NASDAQ:RRR Red Rock Market Expectations - Strong Financial Performance

A comprehensive analysis of Red Rock Resorts reveals impressive earnings, efficient cost management, and strategic growth avenues, solidifying its position in the competitive gaming and hospitality industry | That's TradingNEWS

Analyzing Red Rock Resorts: A Financial Deep Dive into NASDAQ:RRR

Financial Performance and Market Dynamics

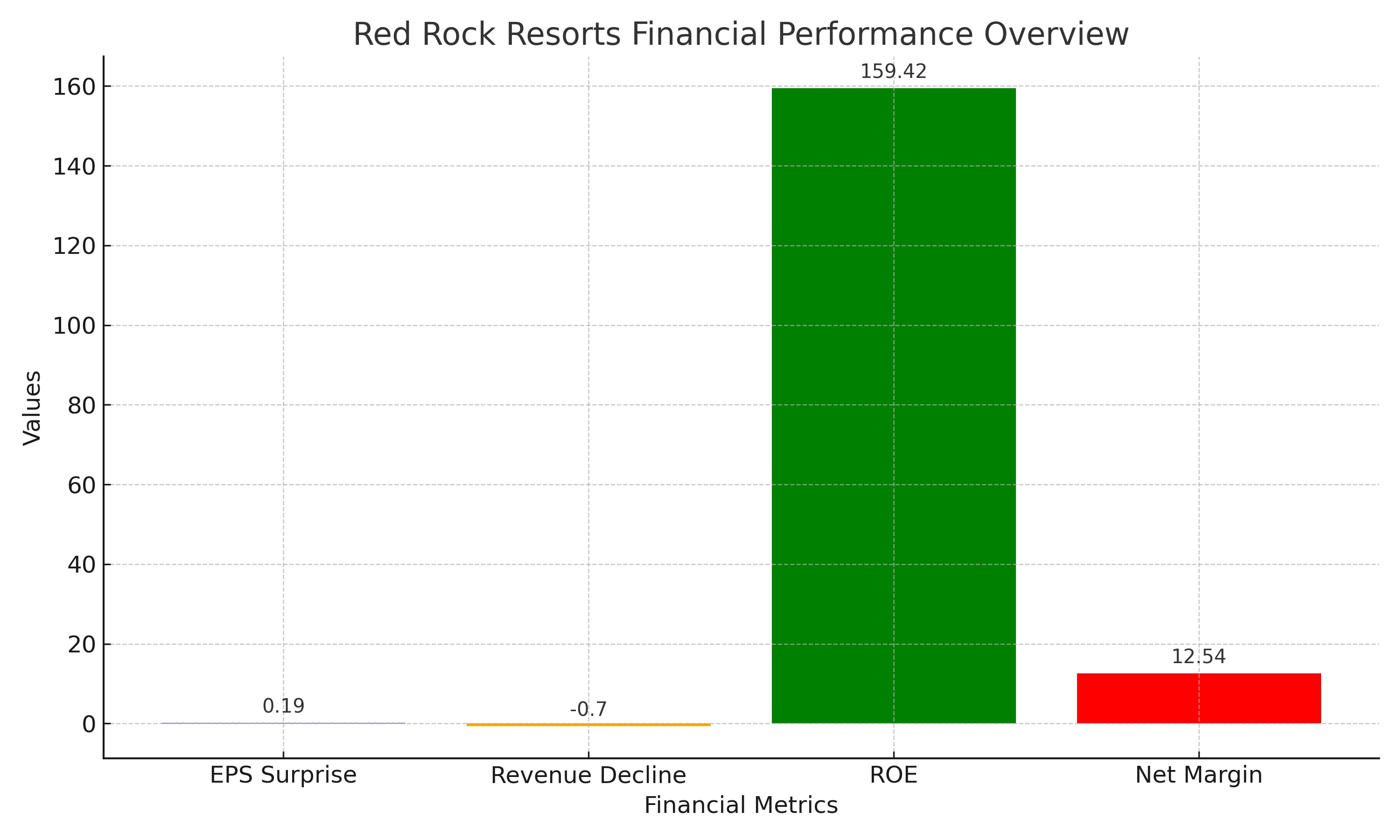

Red Rock Resorts has demonstrated a robust financial performance in its recent quarterly earnings, reporting a significant earnings per share (EPS) of $0.60, surpassing the anticipated $0.41 by a notable margin. This performance is a testament to the company's operational efficiency and strategic positioning in the market. Despite a slight revenue decline of 0.7% year-over-year, the company's ability to exceed earnings expectations speaks volumes about its financial health and management's adeptness in navigating market challenges.

The company's return on equity (ROE) stands at an impressive 159.42%, highlighting its capability in generating profits from its equity investments. The net margin of 12.54% further underscores Red Rock Resorts' profitability, showcasing its success in maintaining cost efficiency while maximizing revenue generation.

For more detailed stock analysis and real-time charting, visit Red Rock Resorts on Trading News.

Stock Valuation and Investor Sentiment

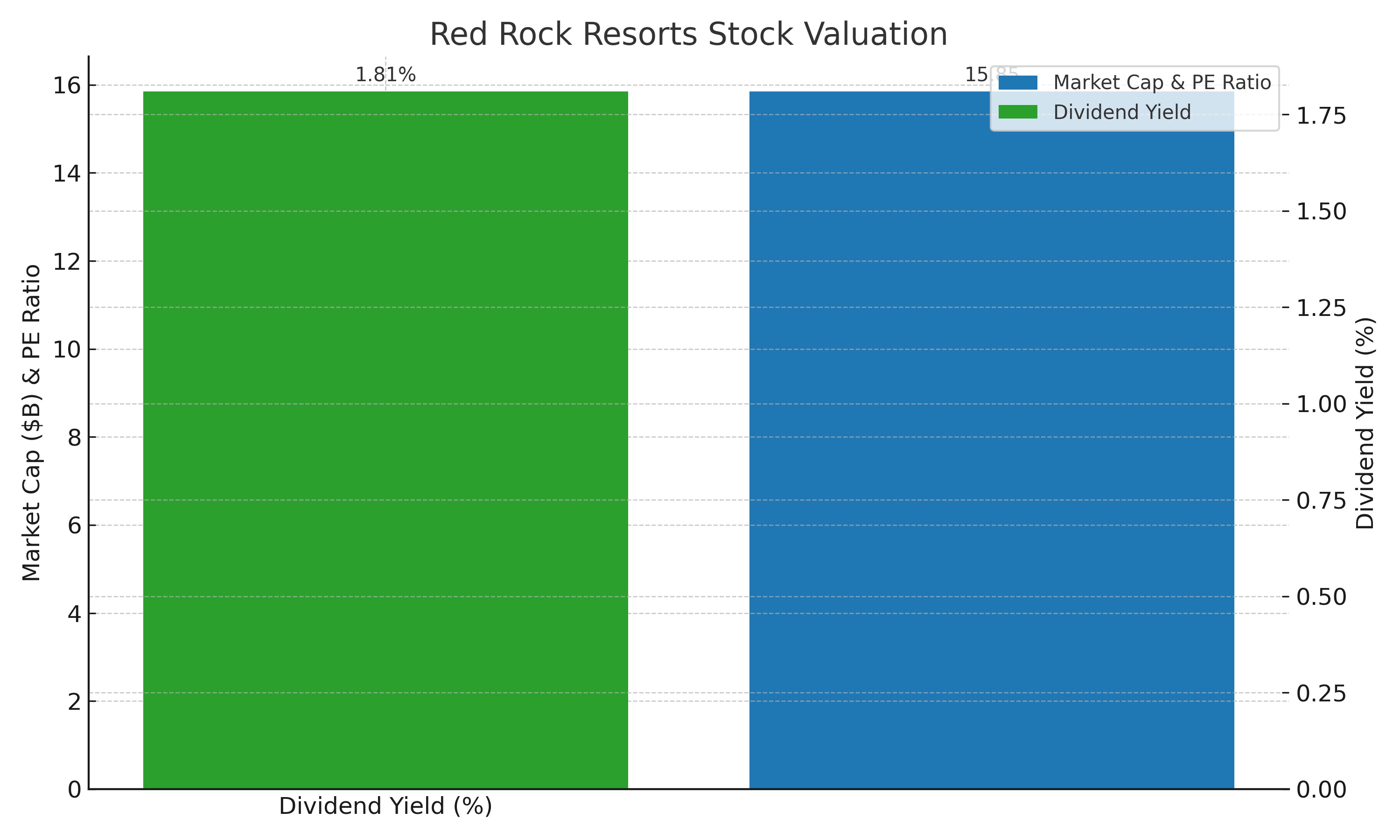

With a current opening price of $55.31, NASDAQ:RRR has seen a significant price movement within a year, touching a low of $37.82 and peaking at $55.81. This volatility reflects the dynamic nature of the market and investor sentiment towards the gaming and hospitality sector. The company's market capitalization of $5.77 billion, coupled with a PE ratio of 15.85, positions it as a considerable player in the industry, reflecting both its market value and investor expectations for future earnings growth.

The dividend announcement of $0.25 per share, translating to a 1.81% yield, indicates Red Rock Resorts' commitment to shareholder returns, further bolstering investor confidence in the company's financial stability and growth prospects.

Analyst Perspectives and Future Outlook

The consensus among analysts suggests a positive outlook for Red Rock Resorts, with several firms setting price targets ranging from $53.00 to $62.00. This optimistic view is supported by the company's consistent performance, strategic market positioning, and potential for future growth. The stock's "Moderate Buy" rating, based on analyst recommendations, underscores its attractiveness to both institutional and retail investors.

Institutional interest in NASDAQ:RRR remains strong, with notable holdings by major firms like Price T Rowe Associates Inc. MD and Goldman Sachs Group Inc. This institutional backing not only provides a solid foundation for the stock but also reflects the broader market's confidence in the company's future trajectory.

For insights on insider transactions and detailed stock profile, check Red Rock Resorts Insider Transactions and Stock Profile.

Intrinsic Value and Investment Potential

Employing a Discounted Cash Flow (DCF) analysis reveals Red Rock Resorts' intrinsic value, indicating potential undervaluation at the current share price. With a calculated equity value significantly higher than its current market price, RRR presents itself as an attractive investment opportunity for those looking for value in the gaming and hospitality sector.

The company's strong financial fundamentals, combined with a positive growth outlook and strategic operational efficiencies, position Red Rock Resorts as a compelling choice for investors seeking growth and stability in their portfolios.

Conclusion

Red Rock Resorts stands out as a robust entity within the gaming and hospitality industry, marked by its impressive financial performance, strategic market positioning, and potential for future growth. The company's ability to surpass earnings expectations, coupled with a solid dividend payout and positive analyst outlook, underscores its appeal to both institutional and retail investors. As the company continues to navigate the dynamic market landscape, its strategic initiatives and operational efficiencies are expected to drive further growth, making NASDAQ:RRR a noteworthy contender for investors seeking value and growth.

Read More

-

Google Stock Price Forecast - AI Capex Shock, Cloud Breakout and What $313 Really Prices In

12.02.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast: XRP-USD Stuck Between $1.34 Support And $1.50 Ceiling

12.02.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: WTI Around $63 And Brent $68 Trapped Between Oversupply And Gulf Risk

12.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Jones Holds 50,000 While S&P 500 Steadies and Nasdaq Sinks on Cisco & AppLovin Rout, CPI Looms

12.02.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - GBPUSD=X Stalls Around 1.3630 as Weak UK GDP Meets Robust US Jobs Data

12.02.2026 · TradingNEWS ArchiveForex