Record Q1 2025 Revenue for NVIDIA (NASDAQ: NVDA)

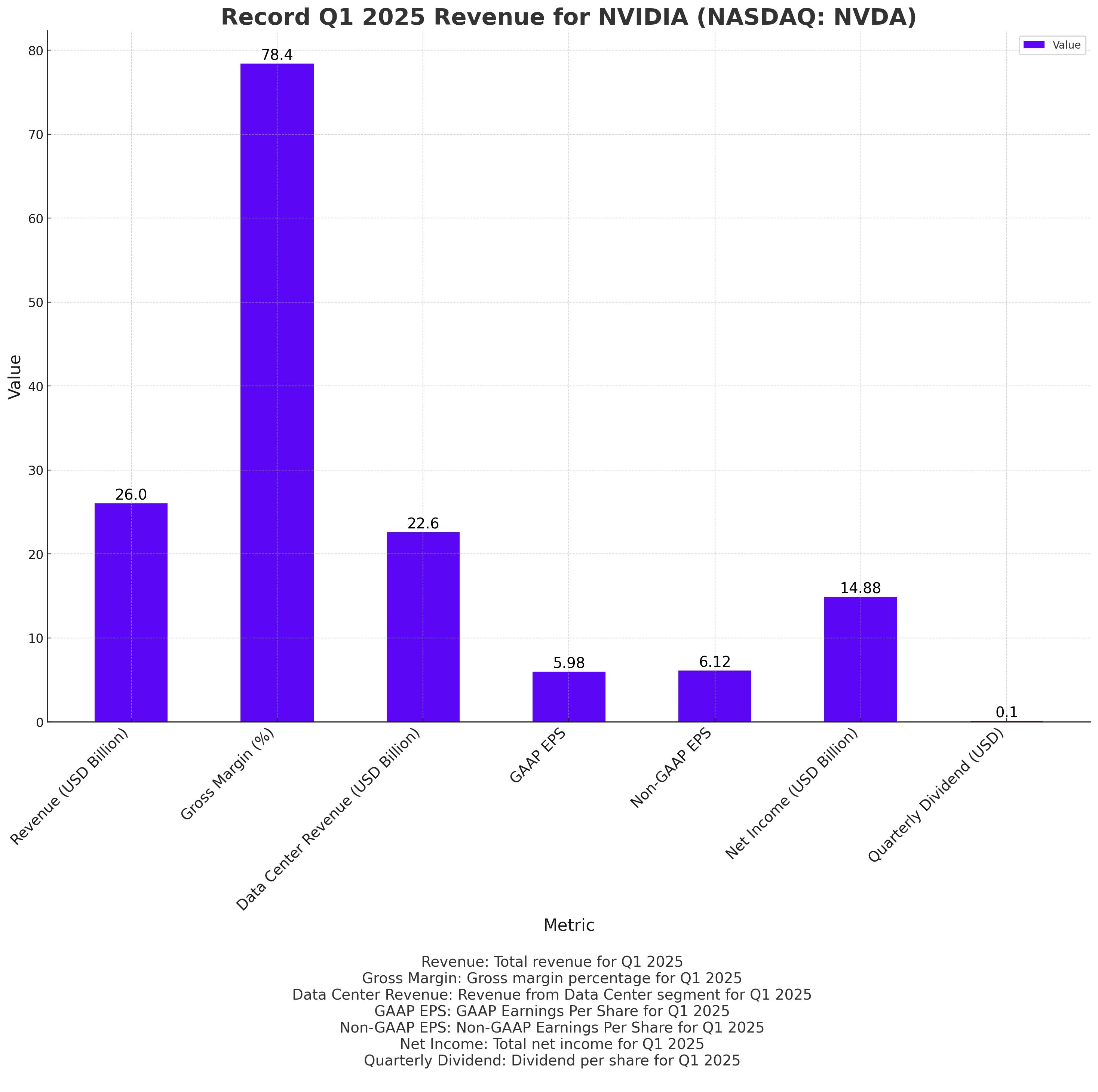

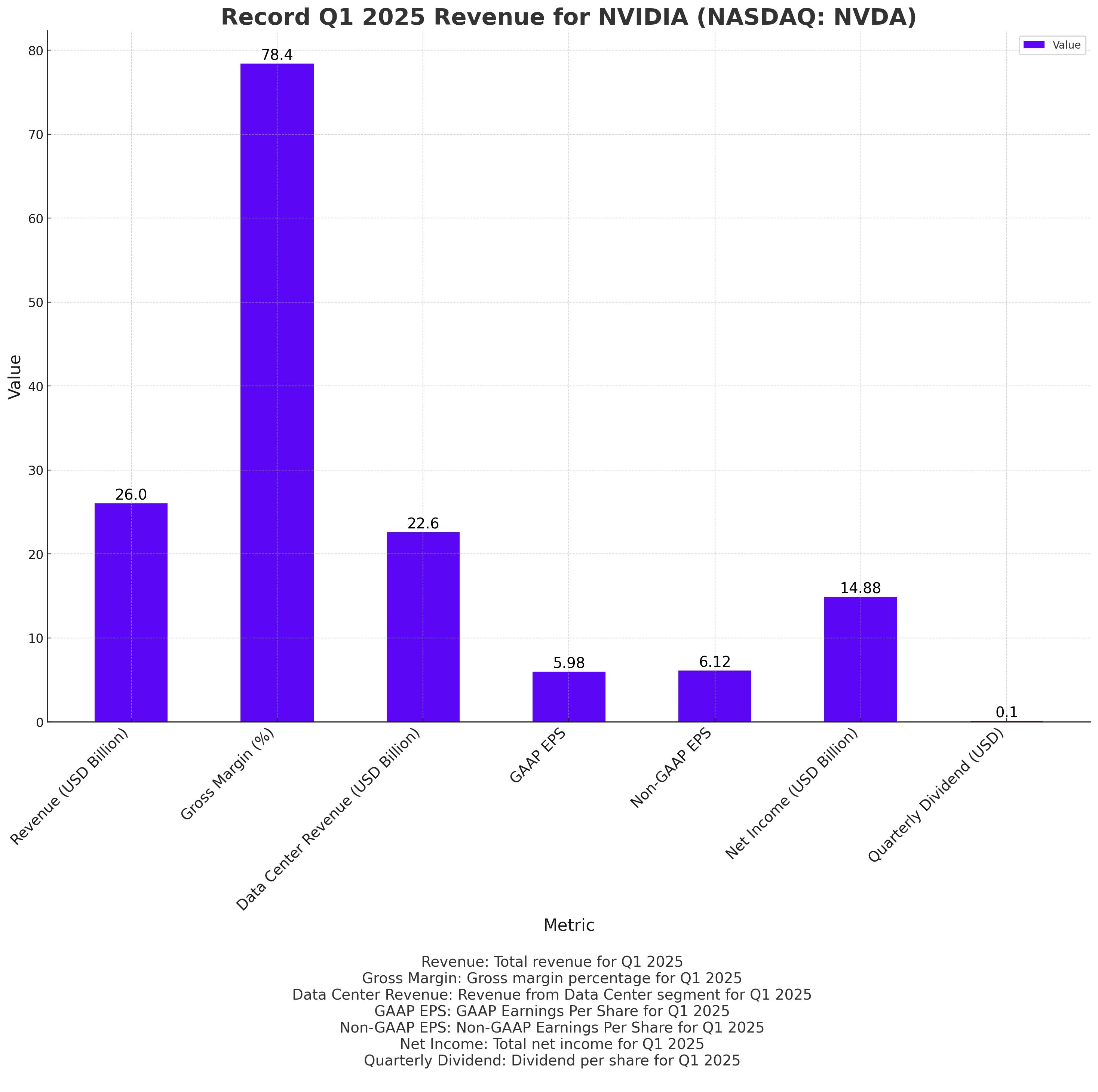

NVIDIA (NASDAQ: NVDA) reported an impressive Q1 2025 with record revenue of $26.0 billion, an 18% increase from the previous quarter and a staggering 262% rise from the same period last year. This robust financial performance underscores NVIDIA’s strong market position and effective business strategies. The company’s Gross Margin also improved to 78.4%, up from 76.0% in the previous quarter, reflecting operational efficiencies and cost management.

Exceptional Data Center Growth

The Data Center segment was a standout performer, generating $22.6 billion in revenue, a 23% increase from Q4 and an astonishing 427% growth year-over-year. This growth was driven by the escalating demand for generative AI training and inference on NVIDIA's Hopper platform. Beyond cloud service providers, NVIDIA's Data Center solutions have been adopted by consumer internet companies, enterprises, sovereign AI entities, automotive, and healthcare sectors, creating multiple multibillion-dollar vertical markets.

Stock Split and Dividend Increase

NVIDIA announced a ten-for-one forward stock split, effective June 7, 2024, making stock ownership more accessible to employees and investors. This strategic move is expected to broaden the investor base and enhance liquidity. Additionally, NVIDIA raised its quarterly cash dividend by 150%, from $0.04 per share to $0.10 per share, equivalent to $0.01 per share post-split. The increased dividend reflects the company’s strong cash flow and commitment to returning value to shareholders.

Robust Financial Metrics

NVIDIA's GAAP earnings per diluted share for Q1 FY25 were $5.98, up 21% from the previous quarter and 629% from a year ago. Non-GAAP earnings per diluted share were $6.12, representing a 19% increase from Q4 and a 461% rise year-over-year. Net income reached $14.88 billion, a 21% increase quarter-over-quarter and 628% higher than the same period last year, highlighting the company’s profitability and efficient cost management.

Future Growth Prospects

Looking ahead, NVIDIA is poised for further growth with the Blackwell platform in full production, aimed at supporting trillion-parameter-scale generative AI. The company introduced NVIDIA NIM, a new software offering delivering enterprise-grade, optimized generative AI across various platforms. With a revenue outlook of $28.0 billion for Q2 FY25, plus or minus 2%, NVIDIA expects continued strong performance, driven by innovation and expanding market opportunities.

Strategic Partnerships and Innovations

NVIDIA has expanded collaborations with AWS, Google Cloud, Microsoft, and Oracle to drive generative AI innovation. The launch of NVIDIA AI Enterprise 5.0 with NVIDIA NIM inference microservices and the introduction of NVIDIA Quantum and Spectrum™ X800 series switches for InfiniBand and Ethernet highlight NVIDIA's commitment to advancing AI infrastructure. These strategic initiatives are set to fuel the next wave of AI-driven growth.

Insider Transactions and Institutional Confidence

Significant insider and institutional ownership underscores confidence in NVIDIA's future prospects. Insiders hold 30.51% of the shares, while institutions own 66.37%, reflecting strong trust and investment from those closely associated with or analyzing the company. This substantial insider ownership aligns management’s interests with those of shareholders, ensuring decisions are made with a long-term perspective.

Conclusion

NVIDIA's record Q1 2025 performance, strategic initiatives in AI and Data Center growth, and shareholder-friendly policies such as the stock split and increased dividend make it a compelling investment. The company’s robust financial health and future growth prospects position NVIDIA as a leader in the tech industry, providing significant value to investors.

For real-time updates on NVIDIA’s stock, visit NVIDIA Real-Time Stock Chart.

For detailed insider transactions, see NVIDIA Insider Transactions.