Why Is Amazon Stock (NASDAQ:AMZN) a Buy at $132?

How Does Amazon (NASDAQ:AMZN) Sustain Growth Against Rivals While Trading at $132? | That's TradingNEWS

1/14/2025 10:18:21 PM

NASDAQ:AMZN – Expanding E-Commerce Dominance with Unprecedented Margins

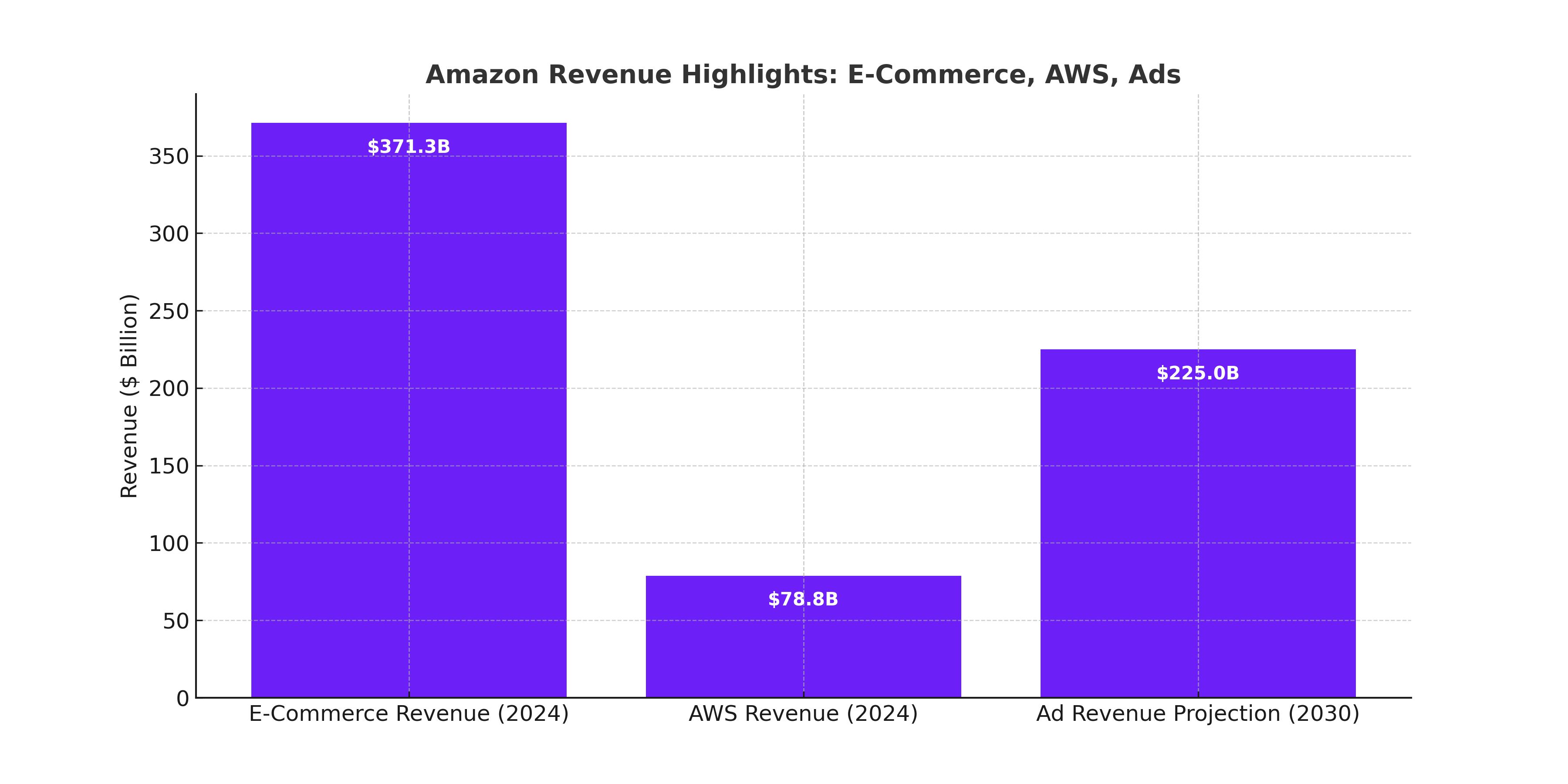

Amazon’s e-commerce business continues to define the global retail market, achieving $271.9 billion in revenue from North America and $99.4 billion internationally in 2024. Holding a 12% global market share in e-commerce, Amazon stands poised to capture substantial growth. McKinsey projects the global e-commerce market will reach $17 trillion by 2040, translating to a $2 trillion opportunity for Amazon if it maintains its current market share. Efficiency gains through robotics and logistics optimization further strengthen its profitability. Deploying over 750,000 robots, Amazon leads global automation efforts, cutting costs and improving delivery speed. Notably, the North American segment hit a record 5.8% operating income margin in 2024—its highest in six years—while the international segment achieved a 2.5% margin.

Read More

-

SCHD ETF at $31.62: Dividend Rotation Turns a 2025 Laggard into a 2026 Leader

11.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI and XRPR Lag Price While Fresh XRPZ Inflows and $152M Bank Bets Test the Dip

11.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Defend the $3.00 Floor After Collapse From Above $7.50

11.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Drops Below Key Averages as Yen Rally Targets 152–150 Zone

11.02.2026 · TradingNEWS ArchiveForex