Tesla's NASDAQ:TSLA Market Review and Strategic Insights

Unveiling Tesla's Performance, Insider Trends, and Investment Potential | That's TradingNEWS

Understanding the Volatility and Future Prospects of Tesla (NASDAQ:TSLA)

Market Performance and Valuation Concerns

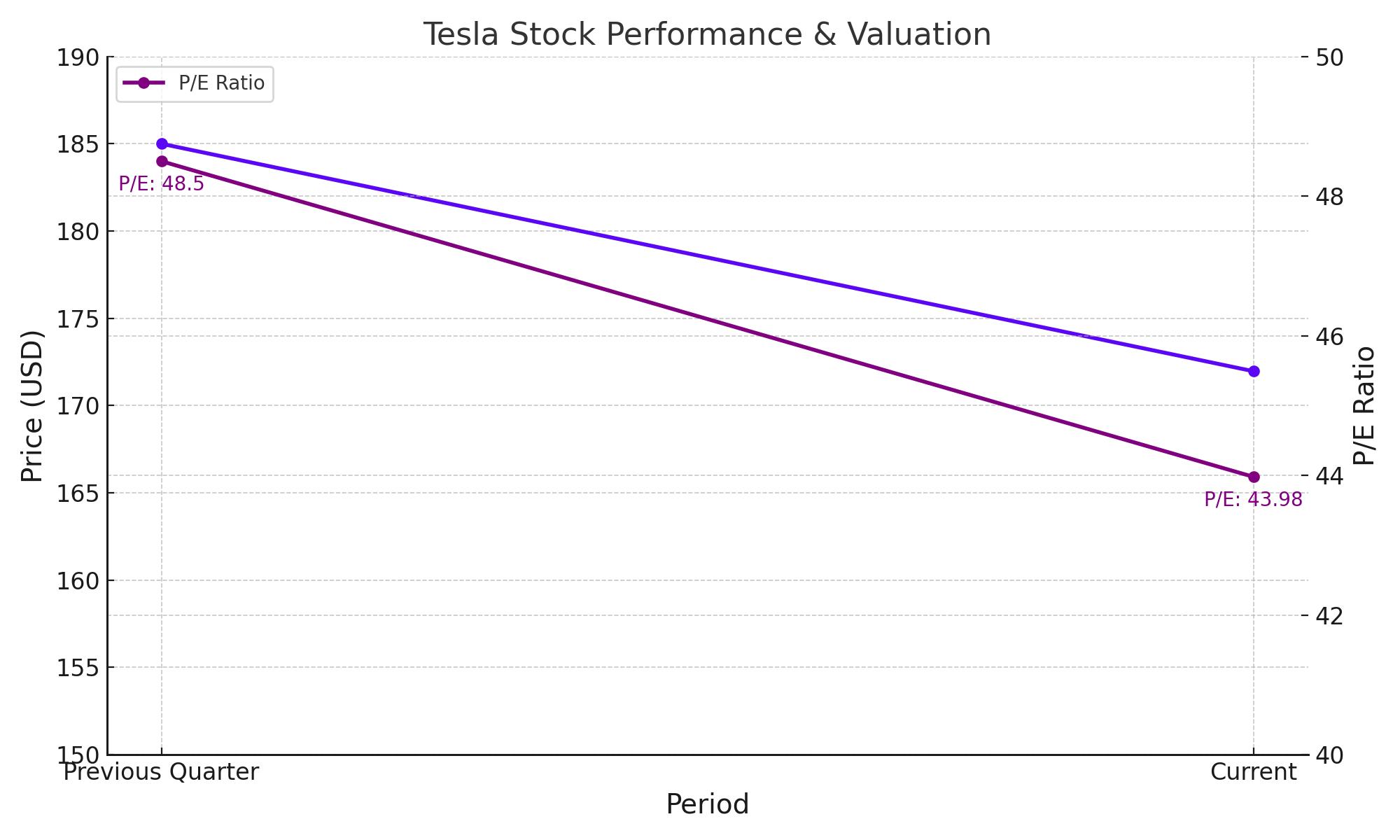

Tesla, Inc. (NASDAQ:TSLA) has been a subject of intense market scrutiny, showing significant price fluctuations. Recently, Tesla’s shares have seen a decline, trading at $171.97, marking a 1.57% decrease. This volatility is mirrored by a substantial daily trading volume, averaging about 65.457 million shares, highlighting investor responsiveness to every Tesla and industry-related news.

The company’s market cap stands robust at approximately $548.447 billion, yet the P/E ratio is notably high at 43.98, which signals that the stock might be overvalued compared to traditional automotive industry metrics. Tesla's EPS (TTM) of 3.91, juxtaposed with the fluctuations in its stock price, underscores a market fraught with high expectations and significant skepticism regarding future growth and profitability.

For detailed stock performance, you can view Tesla's real-time chart here.

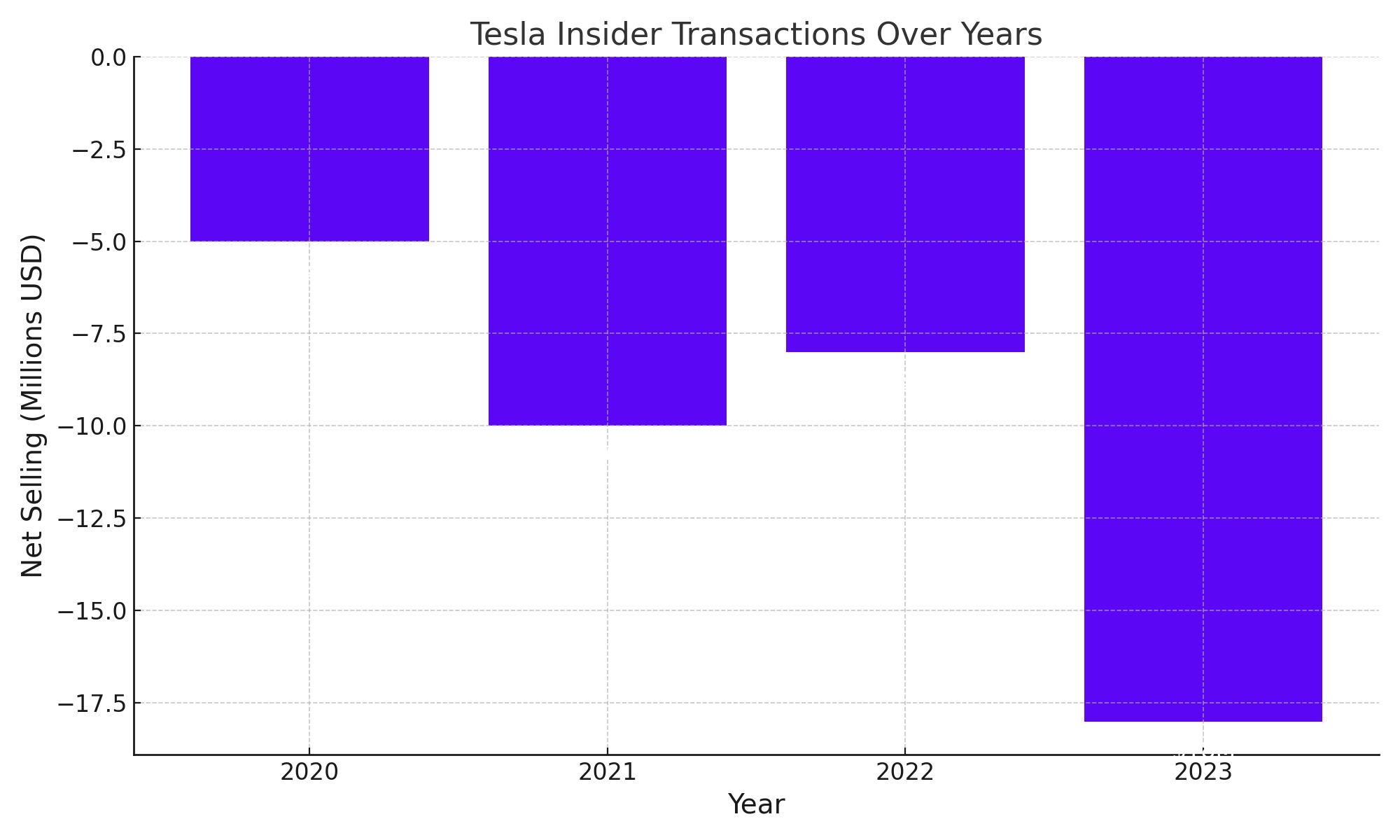

Insider Transactions: A Red Flag?

Tesla’s insider transactions have raised eyebrows, with notable selling and no purchases reported over the past three years. Such activities might reflect internal concerns about the company’s current valuation or future prospects. For instance, former executive Drew Baglino’s recent sale of $181.5 million in stock post-resignation adds to the uncertainty.

Insight into Tesla's insider transactions can be further explored here.

Leadership and Strategic Challenges

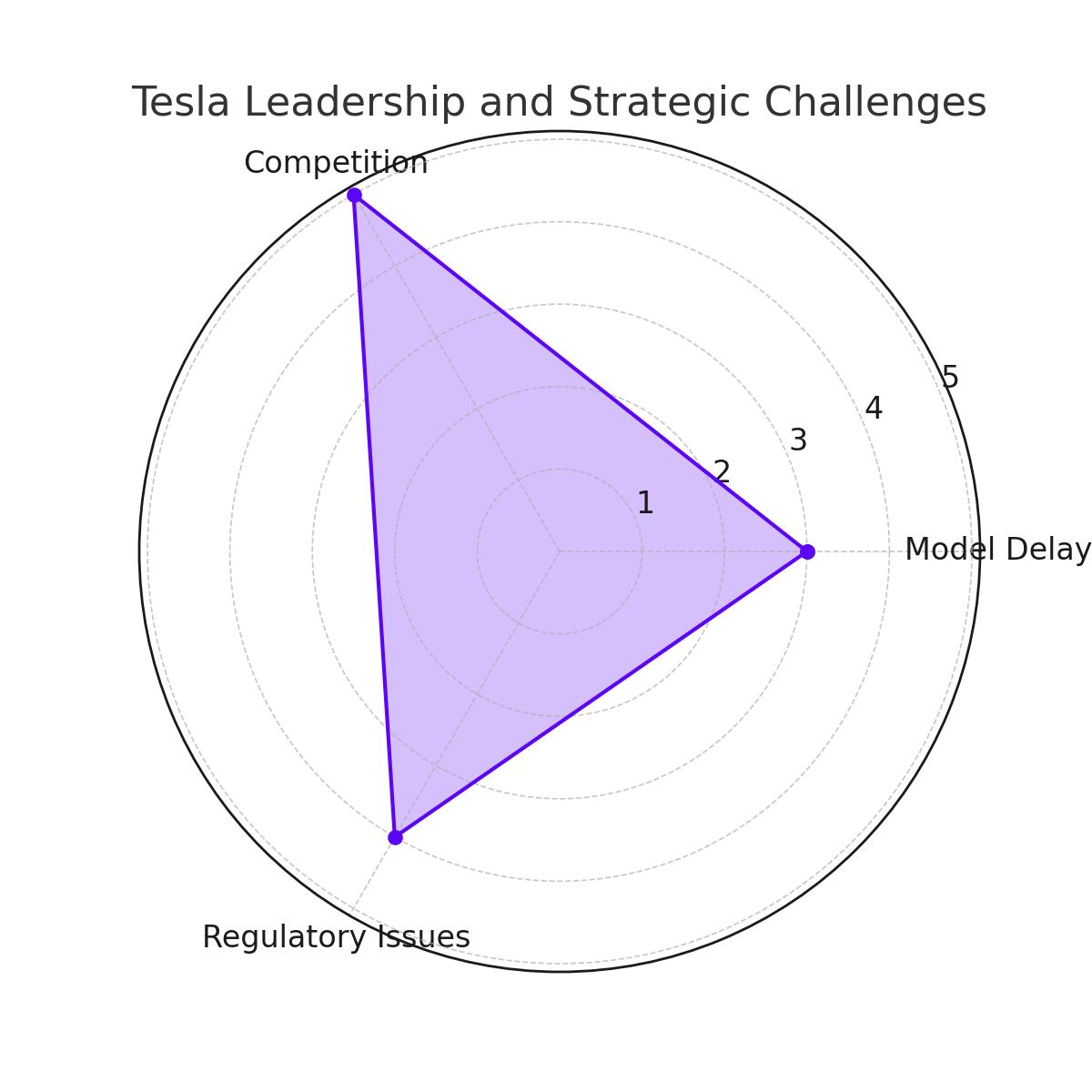

Under Elon Musk's leadership, Tesla has embarked on ambitious projects beyond its core of electric vehicles, such as AI and robotics, including the controversial Tesla Optimus robot. Musk's approach often involves significant risk-taking and has been characterized by both high-profile promises and notable delays, especially in autonomous driving technologies.

However, the stagnation in Tesla’s traditional car models, like the Model Y and Model 3, and the increasing competition from other EV manufacturers pose significant challenges to its market dominance. The automotive landscape has evolved with competitors offering new and affordable electric models, intensifying the pressure on Tesla to innovate or risk losing its competitive edge.

Regulatory Scrutiny and Legal Challenges

Tesla’s ambitious claims regarding its Autopilot and Full Self-Driving capabilities have attracted scrutiny from various regulatory bodies, including the NHTSA and the Justice Department. Recent investigations focus on whether Tesla’s marketing of these features may mislead consumers regarding the actual capabilities of the technology, thus posing safety risks. This scrutiny has resulted in recalls and legal challenges that could affect Tesla’s brand reputation and financial health.

Future Outlook: Innovations and Market Adaptation

Looking ahead, Tesla's aggressive push towards full self-driving technology and its expansion into AI and robotics represent potential growth areas. However, these are fraught with technical and regulatory challenges that could hinder rapid progress. Financially, Tesla’s significant market cap and high P/E ratio suggest that many investors still have faith in its growth potential, despite recent setbacks and increased competition.

The strategic decisions Tesla makes now, including how it addresses insider concerns, regulatory challenges, and competition, will be critical in determining its trajectory. Investors should keep a close eye on these developments, as they will significantly influence Tesla's market position and stock valuation.

For a comprehensive understanding of Tesla’s market performance and insider perspectives, you can access its stock profile here.

That's TradingNEWS

Read More

-

VYM ETF Price Near $148 High As NYSEARCA:VYM Draws $84B Into High-Dividend Value

28.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Inflows Return as XRPI, XRPR and Bitwise Track XRP-USD at $1.92 with $1.38B AUM

28.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Future Price Forecast: NG=F Retreats After $6.80 Surge

28.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - jumps to 153.6 as Fed pause, BoJ shift and gold $5,000 hit FX

28.01.2026 · TradingNEWS ArchiveForex