Oil Market 2024: Trends, Forecasts, and Strategic Insights

A detailed look at the expected dynamics in the 2024 oil market, including price forecasts, OPEC's influence, and the potential impacts of geopolitical factors on global oil prices | That's TradingNEWS

12/29/2023 12:00:00 AM

In-Depth Analysis of Global Oil Market Dynamics for 2024

Global Oil Market Forecast: A Deep Dive into 2024 Projections

Market Trends and Predictions:

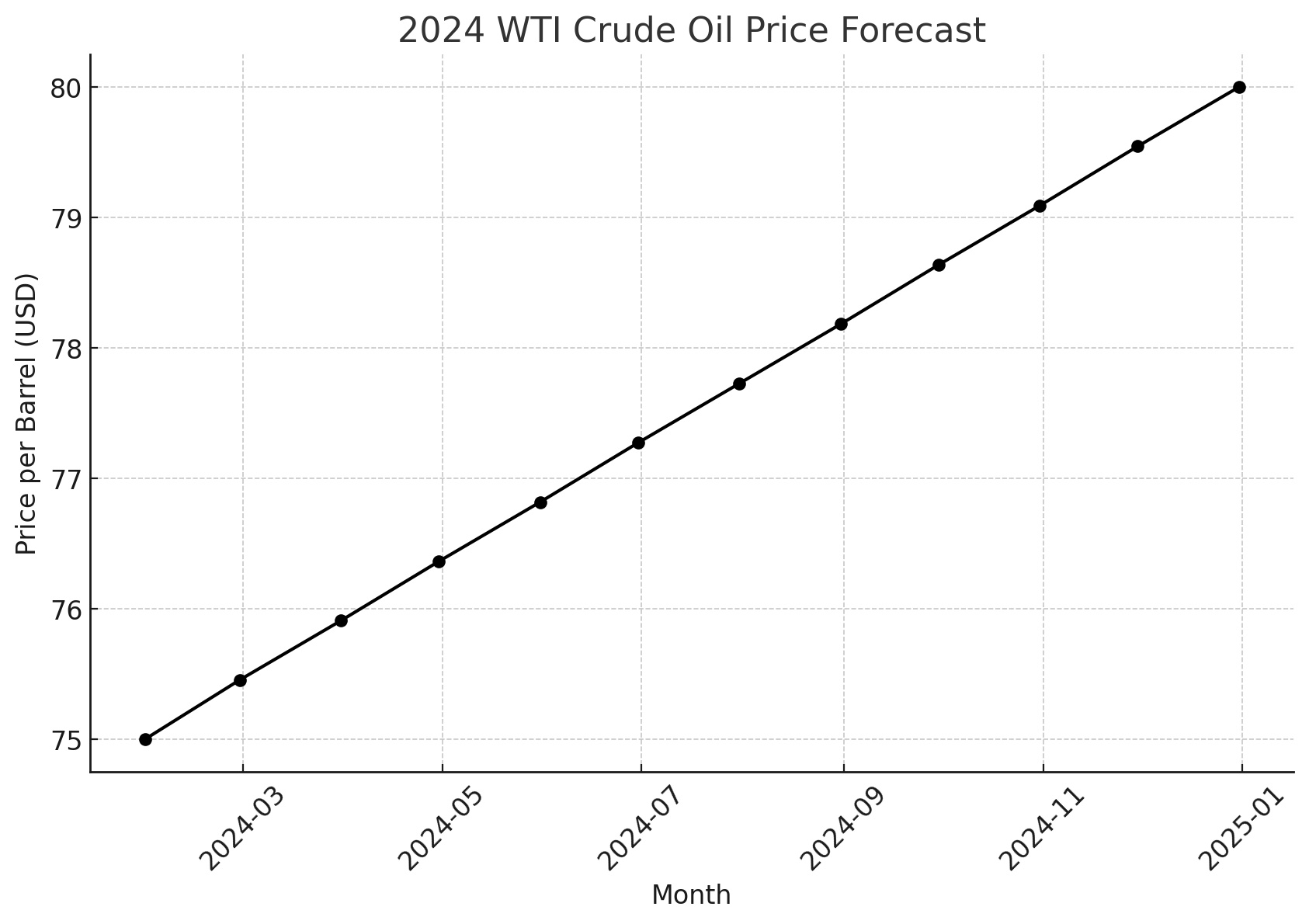

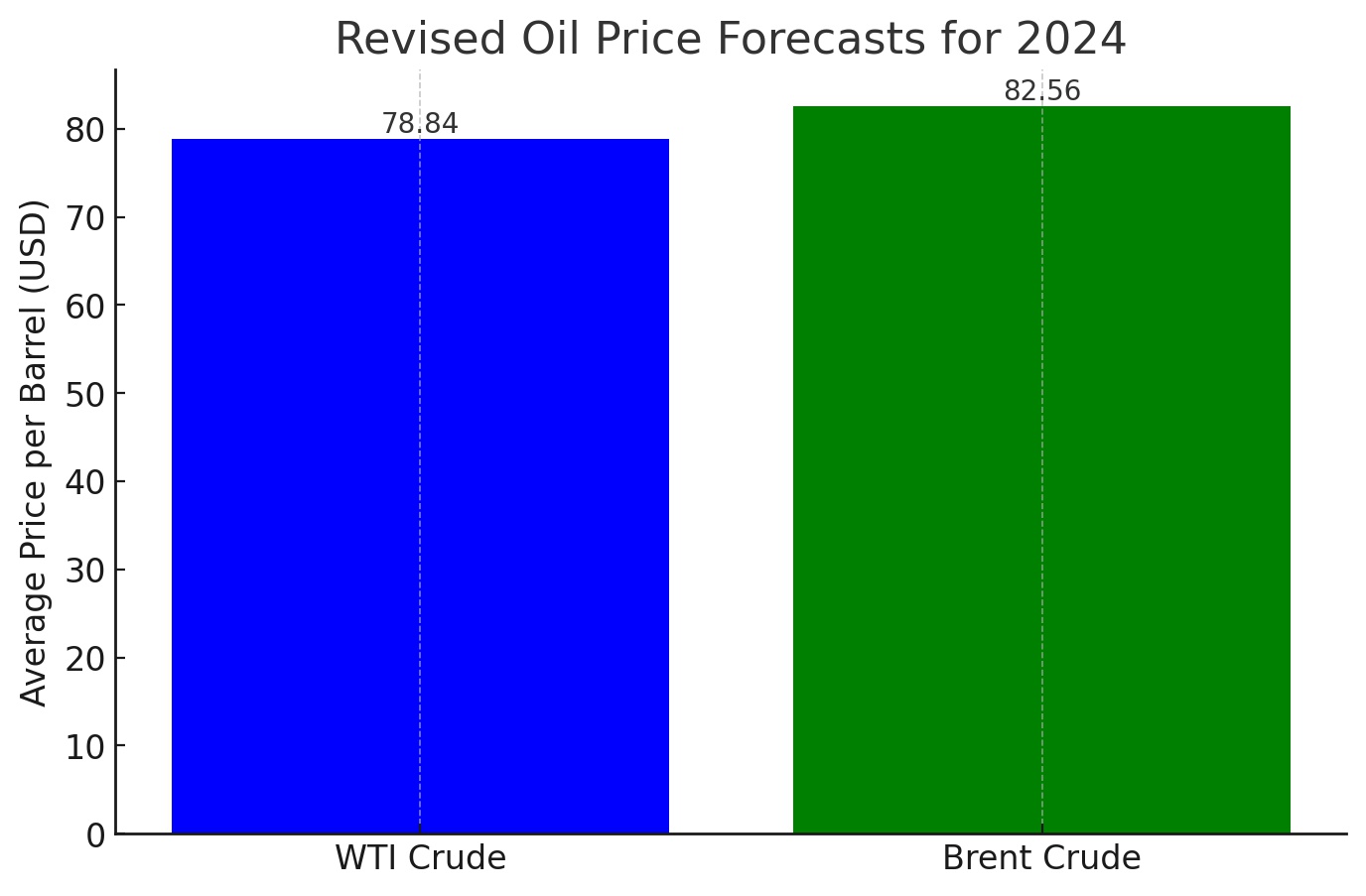

- 2024 Oil Price Forecast: Analysts project that the average U.S. benchmark oil price, specifically West Texas Intermediate (WTI) Crude, will remain below $80 per barrel in 2024. This outlook is shaped by expectations of subdued global economic growth, which is likely to impact oil demand.

- Revised Estimates: Forecasts have been adjusted downwards from previous predictions. WTI Crude is now expected to average $78.84 per barrel, while Brent Crude is forecasted at $82.56 per barrel.

- Market Influencers: Key factors shaping this forecast include global economic slowdown concerns, a boost in non-OPEC+ oil supply, and geopolitical tensions that could heighten market volatility.

Supply and Demand Dynamics:

OPEC+ Influence:

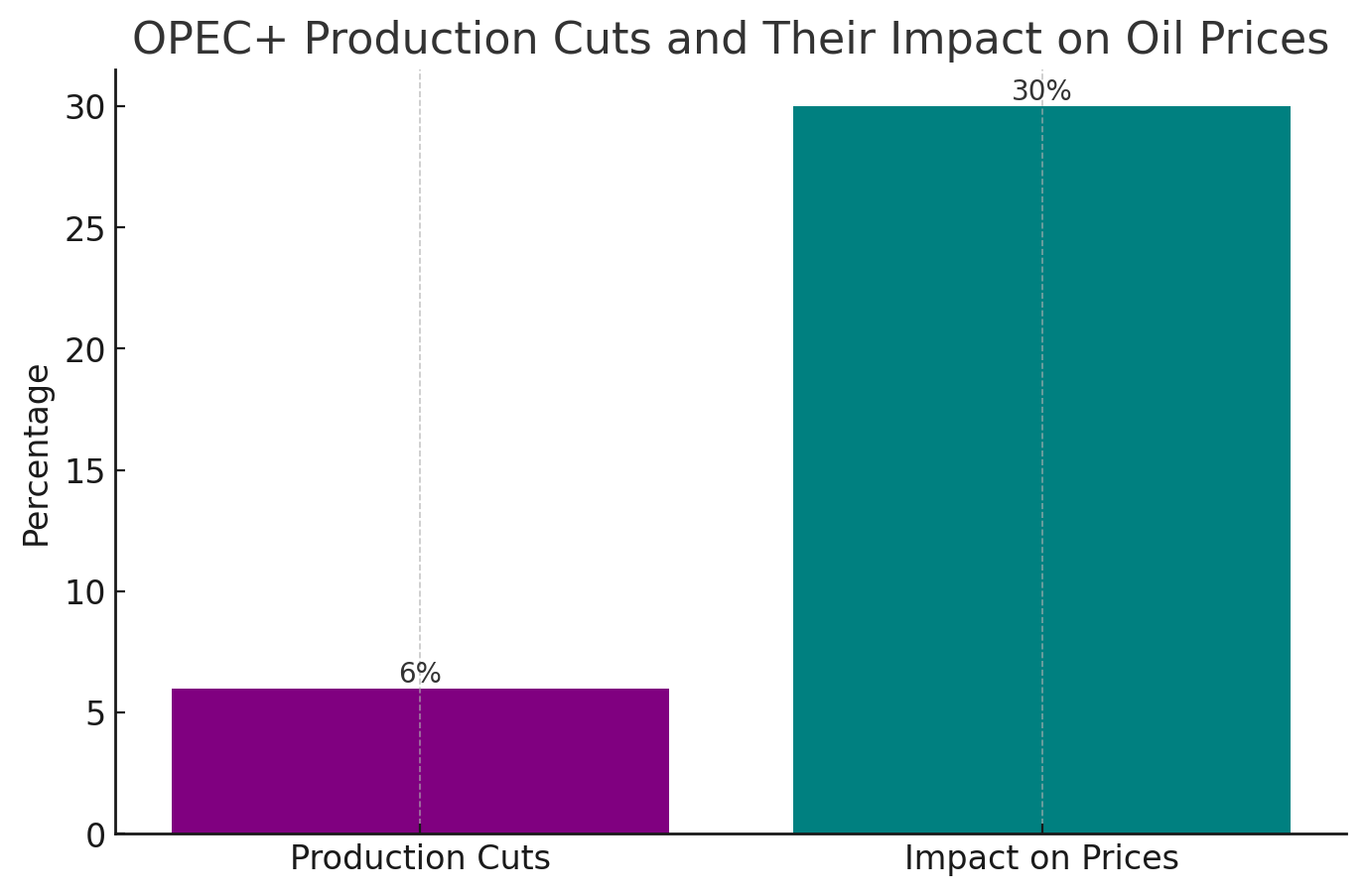

- Production Cuts: Despite OPEC+ efforts to manage oil supply through production cuts, these measures haven't sustained high oil price levels. Current cuts represent about 6% of global oil supply.

- Impact on Prices: The effectiveness of these cuts in influencing oil prices has been somewhat diluted due to other market dynamics.

U.S. Production Impact:

- Record Output: The U.S. has recorded unprecedented levels of oil production, which has played a significant role in balancing, and at times, oversupplying the market.

- Countering OPEC+ Efforts: This increased U.S. output has been a key factor in offsetting the impact of OPEC+ production cuts.

Geopolitical Factors:

- Potential Instability: Events such as Red Sea shipping disturbances and escalations in the Middle East, including the conflict between Hamas and Israel, could introduce more volatility in the oil market.

Consumer Impact:

Gasoline and Diesel Prices:

- Following Oil Trends: Prices of gasoline and diesel have been closely following the trends in crude oil prices.

- Current U.S. Pricing: The national average price for unleaded gas in the U.S. is approximately $3.12 per gallon, reflecting the broader oil market trends.

Investor Outlook:

Stability and Volatility:

- Moderate Price Stability: Despite the potential for geopolitical disruptions, analysts expect a relatively stable oil price environment, but with caution for unexpected shifts.

- Range Predictions: Prices are likely to fluctuate within a certain range, influenced by market and geopolitical factors.

OPEC Strategy:

- Crucial Decisions Ahead: OPEC's strategies in adjusting output levels will be a critical factor in maintaining market balance.

- Responding to Market Conditions: OPEC is likely to alter its production policies in response to price movements, balancing the market demands and external economic conditions.

Conclusion

The global oil market in 2024 is set to be influenced by a mix of economic, geopolitical, and production-related factors. While analysts predict a generally stable environment for oil prices, the potential for geopolitical disturbances and OPEC's strategic decisions will be key determinants in the market's direction. Investors and market participants should closely monitor these developments as they could significantly impact the oil and energy sector.

That's TradingNEWS

Read More

-

GPIQ ETF Price Forecast: Can a 10% Yield at $52 Survive the Next Nasdaq Selloff?

09.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Price Forecast: XRPI at $8.32, XRPR at $11.86 as $44.95M Inflows Defy BTC and ETH Outflows

09.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Forecast: Will The $3.00 Floor Hold After The $7 Winter Spike?

09.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Back Under 50K While S&P 500 and Nasdaq Push Higher as Gold Reclaims $5,000

09.02.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast: Can Bulls Clear 157.5 Without Triggering a 160 Intervention Line?

09.02.2026 · TradingNEWS ArchiveForex