Intel's NASDAQ:INTC $11 Billion Deal with Apollo

Strategic Partnerships and Technological Advancements: Intel's Path to Market Leadership | That's TradingNEWS

Intel's Comprehensive Strategy and Market Dynamics

Intel and Apollo: Strategic Implications

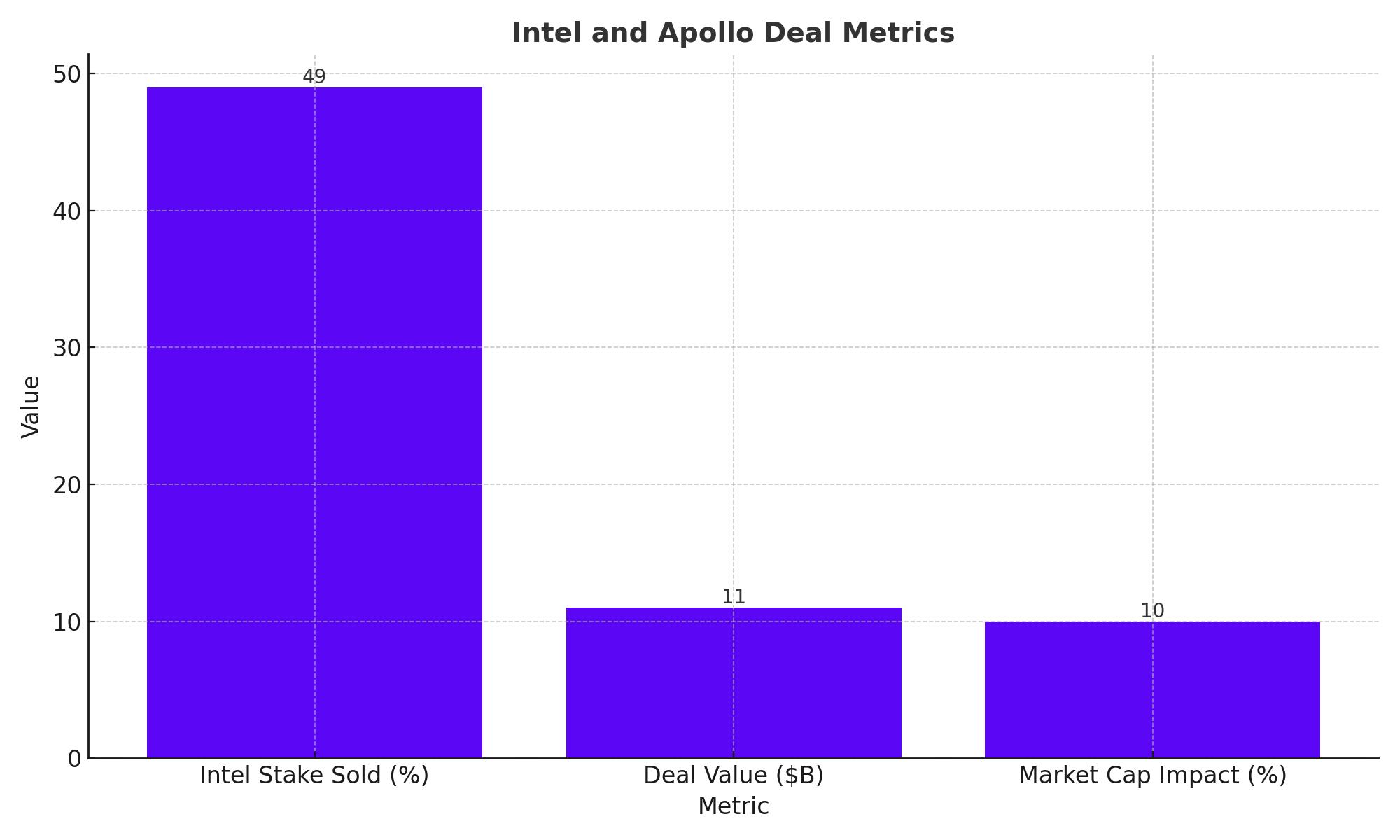

The sale of a 49% stake in the 'Fab 34' facility to Apollo for $11 billion is a pivotal move for Intel, showcasing a strategic shift towards leveraging external capital to enhance its manufacturing capabilities. This move is aimed at reinvigorating Intel’s capital allocation strategy, allowing it to redistribute resources across other burgeoning sectors of its business, particularly in AI and advanced manufacturing technologies.

Impact on Global Manufacturing Operations

Intel has invested over $18 billion in Fab 34, signaling its commitment to leading-edge semiconductor manufacturing. Retaining operational control after the Apollo transaction ensures Intel remains at the forefront of manufacturing innovations, particularly for its Intel 4 process technology. This technology is crucial for maintaining competitiveness against principal rivals like TSMC and Samsung, who are also aggressively expanding their manufacturing capabilities.

Intel’s Market Position and Competitor Analysis

Despite Intel’s substantial investment in manufacturing infrastructure, the company faces stiff competition from Nvidia and AMD, particularly in the GPU and AI sectors. Nvidia’s success with AI-oriented GPUs and AMD’s advancements in chip technology put pressure on Intel to accelerate its innovations. Intel's response includes ramping up its AI and GPU offerings, evident from its developments in AI accelerators and integration of new technologies in client and data center markets.

New Product Launches and Innovations

Intel is not just focusing on manufacturing; it's also innovating in product offerings. The launch of the Gaudi 3 AI accelerators is expected to significantly boost Intel’s portfolio in the AI market, directly competing with Nvidia’s H100 series. These products are critical as Intel aims to capture market share in the high-demand AI processing space, offering substantial performance improvements over previous models.

Financial Health and Investment Insights

Intel's recent transaction with Apollo Global Management, involving the sale of a 49% stake in the Fab 34 facility for $11 billion, marks a significant pivot towards strengthening its financial posture. This infusion of capital—estimated at around 10% of Intel's market cap as of the last trading period—directly enhances its liquidity, which is essential for steering the company's ambitious technological advancements. Notably, Intel's balance sheet reflects a concerted effort to balance aggressive growth with financial stability. As of the latest quarterly report, Intel holds substantial cash reserves, crucial for mitigating risks associated with its capital-intensive projects in semiconductor innovation.

Future Outlook and Industry Positioning

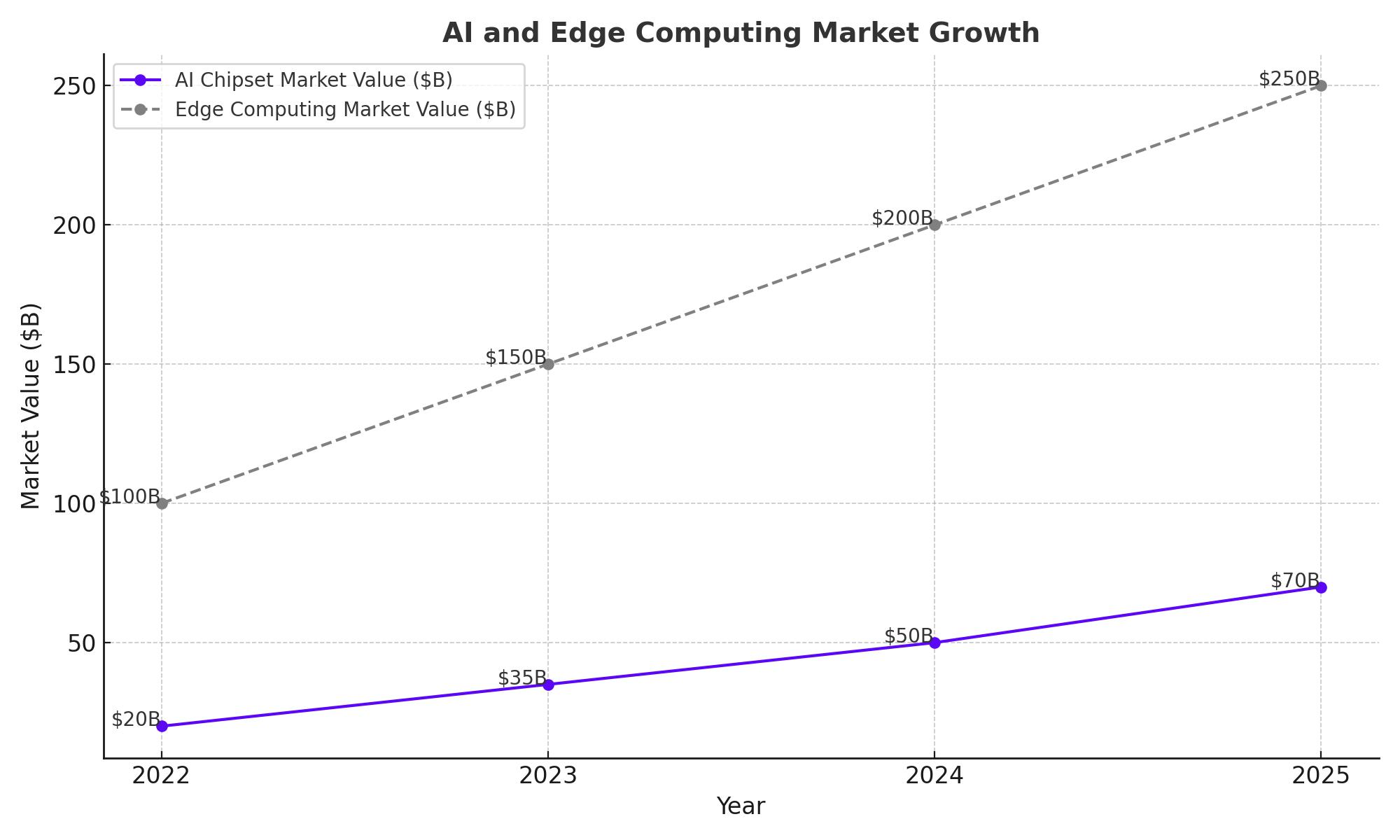

Intel is strategically poised to capitalize on burgeoning tech sectors such as AI, edge computing, and autonomous technologies. With a projected market growth for AI chipsets expected to reach upwards of $70 billion by 2025, Intel's redirection of resources towards these domains could not be more timely. The development of its AI accelerator, Gaudi 3, positions Intel to capture a share of this expansive market, especially as demands for more sophisticated AI capabilities surge across industries. Furthermore, Intel's continued investment in edge computing, projected to grow to $250 billion by 2024, aligns with industry trends towards more decentralized and real-time data processing capabilities. This strategic alignment suggests that Intel is not only stabilizing its financial footing but is also recalibrating its core operational focus to meet future market demands effectively.

Conclusion

Intel's $11 billion Apollo deal exemplifies its strategic agility in a competitive tech landscape. By reallocating funds, Intel aims to bolster its AI and data center sectors, crucial growth areas with significant revenue potential. With the Gaudi 3 AI accelerator expected to generate substantial sales, Intel is positioning itself to capture market share in the rapidly expanding AI chip market. Currently trading around $30, Intel’s financial maneuvers and strategic focus suggest a 'Hold' rating. Investors should monitor revenue growth in new tech ventures, which could shift the outlook to a 'Buy' if Intel's strategies yield expected results.

That's TradingNEWS

Read More

-

SCHD ETF at $31.62: Dividend Rotation Turns a 2025 Laggard into a 2026 Leader

11.02.2026 · TradingNEWS ArchiveEnergy

-

Toyota Stock Price Forecast - TM Near $242 Re-Rates As New CEO Targets Profitability, Hybrids And Software Upside

11.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI and XRPR Lag Price While Fresh XRPZ Inflows and $152M Bank Bets Test the Dip

11.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Defend the $3.00 Floor After Collapse From Above $7.50

11.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Drops Below Key Averages as Yen Rally Targets 152–150 Zone

11.02.2026 · TradingNEWS ArchiveForex