Comprehensive Analysis of Polaris Stock - Insights and Market Dynamics

Evaluating Polaris Inc.’s Financial Performance, Market Position, and Investment Potential | That's TradingNEWS

Analyzing Polaris Inc. (NYSE:PII): A Deep Dive into Performance and Market Position

Market Overview and Recent Performance

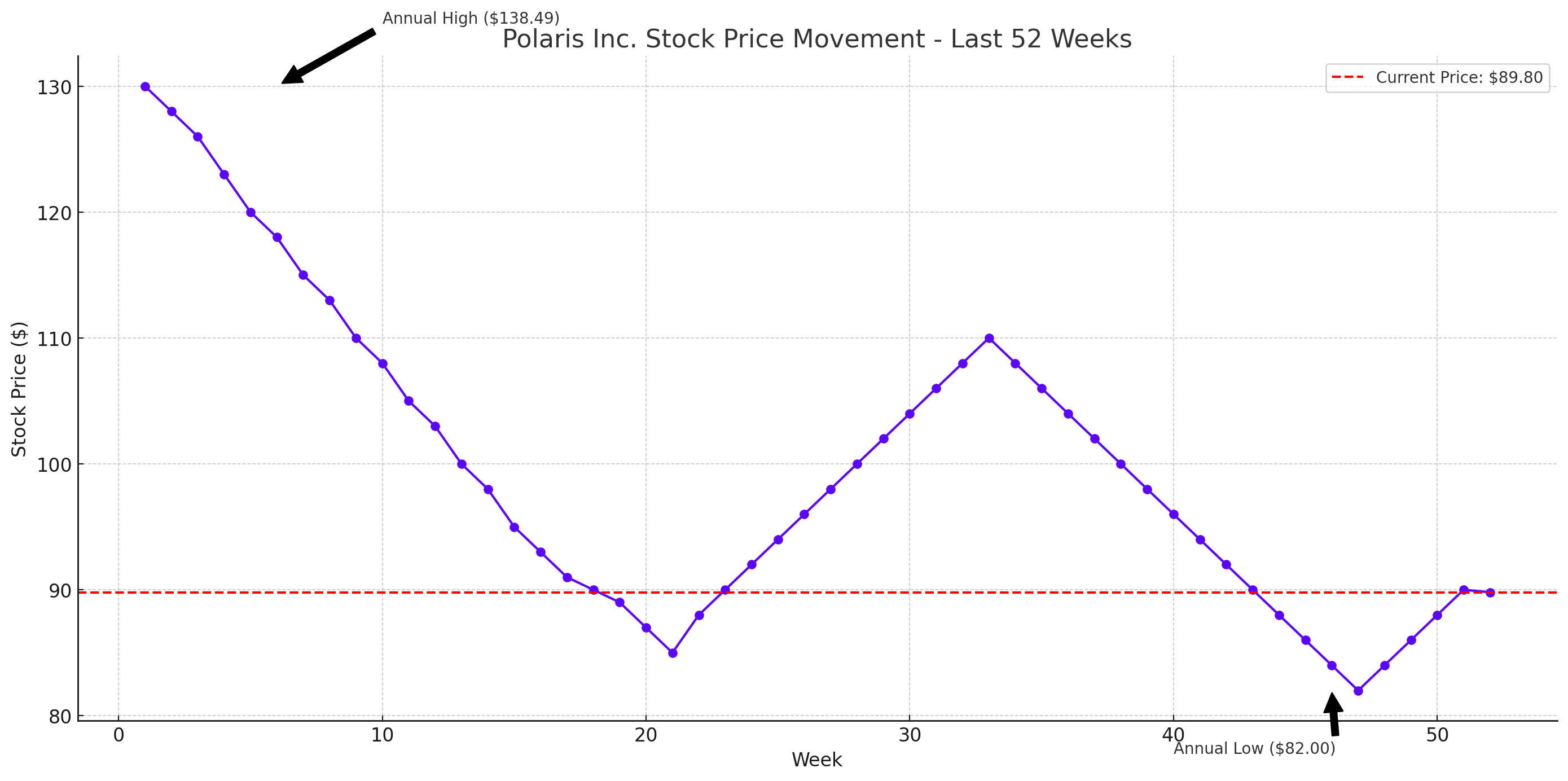

Polaris Inc., a leading name in the recreational vehicle industry, has experienced fluctuations in its stock performance, reflective of broader economic conditions and internal operational challenges. Currently trading at $89.80, the stock has seen a decline of 0.83% in its latest session. This movement is part of a larger trend observed over the past 52 weeks, where Polaris has navigated through significant highs and lows, ranging from $82.00 to $138.49.

Financial Metrics and Valuation Analysis

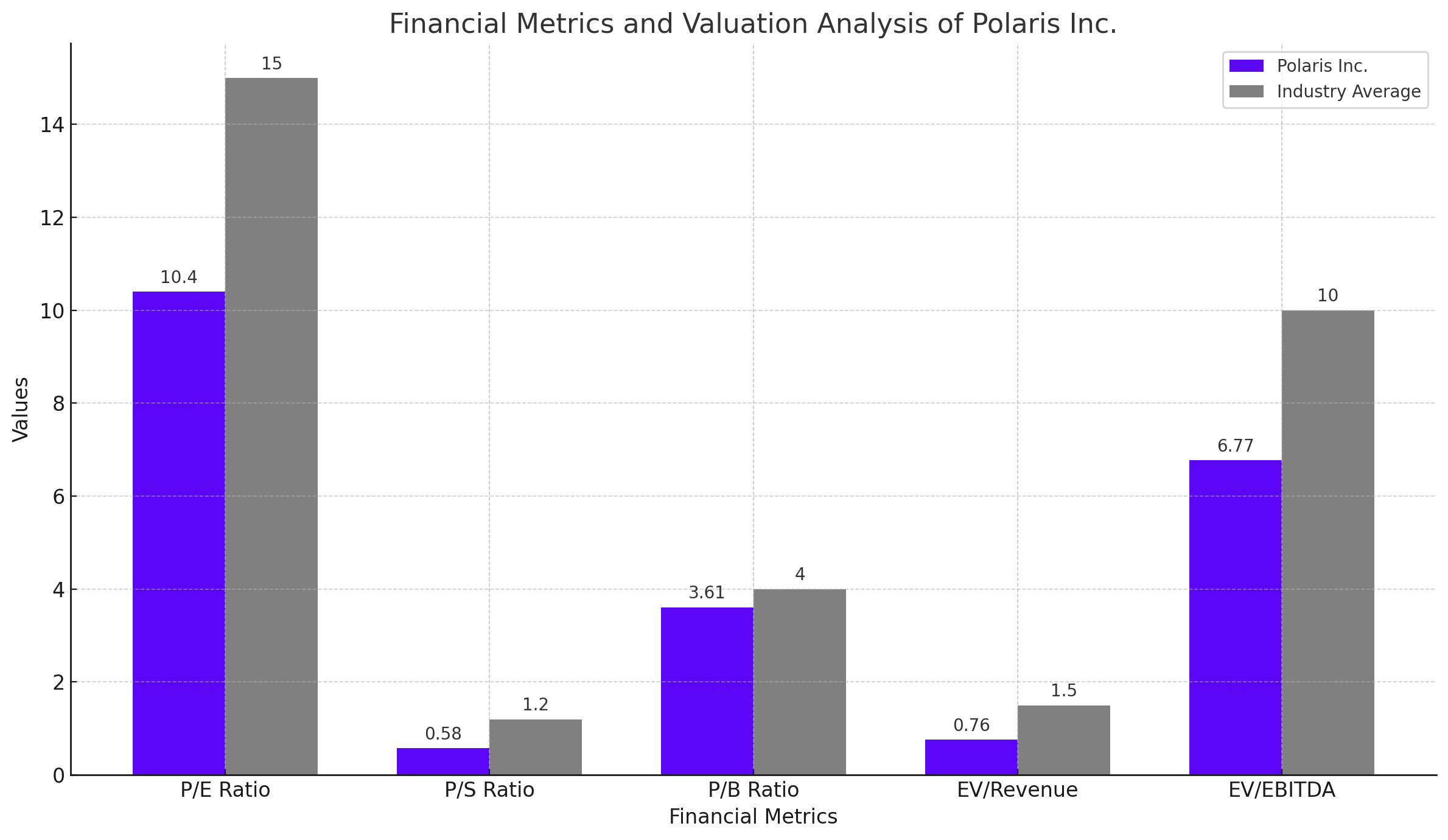

Polaris’s market capitalization stands at approximately $5.11 billion, with an enterprise value of $6.80 billion. The company operates with a trailing Price-to-Earnings (P/E) ratio of 10.40 and a forward P/E of 11.57, suggesting moderate expectations for future earnings growth relative to current earnings.

The stock’s Price-to-Sales (P/S) ratio of 0.58 and Price-to-Book (P/B) ratio of 3.61 indicate a valuation that may appeal to value investors, considering the industry averages. However, its Enterprise Value-to-Revenue (EV/Revenue) at 0.76 and Enterprise Value-to-EBITDA (EV/EBITDA) at 6.77 highlight operational efficiencies and a potentially undervalued stock in comparison to industry peers.

Profitability and Revenue Trends

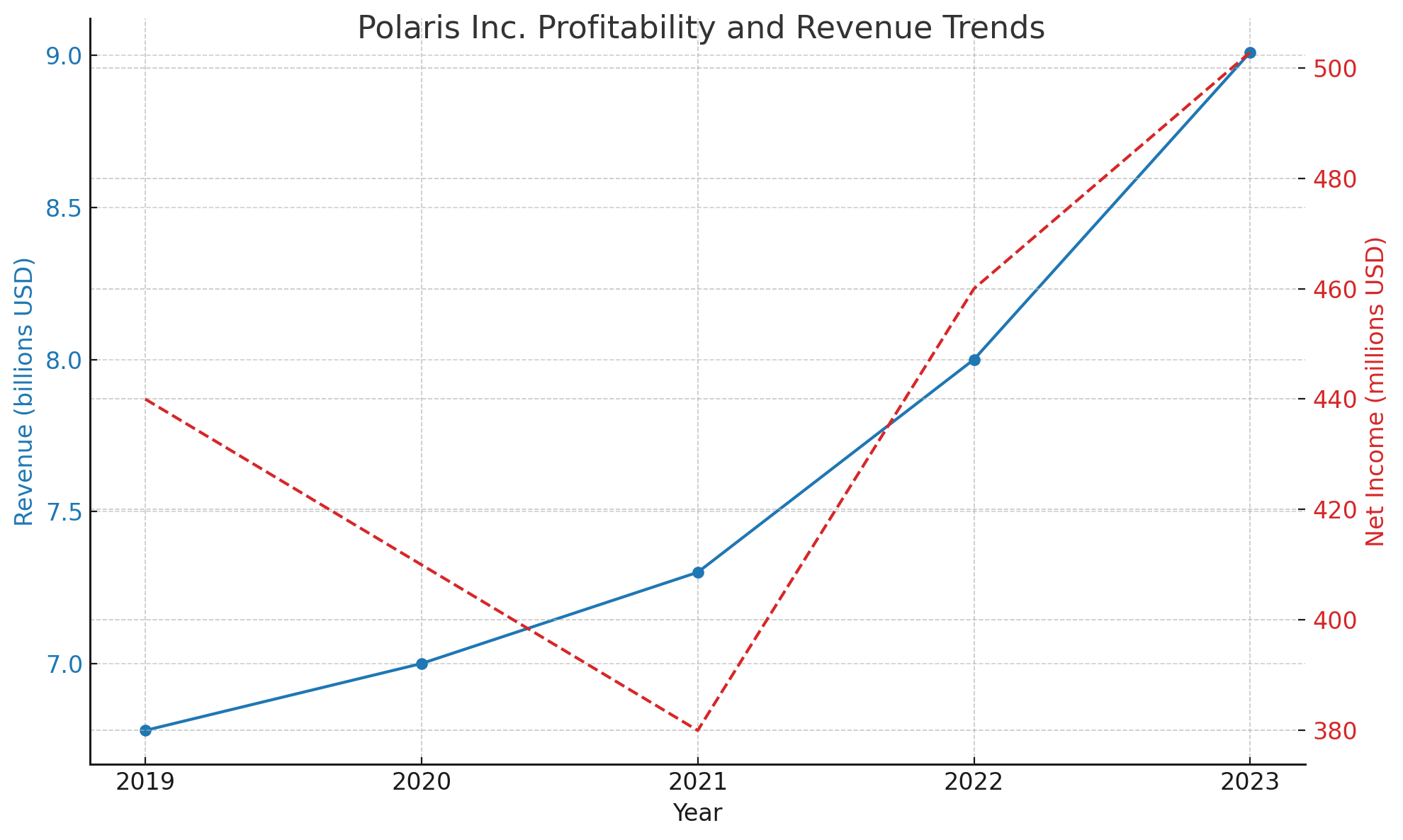

For the fiscal year ending December 31, 2023, Polaris reported a revenue of $9.01 billion, a slight decline year-over-year, marked by a -4.40% growth rate. The net income available to common shareholders was $502.8 million, with a profit margin of 5.58%, reflecting challenges in maintaining profitability amidst fluctuating market demands and operational costs.

Liquidity and Capital Structure

Polaris maintains a total cash reserve of $368.7 million and a substantial debt load of $2.05 billion, leading to a debt-to-equity ratio of 144.50%. Despite this high leverage, the current ratio of 1.39 suggests that the company can cover its short-term liabilities with its short-term assets.

Insider and Institutional Holdings

Insider holdings stand at 5.92%, indicating confidence from management and significant internal investment in the company’s future. Institutional investors own 86.09% of Polaris shares, demonstrating strong external investor confidence and substantial institutional backing.

Dividend Yield and Shareholder Returns

Polaris has consistently increased its dividend, showcasing a commitment to returning value to shareholders. The current forward annual dividend rate is $2.64, yielding 2.92%. This consistent dividend increase, combined with a stable payout ratio of 29.85%, reinforces Polaris's appeal to dividend investors.

Technical Outlook and Future Projections

The stock’s 50-day moving average of $93.03 and 200-day moving average of $100.87 provide key technical levels that traders watch for potential resistance and support. Looking ahead, analysts have mixed forecasts for Polaris with a consensus price target of around $100.73, suggesting a potential upside from current levels.

Operational Challenges and Market Dynamics

Polaris's recent earnings have been impacted by "unexpected operational challenges" as stated by the CEO. These challenges have affected quarterly earnings growth, which saw a significant decrease of 47.10% year-over-year in the most recent quarter. The management’s focus on efficiency and margin initiatives are critical as they navigate through industry cyclicality and competitive pressures.

Investment Strategy: Analyzing Polaris Inc. (NYSE:PII)

Polaris Inc. presents a complex investment landscape, characterized by its robust brand reputation, attractive dividend yields, and the ongoing challenges it faces in operational efficiencies. As the company strives to enhance its operations and capture more market share amid stiff competition, these initiatives warrant close observation by investors. The recreational products sector, to which Polaris belongs, is notably sensitive to economic shifts, with consumer spending and economic health directly influencing the company's performance.

Given the current market conditions and Polaris's strategic responses, the stock represents a potentially undervalued investment. However, the decision to buy, hold, or sell should hinge on several factors:

-

Buy: Investors looking for dividend income and those confident in Polaris's strategy to overcome operational hurdles might view the current valuation as a buying opportunity. The stock could appeal to those who believe in the company's capacity to navigate through its present challenges and leverage economic recovery.

-

Hold: For current shareholders, holding might be advisable. Polaris’s consistent dividend payments and efforts to improve margins could justify waiting to see how its strategic initiatives unfold, particularly if the market stabilizes or improves.

-

Sell: For those with a bearish outlook on the recreational product market or who are concerned about the company's high debt levels and operational challenges, selling might be considered to avoid potential downturns should the economic environment worsen or Polaris’s market strategies falter.

Investment Decision: Hold with Potential to Buy

Given Polaris’s solid fundamentals, consistent dividends, and ongoing strategic efforts amidst a challenging environment, the stock represents a cautiously optimistic investment. Current shareholders should hold, monitoring the company's progress on strategic goals and market conditions. Potential investors might consider buying on dips, leveraging the company’s capacity to rebound post-operational optimizations.

That's TradingNEWS

Read More

-

Google Stock Price Forecast - AI Capex Shock, Cloud Breakout and What $313 Really Prices In

12.02.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast: XRP-USD Stuck Between $1.34 Support And $1.50 Ceiling

12.02.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: WTI Around $63 And Brent $68 Trapped Between Oversupply And Gulf Risk

12.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Jones Holds 50,000 While S&P 500 Steadies and Nasdaq Sinks on Cisco & AppLovin Rout, CPI Looms

12.02.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - GBPUSD=X Stalls Around 1.3630 as Weak UK GDP Meets Robust US Jobs Data

12.02.2026 · TradingNEWS ArchiveForex