Vale S.A. NYSE:VALE Financial Strength and Market Position

Analyzing Vale's Market Cap, Financial Health, and Growth Outlook in the Mining Sector | That's TradingNEWS

Exploring the Financial Landscape of Vale S.A. (NYSE: VALE)

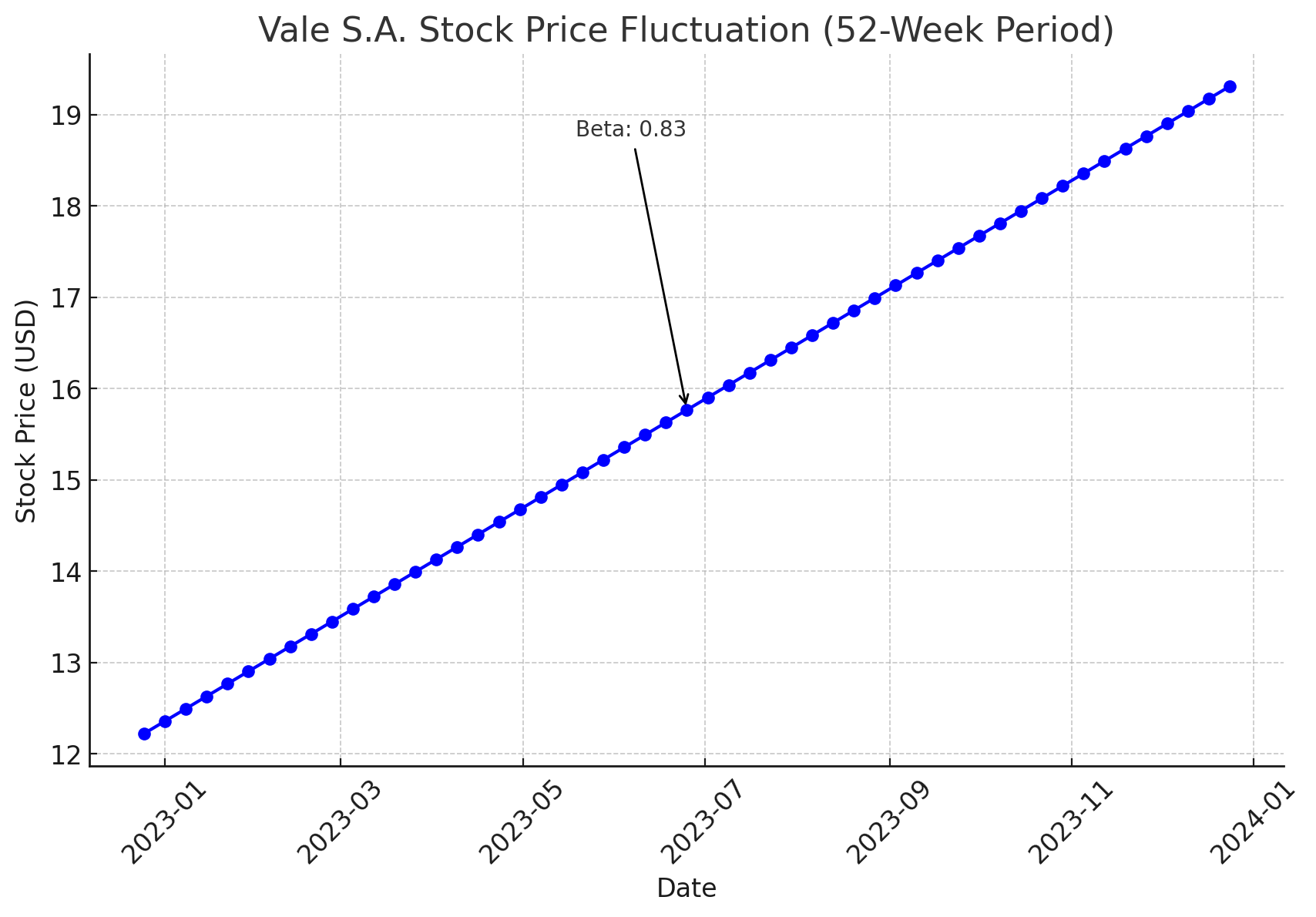

Market Capitalization and Trading Dynamics

Vale S.A. (NYSE: VALE), a prominent force in the mining industry, is listed on the New York Stock Exchange. The company boasts a market capitalization of $67.727 billion, reflecting its significant market presence. With a Beta coefficient of 0.83, VALE exhibits moderate volatility when compared to the broader market. The stock price has experienced a wide range within a 52-week period, oscillating between $12.22 and $19.31, highlighting active investor participation and market sensitivity.

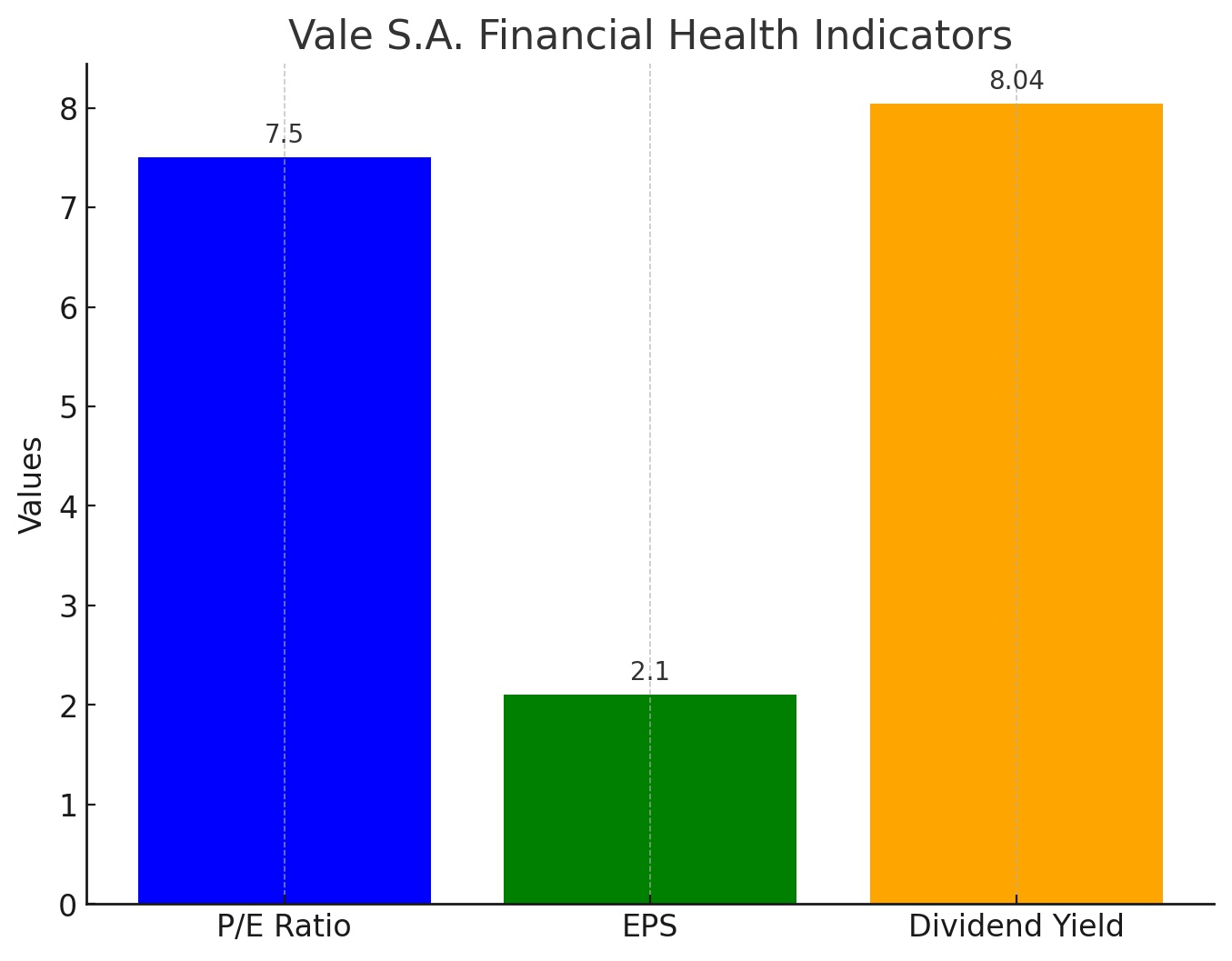

Robust Financial Health Indicators

VALE's financial robustness is evidenced by its trailing Price-to-Earnings (P/E) ratio of 7.50 and an Earnings Per Share (EPS) of $2.10, signaling strong profitability against current earnings. The company's forward dividend yield of 8.04%, although impressive, underscores a strategic focus on reinvestment and growth over distributing earnings as dividends.

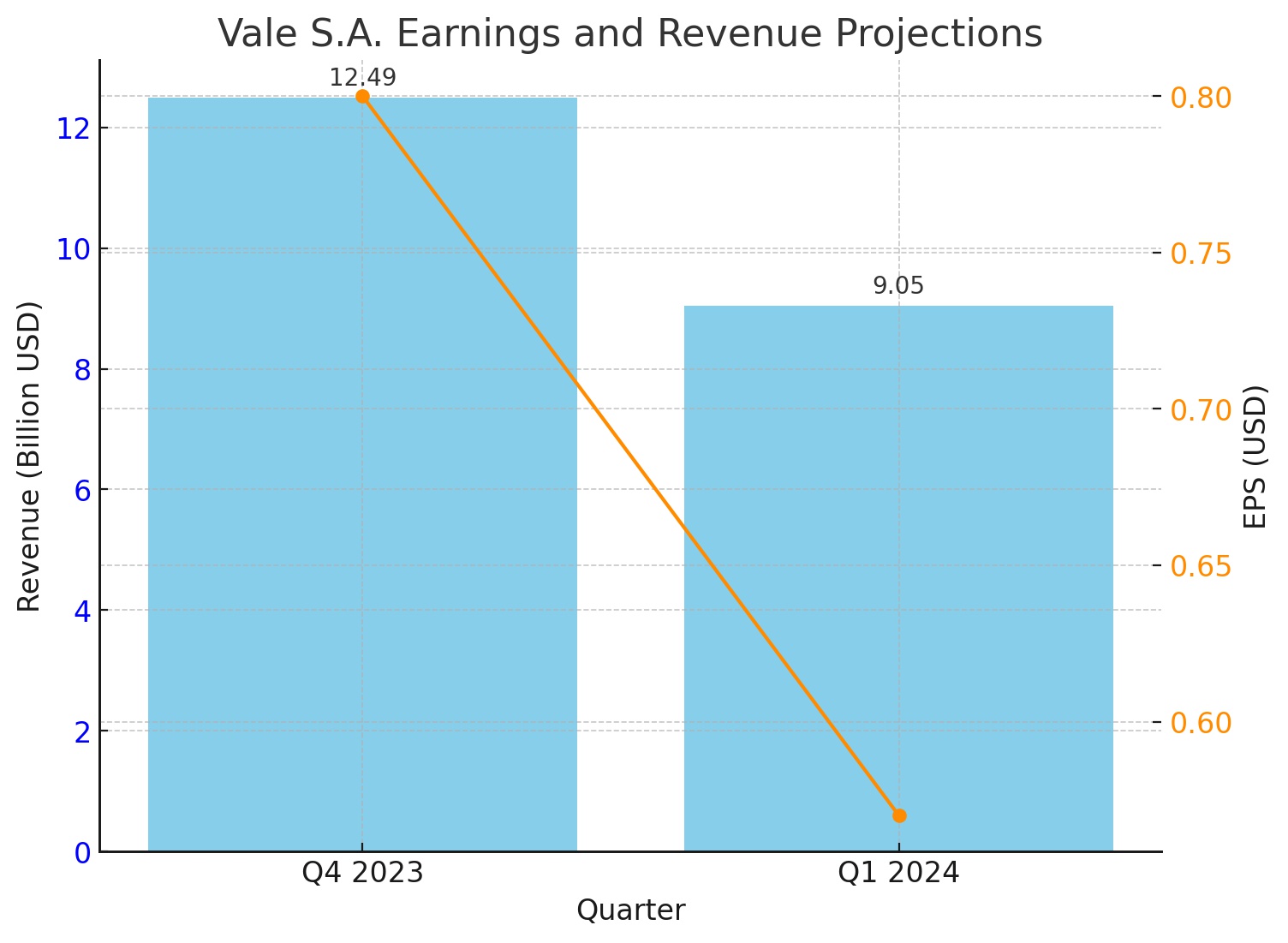

Earnings and Revenue Projections: In-Depth Review

For the upcoming quarter ending December 2023, VALE is projected to report an EPS of $0.80, with a subsequent quarter expectation of $0.57. These forecasts suggest a shift from the prior year's EPS, indicating changing market dynamics. Revenue estimates are poised at $12.49 billion for the current quarter, with a slight decrease to $9.05 billion for the next. These figures illustrate a nuanced picture of VALE's revenue trajectory.

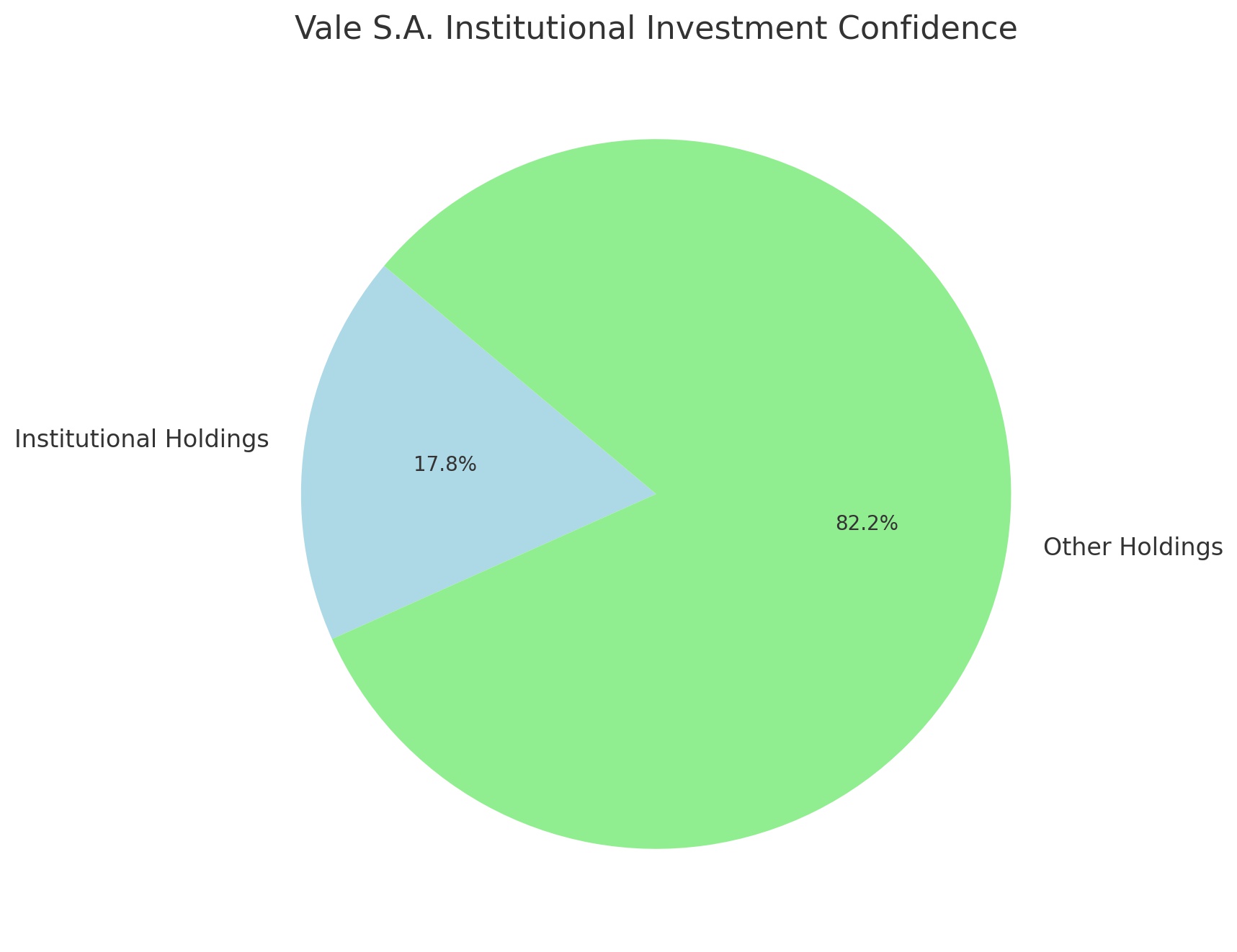

Institutional Investment Confidence

VALE's stock demonstrates substantial institutional trust, evidenced by 17.81% institutional holdings. This significant level of institutional investment suggests a strong confidence in the company's strategic direction and long-term growth potential.

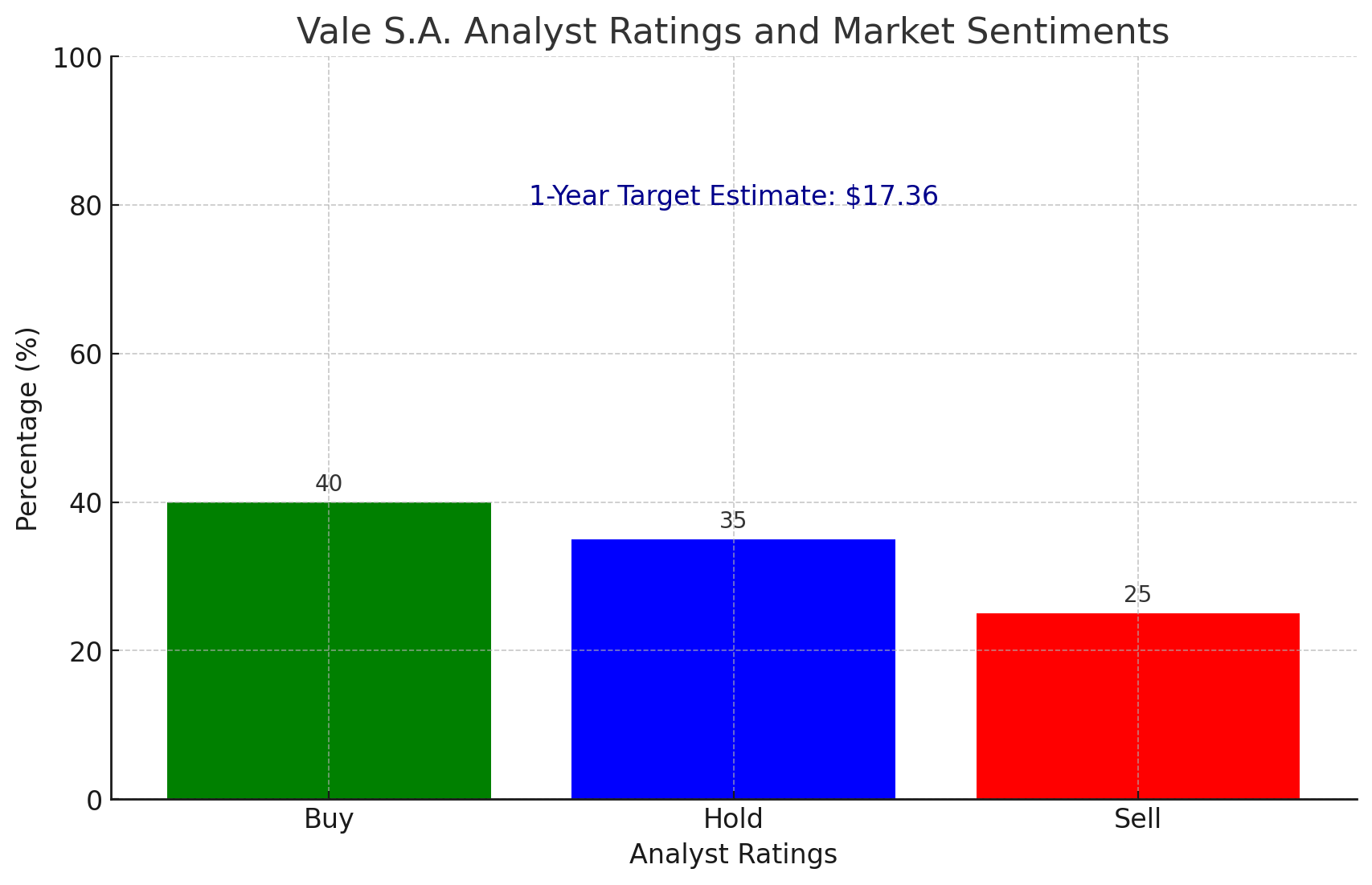

Analyst Ratings and Market Sentiments

The divergent analyst ratings for VALE reflect the complex and evolving nature of the mining sector. The stock's one-year target estimate stands at $17.36, indicating optimistic sentiments among market analysts.

Trading Activity and Market Performance

VALE has shown a 52-week change of -6.75%, contrasting with the S&P 500's positive change of 24.17%. This discrepancy highlights the stock's unique market dynamics. Trading volumes average around 21.1 million shares over three months, signifying active market engagement.

Financial Highlights and Profitability Metrics

For the fiscal year ending December 30, 2022, VALE reported a profit margin of 23.01% and an operating margin of 35.14%. These metrics demonstrate the company's effective management and profitability in turning sales into actual earnings.

Future Growth Projections and Estimates

VALE's growth estimates for the current quarter stand at -2.40%, with a predicted growth of 39.00% for the next quarter. These projections offer insights into the company's potential trajectory in the highly competitive mining sector.

International Operations and Market Positioning

VALE's global operations and strategic positioning are crucial in its sustained growth. The company's focus on diverse mining operations and commitment to sustainable practices are key to its market positioning.

Navigating Industry Challenges

VALE, like other players in the mining sector, faces several challenges, including fluctuating commodity prices and environmental concerns. The company's ability to navigate these challenges while maintaining operational efficiency and compliance with regulations is vital for its long-term success.

Strategic Evaluation for Sustained Growth

VALE's long-term growth is contingent on its strategic decisions, market adaptations, and ability to capitalize on emerging opportunities in the mining industry. The company's ongoing initiatives in innovation and sustainability are expected to drive its future growth.

Investor Considerations

Investors eyeing Vale S.A. should consider the company's market strategies, financial health, and industry position. While VALE demonstrates strong fundamentals, the dynamic mining sector and global economic factors necessitate a thorough and informed investment approach.

For real-time stock analysis and insider transaction details, investors can visit Vale S.A.'s Real-Time Chart and Stock Profile on TradingNews.com.

Read More

-

Robinhood Stock Price Forecast - HOOD at $71: Crypto Crash Pain, Margin Story Intact

12.02.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast: XRP-USD Stuck Between $1.34 Support And $1.50 Ceiling

12.02.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: WTI Around $63 And Brent $68 Trapped Between Oversupply And Gulf Risk

12.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Jones Holds 50,000 While S&P 500 Steadies and Nasdaq Sinks on Cisco & AppLovin Rout, CPI Looms

12.02.2026 · TradingNEWS ArchiveMarkets

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex