Cadence Design Systems: Future of EDA and AI Integration

Explore how Cadence Design Systems (CDNS) is transforming the technology sector with innovative EDA solutions and AI-driven database architectures, fueling growth and market expansion | That's TradingNEWS

Cadence Design Systems, Inc. (NASDAQ:CDNS): A Comprehensive Market Analysis

Unveiling Cadence Design Systems' Market Position and Growth Trajectory

Cadence Design Systems, Inc. (NASDAQ:CDNS), a stalwart in the electronic design automation (EDA) sector, is steering the course of innovation with its state-of-the-art non-relational database solutions, catering to the burgeoning demands of artificial intelligence (AI) applications. Positioned at the intersection of technology advancement and market demand, Cadence's document-oriented database architecture offers a solution to efficiently manage the deluge of semi-structured data that AI technologies produce.

Strategic Growth Indicators and Financial Highlights

Accelerated Customer Growth and Market Share Expansion

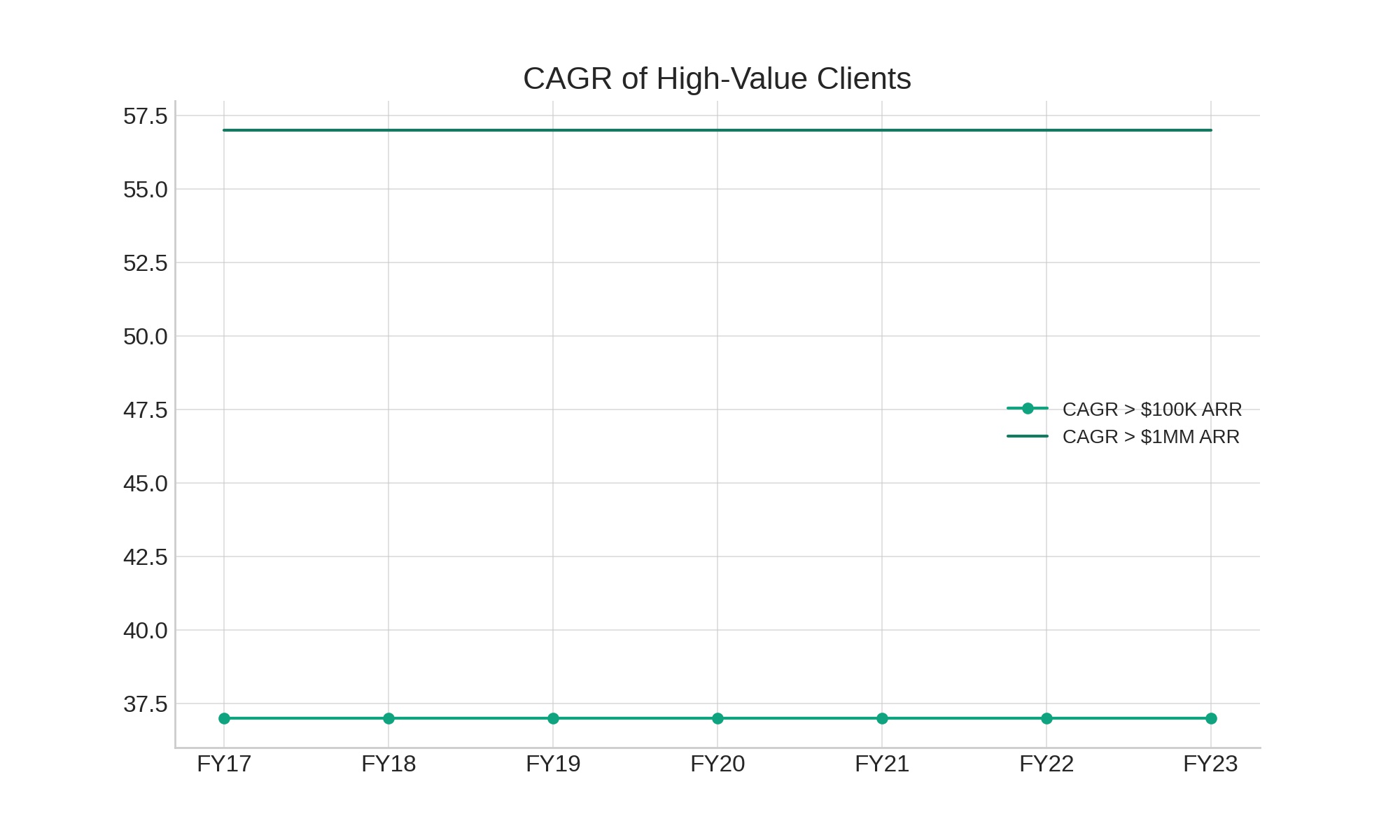

Cadence Design Systems has witnessed remarkable customer growth, with a Compound Annual Growth Rate (CAGR) of 37% among clients contributing over $100K in Annual Recurring Revenue (ARR) from FY17-23. Even more impressive is the 57% CAGR observed among clients exceeding $1MM in ARR, underscoring Cadence's pivotal role in AI workload management and its potential for sustained revenue growth.

Exploring Cadence's Enterprise Market Potential

With a footprint in 457 of the Global 2000 companies, Cadence demonstrates a substantial growth runway, especially considering its strategic utilization by 64 of the Fortune 100 and 192 of the Fortune 500 companies. This underrepresentation in the enterprise sector signifies untapped potential, promising lucrative expansion opportunities.

A Closer Look at Financial Health

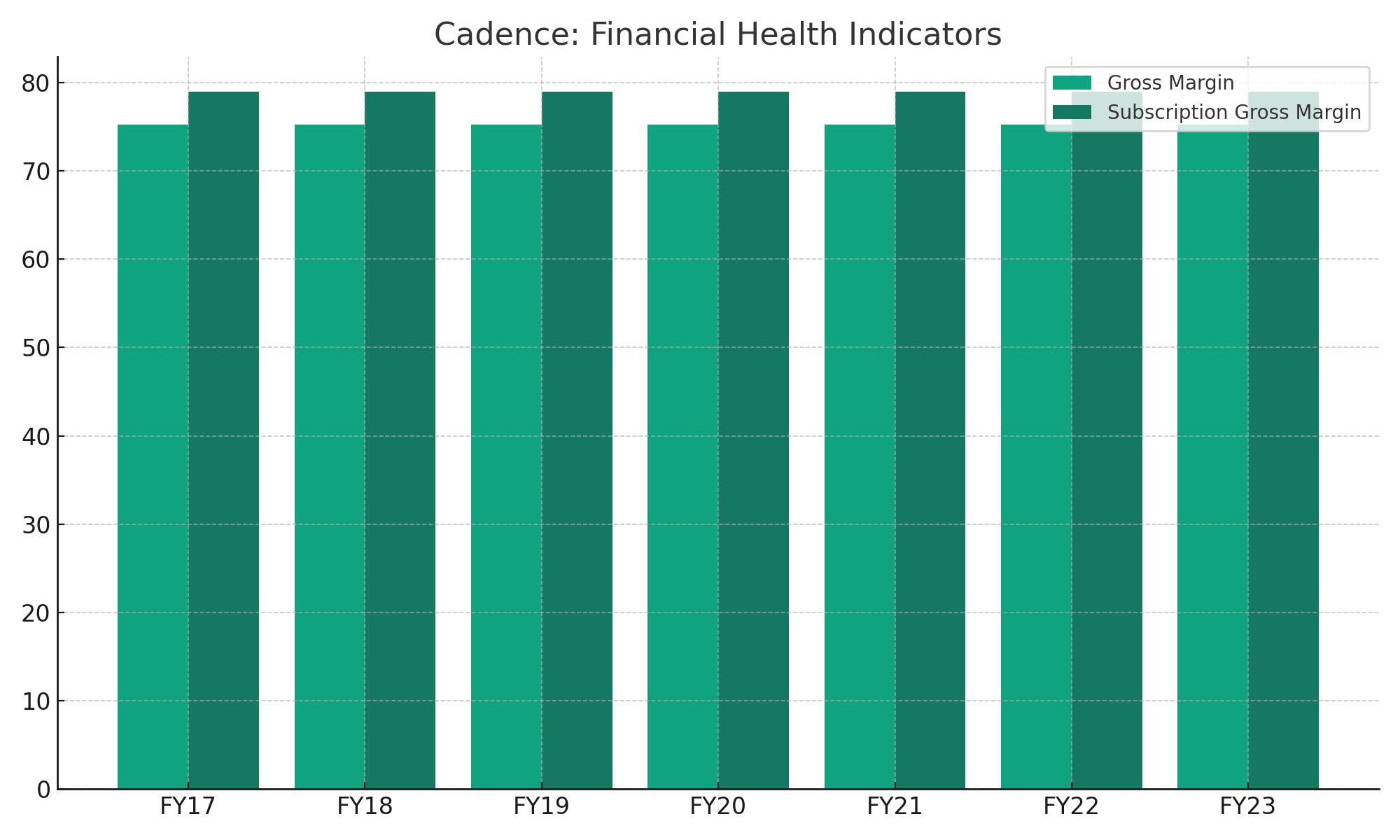

Cadence boasts a robust financial profile with a gross margin of 75.2% and a subscription gross margin of 79%. The shift toward SaaS models is expected to bolster these margins further. Despite facing challenges like prolonged sales cycles in larger enterprises, Cadence's strategic reduction in operational expenses over the past seven years hints at efficiency gains and margin expansion potential.

Cadence in the Competitive EDA Landscape

Market Dynamics and Competitive Edge

Holding a 1.3% share in the $91 billion DBMS market, Cadence is at the forefront of the transition towards non-relational databases. This shift is particularly relevant for AI and machine learning applications, where Cadence's flexible and scalable database architecture offers distinct advantages over traditional relational databases.

Innovation as a Competitive Strategy

Cadence's dedication to innovation is evident through developments in vector search and queryable encryption, enhancing its competitive stance. These advancements address crucial data security concerns and bolster Cadence's appeal for AI-driven applications, marking it as a leader in the evolving tech landscape.

Investment Insights and Market Valuation

Assessing Investment Appeal

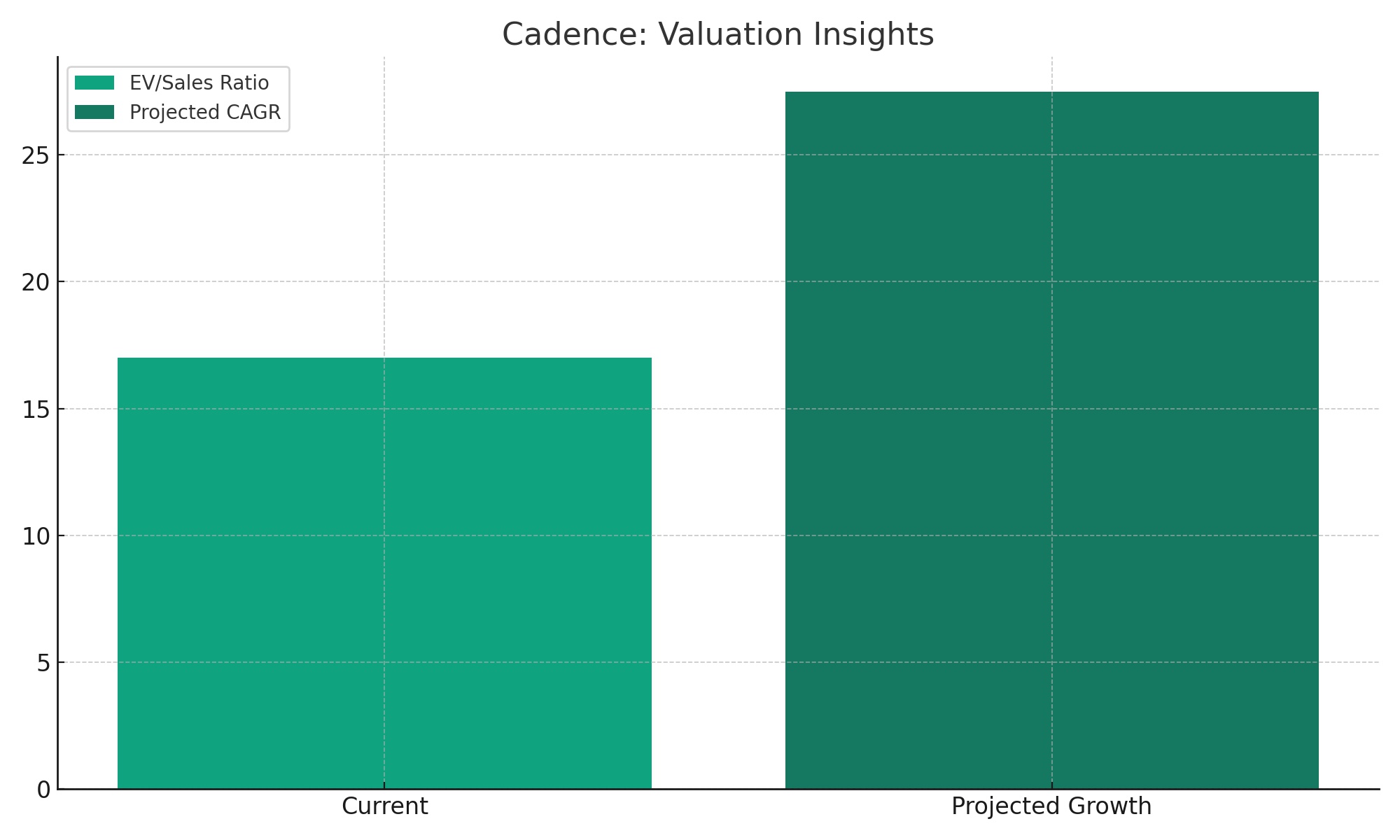

Despite its premium valuation, with an EV/Sales ratio of approximately 17x, Cadence's strategic positioning and growth prospects justify investor optimism. The anticipated top-line growth rate of 25-30% CAGR over the next five years reflects both Cadence's current market performance and its potential for future expansion.

Forward-Looking Market Analysis

Cadence's prospects in the DBMS market appear promising, with significant opportunities for growth and market share expansion. The company's strategic initiatives and technological innovations position it well to capitalize on the increasing reliance on non-relational databases for AI applications.

Conclusion: Cadence Design Systems at the Forefront of Technological Innovation

Cadence Design Systems, Inc. (NASDAQ:CDNS) emerges as a compelling entity within the electronic design automation and AI sectors. Backed by robust financial metrics, strategic market positioning, and a focus on innovation, Cadence is poised for sustained growth. As the company continues to expand its enterprise reach and innovate in response to AI demands, it presents a strategic investment avenue for those looking to capitalize on the future of data management technology.

For real-time stock insights and in-depth financial analysis, explore Cadence Design Systems on Trading News.

Read More

-

Google Stock Price Forecast - AI Capex Shock, Cloud Breakout and What $313 Really Prices In

12.02.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast: XRP-USD Stuck Between $1.34 Support And $1.50 Ceiling

12.02.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: WTI Around $63 And Brent $68 Trapped Between Oversupply And Gulf Risk

12.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Jones Holds 50,000 While S&P 500 Steadies and Nasdaq Sinks on Cisco & AppLovin Rout, CPI Looms

12.02.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - GBPUSD=X Stalls Around 1.3630 as Weak UK GDP Meets Robust US Jobs Data

12.02.2026 · TradingNEWS ArchiveForex