Deep Dive into Home Depot's Market Position and Financial Health

Unveiling Home Depot's Market Dynamics and Future Prospects: An Investor's Guide | That's TradingNEWS

Analyzing The Home Depot Inc's (NASDAQ: HD) Financial and Market Dynamics

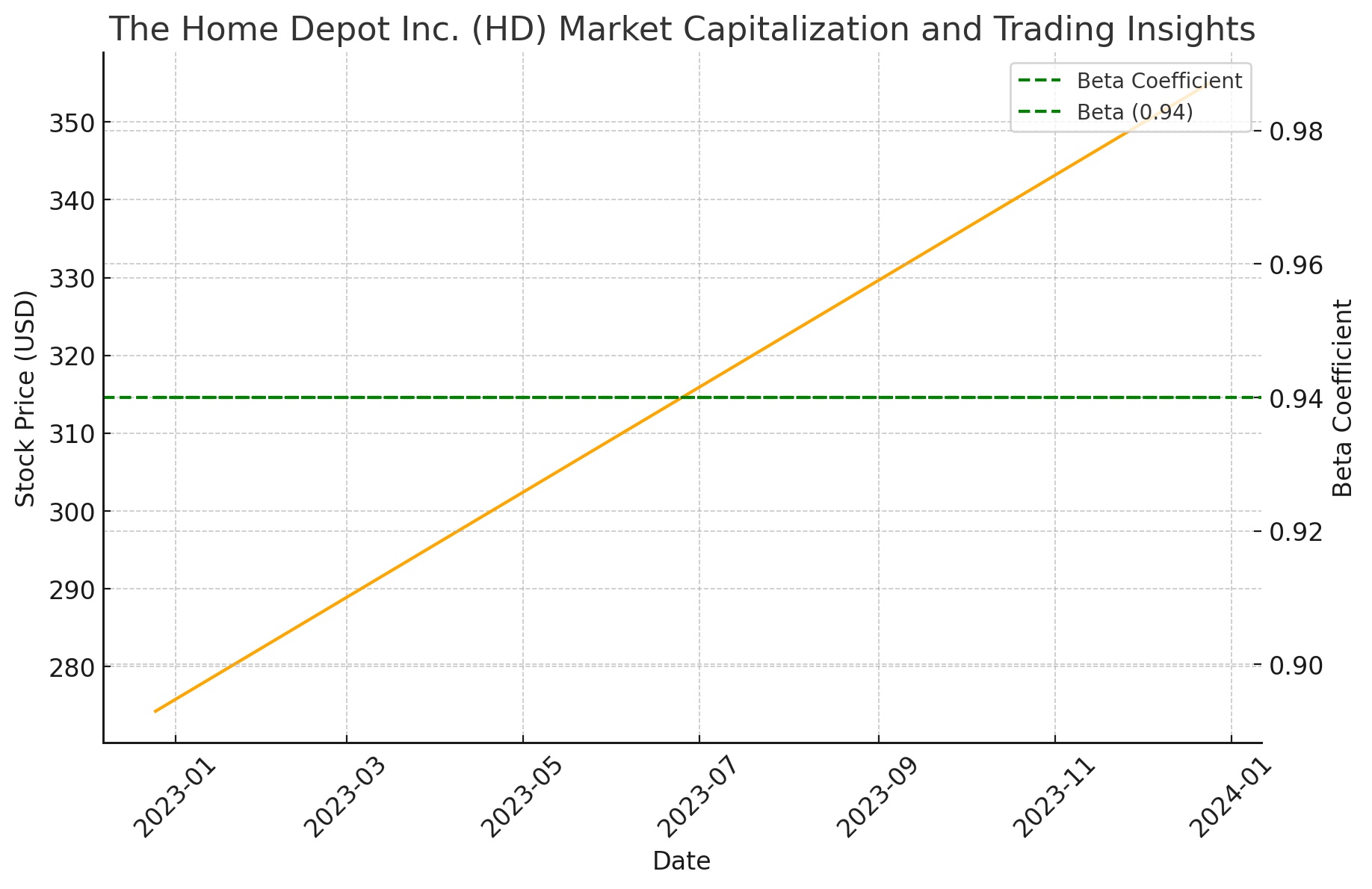

Market Capitalization and Trading Insights

The Home Depot Inc. (NASDAQ: HD) stands prominently in the home improvement retail sector, boasting a substantial market capitalization of $345.714 billion. This robust market presence is reflected in its stock price, fluctuating between $274.26 and $354.92, demonstrating active investor engagement. With a Beta of 0.94, Home Depot shows moderate volatility relative to the market.

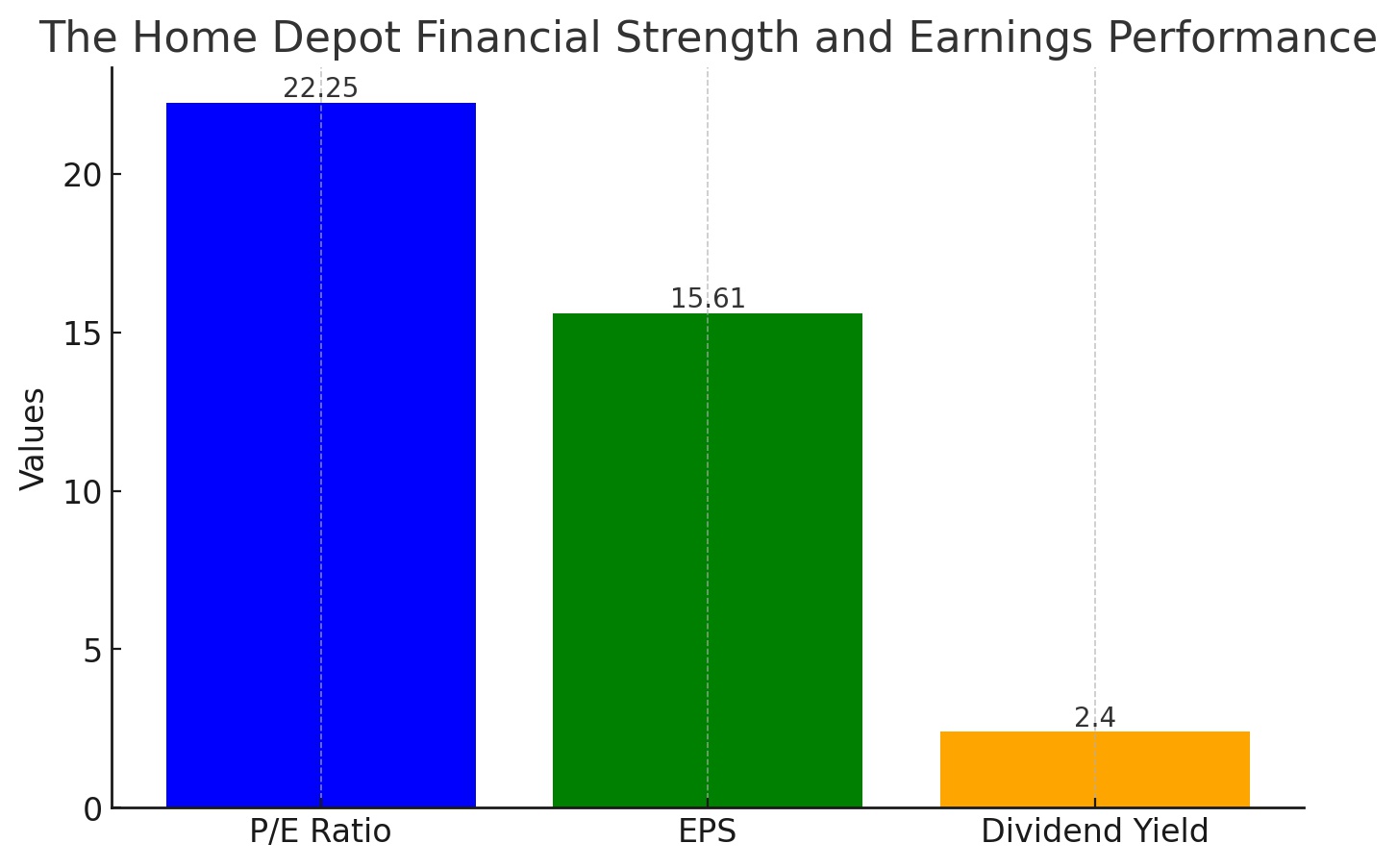

Financial Strength and Earnings Performance

Home Depot's financial health is underscored by a trailing Price-to-Earnings (P/E) ratio of 22.25 and an Earnings Per Share (EPS) of $15.61, indicating robust profitability. The forward dividend yield of 2.40% highlights the company’s commitment to shareholder returns, balanced with strategic growth initiatives.

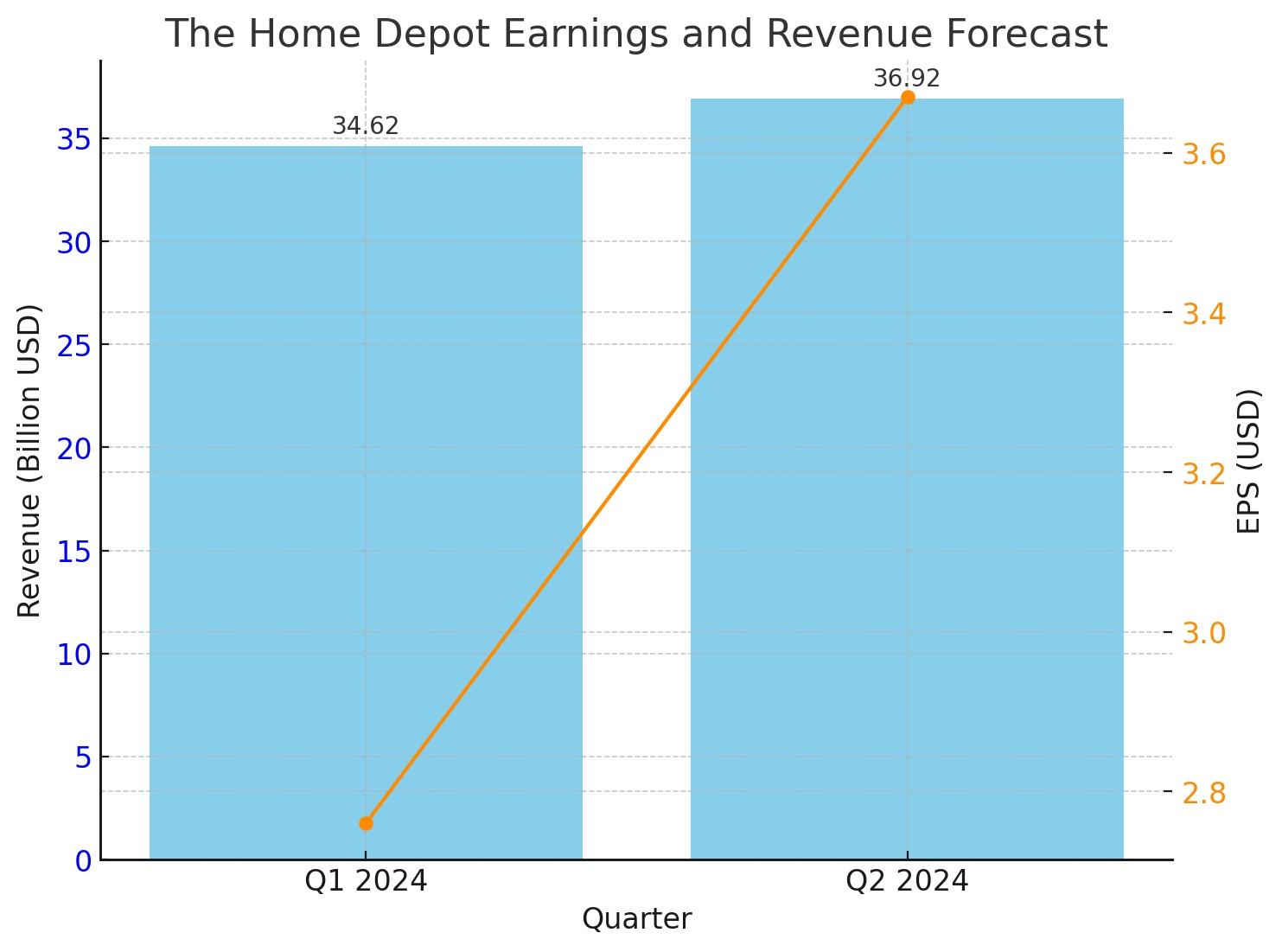

Earnings and Revenue Forecast

Looking ahead, Home Depot is projected to post an EPS of $2.76 for the current quarter ending January 2024 and $3.67 for the next quarter, signaling strong future earnings. Revenue expectations stand at $34.62 billion for the current quarter and $36.92 billion for the following one, reflecting a dynamic financial trajectory.

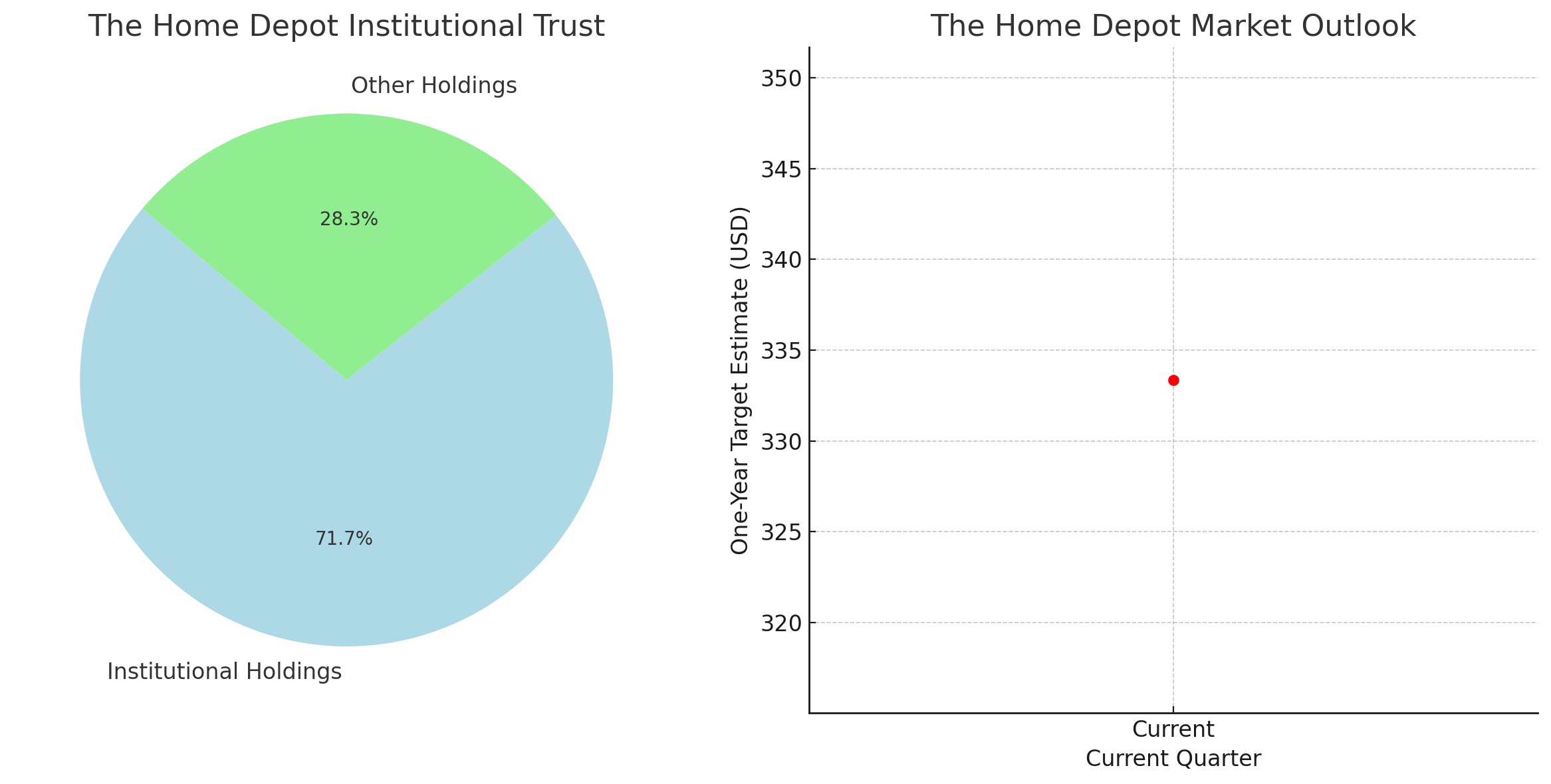

Institutional Trust and Market Outlook

A significant portion of Home Depot's stock, 71.73%, is held by institutional investors, demonstrating confidence in the company's strategic direction. The one-year target estimate of $333.36 portrays a cautiously optimistic outlook on the stock.

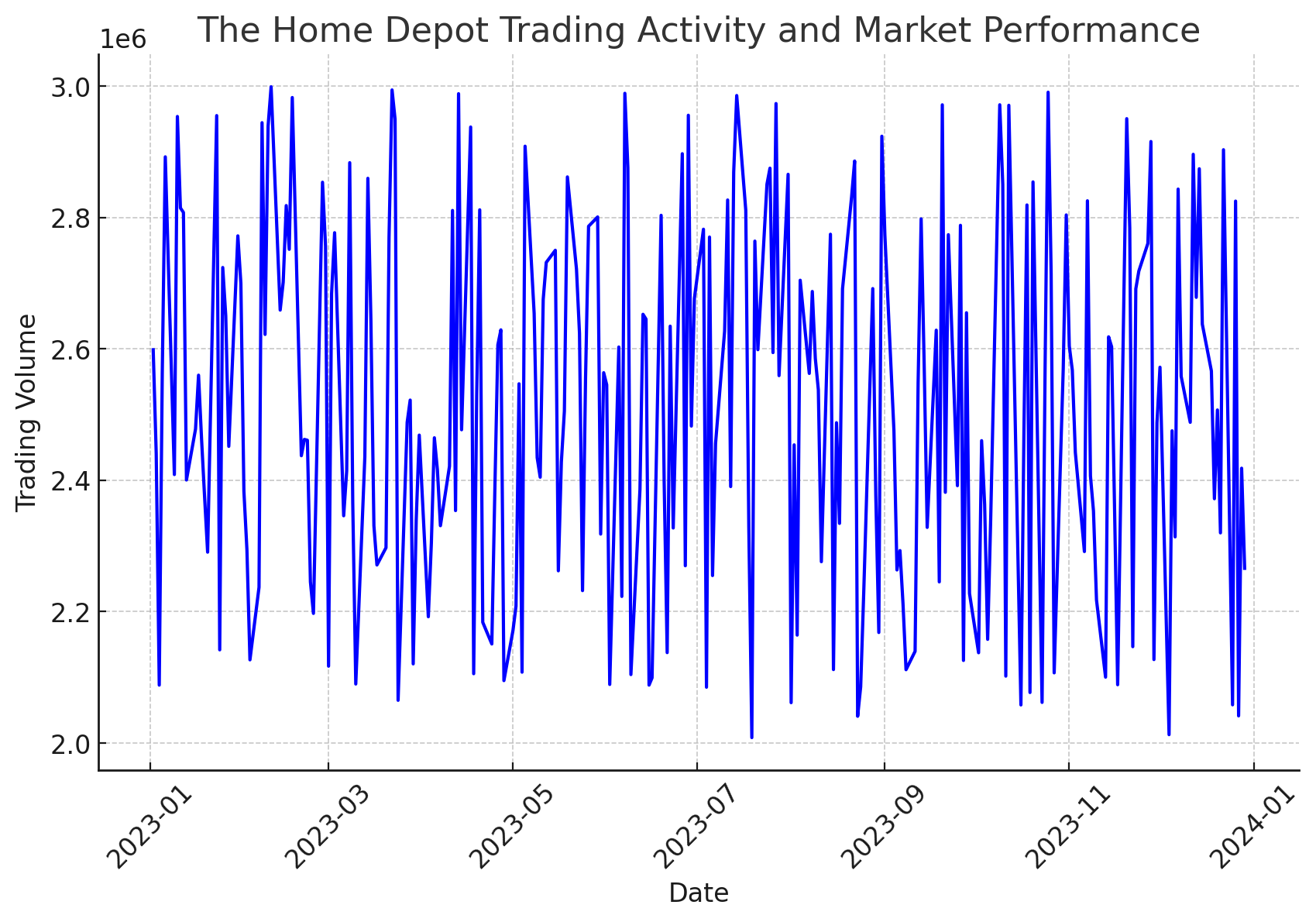

Trading Activity and Market Performance

Despite a challenging market, Home Depot has maintained a steady performance with a volume of 2,855,995 shares, indicative of its stable position in the retail sector.

Profitability and Operational Efficiency

Home Depot boasts a profit margin of 23.92% and an operating margin of 30.44%, reflecting its efficiency in revenue conversion and profitability. A notable return on equity of 41.22% further underscores its effective use of capital.

Growth Forecasts and Future Outlook

The future growth trajectory of Home Depot appears to be a blend of challenges and opportunities. Near-term projections suggest a potential moderation in performance. However, the outlook for 2024 and beyond points to recovery and growth, highlighting the company's adaptability in the evolving retail landscape.

Strategic Positioning and Global Presence

Home Depot’s global footprint and diverse product range play a critical role in its market resilience. The company's ability to innovate and adapt to changing consumer trends is key to maintaining its competitive edge in the home improvement retail sector.

Navigating Industry Challenges

Home Depot faces various challenges, including market competition and shifting consumer preferences. Its strategic responses, including a focus on digital innovation and customer-centric initiatives, are vital in sustaining its leadership position.

Financial Analysis and Operational Resilience

An in-depth analysis of Home Depot’s financials reveals a company adept at maintaining profitability and operational efficiency. The company's robust balance sheet, with a debt-to-EBITDA ratio close to 2x, and a consistent capital allocation policy, including significant stock repurchases, demonstrate financial prudence and commitment to shareholder value.

Digital Marketing Initiatives and Consumer Trends

Home Depot has been progressively investing in digital marketing and adapting to consumer trends, notably in the big-ticket discretionary categories. This strategic shift is evident in the company's approach to minimizing promotional discounting and adapting to market rationalization.

Investment Analysis and Valuation of The Home Depot Inc. (NASDAQ: HD)

Assessing Home Depot's Market Valuation

The valuation of The Home Depot Inc. presents a multifaceted view. With a current market capitalization of $345.714 billion and a trailing Price-to-Earnings (P/E) ratio of 22.25, Home Depot is positioned strongly in the competitive retail market. This valuation, reflecting the company's robust earnings of $15.61 per share, suggests a significant investor confidence in its business model and future prospects.

Investor Considerations and Market Dynamics

Investors contemplating Home Depot as part of their portfolio need to consider several factors. The company's stock, showing moderate volatility with a Beta of 0.94, is subject to market fluctuations. Despite this, Home Depot's strategic focus, reflected in its forward dividend yield of 2.40% and consistent performance in challenging market conditions, underscores its resilience and adaptability.

Future Growth Prospects and Analyst Expectations

Looking forward, Home Depot is projected to maintain strong earnings, with an EPS forecast of $2.76 and $3.67 for the upcoming quarters. These projections, along with revenue estimates of $34.62 billion and $36.92 billion for the respective quarters, indicate a positive growth trajectory. However, the anticipated -3.10% to -3.40% sales growth for the current year signifies potential challenges ahead.

Rationale Behind the Investment Outlook

Given Home Depot's current market performance and future growth estimates, the investment outlook leans towards a cautious optimism. The company's ability to navigate through industry challenges, embrace digital transformation, and capitalize on its market position makes it a potentially lucrative investment. However, potential investors should be mindful of the risks associated with the retail sector, including competitive pressures and evolving consumer preferences.

Recommendation: Buy, Sell, or Hold

In light of the comprehensive analysis, Home Depot currently presents a 'Hold' recommendation for investors. The company’s strong market position, coupled with its operational resilience and strategic initiatives, offers a stable investment opportunity. However, the mixed signals in growth projections and the evolving retail landscape suggest a need for careful monitoring of the stock’s performance.

For an in-depth review and the latest insights on insider transactions, interested parties are advised to visit Home Depot's real-time chart and stock profile on TradingNews.com.

That's TradingNEWS

Read More

-

Robinhood Stock Price Forecast - HOOD at $71: Crypto Crash Pain, Margin Story Intact

12.02.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast: XRP-USD Stuck Between $1.34 Support And $1.50 Ceiling

12.02.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: WTI Around $63 And Brent $68 Trapped Between Oversupply And Gulf Risk

12.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Jones Holds 50,000 While S&P 500 Steadies and Nasdaq Sinks on Cisco & AppLovin Rout, CPI Looms

12.02.2026 · TradingNEWS ArchiveMarkets

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex