TradingNEWS Comprehensive iShares China Large-Cap ETF FXI

Exploring FXI's Performance and Prospects Amidst China's Economic Challenges and Global Geopolitical Shifts | That's TradingNEWS

Comprehensive Analysis of the iShares China Large-Cap ETF (FXI)

Overview of FXI's Current Market Status

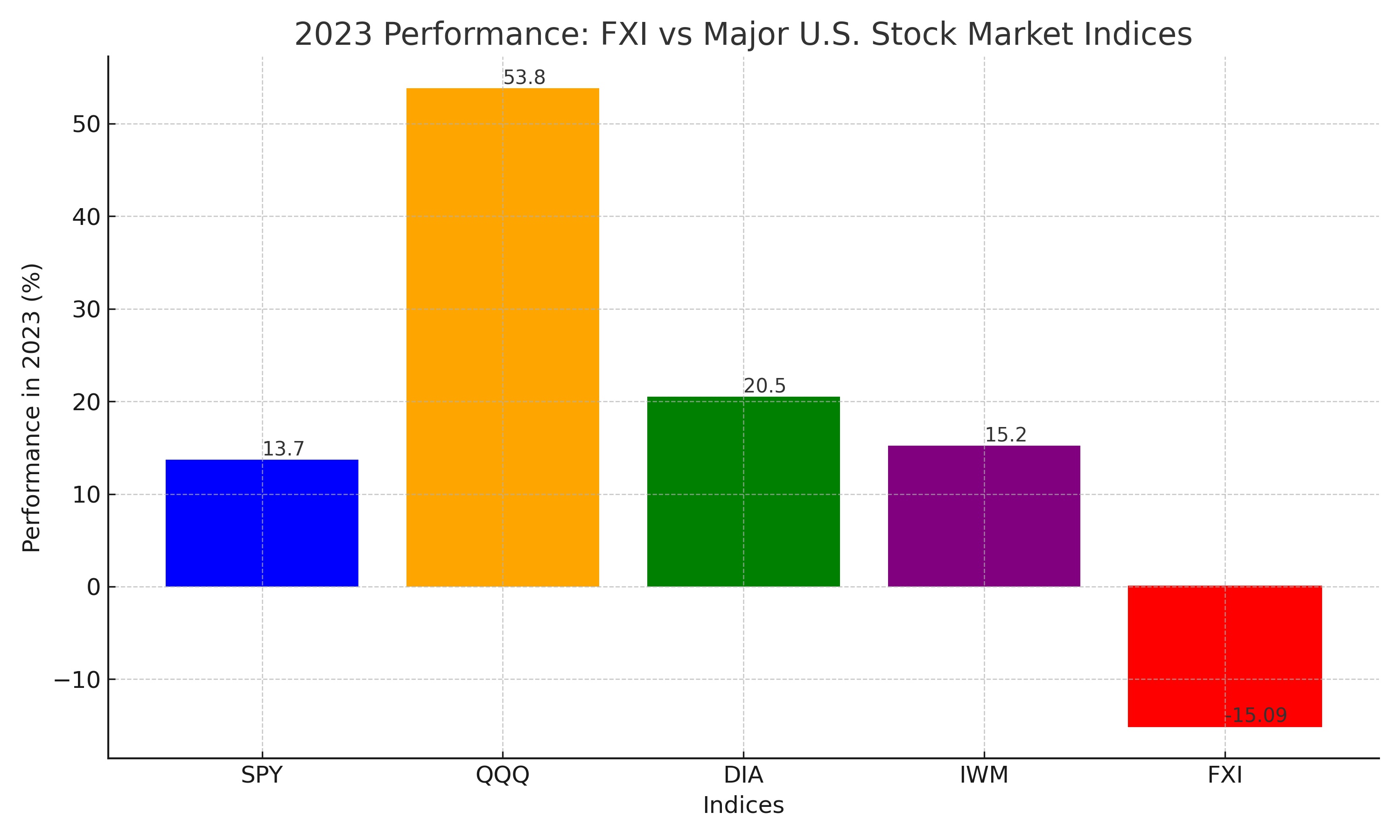

The iShares China Large-Cap ETF (NYSEARCA: FXI) has been navigating turbulent waters, with a notable performance dip of 15.09% in 2023. This decline starkly contrasts the gains seen in major U.S. stock market indices, indicating unique challenges faced by the Chinese market.

FXI's Key Holdings and Market Cap

As of January 12, 2024, FXI's portfolio includes significant holdings in major Chinese companies, as listed on Seeking Alpha. The ETF is trading at $22.20 per share, with a market capitalization of $4.16 billion. FXI offers an annual dividend yield of 2.75%, surpassing its U.S. counterparts like SPY (1.39%), QQQ (0.62%), DIA (1.81%), and IWM (1.40%).

Daily Trading Volume and Management Fee Concerns

FXI's average daily trading volume hovers around 41.5 million shares, accompanied by a management fee of 0.74%. The high dividend yield is a response to poor price performance, leading to capital depreciation for investors.

Comparative Performance of FXI and U.S. Indices

In 2023, while the SPY, QQQ, DIA, and IWM indices experienced growth ranging from 13.7% to 53.8%, FXI's decline of over 15% highlights its underperformance relative to these U.S. benchmarks.

China's Economic Struggles and Investor Sentiment

China's economic slowdown and geopolitical tensions, especially the strained relations with the U.S. and Europe, have led investors to shy away from Chinese equities. The country's central planning economic model means investing in Chinese companies is intrinsically linked to governmental policies.

Potential for Investment in Chinese Equities

Despite the current bearish trend, there exists a potential turnaround in investor sentiment towards Chinese stocks if geopolitical tensions ease. The search for value in a market where U.S. stocks have seen significant gains might pivot investor focus towards underappreciated assets like FXI.

FXI's Technical Analysis and Support Levels

The long-term trend for FXI has been bearish since the high of $54.52 in February 2021. FXI's current price is hovering around crucial technical support levels, drawing close to its previous lows in 2008 and 2022.

Key Challenges and Opportunities for China in 2024

China faces several critical issues in 2024, including weak economic conditions, high youth unemployment, geopolitical tensions, and the ongoing war in Ukraine. Additionally, the rising possibility of a BRICS currency challenging the U.S. dollar could shift the global financial dynamics in favor of China.

Investment Strategy for FXI

Given the current market conditions and technical analysis, a small allocation in FXI could be viewed as a speculative bet on improving U.S.-China relations. The ETF's low price-to-earnings ratio, below 10, coupled with high exposure to consumer sectors, presents a mix of risk and potential value.

FXI's Rating and Investment Rationale

Sector Allocation and Diversification Risks

The FXI ETF's portfolio is heavily weighted towards the Consumer Discretionary sector, accounting for over 33% of its composition, followed closely by Financial Services at 28.51%. This high concentration in specific sectors indicates a risk of limited diversification, which could impact the ETF's stability in market downturns.

Technical Analysis and Future Projections

Analyzing FXI's historical performance, it's evident that the ETF has faced a downward trajectory over the past few years. With a decline of 48% over the last three years and 36% over the last decade, the ETF's performance raises questions about its future prospects. The significant exposure to consumer sectors in China might offer some potential for growth, considering the size and expansion of the Chinese consumer market. However, this is offset by the risks associated with the concentration in these sectors.

Global Economic Influence and China's Position

China's role as a major economic power and its position in global geopolitics, especially in relation to the U.S., Russia, and the Middle East, adds layers of complexity to investing in FXI. The potential for a new BRICS currency to challenge the U.S. dollar's dominance could also significantly impact global trade and investment patterns, possibly benefiting China in the long run.

Valuation Metrics and Investment Appeal

Despite trading at a low price-to-earnings ratio below 10, reflecting harsh government policies and concerns over quasi-government ownership of major companies, FXI presents as an undervalued asset. This low valuation, combined with a high dividend yield of 2.6%, could attract investors looking for value opportunities in emerging markets.

FXI's Portfolio Composition and Ratings

Morningstar rates FXI as a 2-star, Neutral-rated fund, focused solely on large-cap Chinese stocks. The ETF's price-to-earnings ratio stands at 8.6, with a PEG ratio barely above one, suggesting strong value. However, the ETF's heavy weighting in specific sectors raises concerns about its ability to withstand market volatility.

Strategic Investment Considerations

Given the current geopolitical and economic climates, FXI should be viewed as a potential long-term investment, but with caution. The technical and macro risks, coupled with China's uncertain economic and political landscape, suggest that FXI is suitable for investors willing to tolerate high levels of risk and volatility.

Conclusion: A Cautious Approach to FXI

In summary, the iShares China Large-Cap ETF presents a unique investment opportunity in the Chinese market. Its low valuation and high dividend yield are attractive, but significant risks related to China's geopolitical stance, economic policies, and concentrated sector exposure cannot be overlooked. Investors considering FXI should be prepared for potential fluctuations and adopt a tactical approach, keeping an eye on global and domestic factors that could influence the ETF's performance.

That's TradingNEWS

Read More

-

GPIQ ETF Price Forecast: Can a 10% Yield at $52 Survive the Next Nasdaq Selloff?

09.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Price Forecast: XRPI at $8.32, XRPR at $11.86 as $44.95M Inflows Defy BTC and ETH Outflows

09.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Forecast: Will The $3.00 Floor Hold After The $7 Winter Spike?

09.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Back Under 50K While S&P 500 and Nasdaq Push Higher as Gold Reclaims $5,000

09.02.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast: Can Bulls Clear 157.5 Without Triggering a 160 Intervention Line?

09.02.2026 · TradingNEWS ArchiveForex