Navigating the Global Energy Market Amidst Geopolitical Tensions

Analyzing the Impact of Rising Oil Prices and Trade Disruptions on Global Energy and Economy | That's TradingNEWS

Global Energy Market Dynamics Amidst Geopolitical Tensions

Rising Oil Prices and Geopolitical Factors

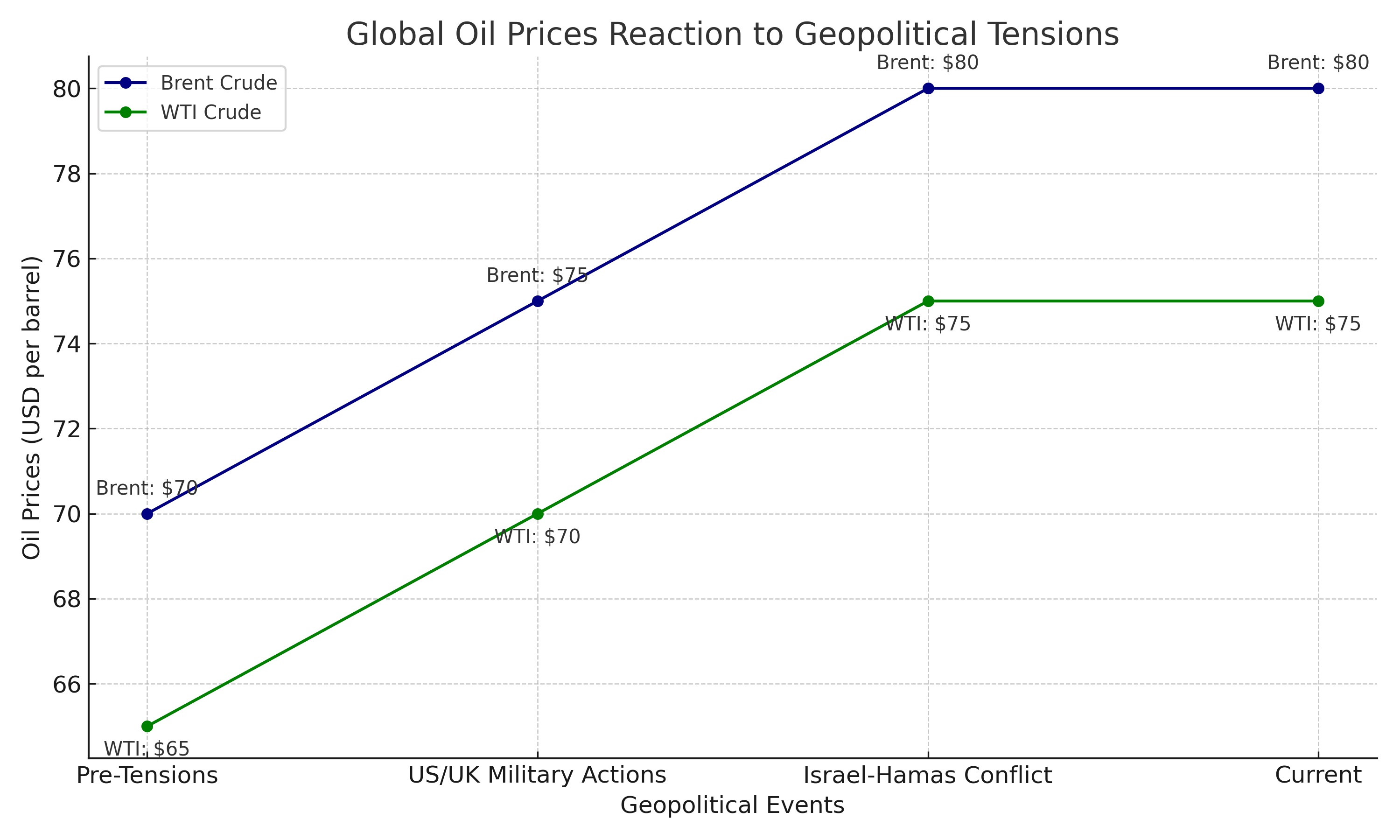

The recent upsurge in oil prices, with Brent crude hitting $80 per barrel, underscores the sensitivity of global energy markets to geopolitical events. The US and UK's military actions in Yemen, targeting Houthi rebel sites, have escalated tensions and fears, directly impacting oil prices. This development comes amidst the backdrop of the ongoing Israel-Hamas conflict, further heightening regional tensions.

Impact on Global Trade and Economy

The situation in the Red Sea, a critical global trade route, has been significantly disrupted by these geopolitical events. The diversion of shipping routes around the Cape of Good Hope adds considerable travel time and cost, affecting the global supply chain. This disruption has implications for various sectors, including manufacturing and retail, as companies like Tesla, Volvo, and Ikea report potential impacts on their operations.

Oil Market Analysis and Technical Levels

The oil market's reaction to these events is evident in the fluctuating prices of Brent and West Texas Intermediate (WTI) crude. The technical analysis of WTI shows constrained price action, with key support and resistance levels identified. The market remains watchful of further geopolitical developments that could influence future pricing and supply dynamics.

LNG Market Trends

In contrast to the oil market, Asian spot liquefied natural gas (LNG) prices have been on a downward trend, reaching seven-month lows. This is attributed to healthy storage levels in Europe and northeast Asia, despite colder weather increasing demand. The LNG market dynamics differ significantly from oil, demonstrating the complexity of global energy markets.

Economic Considerations and Inflation Risks

The surge in oil prices and disruption in shipping routes pose a risk of inflationary pressure on the global economy. Governments and central banks are closely monitoring these developments, as higher energy prices can influence inflation rates and economic growth. The situation presents a challenging scenario for policymakers, particularly in regions like the UK, where economic growth remains fragile.

Conclusion: Navigating Uncertain Waters in Energy Markets

The current geopolitical situation, particularly in the Middle East, has brought about significant volatility and uncertainty in the global energy markets. Oil prices have reacted sharply to these developments, and the disruption in key shipping routes is causing ripple effects across various industries. As the situation evolves, market participants and policymakers must remain vigilant and responsive to these dynamic market conditions.

Read More

-

GPIQ ETF Price Forecast: Can a 10% Yield at $52 Survive the Next Nasdaq Selloff?

09.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Price Forecast: XRPI at $8.32, XRPR at $11.86 as $44.95M Inflows Defy BTC and ETH Outflows

09.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Forecast: Will The $3.00 Floor Hold After The $7 Winter Spike?

09.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Back Under 50K While S&P 500 and Nasdaq Push Higher as Gold Reclaims $5,000

09.02.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast: Can Bulls Clear 157.5 Without Triggering a 160 Intervention Line?

09.02.2026 · TradingNEWS ArchiveForex