NASDAQ:NVDA Nvidia's AI-Driven Market Surge: A Comprehensive Analysis

Strategic Insights, Financial Performance, and Future Prospects of Nvidia's Unprecedented Growth | That's TradingNEWS

Nvidia's AI-Driven Market Surge: A Comprehensive Analysis

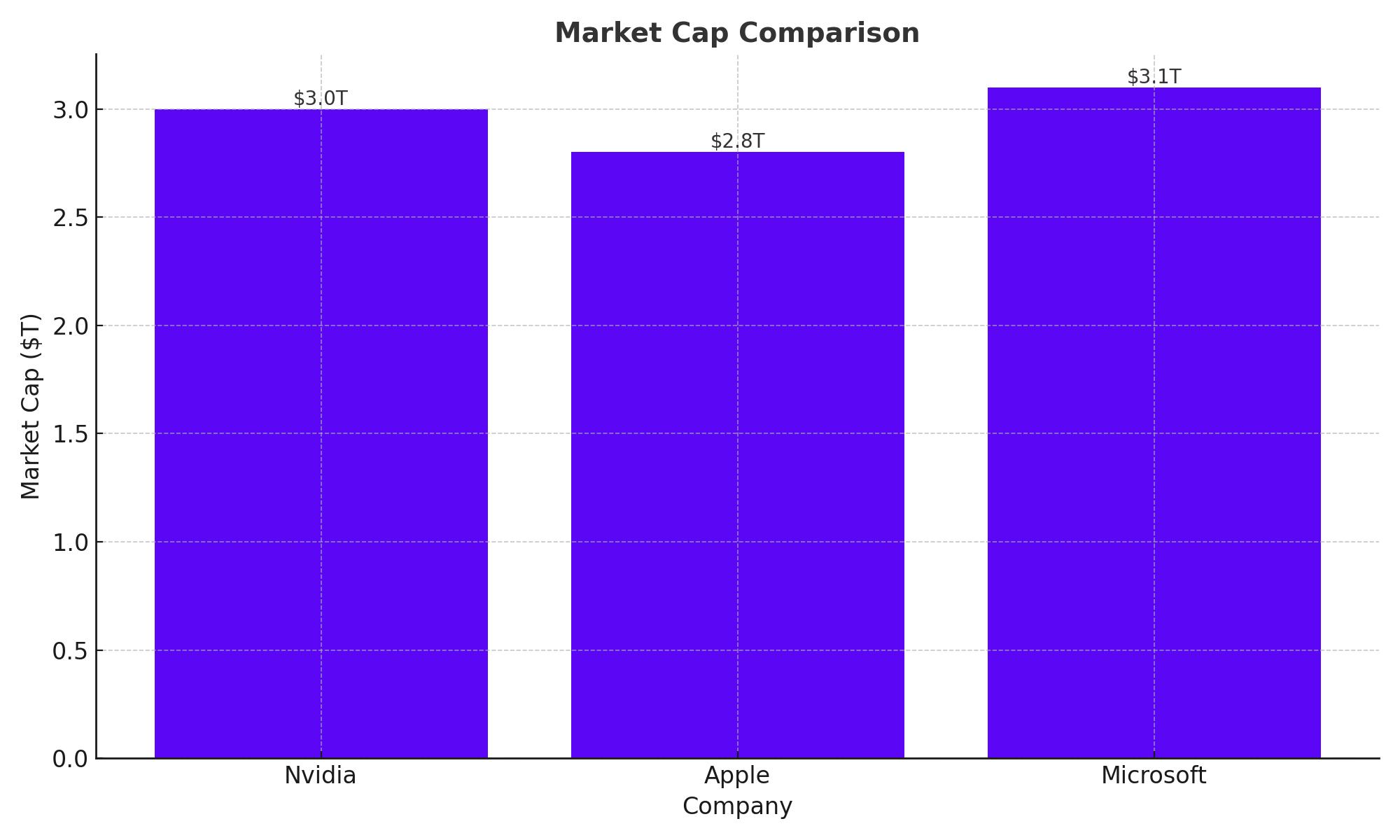

Nvidia Surpasses $3 Trillion Market Cap

Nvidia (NASDAQ:NVDA) has reached a monumental milestone, surpassing a $3 trillion market cap, driven by the growing demand for its AI chips. The company’s stock surged over 5% on Wednesday, closing at more than $1,224 per share. This remarkable growth has propelled Nvidia ahead of Apple, making it the second most valuable publicly traded company globally, just behind Microsoft.

AI Investment and Nvidia’s Strategic Position

Nvidia's rise is fueled by significant investments in AI technology. The company's chips are crucial for AI applications, making it a key player in the ongoing AI boom. Nvidia’s data center segment, which generated $22.6 billion in revenue in Q1 FY2025, a 427% increase from the previous year, highlights the company's dominance. The firm’s AI chips, particularly the Hopper and the upcoming Blackwell and Rubin models, are pivotal in driving its market position.

Strategic Moves and Financial Health

Upcoming Stock Split and Increased Accessibility

Nvidia’s 10-for-1 stock split, announced in May, aims to make its shares more accessible to smaller investors. The split, effective from June 10, has already generated significant market interest, with shares seeing a 9% increase post-announcement. This strategic move is expected to enhance liquidity and broaden Nvidia’s investor base.

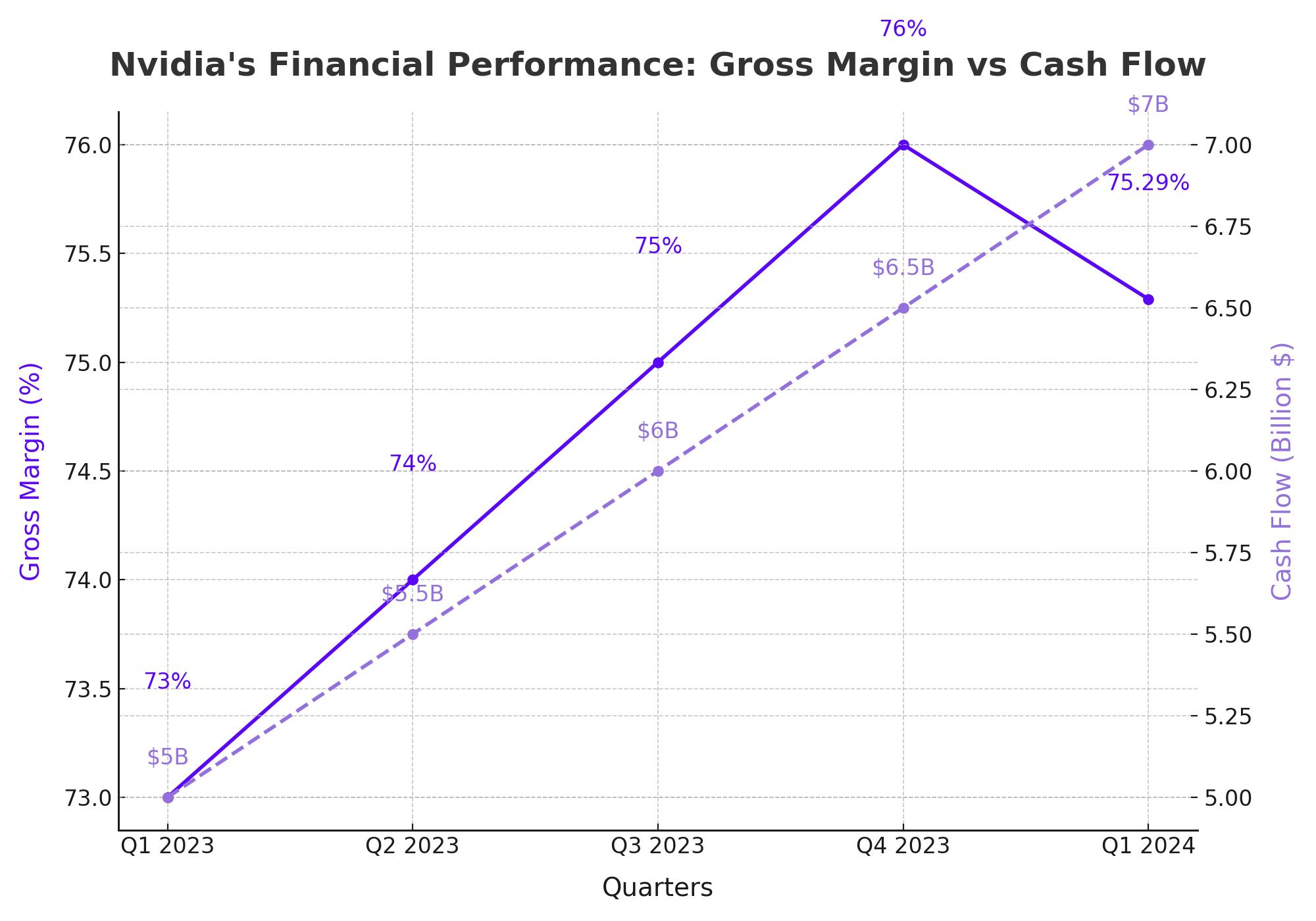

Impressive Financial Performance

Nvidia's financial performance has been nothing short of spectacular. In Q1 FY2025, the company reported revenues of $26 billion, a 262% year-over-year increase, and a non-GAAP net income of $15.2 billion, up 462%. This explosive growth underscores Nvidia’s strong position in the AI market and its ability to capitalize on the increasing demand for AI chips.

Competitor Landscape and Market Position

Competition with AMD and Intel

While Nvidia remains the leader in the AI chip market, it faces competition from AMD and Intel. AMD’s data center revenue in Q1 FY2025 was $2.34 billion, an 80% increase from the previous year, but still significantly behind Nvidia. Intel and other tech giants are also vying for a share of the AI market, emphasizing the competitive landscape Nvidia operates within.

Partnerships and Strategic Alliances

Nvidia’s strategic partnerships with tech giants like Microsoft, Google, and Meta further solidify its market position. These collaborations are crucial as these companies invest billions in AI technologies, relying heavily on Nvidia’s advanced chips.

Innovations and Future Prospects

Introduction of New AI Chips

Nvidia continues to innovate with the introduction of its next-generation AI chips, Rubin, following the recent launch of the Blackwell model. CEO Jensen Huang’s announcement of these new chips at the COMPUTEX conference underscores Nvidia’s commitment to staying at the forefront of AI technology. The rapid progression from Blackwell to Rubin highlights the intense competition in the AI chip market and Nvidia's aggressive development strategy.

Future Growth and Market Projections

Looking ahead, Nvidia's growth prospects remain strong. The company is expected to continue benefiting from the increasing demand for AI hardware, software, and services, projected to grow at a compound annual growth rate (CAGR) of 36.6% through 2030. Analysts anticipate Nvidia to grow its earnings per share (EPS) at an annual rate of 38% over the next three to five years.

Insider Transactions and Market Sentiment

Insider Transactions and Market Analysis

Nvidia's insider transactions, accessible through detailed financial platforms, provide valuable insights into the company's internal expectations and confidence in its strategic decisions. Monitoring these transactions can offer indications of Nvidia's financial health and executive confidence, particularly in light of recent market movements.

Investor Sentiment and Stock Performance

Investor sentiment towards Nvidia remains highly positive, as evidenced by the stock’s impressive performance. Despite some concerns about an unsustainable bubble, Nvidia’s strong financial results and continuous innovation in AI technology support a bullish outlook. The stock’s recent movements, including the significant rise in short positions, reflect the market’s keen interest and varied expectations.

Conclusion: Nvidia's Strategic Dominance in AI

Nvidia’s comprehensive strategy, marked by its impressive financial performance, strategic partnerships, and continuous innovation, positions the company as a dominant force in the AI market. The upcoming stock split and the introduction of new AI chips are poised to drive further growth. With a market cap surpassing $3 trillion, Nvidia's focus on AI and data center technologies ensures it remains at the forefront of the tech industry. Investors should consider Nvidia a strong buy, given its robust growth prospects and strategic positioning in the rapidly evolving AI landscape.

For real-time updates and insider transactions, visit Nvidia Stock Profile and Nvidia Real-Time Chart.

That's TradingNEWS

Read More

-

Google Stock Price Forecast - AI Capex Shock, Cloud Breakout and What $313 Really Prices In

12.02.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast: XRP-USD Stuck Between $1.34 Support And $1.50 Ceiling

12.02.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: WTI Around $63 And Brent $68 Trapped Between Oversupply And Gulf Risk

12.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Jones Holds 50,000 While S&P 500 Steadies and Nasdaq Sinks on Cisco & AppLovin Rout, CPI Looms

12.02.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - GBPUSD=X Stalls Around 1.3630 as Weak UK GDP Meets Robust US Jobs Data

12.02.2026 · TradingNEWS ArchiveForex