Analyzing Humana Inc.'s Strategic Position and Market Dynamics

Financial Health and Market Share

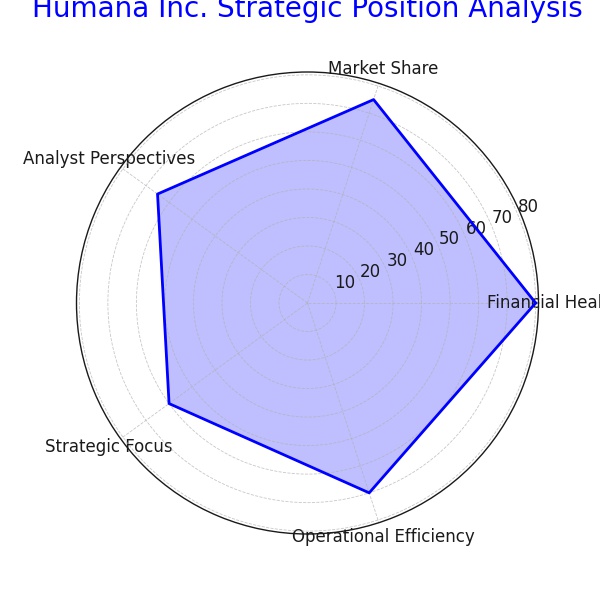

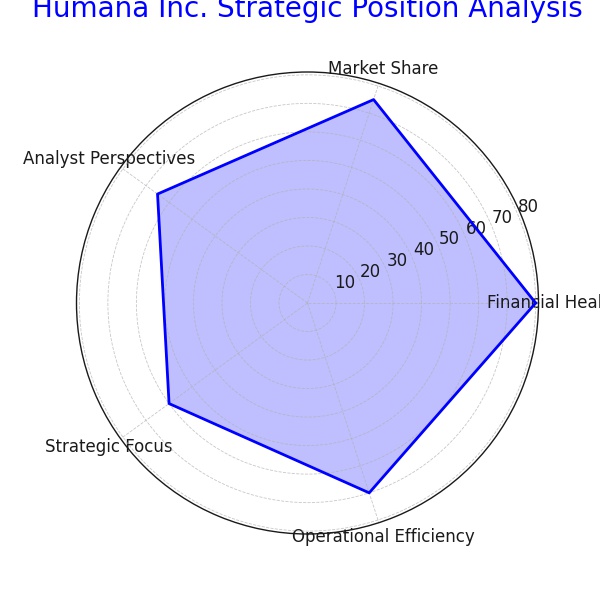

Humana Inc. (NYSE:HUM) has consistently been a significant player in the healthcare insurance industry, with a keen focus on Medicare Advantage plans. The company's strategic positioning and financial health, marked by a 0.27% ownership by Acadian Asset Management LLC and a robust 91.86% institutional investor base, underscore its solid foundation. However, recent market shifts and operational challenges have prompted a reevaluation of its standing and future prospects.

Recent Financial Performance and Market Response

Humana's recent financial performance, especially its quarterly earnings report showcasing a surprising EPS of -$0.11 against an anticipated $0.76, has raised eyebrows among investors and market analysts. This unexpected downturn has not only influenced its stock market performance but also led to a comprehensive review of its strategies, particularly concerning Medicare Advantage plans. The stock's fluctuation, with a 0.8% increase to $366.92, juxtaposes its historical high of $541.21 and a low of $342.69, reflecting market volatility and investor skepticism.

Institutional and Analyst Perspectives

The financial landscape for Humana has seen significant engagement from various institutional investors and hedge funds, indicating a sustained belief in its long-term viability. This is despite the revisions in analyst ratings and price targets, which now lean towards a "Moderate Buy" with an adjusted average price target of $506.72. These revisions, stemming from performance assessments and future earnings potential, highlight the critical need for Humana to recalibrate its strategic focus.

Challenges and Strategic Missteps

The core of Humana's challenges lies in its Medicare Advantage segment, where increased medical costs and utilization have led to a stark reassessment of its future earnings and performance outlook. The company's acknowledgment of these challenges, coupled with a revised 2024 EPS guidance to $16, down nearly 45% from previous estimates, has sent ripples through the investment community. This adjustment, coupled with the projection that 2025 earnings will also fall short of expectations, signals deeper operational and strategic issues.

Competitive Landscape and Industry Comparisons

Humana's market share in Medicare Advantage enrollment, though substantial, is under threat from competitors like UnitedHealth Group, which boasts a more diversified business model. This competition, accentuated by Humana's recent performance and strategic pitfalls, necessitates a thorough reevaluation of its market strategy and operational efficiency. The healthcare industry's dynamic nature, marked by regulatory changes and cost pressures, further complicates Humana's path to recovery and growth.

Forward-Looking Strategies

In response to these challenges, Humana has indicated a strategic pivot towards addressing cost pressures and optimizing its Medicare Advantage pricing model. This includes a focus on value-based care to improve service quality and reduce operational costs. Moreover, Humana's commitment to leveraging its high customer service rankings and achieving operational efficiencies underscores its efforts to navigate through current headwinds and reinforce its market position.

Investment Insights

For investors, the evolving narrative around Humana presents both challenges and opportunities. The company's strategic repositioning and focus on operational excellence are pivotal in determining its trajectory. While current challenges warrant a cautious approach, Humana's underlying strengths and market potential could offer a compelling case for long-term investment. The forward-looking investor would do well to monitor Humana's strategic initiatives, market response, and operational adjustments closely.

For an in-depth analysis of Humana Inc. and real-time stock performance insights, visit Humana's stock profile on Trading News. Additionally, to understand the nuances of insider transactions and their implications on the company's strategic direction, refer to Humana's insider transactions information.

Conclusion

Humana Inc. finds itself at a critical juncture, facing operational challenges and market pressures that necessitate a strategic overhaul. While the path forward is fraught with uncertainties, the company's efforts to realign its strategies and operational focus offer a glimmer of hope. Investors and market watchers alike will benefit from a nuanced understanding of Humana's market dynamics, competitive positioning, and strategic initiatives as they unfold.