NIO NYSE:NIO Comprehensive Analysis of Growth and Innovation

Exploring NIO's Evolving Role in the EV Industry - Financial Resilience, Technological Advancements, and Global Expansion | That's TradingNEWS

NIO Inc. (NYSE:NIO) - Comprehensive Financial and Market Analysis

Introduction: Navigating NIO Inc.'s Market Fluctuations

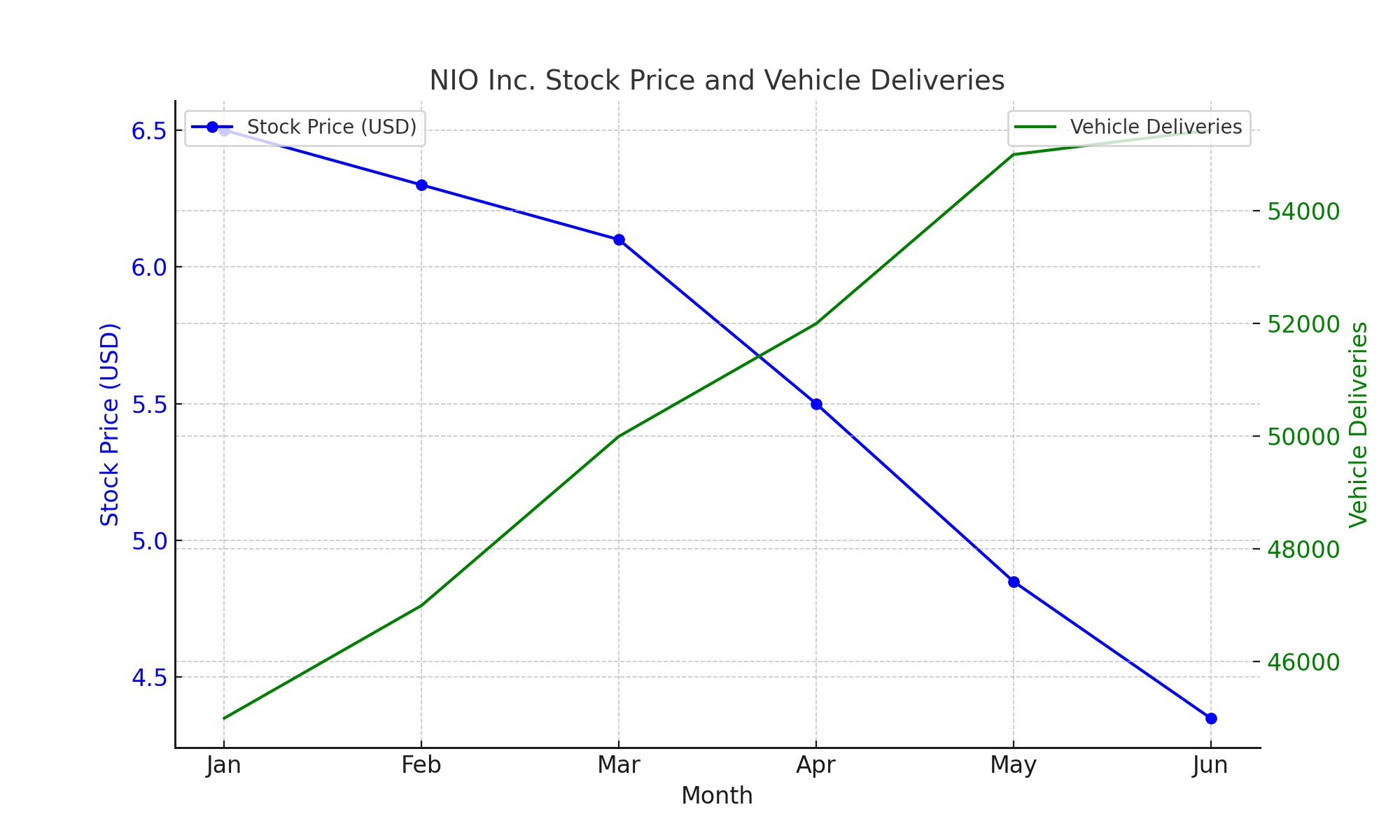

NIO Inc. (NYSE:NIO), a leader in the electric vehicle (EV) industry, has experienced significant market volatility. In 2023, the stock witnessed a pullback with additional downside risks, yet long-term bulls remain optimistic. Investors are encouraged to consider a dollar-cost averaging strategy in the support zone between $6.10 and $4.35.

NIO's Robust EV Deliveries and Market Expansion

NIO's strength lies in its impressive vehicle delivery numbers, a key driver of growth. In Q3 2023, NIO delivered 55,432 vehicles, marking a 75.4% year-over-year increase. The introduction of vehicles on the NT2 platform and expansion of self-service and power networks have been pivotal in achieving these figures. NIO's dominance in the Chinese EV market, with a market share exceeding 45% and a high average construction price, further cements its leadership position.

Financial Performance and Margin Improvements

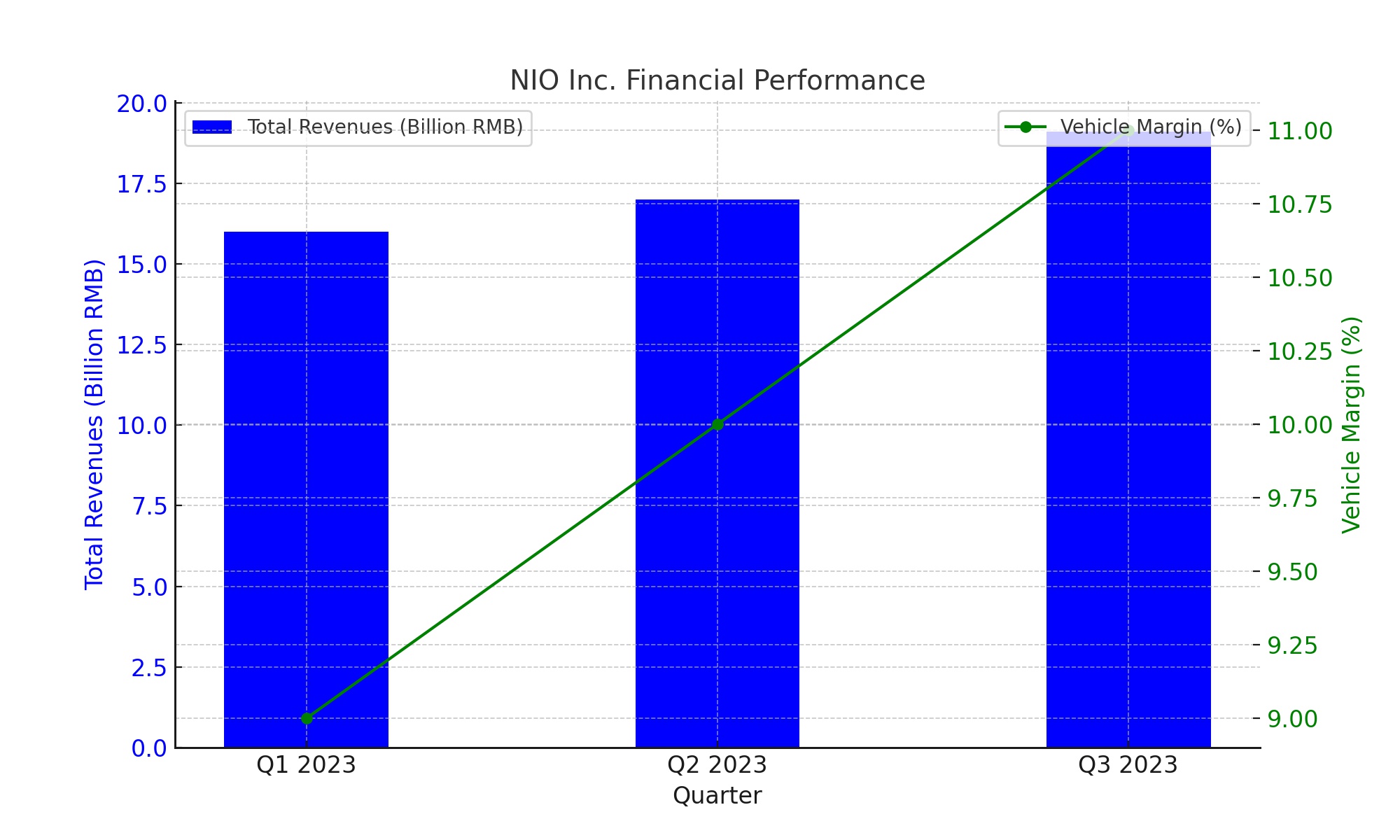

NIO's financial health is reflected in its substantial revenue growth. Q3 2023 saw total revenues of RMB 19.1 billion, a 46.6% increase year-over-year. Vehicle sales contributed significantly to this, amounting to RMB 17.4 billion. Notably, NIO's vehicle margin improved to 11% in Q3 2023, a promising sign amidst the competitive EV landscape.

Strategic Focus: Product Mix and Pricing Stability

NIO's strategic approach, including maintaining stable pricing and introducing new models like the All-New EC6, impacts its vehicle margins. Although this strategy bolsters brand loyalty, it poses challenges in balancing profitability against aggressive market competition.

Technological Innovation and Infrastructure Development

NIO's commitment to innovation is evident in its R&D initiatives. The unveiling of China's first vehicle operating system, SkyOS, and the LiDAR SoC Yang Jian, positions NIO at the forefront of smart EV technology. Infrastructure expansion, including power swap stations and charging networks, strengthens NIO's market presence.

Technical Analysis: Current Trends and Future Outlook

NIO's stock is currently in a downtrend, evident in its moving averages and Fibonacci retracement analysis. While the stock may find support in the $6.10 to $4.35 range, it remains critical for risk-averse investors to monitor key technical indicators like the Relative Strength Index (RSI) and potential upside triggers.

Market Penetration and Global Expansion

NIO's strategic expansion into international markets, particularly Europe, is a significant move. This global outreach is not just about increasing sales but also about diversifying market risk. NIO's entry into the European market, known for its stringent environmental policies and high demand for EVs, presents an opportunity to capture a new customer base. The company's performance in these new markets, backed by numbers such as sales figures and market share, will be crucial indicators of its global growth potential.

Financial Resilience Amid Market Volatility

NIO's financial resilience in a volatile market is demonstrated by its revenue and sales growth. Despite the challenging market conditions, NIO has maintained a steady increase in revenues. For instance, in Q3 2023, NIO reported a 46.6% increase in total revenues year-over-year. This financial resilience, especially in a competitive and capital-intensive industry like EVs, is a testament to NIO's robust business model and operational efficiency.

Innovation and R&D Investment

NIO's commitment to innovation and R&D is evident from its continued investment in these areas. The company's R&D expenditure, though a significant portion of its revenue, is essential for long-term sustainability and competitiveness. NIO's investment in developing new models, battery technologies, and autonomous driving capabilities is critical for staying ahead in the EV race. The allocation of R&D budget and its outcome in terms of patents, new product launches, and technology advancements are quantifiable measures of NIO's innovation drive.

Insider Transactions: A Mirror to Company Health

Analyzing insider transactions provides investors with insights into the company's internal confidence. High insider selling could be a red flag, whereas insider buying often indicates optimism about the company's future. Monitoring the volume and nature of these transactions is critical for investors to gauge the company's perceived value by those who know it best.

NIO's Competitive Positioning in the EV Market

NIO's position in the highly competitive EV market is strengthened by its unique offerings and customer service initiatives. Its focus on premium EVs and customer-centric services like battery swap stations differentiates it from competitors. Comparing NIO's market share, customer retention rates, and service network expansion with competitors can provide a clearer picture of its competitive standing.

Battery Technology and Charging Infrastructure

NIO's investment in battery technology and charging infrastructure is a pivotal aspect of its business strategy. The company's approach to battery swap technology, which reduces charging time and addresses range anxiety, is innovative in the EV space. The number of battery swap stations and their usage rates are direct indicators of the success of this strategy.

Conclusion: NIO's Prospects in the EV Industry

In conclusion, NIO's journey in the EV market is marked by strategic growth, financial resilience, and continuous innovation. While the company faces challenges in terms of competition and market volatility, its robust delivery numbers, global expansion, and technological advancements position it well for future growth. Investors should consider these factors, backed by concrete financial and operational performance metrics, to make informed decisions. For ongoing updates and detailed analysis, NIO's stock profile offers valuable insights.

Read More

-

Google Stock Price Forecast - AI Capex Shock, Cloud Breakout and What $313 Really Prices In

12.02.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast: XRP-USD Stuck Between $1.34 Support And $1.50 Ceiling

12.02.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: WTI Around $63 And Brent $68 Trapped Between Oversupply And Gulf Risk

12.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Jones Holds 50,000 While S&P 500 Steadies and Nasdaq Sinks on Cisco & AppLovin Rout, CPI Looms

12.02.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - GBPUSD=X Stalls Around 1.3630 as Weak UK GDP Meets Robust US Jobs Data

12.02.2026 · TradingNEWS ArchiveForex