Honda Analysis: Strategic Growth & Financial Health NYSE:HMC

Diving Deep into Honda's Global Diversification and Future Prospects Amidst EV Market Expansion | That's TradingNEWS

Honda Motor Co., Ltd. (NYSE:HMC): A Financial and Strategic Analysis

Introduction to Honda's Market Position and Financial Health

Honda Motor Co., Ltd. (NYSE:HMC) is navigating an intricate period, characterized by lower-than-expected revenues yet buoyed by significant deals in the EV sector and promising R&D endeavors. Despite trading at multi-year lows, Honda's diverse business model and its geographic reach, particularly in Asia, provide a unique market position.

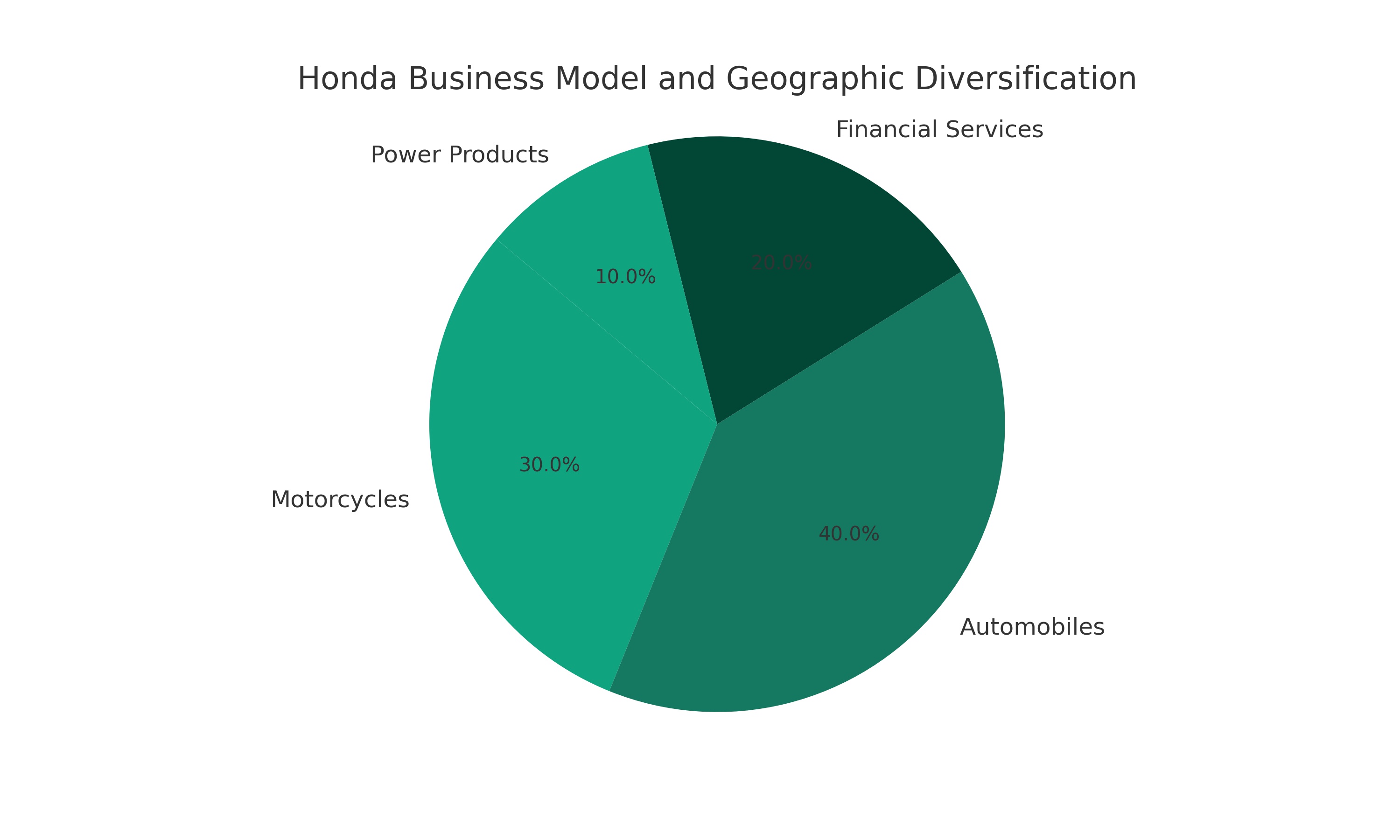

Business Model and Geographic Diversification

Honda's operational segments, comprising motorcycles, automobiles, financial services, and power products, exhibit a significant global footprint. Although more dominant in Japan and Asia than in the United States and Europe, Honda's international presence affords it a competitive edge, particularly in emerging markets.

- Revenue Distribution: Honda's revenue is geographically diverse, with a strong presence in Asian markets. This diversification is pivotal in the current global economic environment.

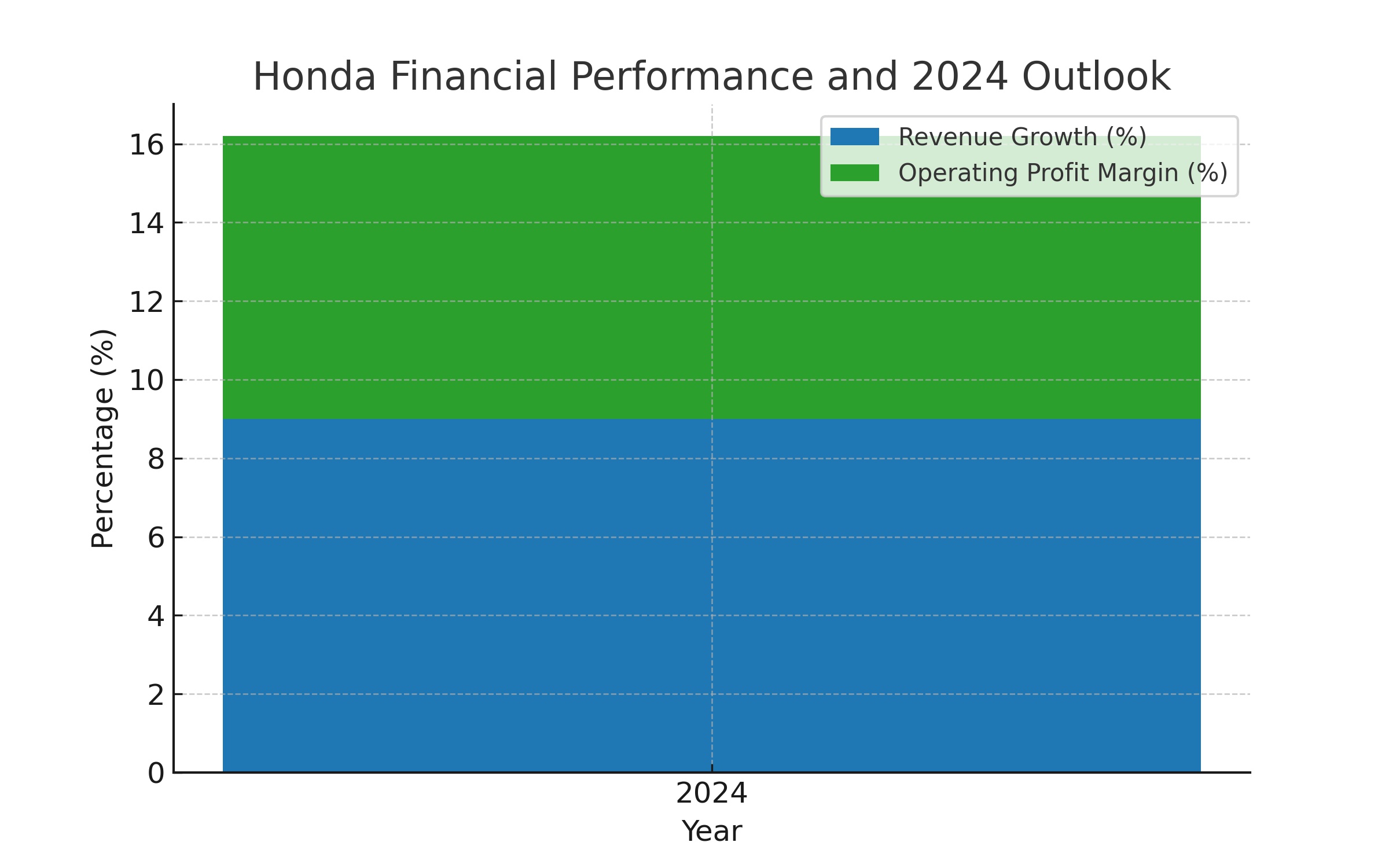

Financial Performance and 2024 Outlook

Honda's financial performance in recent quarters indicates a challenging environment, especially in China and Asia. However, management's 2024 forecast suggests a favorable turn with expected revenue growth, improved production volumes in North America, and positive net sales revisions.

- Revenue and Profit Forecasts: The company anticipates single-digit revenue growth in the first half of 2024, with operating profits expected to reach around 7.2%, an improvement from the previous year.

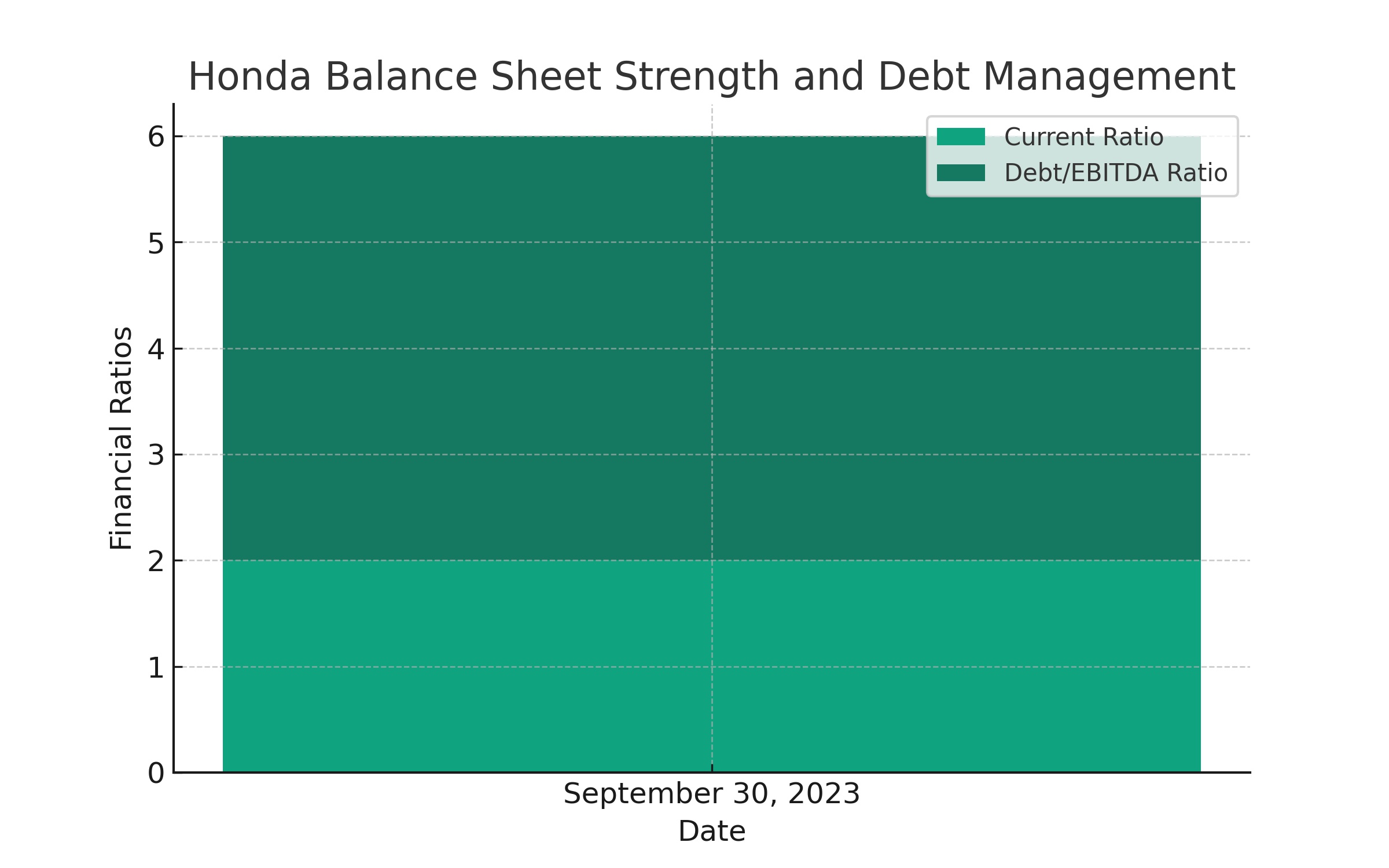

Balance Sheet Strength and Debt Management

As of September 30, 2023, Honda reported robust cash reserves and a healthy current ratio above 2x, signaling no immediate liquidity concerns. However, the total debt amount warrants attention, especially considering the ongoing global economic uncertainties.

- Debt Metrics: Honda's financial debt/EBITDA ratio, approximately 4x, has decreased from 2021 levels, but further reduction could enhance the company's valuation and financial flexibility.

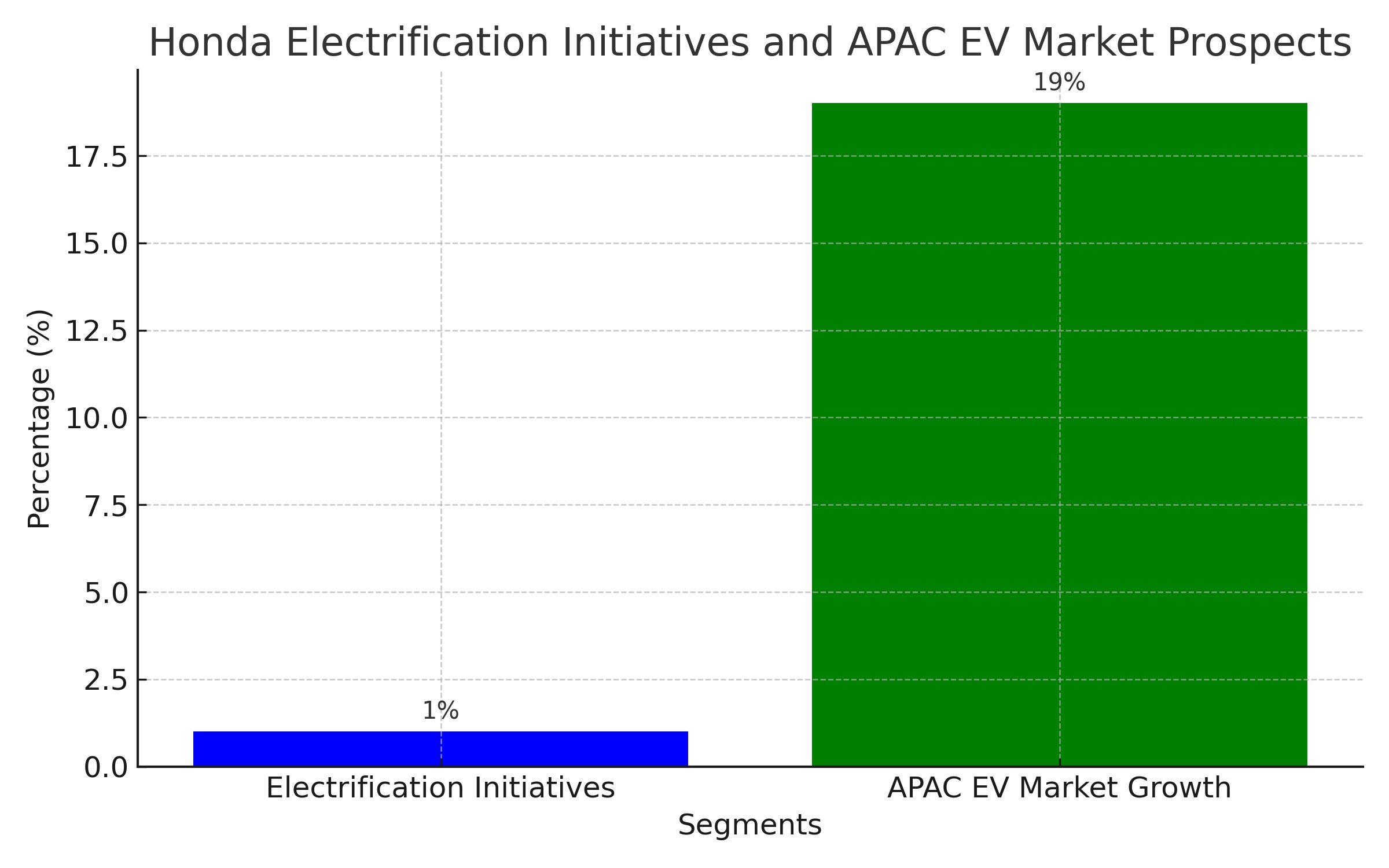

Electrification Initiatives and Market Prospects

Honda's active participation in the EV market, including collaborations with major players and the creation of new business units like ChargeScape, positions it favorably in the burgeoning EV sector. The APAC EV market, expected to grow at a 19% CAGR until 2027, presents substantial opportunities for Honda.

R&D and New Business Developments

Honda's creation of the Electrification Business Development Operations signals a serious commitment to the EV sector. This strategic move could significantly increase the company's market valuation, particularly if it leads to the development of new, high-value business units.

Stock Repurchase Program and Share Value Implications

Honda's modification of its stock repurchase program, targeting up to 3.8% of total shares, indicates a proactive approach to managing its share value. This could lead to favorable stock price adjustments in the near future.

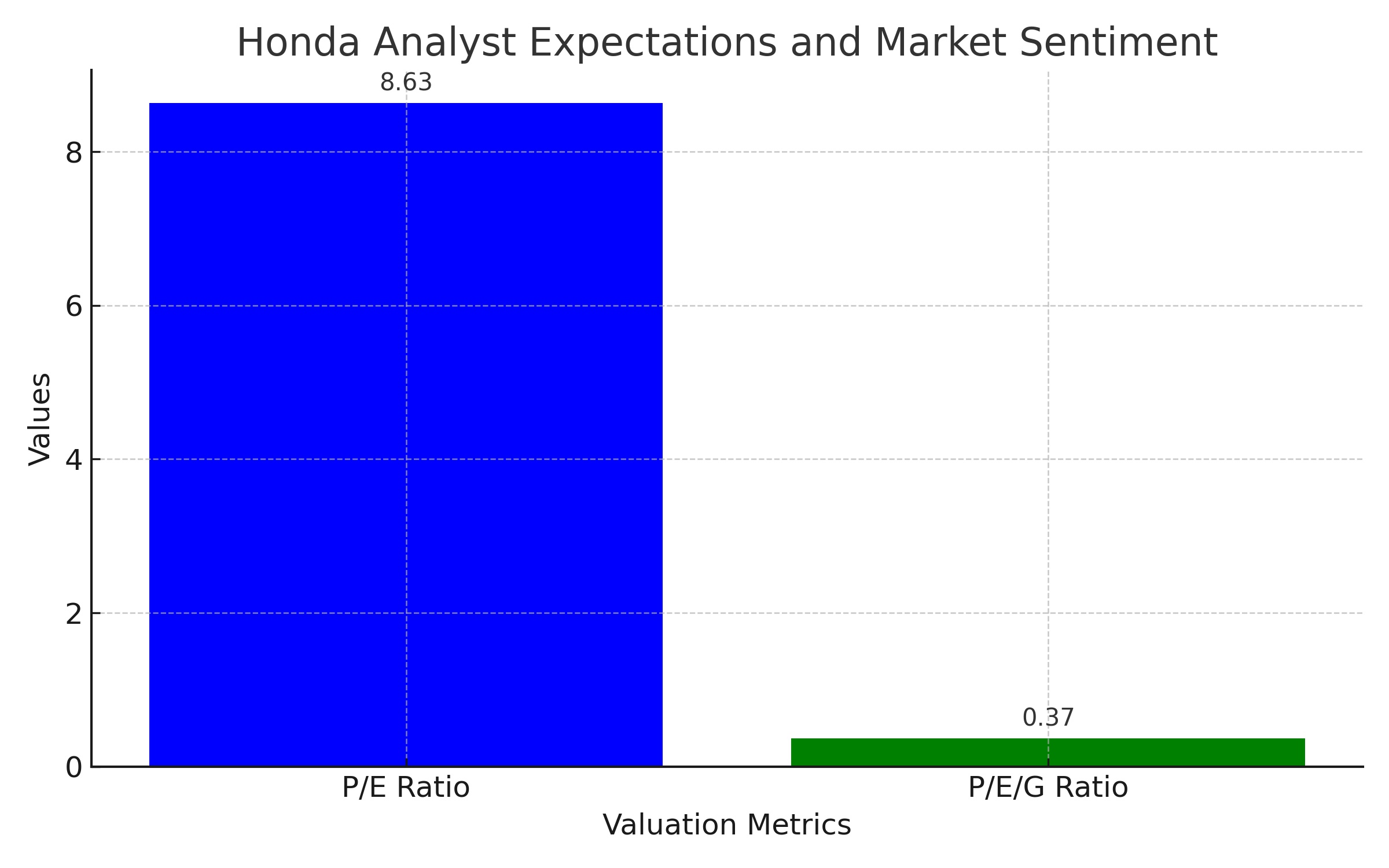

Analyst Expectations and Market Sentiment

The consensus among analysts suggests a positive outlook for Honda, with expectations of steady growth in net sales and operating margins. The company's current trading multiples, including a P/E ratio of 8.63 and a P/E/G ratio of 0.37, suggest that Honda is undervalued compared to its potential.

Institutional Investment Trends

Recent activity by institutional investors and hedge funds shows a growing interest in Honda's stock. Increased stakes by entities like Sequoia Financial Advisors LLC and Hexagon Capital Partners LLC reflect confidence in Honda's market strategy and future prospects.

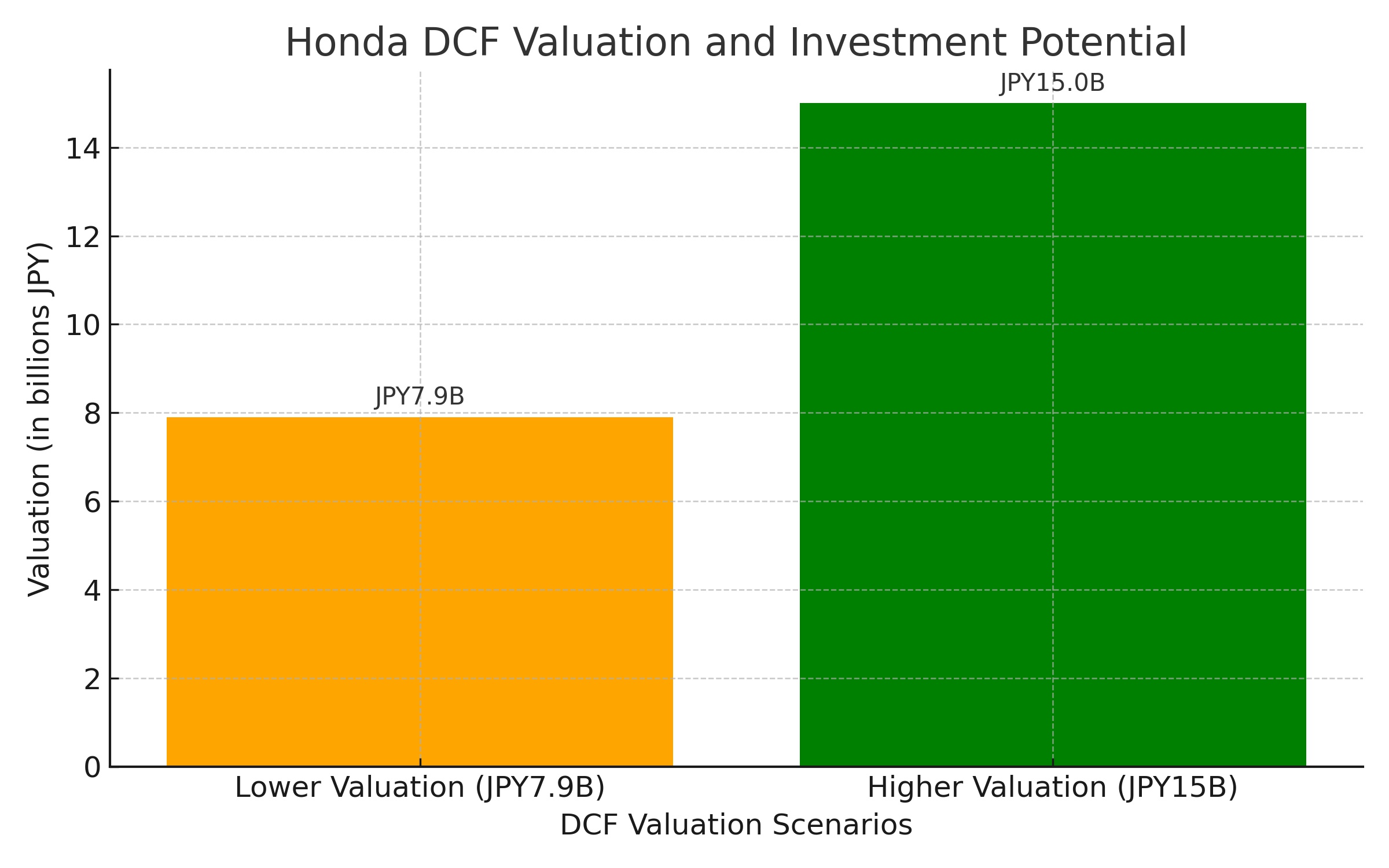

DCF Valuation and Investment Potential

Using a Discounted Cash Flow (DCF) model with conservative assumptions of a WACC between 5% and 11%, and an FCF multiple of 4x-7x, Honda's valuation ranges between JPY7.9 billion and JPY15 billion, indicating significant investment potential. This valuation is conservative compared to industry peers, further highlighting the attractiveness of Honda's stock.

Risk Considerations

Investors should be aware of risks, including potential increases in interest rates affecting debt refinancing, cyber-security threats impacting operations, and changes in public policy or consumer behavior towards EVs.

Conclusion

While Honda Motor Co., Ltd. faces challenges, including debt levels and market volatility, its strategic investments in the EV sector, strong geographic diversification, and robust R&D initiatives position it well for future growth. The company's current undervaluation presents an attractive opportunity for investors seeking exposure to the evolving automotive industry.

For more detailed stock performance and insider transaction insights, visit:

That's TradingNEWS

Read More

-

Stock Market Today — Dow Loses 903 Points, S&P 500 Cracks 6,734 and Breaks December Support, Nasdaq Hits 22,458 as February NFP Sheds 92,000 Jobs

06.03.2026 · TradingNEWS ArchiveStocks

-

Bitcoin Price Forecast - BTC-USD at $68K — $74K Rejected at 61.8% Fibonacci

06.03.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast - XAU/USD at $5,097 — 92K Jobs Lost, ICBC Bars and the $5,153 Resistance That Unlocks $5,426

06.03.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast - EUR at 1.1579 — Rising Channel Broken, DXY Eyes 100.00

06.03.2026 · TradingNEWS ArchiveForex