Navigating the Turbulence: A Deep Dive into Global Oil Dynamics Amid Geopolitical Strife

The Immediate Impact of Geopolitical Events on Oil Prices

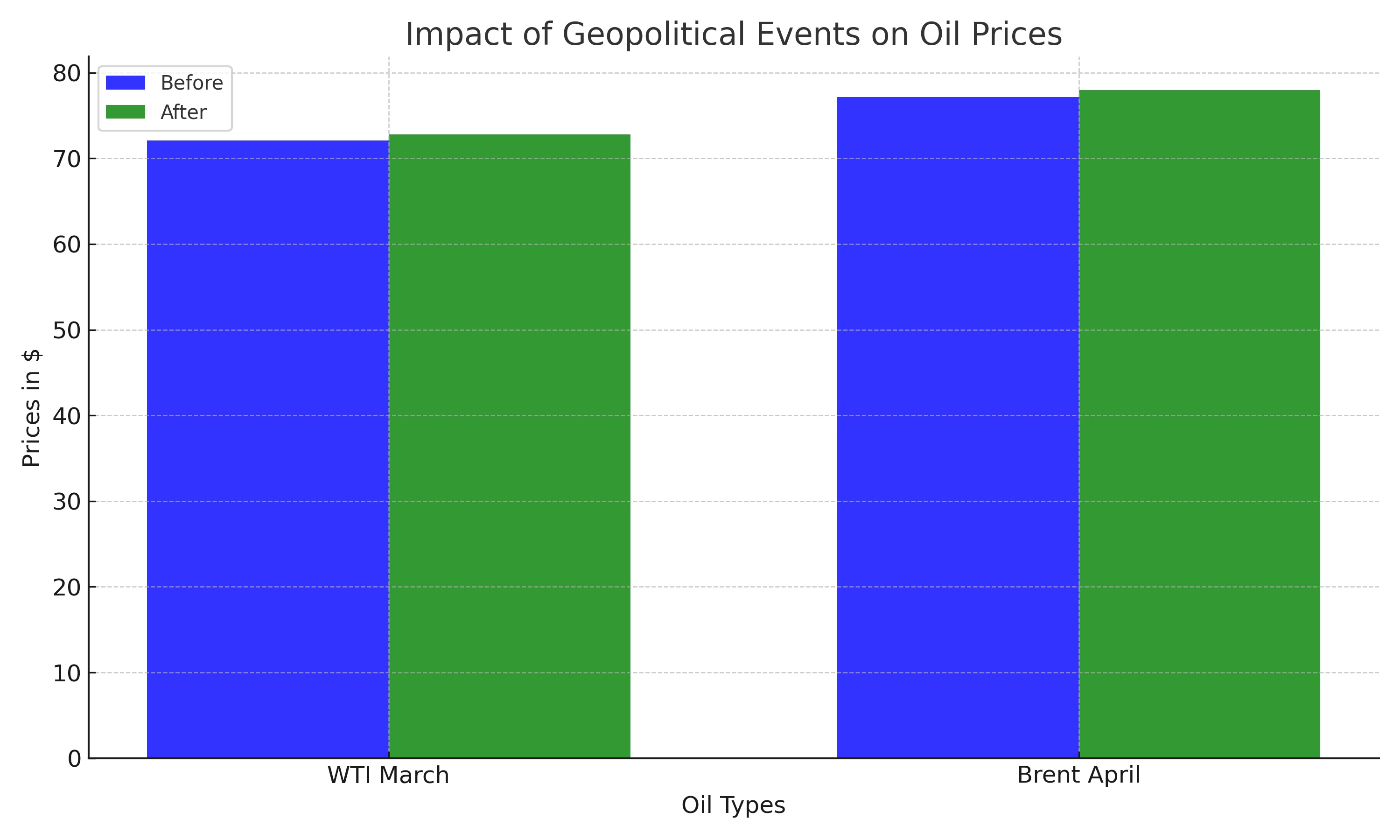

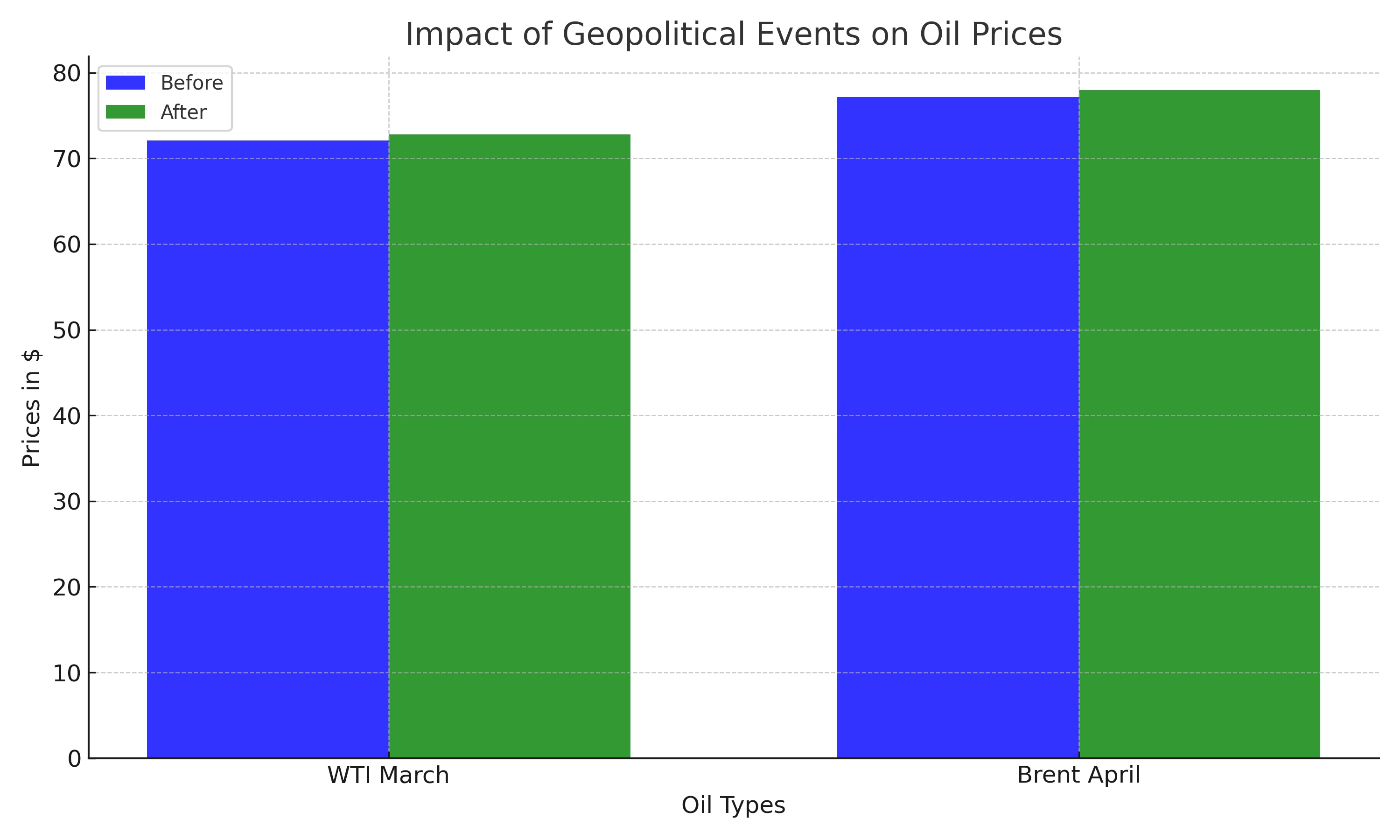

In the wake of recent US retaliatory strikes in the Middle East, global oil prices experienced notable fluctuations. The West Texas Intermediate (WTI) for March witnessed a 0.69% increase, closing at $72.78 a barrel, while Brent crude for April rose by 0.85% to settle at $77.99 a barrel. These movements underscore the sensitivity of oil markets to geopolitical tensions, particularly in regions critical to oil supply chains.

Analyzing Market Reactions and Strategic Movements

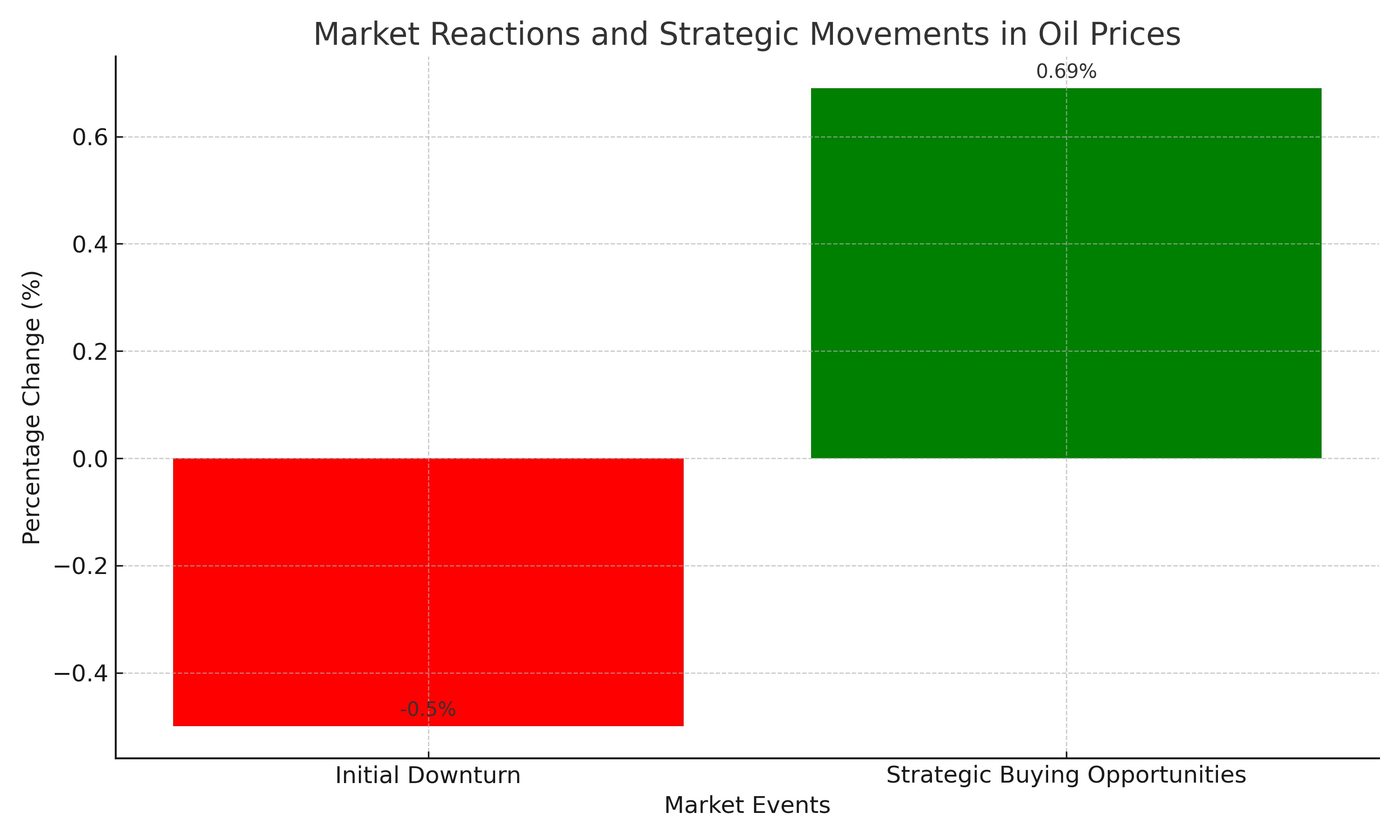

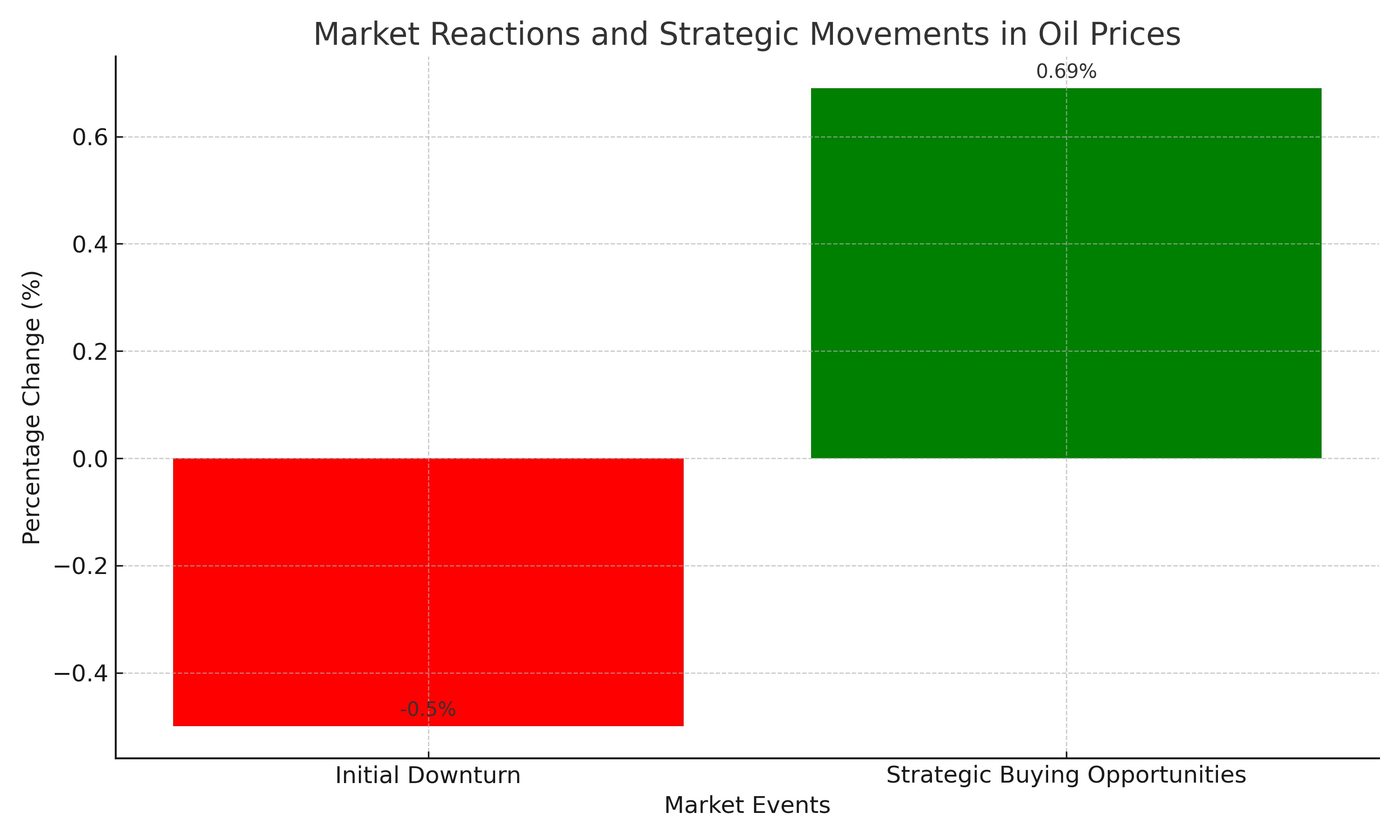

The initial downturn in oil prices during the early trading session was quickly reversed, highlighting strategic buying opportunities seized by investors, as noted by Velandera Energy Partners. This pivot reflects a broader market consensus that geopolitical escalations in oil-rich regions invariably tighten supply outlooks, thereby buoying prices.

US and Global Powers' Military Actions: Escalating Tensions

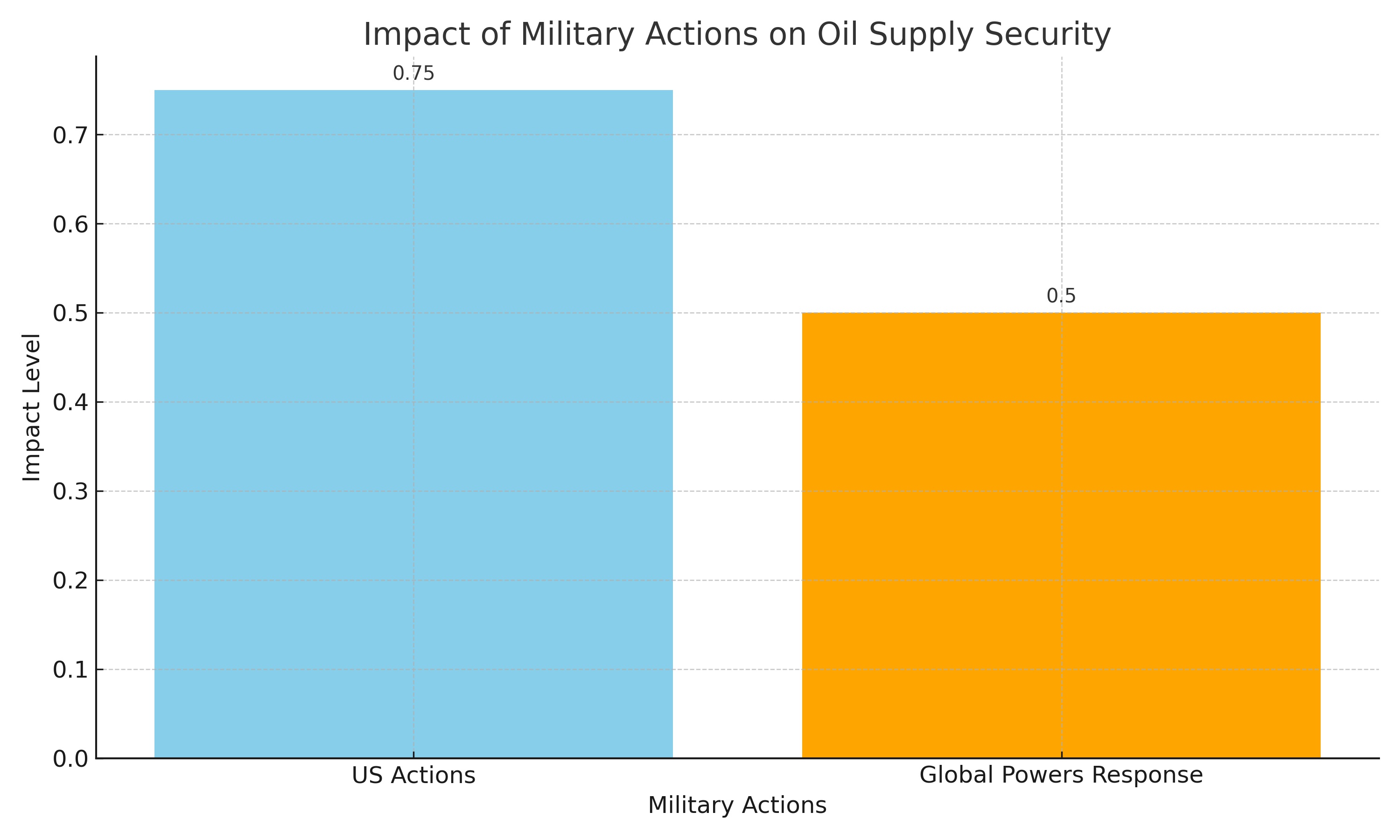

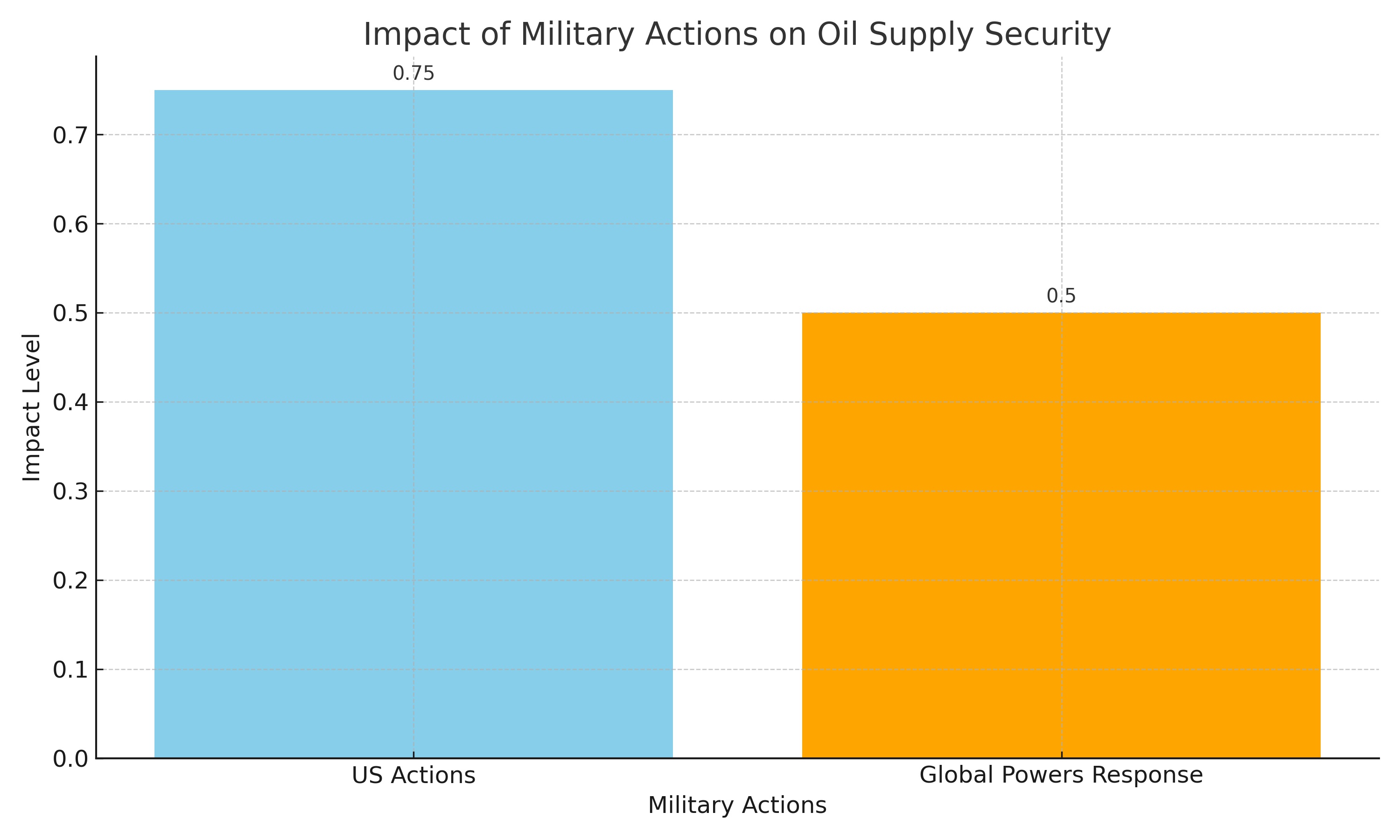

The US's strategic military responses in Iraq, Syria, and Yemen, targeting Iran's Islamic Revolutionary Guard Corps and Houthi militants, have escalated regional tensions. Such actions, while aiming to curb immediate threats, risk broader conflicts that could severely disrupt oil supplies, particularly through critical chokepoints like the Strait of Hormuz.

Diplomatic Efforts Amid Rising Tensions

US Secretary of State Antony Blinken's Middle East tour, aimed at negotiating a humanitarian pause in Gaza, represents a crucial diplomatic endeavor amidst escalating conflict. The outcomes of these diplomatic efforts could significantly influence regional stability and, by extension, global oil markets.

The Strategic Significance of the Guyana-Venezuela Dispute

The US's increased military support to Guyana amidst its territorial dispute with Venezuela underscores the geopolitical significance of oil-rich regions. Such international interventions highlight the intricate nexus between regional disputes and global energy security concerns.

The Federal Reserve's Stance and Its Implications for Oil Markets

Federal Reserve Chairman Jerome Powell's cautious stance on interest rate cuts, following a robust US job report, has strengthened the dollar, consequently exerting downward pressure on oil prices. This dynamic illustrates the intricate interplay between monetary policy, currency markets, and commodity prices.

Supply Dynamics and Forecasted Shortages

Amidst these geopolitical and economic developments, industry leaders, including Occidental CEO, forecast a supply shortage by the end of 2025. This projection, coupled with Chevron and Exxon's financial performances, indicates a complex future for oil markets, balancing between supply constraints and demand recovery post-pandemic.

The UAE's Strategic Oil Production Goals

The UAE's ambitious plans to increase its oil production capacity to 5 million barrels per day by 2027 highlight a strategic shift in OPEC+ dynamics. This move not only aims to secure the UAE's position as a leading oil producer but also reflects broader efforts within OPEC+ to manage supply in a fluctuating global market.

The Broader Economic Context: Saudi Arabia's Economic Contraction

Saudi Arabia's economic contraction, with a -0.9% GDP growth in 2023, amidst capped oil prices and global geopolitical turmoil, underscores the challenges faced by oil-dependent economies. The kingdom's efforts to diversify its economy and boost non-oil sectors highlight a strategic pivot in response to evolving global energy markets.

Conclusion: A Precarious Balance

The global oil market stands at a crossroads, with geopolitical tensions, strategic military interventions, and economic policies casting long shadows over supply and demand dynamics. As nations navigate these turbulent waters, the interplay between diplomatic endeavors, economic strategies, and military actions will continue to shape the energy landscape. The resilience of global oil markets amidst these challenges speaks to the complex interdependencies defining modern geopolitics and economics.

That's TradingNEWS