Intel Stock Price Forecast - INTC Holds $37.96 as AMD Surges 8.76% to $258.32 Amid AI Boom and Fed Rate Cut Hopes

Intel steadies near $38 as AMD rallies above $258 after weak US jobs data boosts Fed cut bets; CEO Lip-Bu Tan intensifies Intel’s AI comeback | That's TradingNEWS

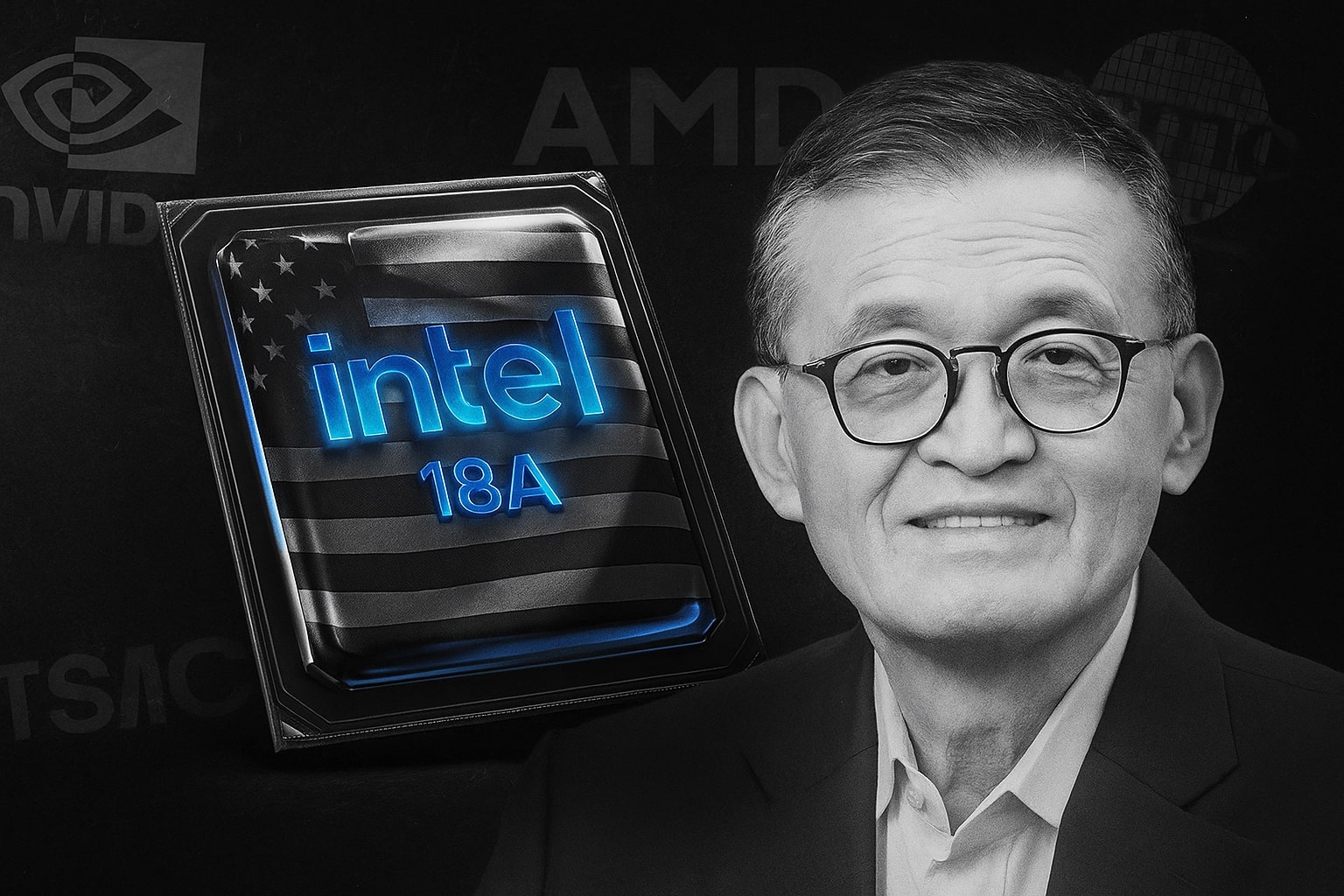

Intel (NASDAQ:INTC) Rises to $37.96 as CEO Lip-Bu Tan Personally Leads AI Division Amid Market Pressure

Intel Corporation (NASDAQ:INTC) traded at $37.96, up 0.20%, moving within a $37.35–$38.20 range on November 12, 2025. With a market capitalization of $180.69 billion, the stock remains 11% below its 52-week high of $42.48 but well above its 52-week low of $17.67, reflecting investor confidence in Intel’s restructuring momentum under new leadership.

Lip-Bu Tan Takes Direct Control of AI Strategy

New CEO Lip-Bu Tan has taken personal control of Intel’s AI and Advanced Technologies division following the departure of Sachin Katti to OpenAI, where he will lead compute infrastructure for AGI development. Tan’s hands-on involvement marks a strategic pivot designed to reestablish Intel’s competitiveness against NVIDIA (NASDAQ:NVDA) and AMD (NASDAQ:AMD). Intel reaffirmed that “AI remains one of its highest strategic priorities,” signaling a shift to execution-focused leadership to strengthen data-center and edge AI growth.

Financial Results and Earnings Snapshot

Intel’s Q3 2025 revenue reached $13.65 billion, rising 2.78% year-over-year, while net income surged 124.42% to $4.06 billion. Earnings per share (EPS) jumped 150% to $0.23, supported by operating expenses down 19.73% to $4.36 billion and a 29.76% net profit margin. EBITDA rose 54.28% to $3.51 billion, with an effective tax rate of 6.65% aided by CHIPS Act incentives.

Intel closed the quarter with $30.94 billion in cash, up 28.44%, and total assets of $204.51 billion versus liabilities of $87.78 billion. Free cash flow soared 2,200% to $4.08 billion, demonstrating strong operational control and capital discipline.

Guidance and Strategic Direction for Q4 2025

Intel projects Q4 revenue of $12.8–$13.8 billion and non-GAAP EPS of $0.08, while GAAP EPS is forecast at –$0.14, reflecting fabrication costs tied to new AI fabs. The firm trimmed its FY2025 operating expense target to $16.8 billion and finalized the $10 million sale of its 1501 Martin Avenue Santa Clara property as part of its ongoing efficiency drive.

AMD Surges 8.76% as Competition Heats Up

On the same day, Advanced Micro Devices Inc. (NASDAQ:AMD) soared 8.76% to $258.32, gaining $20.79 during the session. The stock traded between $250.00 and $263.51, with a market cap of $421.86 billion and a P/E ratio of 127.80. AMD’s rally reflects aggressive investor appetite following strong AI chip demand and optimism for its next-generation accelerators. The 52-week high of $267.08 now looms as a key resistance level, while AMD’s 52-week low of $76.48 underscores the magnitude of its 2025 rebound.

In contrast, NASDAQ:INTC remains undervalued, trading at a fraction of AMD’s earnings multiple, but Intel’s ongoing restructuring aims to close this valuation gap through its AI and foundry strategy.

Capital Support from Government and Strategic Partners

Intel’s recovery is bolstered by significant capital backing: a 9.9% U.S. government equity stake worth $8.9 billion, NVIDIA’s $5 billion investment at an average price of $23.28 per share, and SoftBank’s prior $2 billion stake. These moves reflect deep institutional confidence in Intel’s U.S. manufacturing expansion and AI roadmap.

Board Expansion and Leadership Restructuring

Intel recently added Dr. Craig H. Barratt, former Barefoot Networks CEO, to its board of directors, reinforcing technical depth in networking and semiconductor architecture. His appointment complements Tan’s leadership overhaul within the Data Center and AI Group (DCAI), designed to improve execution speed and accountability across divisions.

Market Performance and Sector Dynamics

On November 11, NASDAQ:INTC fell 1.5% to $37.88, outperforming NVIDIA (–2.9% to $193.16) while lagging behind AMD’s sharp recovery from $237 to $258.32. Intel’s 52.8 million trading volume was below its 50-day average of 119.5 million, suggesting limited selling pressure. The Dow Jones Industrial Average rose 1.18% to 48,307, while the Nasdaq Composite edged down 0.25%, reflecting rotation from high-growth to value sectors — a dynamic favorable for Intel’s valuation-driven rebound.

Liquidity and Balance Sheet Strength

Intel’s operating cash flow reached $2.55 billion, while financing inflows surged 235.86% to $5.15 billion. Capital expenditures of $6.25 billion reflect heavy fab investment in Arizona and Ohio. Return on assets (ROA) improved to 1.08%, with ROIC at 1.34% and a conservative debt-to-equity ratio of 0.38, positioning Intel with one of the healthiest balance sheets among large-cap semiconductor firms.

Read More

-

SCHG ETF Near $33 High As AI Giants Drive 19% 2025 Rally

01.01.2026 · TradingNEWS ArchiveStocks

-

XRP-USD Stuck At $1.87 As XRPI Near $10.57 And XRPR Around $14.98 Despite $1.16B ETF Wave

01.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Slides Toward Key $3.57 Support As Ng=F Extends 33% Drop

01.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Near 156 As Fed Cuts Meet Boj Hawkish Turn

01.01.2026 · TradingNEWS ArchiveForex

AI Infrastructure and Manufacturing Expansion

Intel’s strategic roadmap aims for process parity with TSMC by 2026, supported by CHIPS Act subsidies and enhanced Intel Foundry Services (IFS). The focus includes expanding AI PC, data-center inference, and custom silicon pipelines. Tan’s decision to oversee AI development personally signals an urgent pivot toward NVIDIA’s execution model, emphasizing integration speed and commercialization efficiency.

Technical Levels and Institutional Behavior

Intel trades above its 50-day moving average ($33.91) and 200-day average ($26.04), maintaining a strong technical setup. Support is anchored at $36.50, with resistance at $39.20 and $42.50. A break above $39.20 could accelerate momentum toward its 52-week high, while a drop below $36.00 may trigger short-term consolidation. Geode Capital Management increased its Intel holdings by 1.8% in Q2, now owning 97.56 million shares (2.23%) valued at $2.17 billion, signaling institutional conviction.

Valuation Metrics and Market Context

At $37.96, Intel’s P/E ratio of 3,570.69 appears distorted due to write-offs, while its price-to-book ratio of 1.70 and beta of 1.31 suggest moderate volatility. The stock remains deeply discounted relative to AMD’s 127.8 P/E and NVIDIA’s 70+ multiple, positioning Intel as a high-upside value play in an overheated AI sector.

Analysts maintain an average price target of $34.84, though this underrepresents upside potential if Intel achieves consistent AI monetization and fab utilization growth in 2026.

Outlook and Investment Verdict

Intel’s transformation is gathering traction — with government support, strong cash reserves, and renewed AI leadership under Lip-Bu Tan, the company’s turnaround narrative is regaining credibility. While AMD captures market attention through innovation and growth, Intel’s value-to-growth transition remains its strongest long-term catalyst.

Verdict: Buy, with a medium-term target of $42–$45, contingent on AI execution and stable revenue above $13 billion per quarter through 2026.

Follow live data at Intel Real-Time Chart.