EUR/USD Stalls at 1.0400 – Can the Euro Withstand Dollar Strength?

Will U.S. Job Data and Fed Policy Push EUR/USD Below 1.0350? | That's TradingNEWS

Is EUR/USD Stuck in a Trading Range or Preparing for a Breakout?

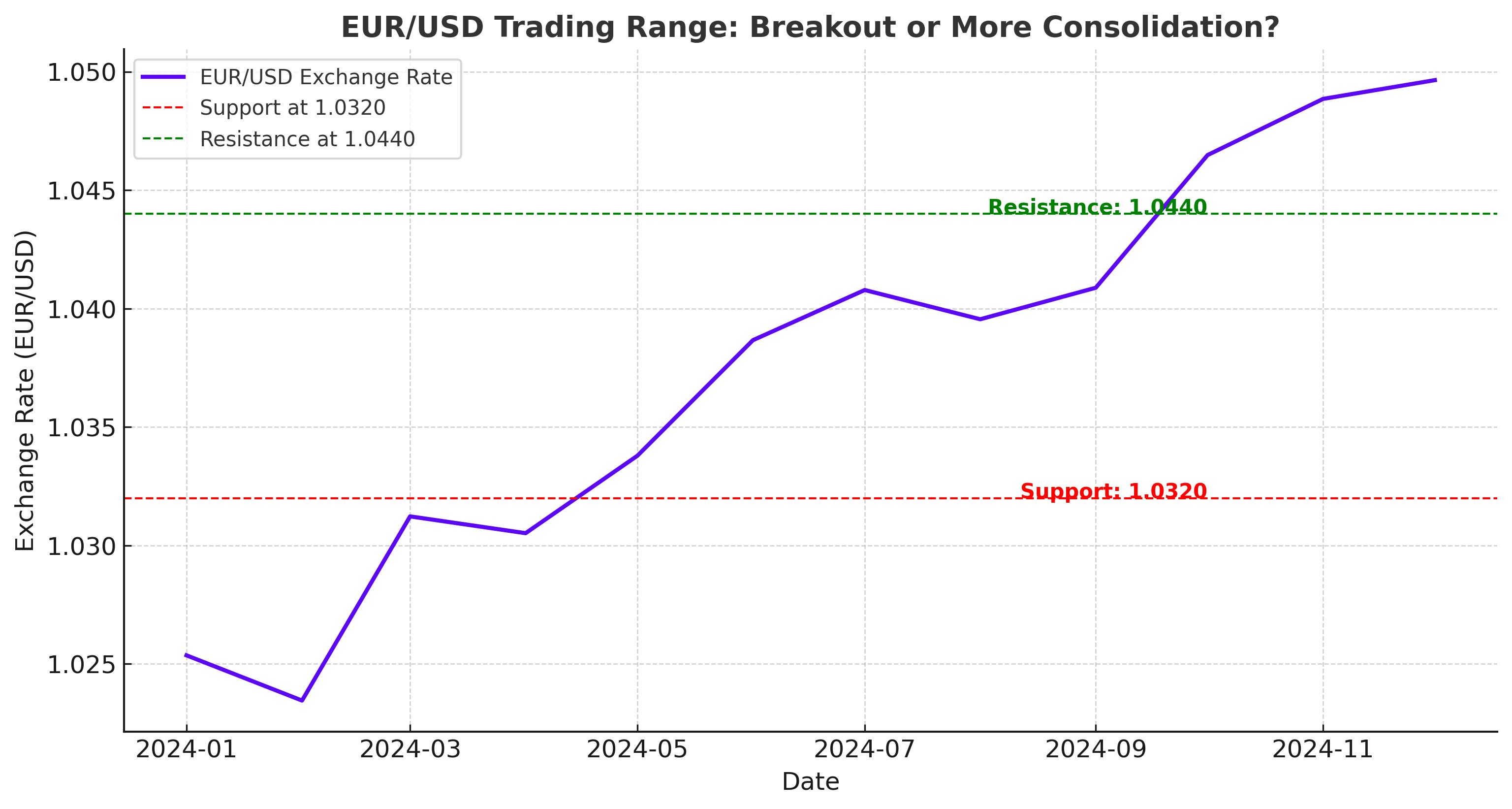

EUR/USD has been trapped between 1.0250 and 1.0490, with the 1.0400 handle acting as a key pivot point. Recent price action suggests consolidation, but with the Non-Farm Payrolls (NFP) report on deck, traders are questioning whether the pair will break out or remain stuck in a sideways range. The short-term outlook is uncertain, with resistance at 1.0440 and support near 1.0320, leaving traders on edge for the next major move.

How Will the NFP Report Impact EUR/USD?

All eyes are on the upcoming Non-Farm Payrolls (NFP) data, which is expected to show 169K new jobs, down from 256K in the prior report. If job growth slows significantly, speculation over Federal Reserve rate cuts could resurface, weakening the U.S. dollar and lifting EUR/USD. However, stronger-than-expected job data could reinforce Fed hawkishness, driving yields higher and sending EUR/USD lower. Will this be the catalyst that finally breaks the pair out of its range?

Can the Euro Hold Above 1.0350 as U.S. Dollar Demand Increases?

The U.S. Dollar Index (DXY) is holding firm at 107.78, reflecting renewed demand for safe-haven assets. The dollar's strength is a headwind for EUR/USD, especially as European economic data remains weak. Eurozone retail sales came in at 1.9% YoY, but monthly figures disappointed at -0.2%, signaling sluggish consumer spending. If the dollar remains in demand, can the euro maintain support above 1.0350, or is a drop toward 1.0250 inevitable?

What Technical Levels Will Determine EUR/USD’s Next Move?

From a technical perspective, EUR/USD is testing critical support near 1.0350 after failing to sustain momentum above 1.0400. The 50-day EMA at 1.0374 is providing short-term support, but if the pair breaks below 1.0320, it could open the door for a slide toward 1.0250. On the upside, a push above 1.0440 could challenge 1.0495, where sellers may step in again. Will EUR/USD break support or stage a comeback?

That's TradingNEWS

Read More

-

GPIX ETF Price Forecast: 8% Yield and Tech-Heavy Covered Call Play Around $52

16.02.2026 · TradingNEWS ArchiveStocks

-

XRPI and XRPR XRP ETFs Rebound as $1.3B Flows Clash With a 60% XRP Price Collapse

16.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: Sub-$3 Slide Turns Winter Spike Into Capitulation

16.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Pair Hovers Near 153 After 3% Drop From 157.7 High

16.02.2026 · TradingNEWS ArchiveForex