General Motors (NYSE:GM): Comprehensive Financial Analysis and Outlook

Introduction to General Motors' Current Financial Status

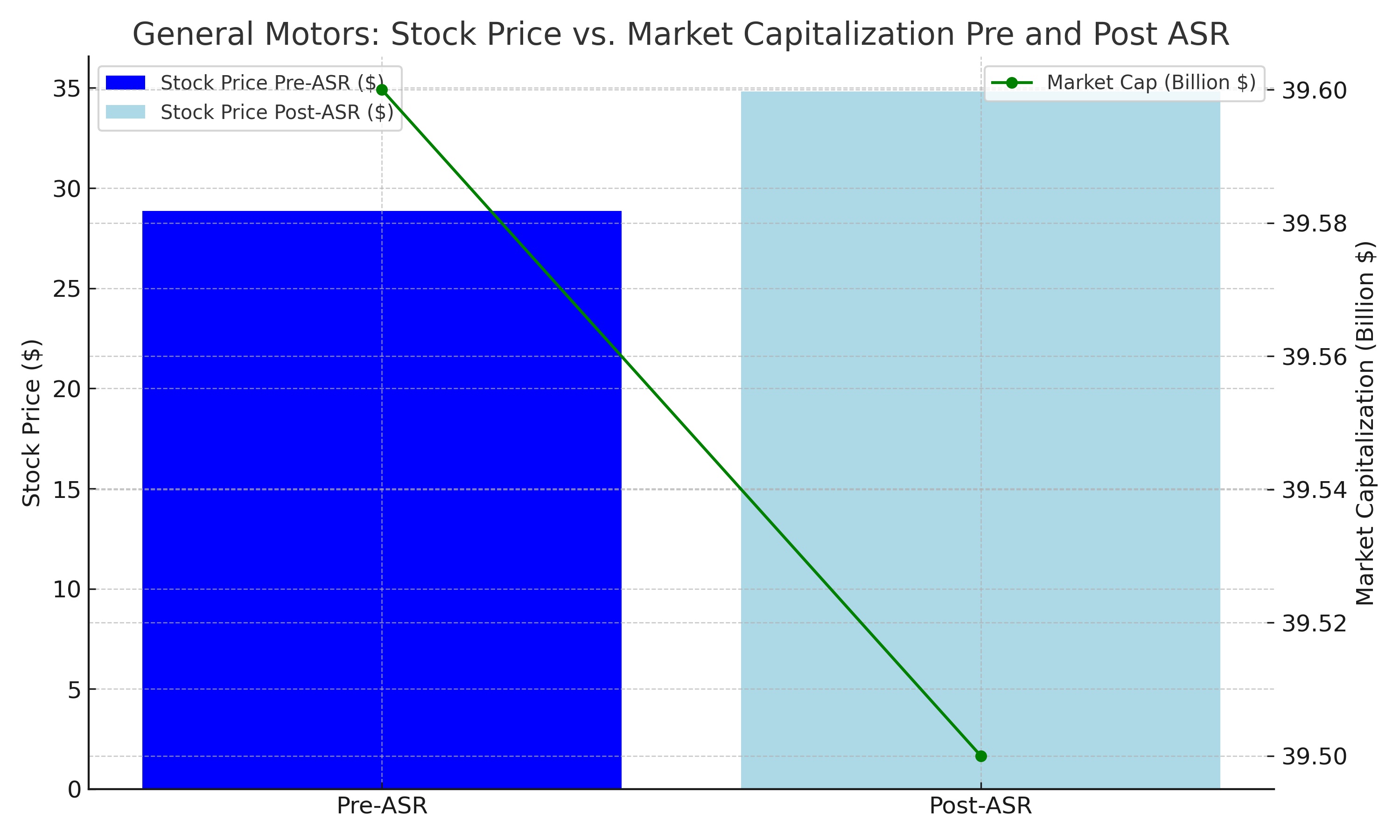

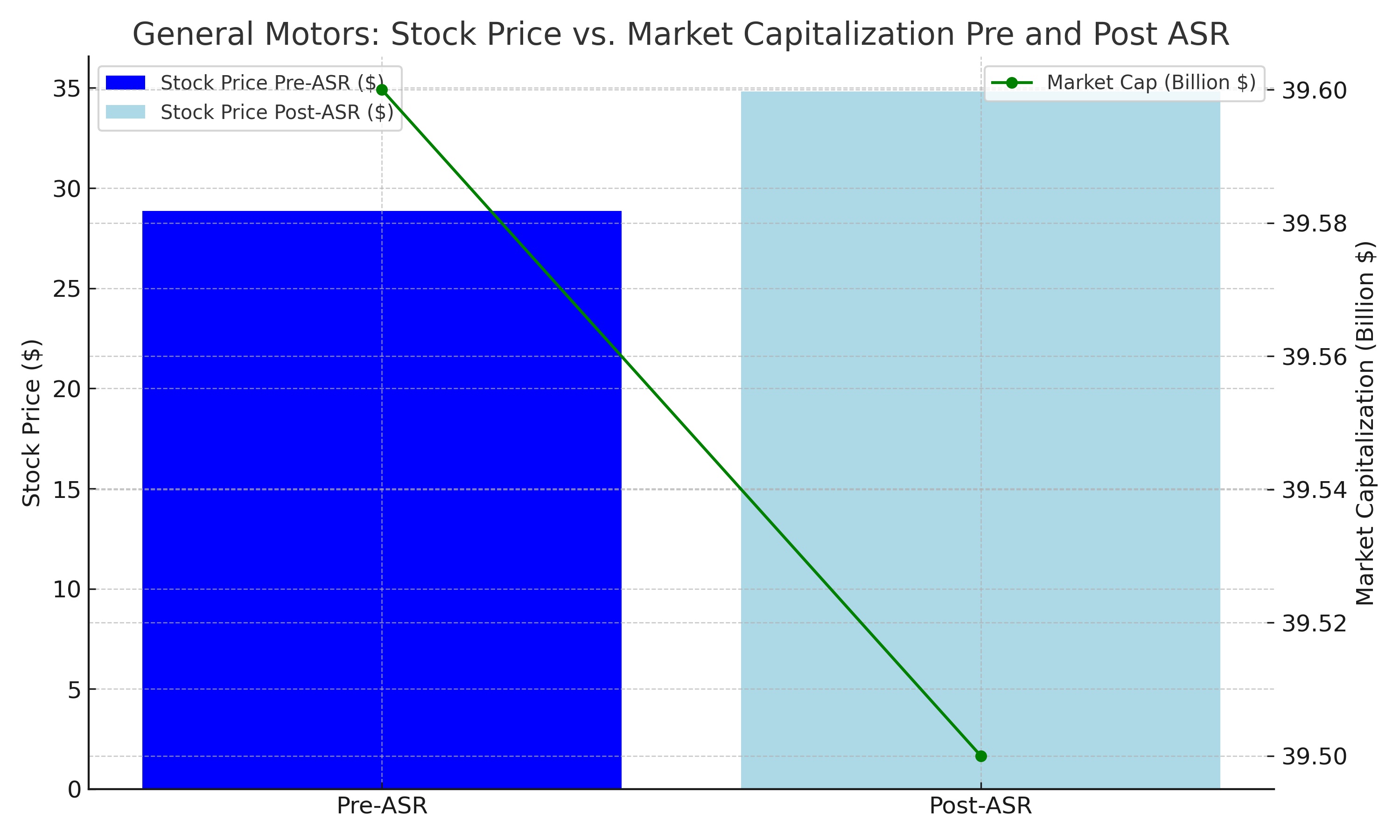

General Motors (NYSE:GM) is currently at a pivotal point, marked by a notable 20% stock increase following a $10B Accelerated Share Repurchase program and a 33% dividend hike. Despite these aggressive financial maneuvers, GM's market capitalization remains largely unaffected. This analysis delves into GM's quarterly report, valuing the stock to determine if it presents a worthwhile investment at approximately 4.5x forward P/E.

Recent Financial Engineering and Market Reaction

GM's recent financial engineering efforts, including the substantial ASR program and dividend rise, have not significantly influenced its market valuation. The unchanged market cap, post-share repurchase, indicates investor skepticism towards these strategies.

- Stock Price vs. Market Capitalization: Pre-ASR, GM's stock price was $28.85 with 1.37B shares outstanding, equating to a market cap of $39.6B. Post-ASR, despite the stock price rising to $34.83 and a reduction in outstanding shares to 1.135B, the market cap remained steady at $39.5B.

Preview of GM's Q4 2023 Report

For Q4 2023, GM is expected to report an EPS of $1.13 on revenues of $39.25B. However, recent downward revisions in revenue and EPS forecasts by analysts reflect concerns over GM's performance. The Q4 vehicle delivery report showed modest growth, marred by brand-specific weaknesses and strike impacts, likely influencing Q4 outcomes.

- Vehicle Deliveries and Brand Performance: GM's overall vehicle deliveries increased slightly by 0.3% y/y, with mixed performance across brands. While Buick sales surged by 57% y/y, other key brands like Cadillac, Chevrolet, and GMC saw declines.

GM's Updated Earnings Guide and Financial Outlook

GM's management has revised its 2023 outlook, forecasting improved automotive OCF and adjusted FCF. These projections are tempered by ongoing challenges, including rising labor costs and the evolving EV market landscape.

- Labor Costs and EV Market Pressures: The impact of the UAW strike and incremental costs from new labor agreements are significant factors in GM's financial outlook. GM’s venture into EVs, a crucial strategic move, is yet to yield profitable returns.

Market Share and EV Segment Performance

Despite increasing its market share in 2023, GM faces challenges in its EV segment. The company's transition to EVs is critical but is currently not profitable on a per-unit basis.

- 2024 Sales Forecast: GM’s forecast of 16M vehicle sales in the US for 2024, matching 2023 levels, might be overly optimistic given potential economic downturns.

GM Stock Valuation and Investment Potential

GM's stock, trading at around 4.5x forward P/E, suggests an attractive earnings yield. However, a closer valuation using conservative sales growth and FCF margin assumptions places GM's fair value at approximately $35 per share.

- Valuation Model Insights: The TQI Valuation Model indicates that GM's stock is fairly valued at current levels but falls short of the 15% investment hurdle rate for long-term growth.

GM's Long-term Prospects and Strategic Initiatives

Despite GM's apparent undervaluation, concerns persist regarding its EV transformation, long-term growth outlook, and profitability margins. GM's strategic shift towards EVs, while essential, is currently a costly endeavor without immediate returns.

- Investor Sentiment and Market Position: The market’s neutral response to GM’s financial strategies and its current stock valuation reflects a cautious investor sentiment towards the company's long-term prospects.

For more in-depth stock performance analysis and insider transaction details, visit: