MongoDB Growth Trajectory: AI Integration and Market Expansion

A Deep Dive into MongoDB's Market Dynamics, Financial Strength, and Expansion Opportunities in the AI-Driven Technology Landscape | That's TradingNEWS

MongoDB Inc. (NASDAQ:MDB): A Data-Driven Analysis of Growth and Market Dynamics

MongoDB's Strategic Position in the AI-Driven Future

The Advent of AI and MongoDB's Database Solutions

MongoDB Inc. (NASDAQ:MDB) is carving a niche in the technology sector with its innovative non-relational database, perfectly aligned with the burgeoning demands of artificial intelligence (AI) applications. MongoDB's document-oriented approach facilitates the agile development of applications that can efficiently manage and analyze the vast volumes of semi-structured data generated by AI technologies.

Quantitative Growth Indicators

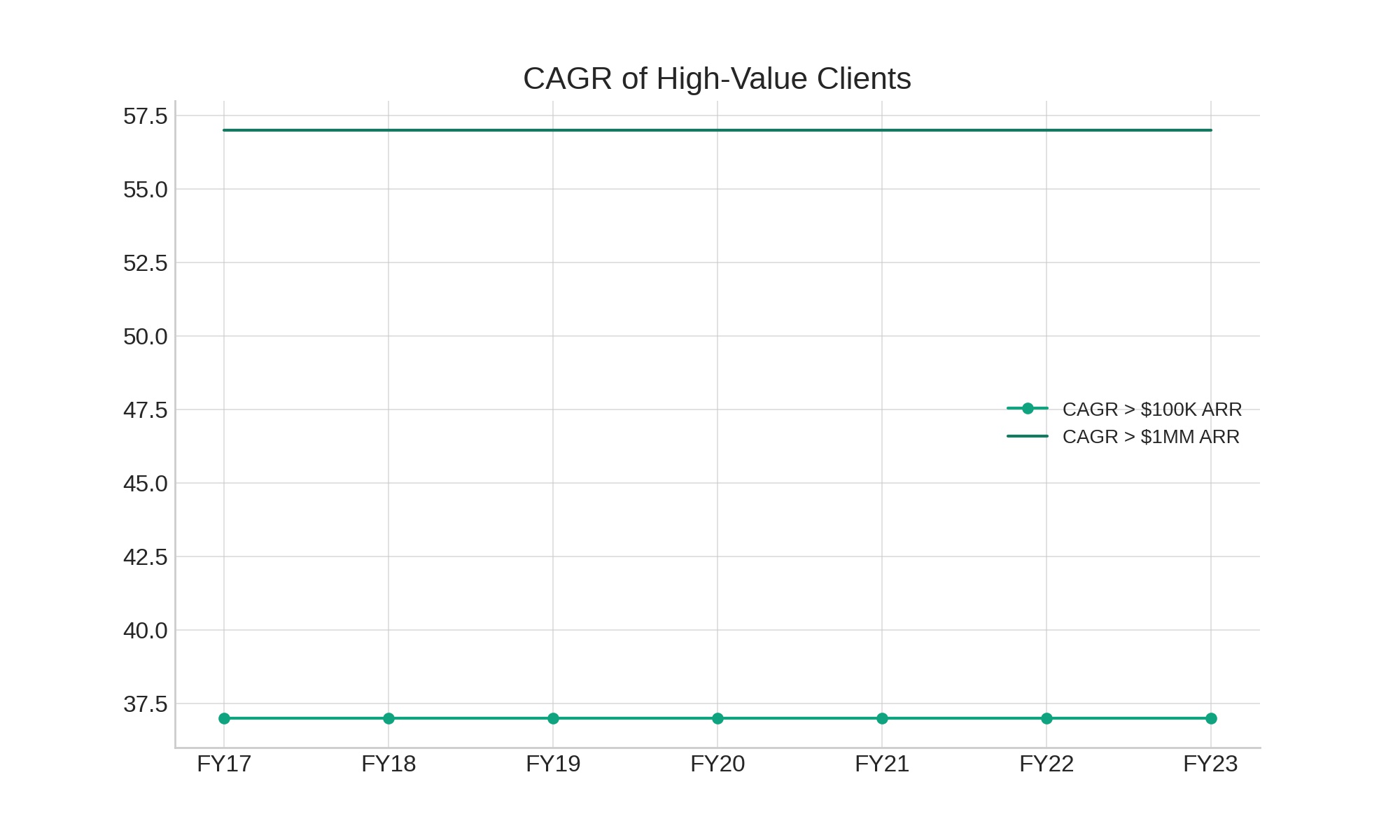

MongoDB's strategic advantage is underscored by its rapid customer growth, notably achieving a Compound Annual Growth Rate (CAGR) of 37% among clients with over $100K in Annual Recurring Revenue (ARR) from FY17-23. The expansion is even more pronounced among clients surpassing $1MM in ARR, showcasing a 57% CAGR within the same period. Despite macroeconomic headwinds slightly decelerating average consumption growth, MongoDB's top-line growth is bolstered by its critical role in AI workloads, promising sustained revenue growth.

MongoDB's Expansion Potential

Enterprise Market: A Landscape of Opportunities

With MongoDB's services currently utilized by 457 of the Global 2000 companies, the potential for market penetration is significant. This figure represents a modest slice of the enterprise pie, particularly given MongoDB's offerings are leveraged by 64 of the Fortune 100 and 192 of the Fortune 500 companies. This underpenetration signals robust growth opportunities as MongoDB aims to deepen its footprint in the enterprise domain.

Financial Health: A Closer Look

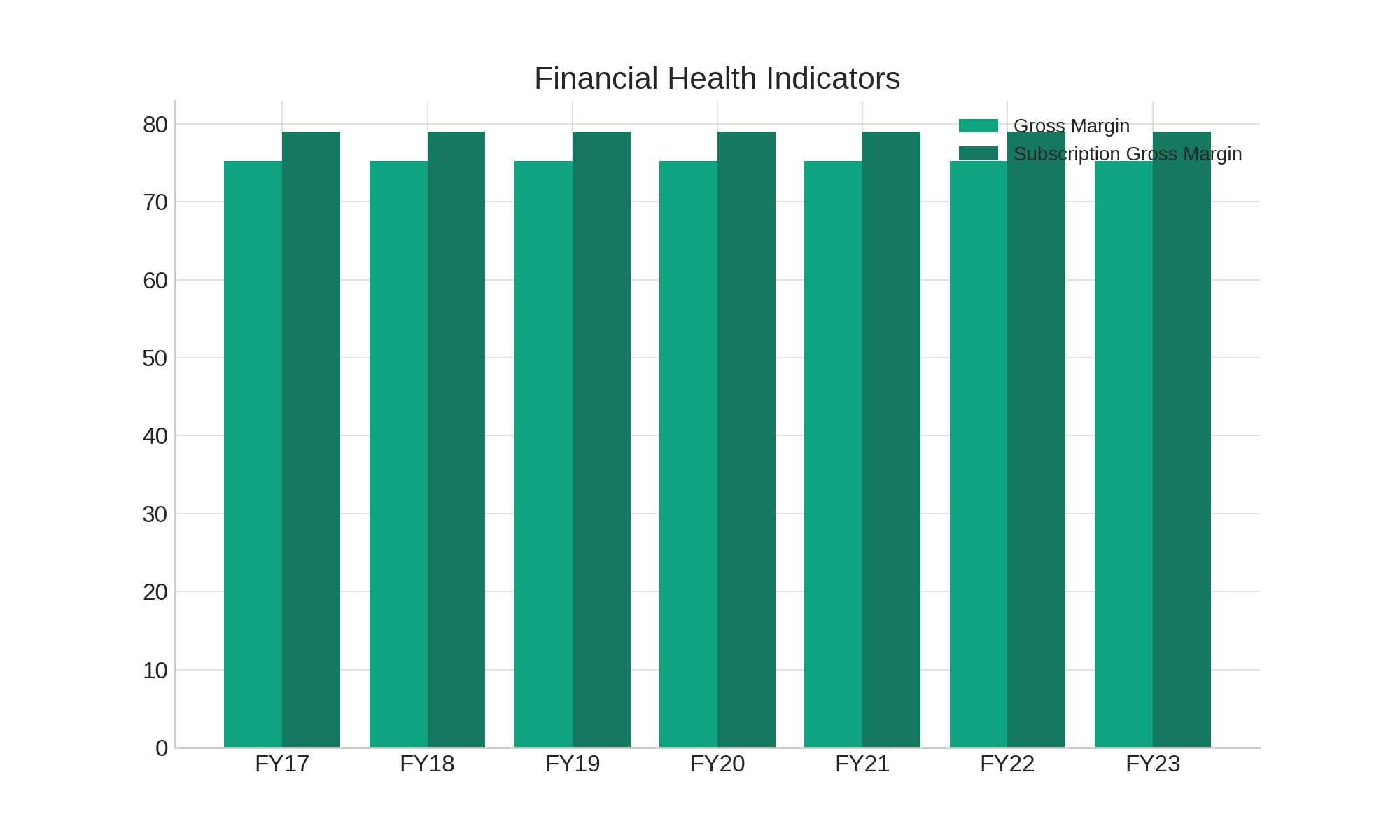

MongoDB's financial landscape is marked by a stable gross margin of 75.2% and an even more impressive subscription gross margin of 79%. The transition towards SaaS models promises to enhance these margins further. Despite challenges such as elongated sales cycles in larger enterprises, MongoDB's operational expense ratio has seen a strategic decrease over the past seven years, indicating efficiency improvements and potential for margin expansion. Management's long-term objective of surpassing a 20% operating margin reflects an ambitious yet achievable goal, considering MongoDB's current trajectory.

MongoDB in the Competitive Landscape

Confronting Market Dynamics

MongoDB's 1.3% share in the $91 billion DBMS market is a testament to its growth potential in a domain experiencing a pivot towards non-relational databases. This transition is especially pertinent for AI and machine learning applications, where MongoDB's architecture offers distinct advantages over traditional relational databases, such as flexibility and scalability for handling complex data structures.

Technological Innovations: A Competitive Edge

MongoDB's commitment to innovation, exemplified by developments in vector search and queryable encryption, solidifies its competitive position. These advancements address critical data security concerns and enhance MongoDB's appeal for AI-driven applications, offering an edge over competitors in the rapidly evolving tech landscape.

Investment Insights and Valuation

Evaluating MongoDB's Investment Appeal

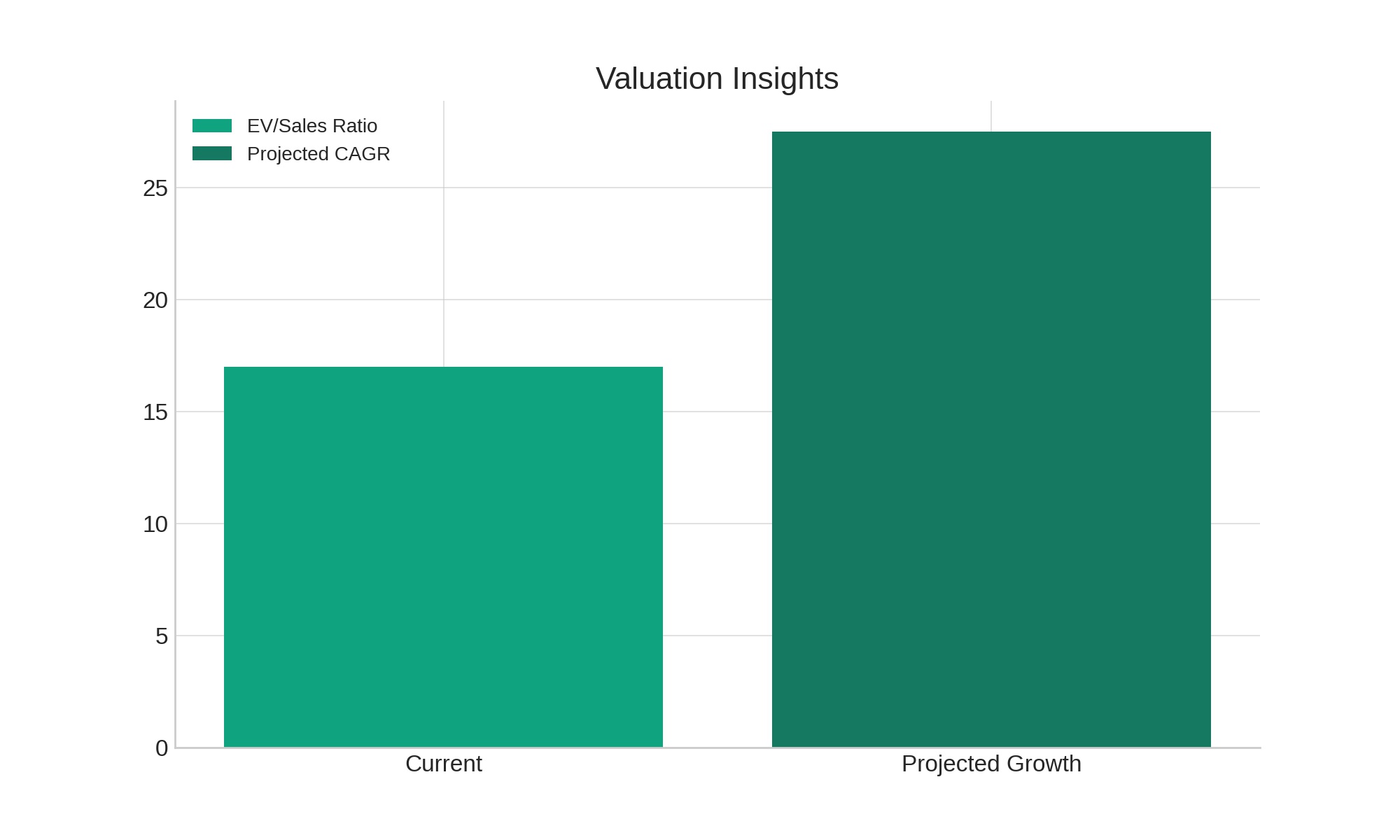

With MongoDB trading at an EV/Sales ratio of approximately 17x, the valuation underscores investor optimism about its strategic position and growth prospects. Assuming a continued top-line growth rate of 25-30% CAGR over the next five years, MongoDB's valuation reflects both its current market performance and future potential. Investors considering MongoDB should weigh its high trading multiples against the expansive growth opportunities presented by its strategic focus on AI and large enterprise adoption.

Forward-Looking Analysis

Looking ahead, MongoDB's prospects in the DBMS market appear promising, with significant room for growth and market share expansion. The company's strategic initiatives and technological innovations position it well to capitalize on the increasing reliance on non-relational databases for AI applications. As MongoDB continues to navigate the competitive landscape, its focus on technological advancements and market expansion strategies will be key drivers of its long-term success.

Conclusion

MongoDB Inc. (NASDAQ:MDB) represents a compelling opportunity within the evolving database management and AI sectors. Backed by strong financial metrics, strategic market positioning, and a focus on innovation, MongoDB is poised for sustained growth. As the company expands its enterprise reach and continues to innovate in response to the demands of AI applications, MongoDB offers a strategic investment avenue for those looking to capitalize on the future of data management technology.

For in-depth financial analysis and real-time stock insights, visit MongoDB on Trading News.

That's TradingNEWS

Read More

-

Google Stock Price Forecast - AI Capex Shock, Cloud Breakout and What $313 Really Prices In

12.02.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast: XRP-USD Stuck Between $1.34 Support And $1.50 Ceiling

12.02.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: WTI Around $63 And Brent $68 Trapped Between Oversupply And Gulf Risk

12.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Jones Holds 50,000 While S&P 500 Steadies and Nasdaq Sinks on Cisco & AppLovin Rout, CPI Looms

12.02.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - GBPUSD=X Stalls Around 1.3630 as Weak UK GDP Meets Robust US Jobs Data

12.02.2026 · TradingNEWS ArchiveForex