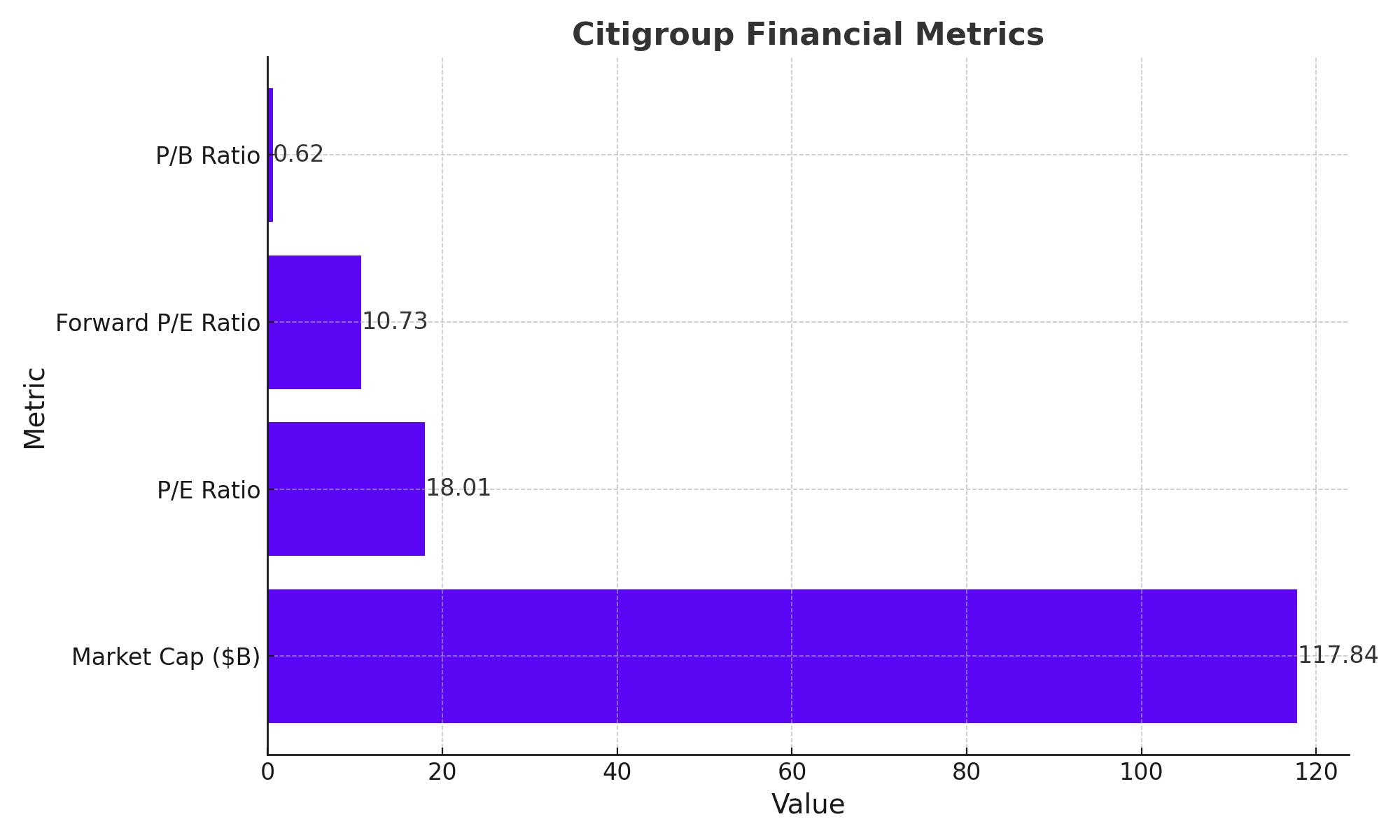

Financial Metrics and Market Valuation

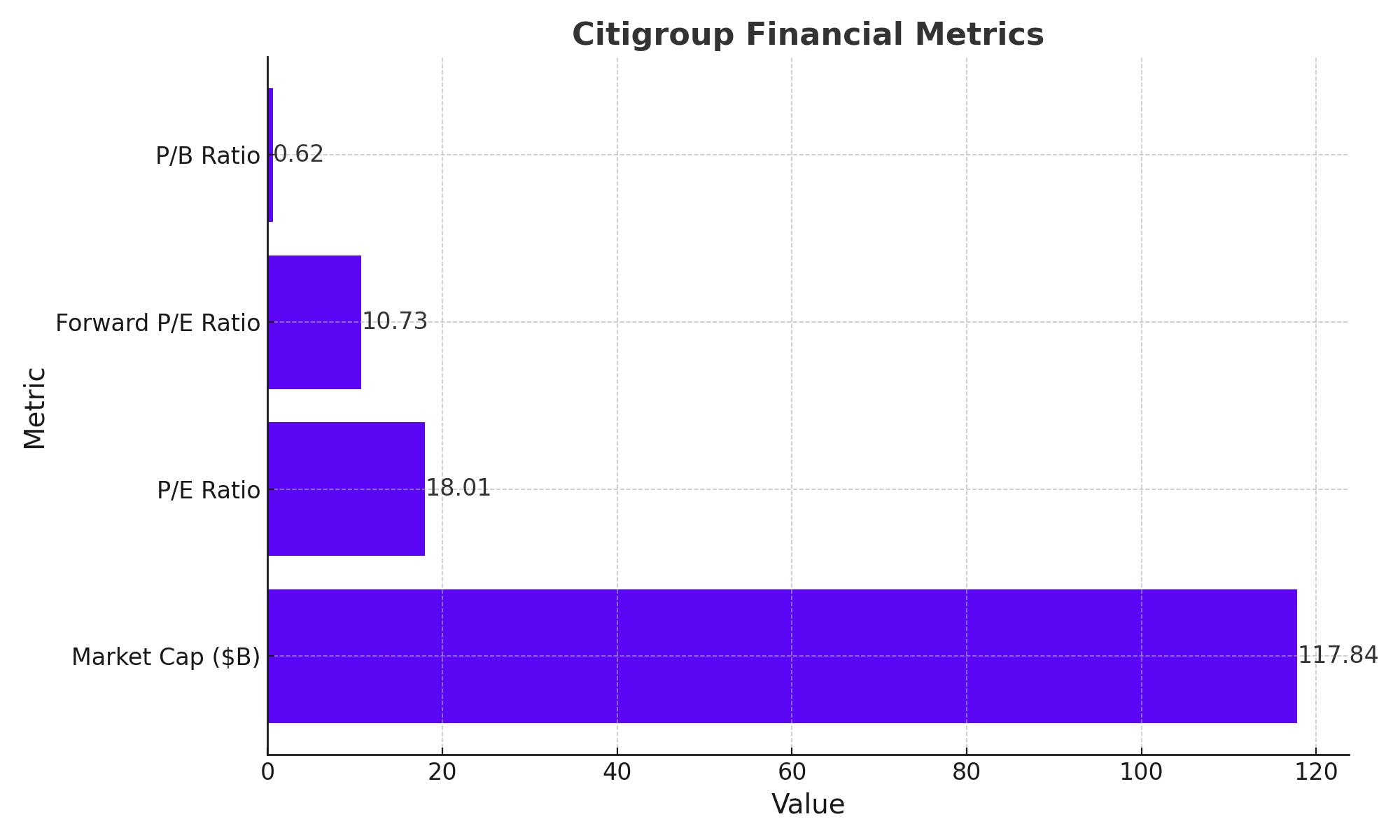

Citigroup Inc. (NYSE:C) presents a compelling case study in financial resilience and strategic valuation. As of the latest data, the company boasts a market capitalization of $117.84 billion, a notable rebound from its year-low of $79.20 billion. This recovery is indicative of investor confidence being restored after periods of volatility.

- Price-to-Earnings (P/E) Ratio: Currently, Citigroup's trailing P/E stands at 18.01, suggesting investors are willing to pay $18.01 for every dollar of the last twelve months’ earnings. More forward-looking, the P/E ratio is pegged at 10.73, reflecting optimism about Citigroup's earnings growth over the next year relative to its current share price.

- Price-to-Book (P/B) Ratio: The P/B ratio of 0.62 points to a potential undervaluation of the stock, given that it is trading below the value of its assets minus liabilities.

These metrics underscore Citigroup’s attractiveness to both value-oriented and growth-focused investors, highlighting its underappreciated assets and anticipated earnings expansion.

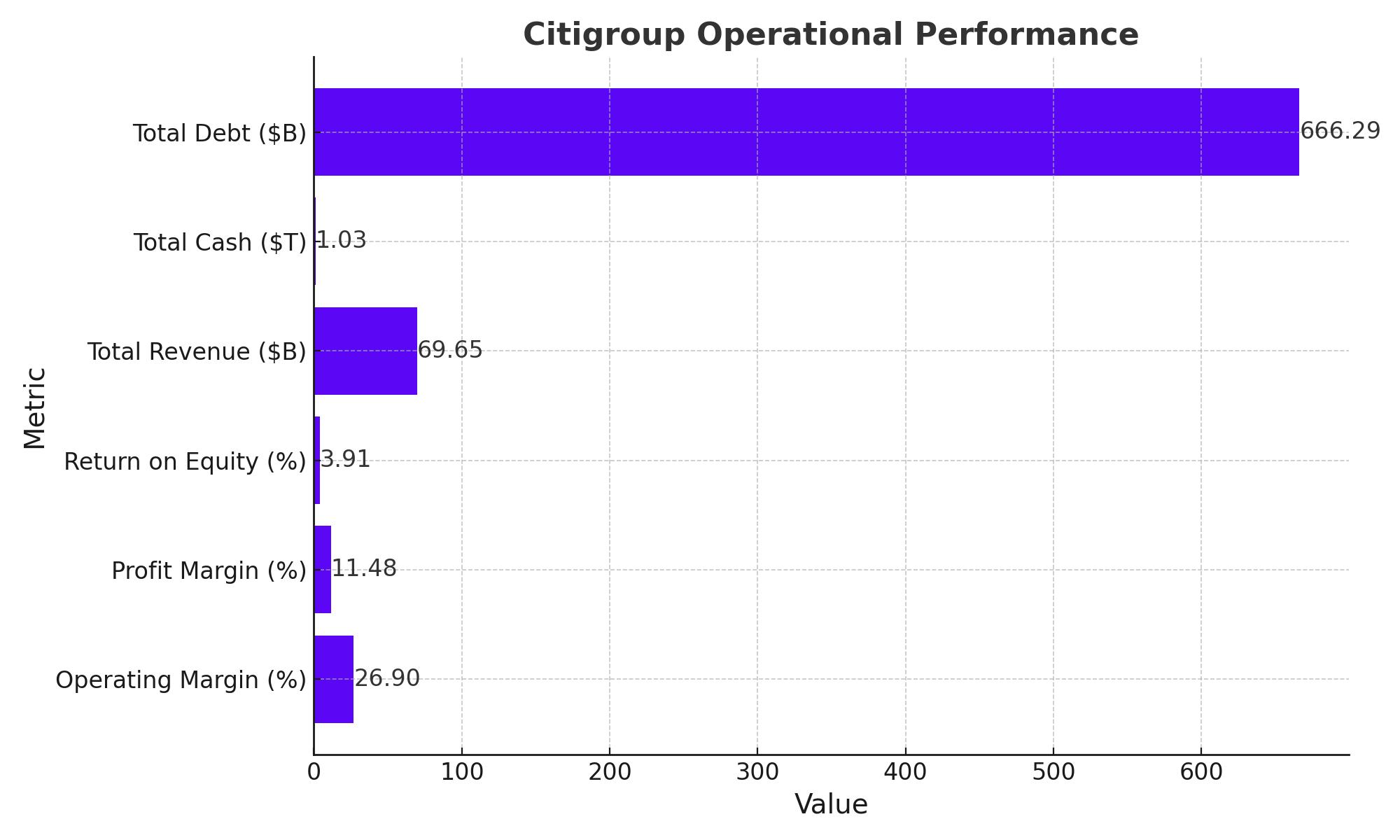

Operational and Financial Performance

Citigroup’s financial structure reveals a robust framework:

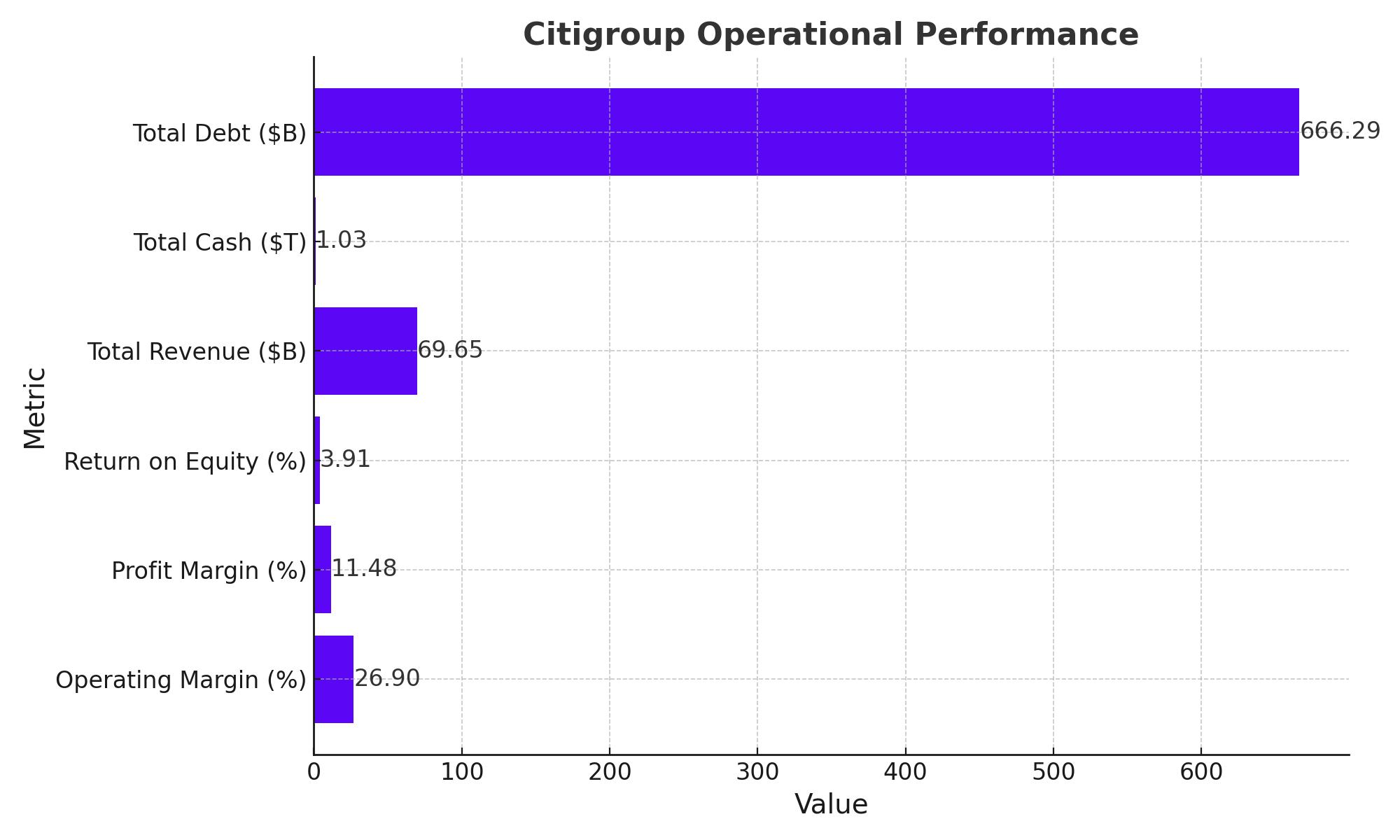

- Profitability Metrics: With an operating margin of 26.90% and a profit margin of 11.48%, Citigroup efficiently converts a significant portion of revenue into net income, outperforming many peers in the financial sector.

- Return on Equity (RoE): At 3.91%, the RoE is relatively modest, which signals potential areas for improvement in capital management or operational efficiency.

Revenue and Cash Flow Analysis

- Total Revenue: Standing at $69.65 billion, the revenue streams are broad and diversified across consumer banking and institutional client services, providing a stable income base despite market fluctuations.

- Cash and Debt Management: Citigroup's total cash holdings are an impressive $1.03 trillion, providing substantial liquidity to meet operational needs and debt obligations. However, its total debt at $666.29 billion warrants strategic debt management to optimize interest expenses and credit standings.

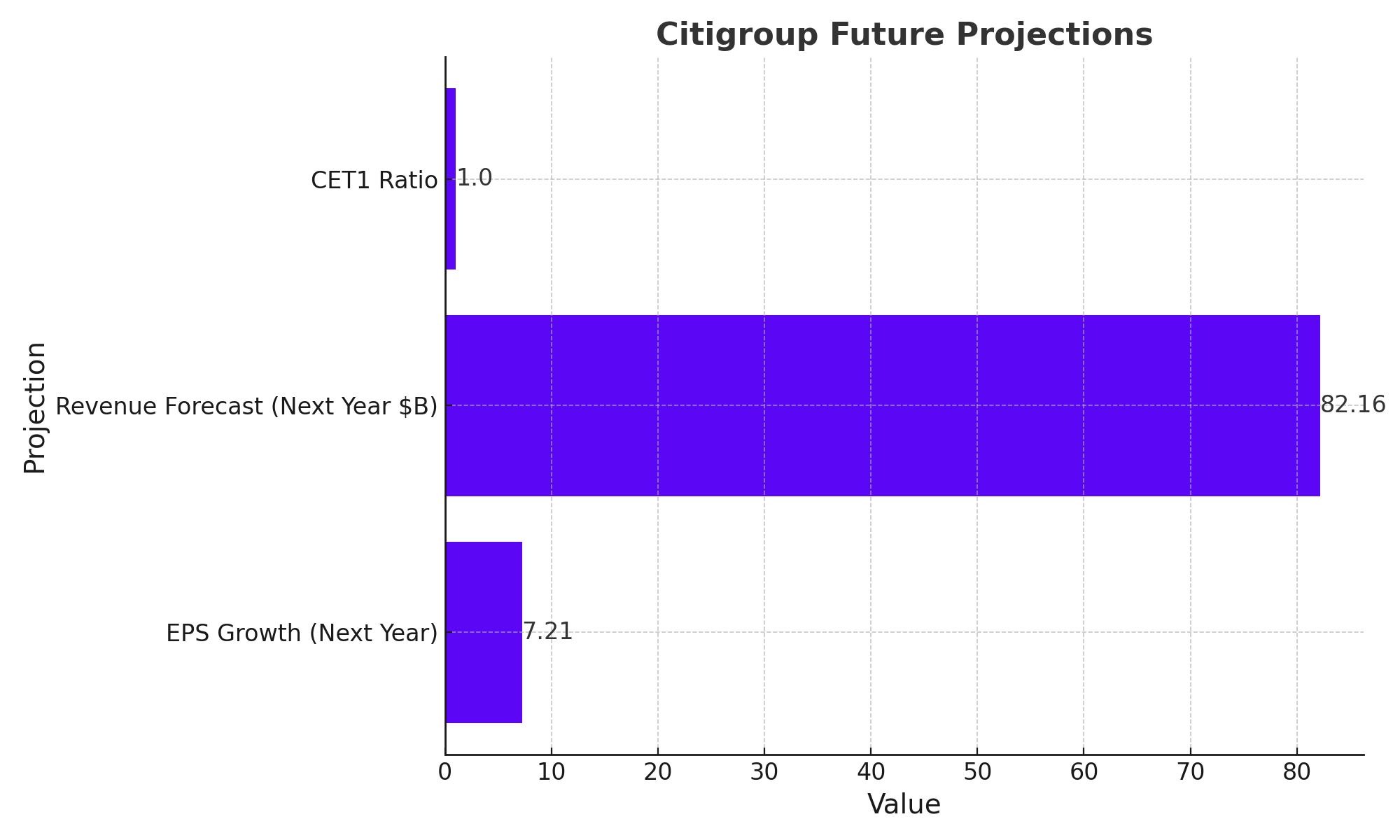

Strategic Developments and Market Adaptation

Citigroup’s strategic initiatives are focused on regulatory compliance and capital optimization:

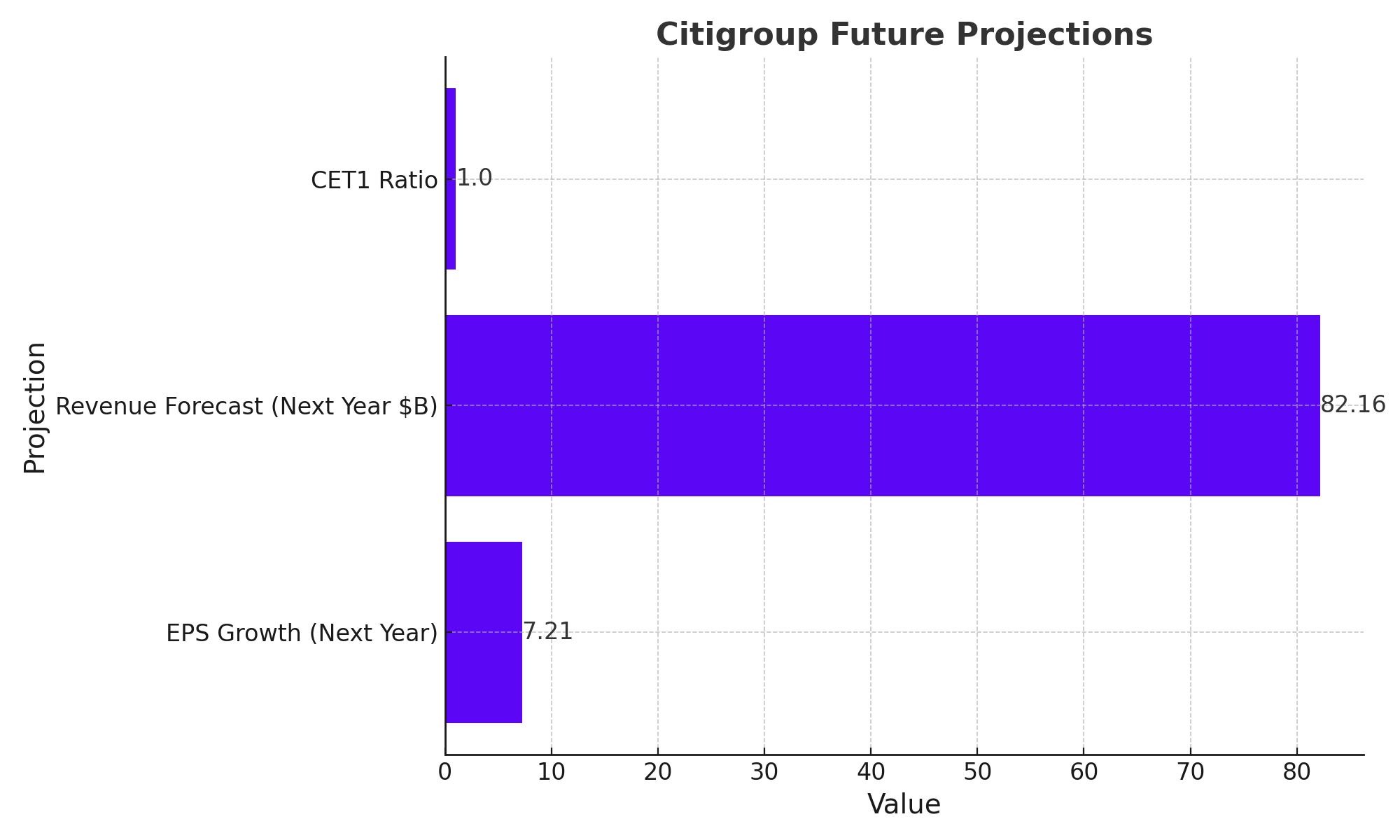

- Capital Adequacy: The CET1 ratio significantly exceeds the regulatory requirement, reflecting a solid capital buffer that enhances Citigroup’s resilience against potential financial shocks.

- Adaptation to Basel 3 Regulations: Citigroup has been proactive in adjusting to increased capital requirements, ensuring that it remains well-positioned to navigate future regulatory changes without compromising on growth initiatives.

Future Outlook and Growth Projections

Looking ahead, Citigroup is positioned for sustainable growth:

- Earnings Growth: Analysts project an EPS increase to $7.21 by next year, suggesting an expected improvement in profitability driven by operational efficiencies and strategic expansions.

- Revenue Forecasts: With anticipated revenues reaching $82.16 billion next year, Citigroup is expected to leverage its global network and digital banking platforms to capture market share and enhance revenue streams.

Challenges and Strategic Risk Management

Despite Citigroup's robust financial health and strategic growth, it encounters a range of operational and financial risks that require meticulous management:

Interest Rate Sensitivity

Citigroup operates globally, exposing it to diverse interest rate environments that can significantly impact financial operations. The bank's interest income, the primary revenue source, is highly sensitive to changes in interest rates. Effective asset and liability management strategies are critical for mitigating risks associated with rate volatility. This includes optimizing the balance sheet to align with potential short-term disruptions and long-term economic cycles, ensuring sustainability in various economic conditions.

Credit Risk Oversight

With a substantial loan portfolio, Citigroup must enforce a rigorous credit risk management framework. This involves advanced analytics for assessing borrower solvency and continual monitoring of loan performance across different sectors and geographies. Strategies such as diversification of loan types, stringent underwriting criteria, and proactive risk assessment are essential to minimize the likelihood of default and safeguard the bank's financial stability.

Regulatory Compliance and Operational Integrity

Navigating Global Regulations

Citigroup's global presence requires compliance with an intricate web of financial regulations across multiple jurisdictions. This regulatory environment is constantly evolving, posing a challenge for the bank to adapt swiftly and efficiently. Compliance risks include potential financial penalties and reputational damage arising from any failure to meet regulatory standards. Citigroup's investment in compliance infrastructure and ongoing training for its workforce are vital in managing these risks effectively.

Cybersecurity and Data Privacy

In an era where digital operations are critical, Citigroup faces significant cybersecurity threats that could compromise sensitive customer data and disrupt operations. Implementing cutting-edge security technologies, conducting regular security audits, and fostering a culture of cybersecurity awareness are paramount. This also extends to ensuring compliance with global data protection regulations, protecting client information, and maintaining trust.

Market Competition and Innovation

Staying Ahead in a Competitive Landscape

The financial services industry is highly competitive, with players ranging from traditional banks to fintech startups. Citigroup needs to continually innovate to maintain a competitive edge. This includes investing in technology to improve customer experience, expanding digital banking services, and exploring new financial products that meet evolving consumer and business needs.

Sustainable Banking and Social Responsibility

Increasingly, banks are expected to engage in sustainable banking practices and demonstrate corporate social responsibility (CSR). For Citigroup, this means investing in green finance initiatives, enhancing financial inclusion, and adhering to ethical banking standards. These efforts not only contribute to a better global environment and society but also appeal to increasingly conscientious investors and customers.

Strategic Mergers and Acquisitions

Leveraging M&A for Growth

To accelerate growth and diversification, Citigroup may consider strategic mergers and acquisitions. This strategy can provide quick access to new markets and technologies, enhancing Citigroup’s service offerings and operational efficiencies. However, M&A activities come with integration risks, culture clashes, and potential dilution of shareholder value if not managed adeptly.

Conclusion: Citigroup's Investment Potential

Given Citigroup's comprehensive financial analysis and market positioning, a "Buy" recommendation is advised. The bank's strong recovery in market capitalization, rising from $79.20 billion to $117.84 billion, coupled with a forward P/E of 10.73, showcases investor confidence and a favorable valuation relative to future earnings potential. Moreover, the P/B ratio of 0.62 indicates that the stock might be undervalued, as it trades below the intrinsic value of its assets.

The bank's operational efficiency, demonstrated by a robust operating margin of 26.90% and a transition towards stringent regulatory compliance, positions it well for sustainable growth. Despite a moderate RoE of 3.91%, strategic initiatives aimed at capital optimization and technological advancements are likely to enhance profitability.

Citigroup's proactive approach in managing its substantial loan portfolio and adapting to global regulatory changes further solidifies its market stance. With projected EPS growth to $7.21 and revenue forecasts increasing to $82.16 billion, Citigroup is poised for a promising financial trajectory.

Investors should consider Citigroup’s current valuation and strategic direction, which indicate a potential for significant appreciation. The blend of strong fundamental indicators with strategic growth initiatives makes Citigroup a compelling buy for those looking to capitalize on the evolving dynamics of the financial sector.

That's TradingNEWS