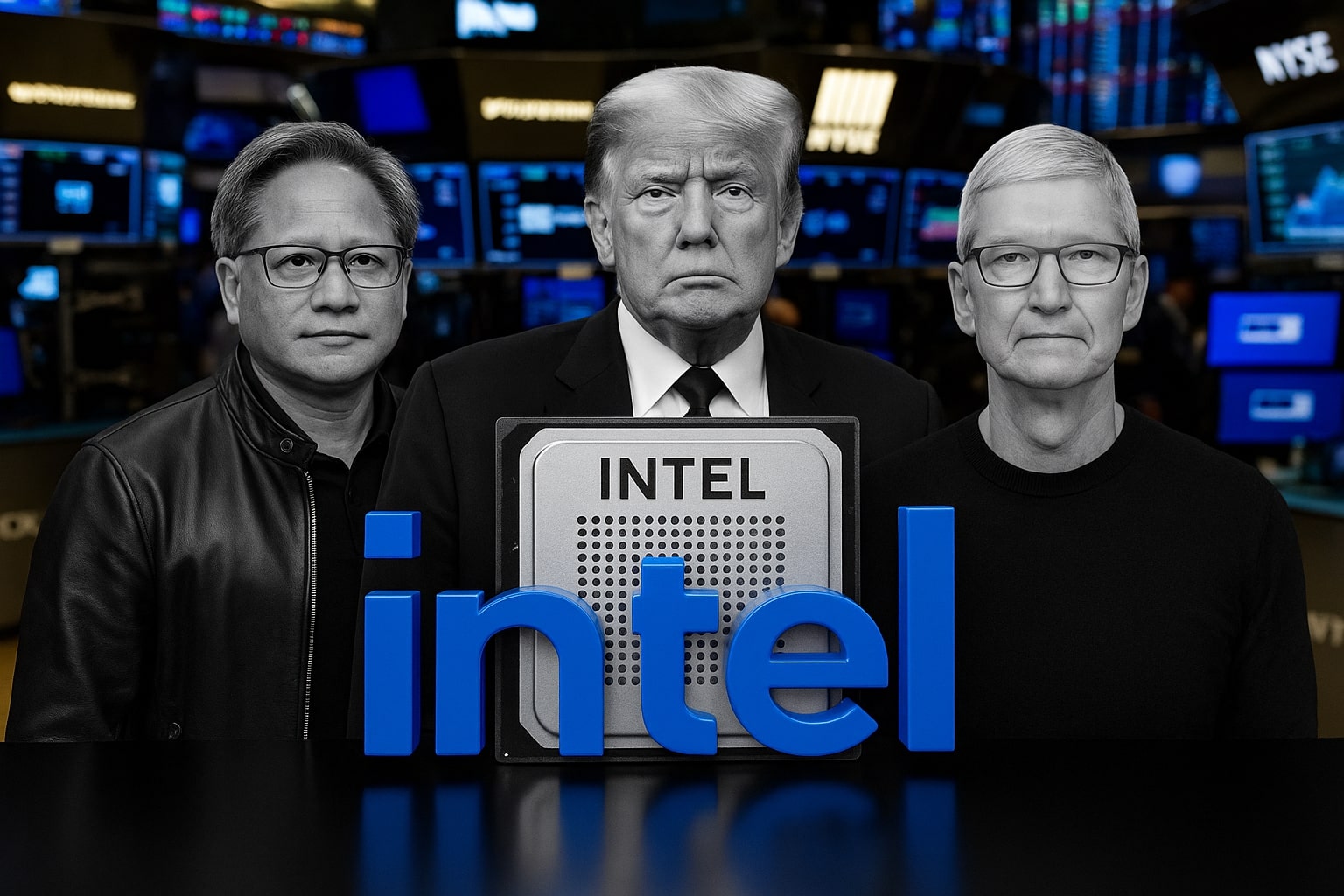

Is Intel Stock a Buy? INTC Rockets 45% as Nvidia Invests $5B, Apple & TSMC Talks Gain Traction, and Trump Tariffs Fuel Price Forecast

Shares hit $36.30, a 52-week high, with Nvidia’s stake, U.S. subsidies, and tariff protection lifting sentiment. Apple and Taiwan Semiconductor (NYSE: TSM) negotiations hint at a new foundry strategy, as Intel’s YTD rally reaches 77% and targets shift toward $40 | That's TradingNEWS

Intel (NASDAQ: INTC) Surges 45% in September as Strategic Deals Reshape the Chip Sector

Intel’s September rally, with shares jumping 45% to $35.50, marked one of the most dramatic comebacks in the semiconductor space this year. After lagging rivals Nvidia (NASDAQ: NVDA) and AMD (NASDAQ: AMD) for years, Intel’s stock has surged on a convergence of powerful catalysts: Nvidia’s $5 billion equity stake, Apple (NASDAQ: AAPL) and Taiwan Semiconductor Manufacturing (NYSE: TSM) partnership talks, and a tariff boost under the Trump administration. For the first time since 2021, Intel is being revalued not as a legacy player, but as a strategic U.S. technology asset central to both corporate and geopolitical agendas.

Nvidia’s $5 Billion Stake Validates Intel’s Foundry Ambitions

The market’s perception of Intel shifted sharply after Nvidia disclosed a $5 billion investment in the company. For years, Nvidia dominated the AI accelerator market while outsourcing all chip production to TSMC. By taking a direct stake in Intel, Nvidia signaled confidence in Intel Foundry Services as a viable long-term alternative. This move is particularly significant as Washington pushes to diversify U.S. tech supply chains away from Asia. Shares of INTC rallied 7% on the day of the announcement, hitting intraday highs near $36.50 before consolidating at $35.50. The partnership is not just financial—it underscores Nvidia’s willingness to hedge its dependence on TSMC while giving Intel a critical stamp of credibility in advanced manufacturing.

Apple and TSMC Talks Signal a Turning Point for Supply Chains

Intel’s momentum accelerated as reports surfaced of high-level discussions with Apple, a company that abandoned Intel processors in favor of in-house silicon during the M1 transition. With iPhone sales driving Apple’s $3 trillion market cap, a potential reconciliation between Apple and Intel could reshape demand flows. At the same time, Intel’s engagement with TSMC—its largest competitor—highlights the pragmatism of CEO Pat Gelsinger’s strategy. Intel is no longer positioning itself purely as a rival but as a collaborator capable of absorbing U.S.-based production needs. For investors, these dual-track talks with Apple and TSMC illustrate that Intel is becoming indispensable in an era where supply chain security is paramount. The news helped reinforce INTC’s climb from $28 in August to $35.50 by month-end.

Trump Tariffs Boost Intel’s Status as a National Champion

The Trump administration’s sweeping tariffs—100% on pharmaceuticals, 50% on kitchen and bath imports, and 25% on heavy trucks—carry broader implications for technology and semiconductors. With China facing sharper restrictions on chip exports and imports, Intel stands to capture additional U.S. demand as companies diversify away from Chinese suppliers. The timing couldn’t be better: Intel is already receiving over $8 billion in CHIPS Act subsidies to fund its fabs in Arizona, Ohio, and Oregon. The three-day period following the tariff announcement saw INTC rally over 12%, adding nearly $15 billion to its market capitalization. Investors are clearly treating Intel as not just a corporate turnaround story but a geopolitical hedge.

Valuation Still Attractive Despite Sharp Rally

At $35.50, Intel’s stock is still trading more than 50% below its 2021 peak of $70. For value-focused investors, the current price represents an opportunity: INTC trades at just 14x forward earnings versus 40x for NVDA and 33x for AMD. Its price-to-sales ratio at 2.8 remains modest compared to Nvidia’s 18 and AMD’s 9. With cash flows supported by both subsidies and potential corporate partnerships, Intel’s risk-reward profile is unique. The 45% monthly surge has closed part of the valuation gap, but Wall Street still sees Intel as discounted relative to its strategic positioning.

Institutional Flows and Record Volumes Reinforce the Rally

Intel’s September breakout wasn’t driven by retail speculation alone. Institutional investors piled into the stock as volumes surged past 120 million shares per day, nearly triple the 30-day average. ETFs tied to U.S. manufacturing and semiconductors rebalanced to include heavier INTC weightings, while hedge funds repositioned into the name on expectations of deal-driven upside. The $5 billion Nvidia stake also acted as a liquidity catalyst, anchoring confidence that other strategic investors could follow. With subsidies flowing and balance sheet support in place, Intel’s trading profile has shifted from low-growth to strategic asset, pushing INTC toward new institutional ownership highs.

Read More

-

Google Stock Price Forecast: GOOG Holds $314 As 2026 AI CAPEX, $240B Cloud Backlog And SpaceX Upside Collide

23.02.2026 · TradingNEWS ArchiveStocks

-

Bitcoin Price Forecast – BTC-USD Tests $65K as Bears Target $62K–$58K Zone

23.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast – XAU/USD Holds $5,150 as 15% Tariff Shock Ignites Safe-Haven Bid

23.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Nasdaq, S&P 500 and Dow Jones Struggle While Gold and Oil Diverge

23.02.2026 · TradingNEWS ArchiveMarkets

-

EUR/USD Price Forecast - EURUSD: Tariff Chaos And Fed Cut Pricing Keep 1.18 In Play, 1.20 On The Radar

23.02.2026 · TradingNEWS ArchiveForex

Technical Breakout Resets Key Price Targets for INTC

On the technical side, Intel’s surge above $33 confirmed a breakout from a multi-month downtrend. The stock is now consolidating at $35.50, with resistance levels in sight at $38 and $42. Momentum remains strong, with RSI readings at 68 suggesting near-term overbought conditions but not yet at extreme levels. The 200-day moving average at $31 has turned into firm support, creating a safety floor for bulls. If momentum holds, the next upside zone could extend toward $45, marking a potential 25% rally from current levels. A breakdown below $30, however, would negate the bullish trend and reopen downside risk toward $25.

Intel Versus Global Competitors: New Role in the Chip War

Intel’s rally must be understood in the context of its peers. Nvidia remains flat at $178.19 after a year of massive gains, while AMD continues to command premium multiples with shares near $113. TSMC trades at $139, benefiting from AI demand but weighed by Taiwan’s geopolitical risks. Intel’s advantage now lies in its hybrid positioning: it is simultaneously a U.S. national champion supported by subsidies, a partner validated by Nvidia, a potential collaborator with Apple, and a possible co-investor with TSMC. No other semiconductor stock combines all these angles, giving INTC a unique valuation story.

Final Verdict: Intel (NASDAQ: INTC) Rated Buy on Strategic Catalysts

Intel’s 45% surge in September is not simply a technical bounce. It reflects a deep realignment of corporate strategy, government policy, and institutional flows. With Nvidia’s $5 billion investment, Apple and TSMC discussions, and Trump’s tariff-driven boost to U.S. manufacturing, Intel’s fundamentals have shifted toward recovery. At $35.50, INTC offers significant upside toward $42–45, supported by subsidies, partnerships, and its role in securing U.S. technological independence. While risks remain from execution missteps and potential supply chain delays, the stock’s valuation discount and strategic backing justify a Buy rating.