Deciphering AbbVie Inc's Financial Dynamics and Market Position

Financial Health and Market Performance

Revenue Dynamics and Institutional Confidence

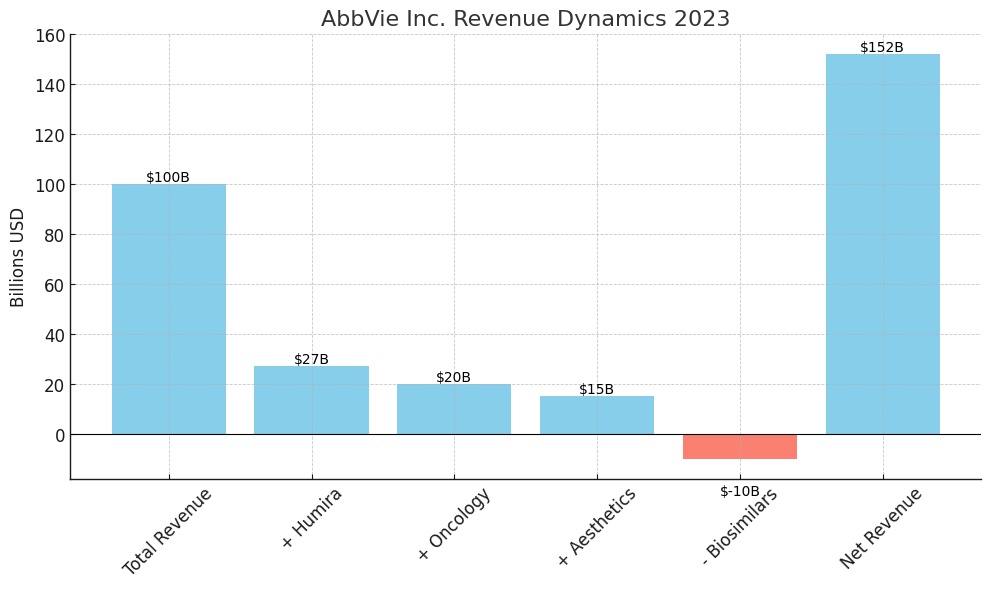

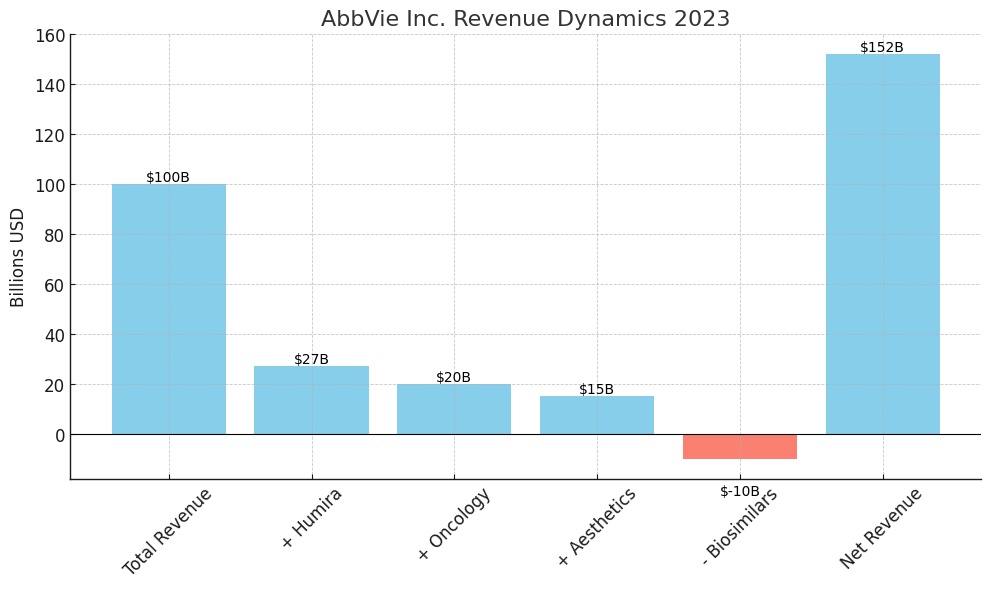

AbbVie's revenue streams are diversified, with significant contributions from its immunology and oncology segments. The company's flagship product, Humira, although facing biosimilar competition, contributed 27% to the total net revenues in 2023, showcasing AbbVie's capability to generate substantial income from its leading treatments. The acquisitions, such as that of Allergan, have not only broadened AbbVie's product portfolio but have also infused new energy into its revenue streams, particularly in aesthetics with Botox.

Institutional investors and hedge funds own 67.86% of AbbVie's stock, reflecting a strong vote of confidence in the company's strategy and leadership. The investment by Mariner LLC, which increased its holdings by 5.0% to 944,049 shares, underscores the financial community's belief in AbbVie's value proposition and growth prospects.

Stock Performance and Analyst Optimism

ABBV has garnered attention from Wall Street analysts, with a consensus rating of "Moderate Buy" and a target price of $175.36. The stock's performance, with a year high of $178.92 and a resilient dividend payout ratio of 227.11%, illustrates the company's robust financial health and its commitment to returning value to shareholders. The dividend yield of 3.50% is a testament to AbbVie's financial strength and strategic foresight in capital allocation.

Strategic SWOT Analysis

Strengths: Diverse Portfolio and R&D Investments

AbbVie's diversified product range, particularly in immunology and oncology, is a cornerstone of its strength. Strategic acquisitions have not only expanded its therapeutic areas but also enhanced its pipeline, promising a future of innovation and growth. The commitment to R&D, with substantial investments, is poised to yield a rich pipeline of compounds, ensuring AbbVie's competitiveness in the pharmaceutical industry.

Weaknesses: Patent Expirations and Supply Chain Dependencies

The expiration of patents, especially for Humira, presents a significant weakness, opening the door for biosimilar competition. Additionally, dependencies in the supply chain pose risks, although AbbVie's strategies for maintaining alternate supply relationships aim to mitigate these challenges.

Opportunities: Emerging Markets and Biologics

Emerging markets offer vast opportunities for AbbVie, with increasing demand for advanced therapeutics. The company's focus on biologics and specialty care, aligned with the industry's shift towards personalized medicine, positions AbbVie to capitalize on these growing segments.

Threats: Regulatory Challenges and Price Sensitivity

Regulatory and legal challenges remain a constant threat, with potential impacts on market exclusivity and financial performance. The pressure to lower drug prices, amidst healthcare reforms, could affect AbbVie's profitability and necessitate strategic adjustments.

Future Outlook: Navigating Challenges and Seizing Opportunities

AbbVie's strategic positioning, bolstered by a strong portfolio, strategic acquisitions, and robust R&D investment, sets a solid foundation for future growth. The company's ability to navigate patent expirations, supply chain vulnerabilities, and regulatory pressures will be pivotal in sustaining its market leadership. With the immunology segment poised for expansion and the potential for growth in emerging markets and biologics, AbbVie is well-equipped to face the dynamic pharmaceutical landscape.

For detailed stock performance and insider transaction insights, explore further at:

In conclusion, AbbVie Inc (NYSE:ABBV) exhibits resilience and strategic agility in the face of industry challenges. The company's financial health, coupled with its diversified portfolio and commitment to innovation, positions AbbVie for continued success. As AbbVie navigates the complexities of the pharmaceutical industry, its strategic initiatives and market adaptability will be key drivers of its future growth and sustainability.

That's TradingNEWS