead of the critical OPEC+ meeting on June 1, where the coalition will decide on production cuts for the second half of the year.

Federal Reserve’s Impact on Oil Prices

Minutes from the latest Federal Reserve policy meeting, released Wednesday, indicated a willingness among officials to raise interest rates further if inflation remains high. This hawkish stance has added to the bearish sentiment in the oil market, as higher interest rates can slow economic growth and reduce oil demand in the world's largest consumer of oil, the United States.

Technical Analysis and Future Projections

Despite the recent volatility, technical indicators for crude oil suggest a range-bound trade near the $80 mark, with Brent crude facing resistance at $84.30, its 200-day moving average. A break below $81 could trigger further selling. Hedge funds have been net sellers of WTI and Brent crude since mid-April, reducing their combined net long positions by 40% to 314,000 contracts. This speculative selling has pressured prompt spreads and weakened the market's fundamentals.

Demand and Inventory Insights

Global demand growth for oil remains robust, expected to rise above historical trends. The U.S. Energy Information Administration (EIA) reported a 1.8 million barrel increase in crude stocks last week, contrary to expectations of a 2.5 million barrel draw. The EIA's detailed reports, due later today, will provide further insights into crude production, exports, refinery activity, and implied demand from gasoline and diesel.

In summary, while crude oil prices have faced short-term pressures due to interest rate concerns and inventory builds, the longer-term outlook remains bullish. UBS's projection of Brent reaching $91 per barrel, coupled with robust demand growth and OPEC+ production cuts, supports a positive trajectory for oil prices into the Northern Hemisphere summer months. Investors should closely monitor upcoming economic data and OPEC+ decisions to gauge future market movements.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex