DraftKings NASDAQ: DKNG - Outlook Amid Growing Market Share

Robust Revenue Growth, Insider Activity, and Strategic Acquisitions Highlight DraftKings' Promising Future | That's TradingNEWS

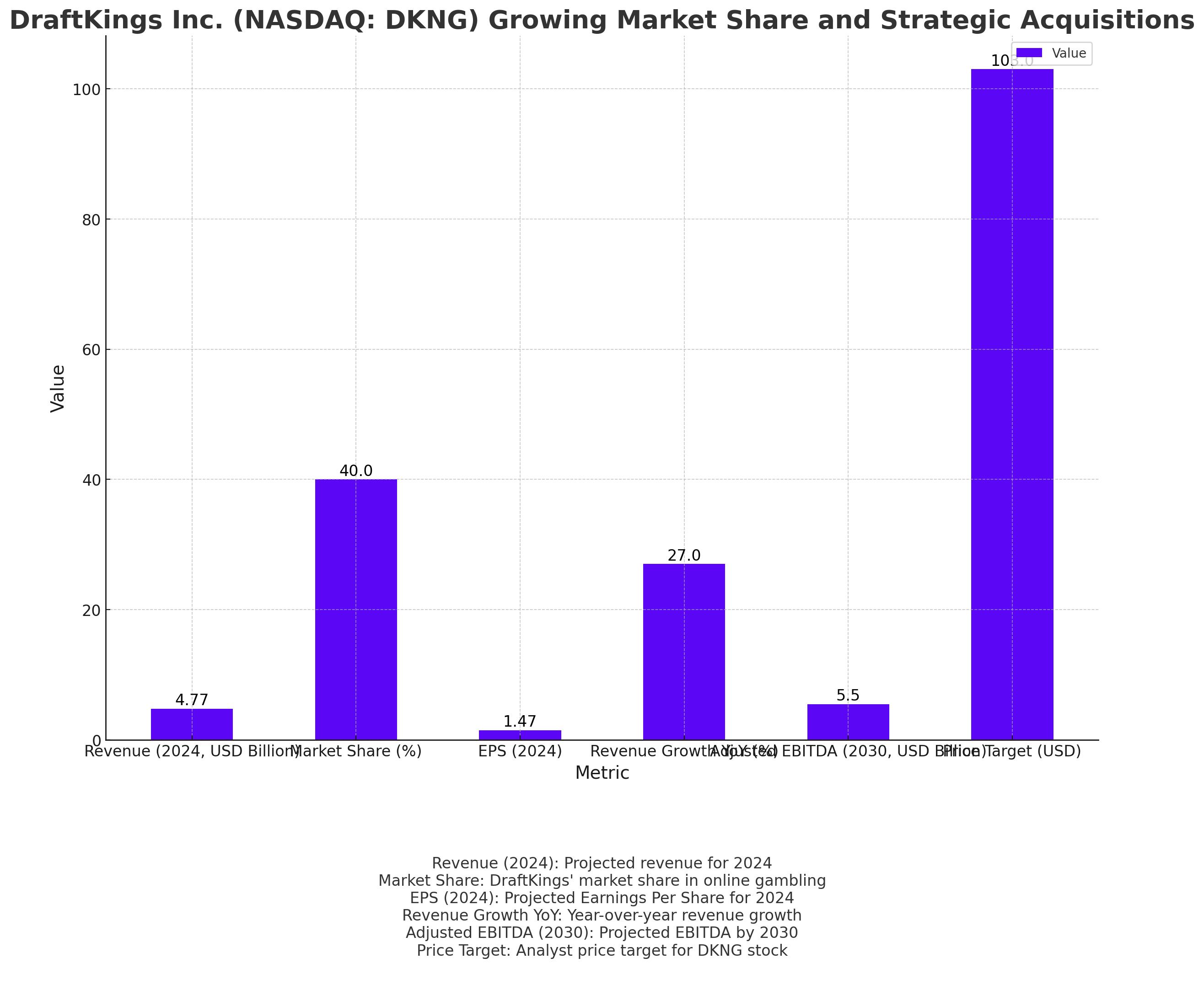

DraftKings Inc. (NASDAQ: DKNG) Growing Market Share and Strategic Acquisitions

Robust Revenue Growth and Market Share

DraftKings Inc. (NASDAQ: DKNG) aims to maintain its impressive 40%+ market share in the burgeoning online gambling and sports betting markets. As new competitors like BetESPN and Fanatics enter the field, DraftKings projects revenue to reach $4.77 billion by 2024, reflecting a 27% year-over-year increase. The U.S. sports gambling sector is expected to surpass $19 billion in 2023, with DraftKings positioned to capture a significant portion of this growth.

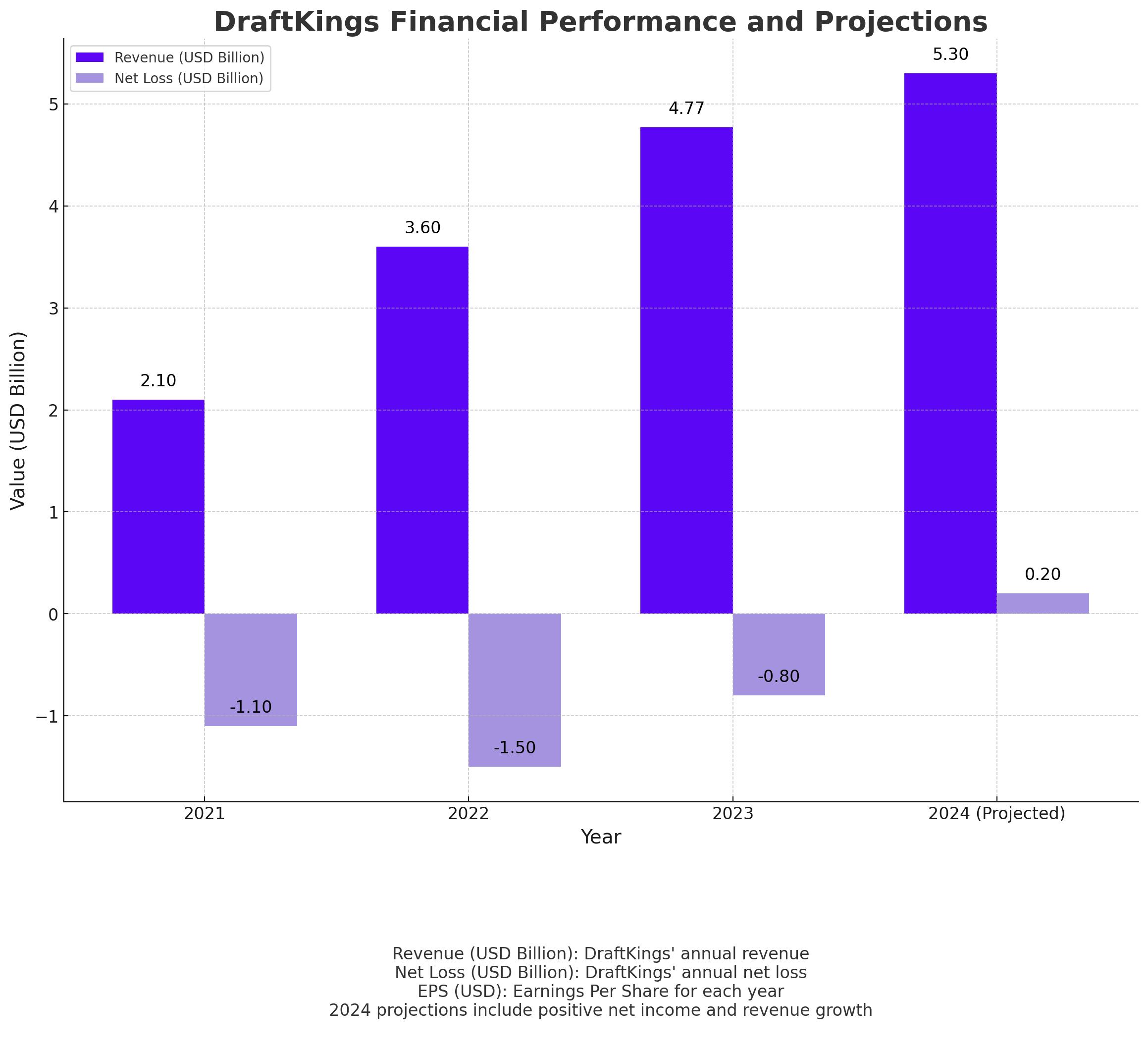

Financial Performance and Projections

DraftKings has shown a remarkable recovery from its post-IPO volatility. After peaking at $70 in 2021, the stock faced a downturn, driven by substantial marketing costs and operating losses. However, the company is on track to turn profitable by 2023, with improved financial health. In 2023, DraftKings reported a loss of $800 million, a significant improvement from the $1.5 billion loss in 2022. This year, analysts expect the company to post an EPS of 1.47 and project further revenue growth.

Strategic Acquisitions and Partnerships

DraftKings’ strategic moves, including the acquisition of Jackpocket, position it well for future growth. Jackpocket, valued at $750 million, provides DraftKings with a foothold in the $100 billion lottery industry. This acquisition is expected to boost DraftKings’ adjusted EBITDA by $60 to $100 million in 2026 and $100 to $150 million in 2028, thanks to Jackpocket’s lower customer acquisition costs and existing user base.

Insider Activity and Institutional Investments

Significant insider transactions highlight confidence in DraftKings’ future. Chairman John C. Malone sold 139,065 shares at $68.98, while major shareholder Berkshire Hathaway Inc. acquired 20,609 shares at $29.94. Institutional investors have also shown strong interest, with Kornitzer Capital Management Inc. KS increasing its stake by 38.1%, now holding 30,829 shares valued at $1.787 million.

Market Dynamics and Competitive Landscape

The entry of BetESPN and Fanatics into the market will test DraftKings’ resilience. BetESPN’s integration with Penn Entertainment’s vast resources and Fanatics’ extensive customer base present formidable challenges. However, DraftKings’ established market presence and high customer retention rates provide a solid defense against these new entrants.

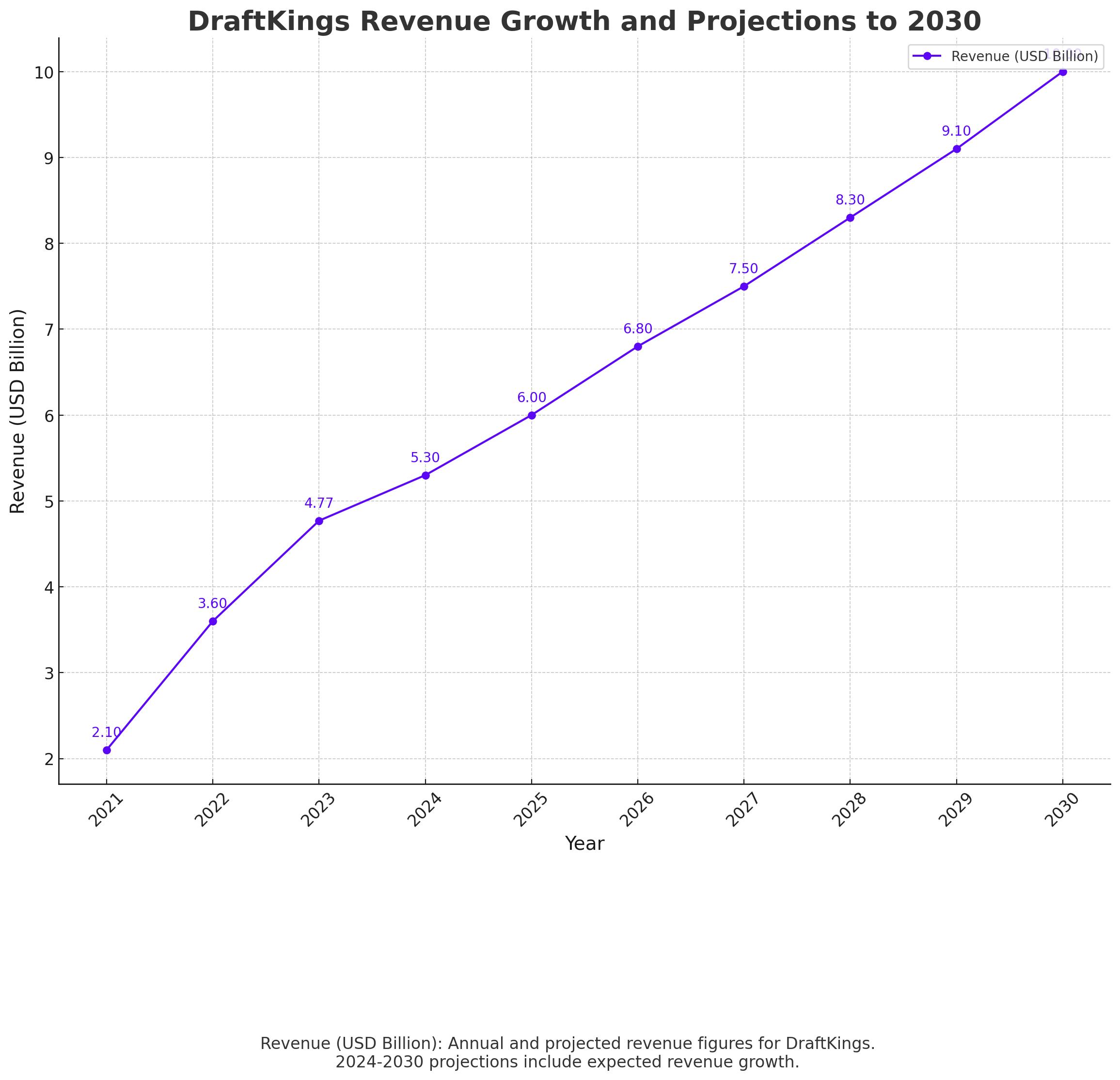

Future Revenue Projections and Market Potential

The total addressable market for sports betting and iGaming in the U.S. is forecasted to reach $40 billion by 2030. If DraftKings maintains its current market share, it could generate $13.6 billion in annual revenues by then. With the anticipated growth and strategic acquisitions, DraftKings’ market share could increase to 38%, translating to projected revenues of $15.2 billion by 2030.

Jackpocket Acquisition and Synergies

The acquisition of Jackpocket is a significant growth driver. Jackpocket’s revenue grew at a CAGR of 114% from 2020 to 2023 and is expected to reach $135 million in 2024. This growth, combined with DraftKings’ strong market position, suggests a promising future. The cross-sell opportunities between DraftKings’ and Jackpocket’s customer bases could further enhance profitability.

Valuation and Price Target

DraftKings’ adjusted EBITDA margin is expected to reach 35% by 2030, resulting in an adjusted EBITDA of $5.5 billion. Applying a sector median EV/EBITDA multiple of 9.16, DraftKings’ implied enterprise value is $50.3 billion. With a price target of $103 per share, this represents a 153% upside from the current share price of $40.68.

Summary of Analyst Ratings

DraftKings has received favorable ratings from several analysts. UBS Group recently raised its price target from $56.00 to $60.00, with a "buy" rating. Oppenheimer, Benchmark, Barclays, Morgan Stanley, and Stifel Nicolaus have all provided optimistic price targets, reflecting strong confidence in DraftKings' growth prospects. The consensus rating is "Moderate Buy," with an average target price of $49.21.

Institutional Investments and Market Activity

DraftKings has seen significant institutional investments, with hedge funds and large investors increasing their stakes. Highlander Capital Management LLC, Montag A & Associates Inc., and other investors have recently bought and sold shares, reflecting strong market activity. Avantax Advisory Services Inc. raised its stake by 33.9%, highlighting the growing institutional confidence in DraftKings.

Why to Buy NASDAQ:DKNG Stock?

DraftKings Inc. (NASDAQ: DKNG) presents a compelling investment opportunity due to its strong revenue growth, projected to reach $4.77 billion in 2024, marking a 27% YoY increase. The company is expected to turn profitable by the end of 2023, significantly improving its financial health. DraftKings maintains over 40% market share in the U.S. sports betting sector, second only to FanDuel. Strategic acquisitions, such as the $750 million acquisition of Jackpocket, tap into the $100 billion lottery market, boosting revenue and profitability. Significant investments from major players like Berkshire Hathaway signal strong confidence in future growth. Additionally, DraftKings' market expansion and exclusive state deals further solidify its leading position in the industry. The anticipated growth in the sports betting market and cost synergies from acquisitions provide a bullish outlook for the stock.

That's TradingNEWS

Read More

-

Google Stock Price Forecast - AI Capex Shock, Cloud Breakout and What $313 Really Prices In

12.02.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast: XRP-USD Stuck Between $1.34 Support And $1.50 Ceiling

12.02.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: WTI Around $63 And Brent $68 Trapped Between Oversupply And Gulf Risk

12.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Jones Holds 50,000 While S&P 500 Steadies and Nasdaq Sinks on Cisco & AppLovin Rout, CPI Looms

12.02.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - GBPUSD=X Stalls Around 1.3630 as Weak UK GDP Meets Robust US Jobs Data

12.02.2026 · TradingNEWS ArchiveForex