Gold's Response to U.S. Political Shifts and Monetary Policy

Delving into the Recent Fluctuations in Gold Prices and Evaluating Long-Term Investment Opportunities | That's TradingNEWS

Comprehensive Analysis: The Future Trajectory of Gold Prices

Navigating Gold's Market Dynamics: An In-depth Look at Recent Trends and Future Projections

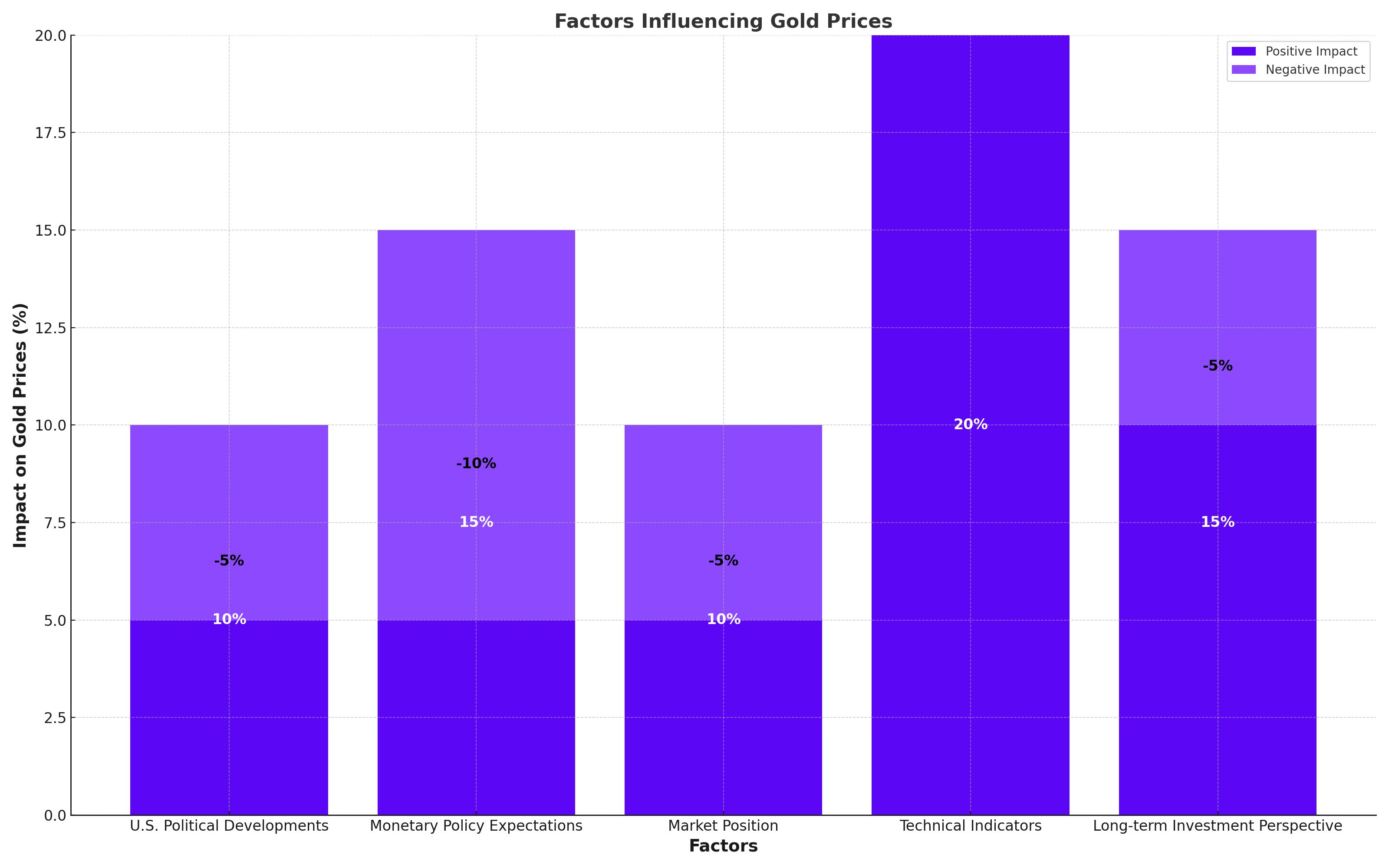

Gold has recently shown signs of volatility, with prices hovering around 11-day lows, influenced by the complex interplay of U.S. politics and expectations surrounding monetary policy. As the market anticipates the next Federal Reserve meeting, there's a palpable tension among investors regarding interest rate directions and their impact on gold.

Current Market Position

As of the latest trading session, spot gold saw a modest increase of 0.1% to $2,398.38 an ounce, with futures marginally rising to $2,399.40. This slight uptick comes after a significant retreat from July's record highs of approximately $2,470, underpinned by a stronger U.S. dollar and speculations about the political landscape reshaping under a potential Donald Trump presidency.

Political Influences and Economic Indicators

The withdrawal of President Joe Biden from the re-election race, endorsing Vice President Kamala Harris, has added a layer of uncertainty that is subtly affecting the gold markets. Investors are closely monitoring these developments, gauging their potential impact on the U.S. and global economy. The upcoming Federal Reserve meeting is another critical event, with widespread consensus leaning towards steady rates, yet the murmurs of possible rate cuts in September persist, fueling both apprehension and anticipation in the gold markets.

Technical and Strategic Outlook

From a technical perspective, gold’s performance remains robust on a year-to-date basis, despite recent pullbacks. The anticipation of Fed policy decisions continues to play a significant role in shaping market sentiments. Investors are advised to watch for key resistance and support levels, with current trends suggesting a potential for rebound if gold maintains above the psychological $2,400 threshold.

Long-term Investment Perspective

For long-term investors, the recent dip might present a buying opportunity, especially if gold resumes its upward trajectory driven by broader economic uncertainties and its traditional role as a safe-haven asset. The strategic stance involves recognizing the cyclical nature of gold prices, influenced by a myriad of factors including U.S. interest rate policies, geopolitical tensions, and shifts in the economic policies of major nations.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex