ECB Poised for Rate Cut: Eurozone Growth and Currency Dynamics

As the ECB prepares to lower rates for the first time since 2019, markets and analysts watch closely for potential economic revival and implications for EUR/USD | That's TradingNEWS

Analyzing the Impending ECB Rate Decision and Its Market Implications

European Central Bank's Rate Cut Anticipation

In a pivotal moment for European finance, the European Central Bank (ECB) is poised to adjust its interest rates, with a consensus forming around a potential 25 basis point reduction. This would mark the ECB's first rate decrease since 2019, reflecting a strategic pivot as the Eurozone grapples with stagnant growth since Q4 of 2022 and a tempering inflation landscape. Despite an unexpected uptick in April's inflation figures, the trajectory suggests manageable price increases, maintaining the momentum towards achieving a 2% inflation target.

Market Reactions and Speculative Positioning

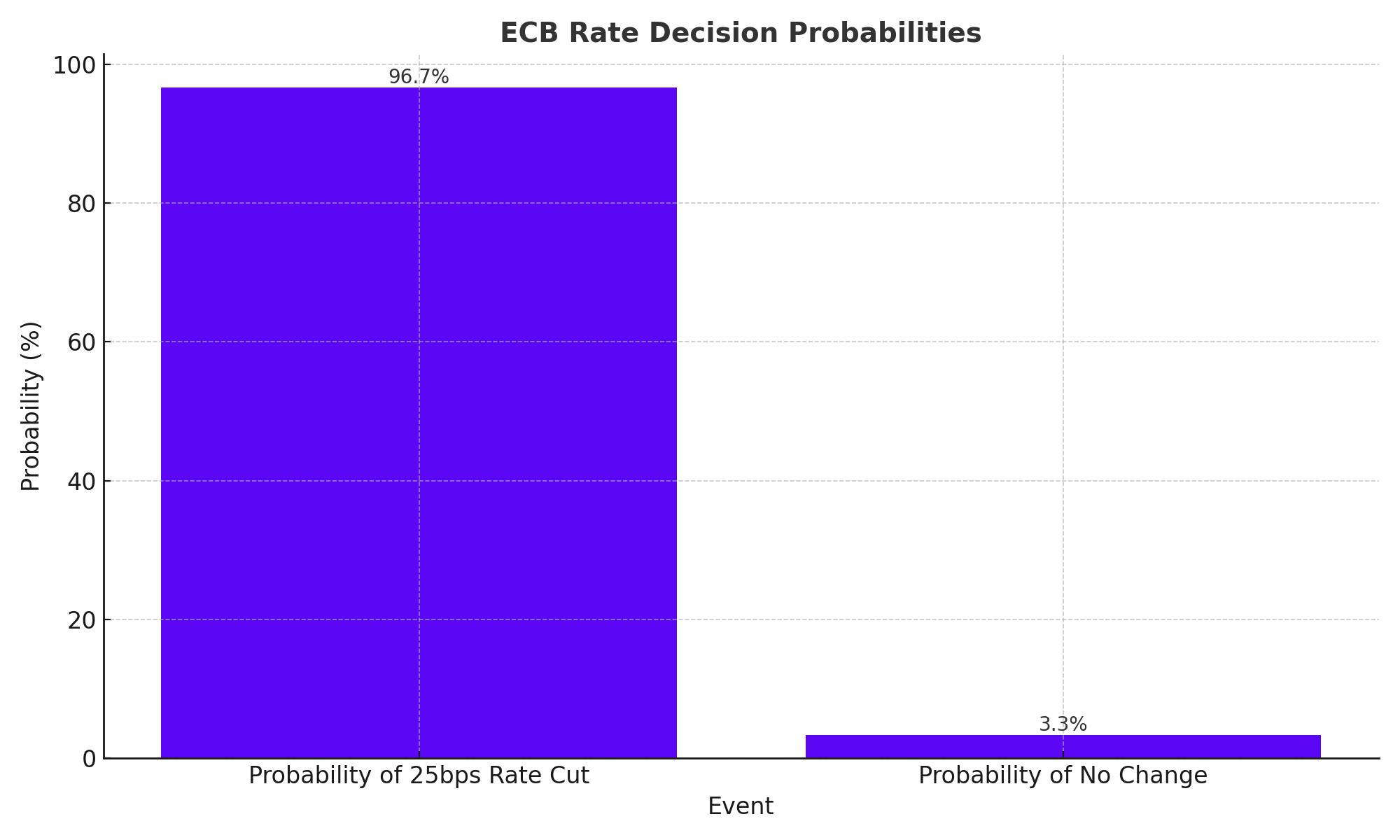

The financial markets have priced in a significant probability of a rate cut, standing at 96.7% for a 25 basis point reduction this week. This expectation is not merely speculative but is underpinned by substantial shifts in currency positions, where there has been a notable decline in short positions against the euro, hinting at a bullish outlook for the currency.

Eurozone's Economic Dynamics:

- GDP Stagnation: Persistent near-zero growth rates have prompted reconsideration of monetary policies to stimulate economic activity.

- Inflation Trends: Although a recent spike in inflation poses questions, the broader deflationary trend aligns with policy adjustments.

EUR/USD Outlook Amidst US Economic Uncertainty

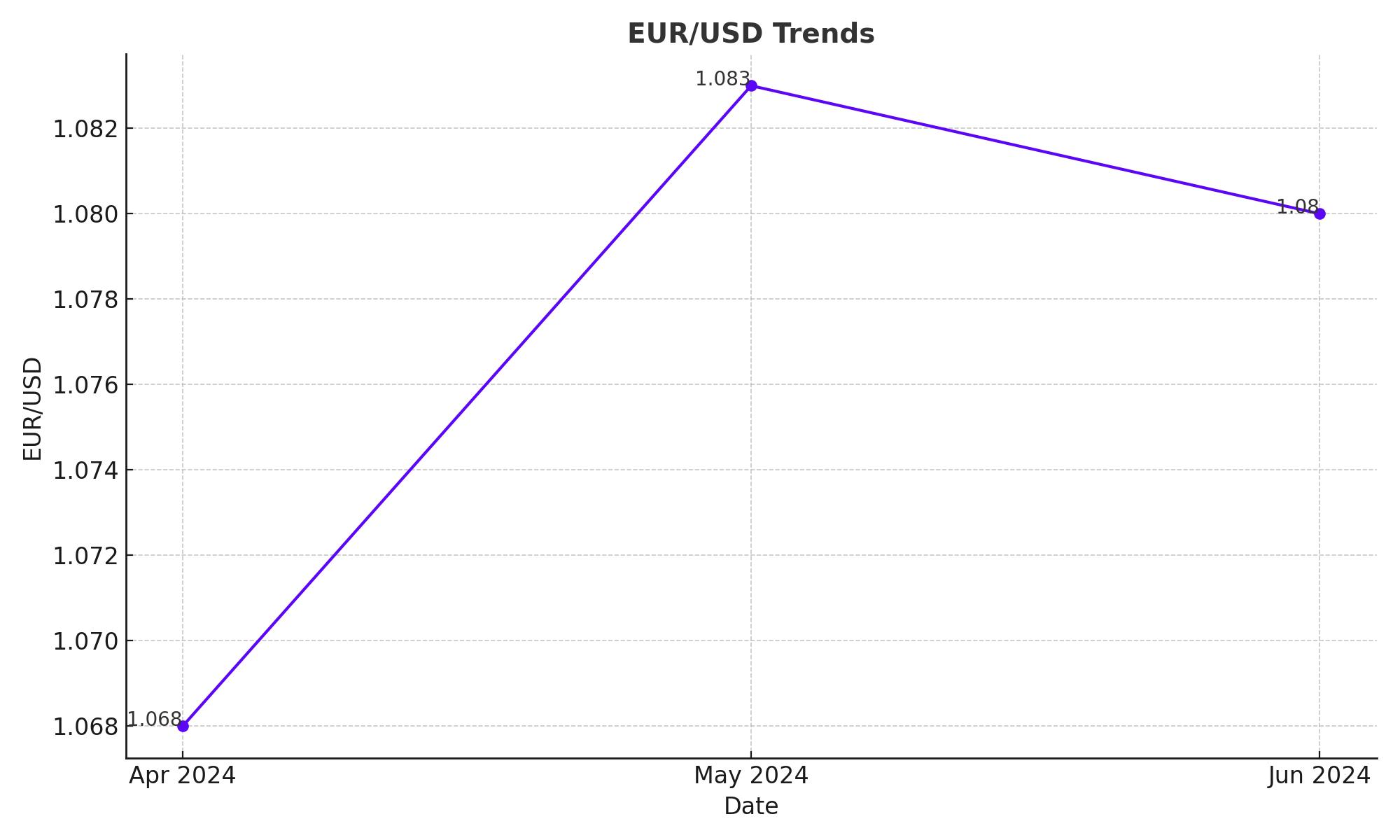

The EUR/USD pair has demonstrated resilience, aided by the weaker dollar and the anticipation surrounding the ECB's rate decisions. The currency pair has seen a 2.8% rise since April lows, navigating through fluctuating market sentiments influenced by ongoing US economic data. Current support levels are eyed at 1.0800, with potential resistance at 1.0942/1.0950, contingent on upcoming economic disclosures from both regions.

Strategic Comments from SNB Chairman and Implications for the Swiss Franc

Thomas Jordan, the outgoing Chairman of the Swiss National Bank (SNB), recently highlighted potential inflation risks linked to a weakening Swiss franc. His remarks have had an immediate impact on the EUR/CHF dynamics, accentuating a bearish trend for the pair, evidenced by technical patterns like the evening star formation and a breach below the 50-day SMA.

Technical Analysis and Market Sentiments

The EUR/USD pair is currently experiencing a consolidation phase, with critical support established at 1.0830. A breach below this level could trigger further bearish momentum, targeting lower supports at 1.0800 and 1.0780-1.0770. Conversely, resistance lies at 1.0850, with potential upward movement towards 1.0890-1.0900.

Broader Market Implications:

- ECB's Forward Guidance: Key insights are expected on future rate trajectories, which will significantly influence market strategies.

- US Economic Indicators: Upcoming ISM Manufacturing PMI data will provide further clarity on the economic landscape, potentially impacting the dollar's strength and subsequent EUR/USD movements.

Conclusion and Strategic Insights

As the ECB deliberates on a critical rate decision, the broader implications for currency markets and European economic health remain at the forefront of investor considerations. The anticipated policy shift comes at a crucial juncture, with potential to redefine market dynamics and investment strategies across the board. Investors and market analysts will be closely monitoring the ECB's press conference for strategic cues and future economic forecasting, making this an essential event for both short-term traders and long-term economic strategists.

That's TradingNEWS

Read More

-

JIVE ETF Near $90: International Value Rally That Still Looks Investable

17.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI And XRPR: Deep 60% Drawdown Or Rare $8.51 Entry After $1.3B Flows?

17.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: Can the $3 Henry Hub Floor Survive Spring?

17.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY Tests 153 Support as BoJ April Hike Talk Lifts Yen

17.02.2026 · TradingNEWS ArchiveForex