Is SQM Stock a Smart Investment Choice?

Analyzing SQM's Potential in the Lithium Market and Its Impact on Investor Returns | That's TradingNEWS

Revamping Sociedad Química y Minera de Chile’s Financial Outlook

An Insight into SQM’s Current Financial Position

Sociedad Química y Minera de Chile S.A. (NYSE: SQM), a pivotal player in the global lithium market, recently reported financial figures that reflect significant market shifts. The company closed its recent trading session at $48.30, marking a 1.71% increase, indicating a resilient market position despite broader industry challenges. Here, we dissect SQM’s financial health, scrutinizing earnings estimates, revenue trajectories, and profitability margins, offering investors a granular view of its fiscal dynamics.

Financial Performance and Market Dynamics

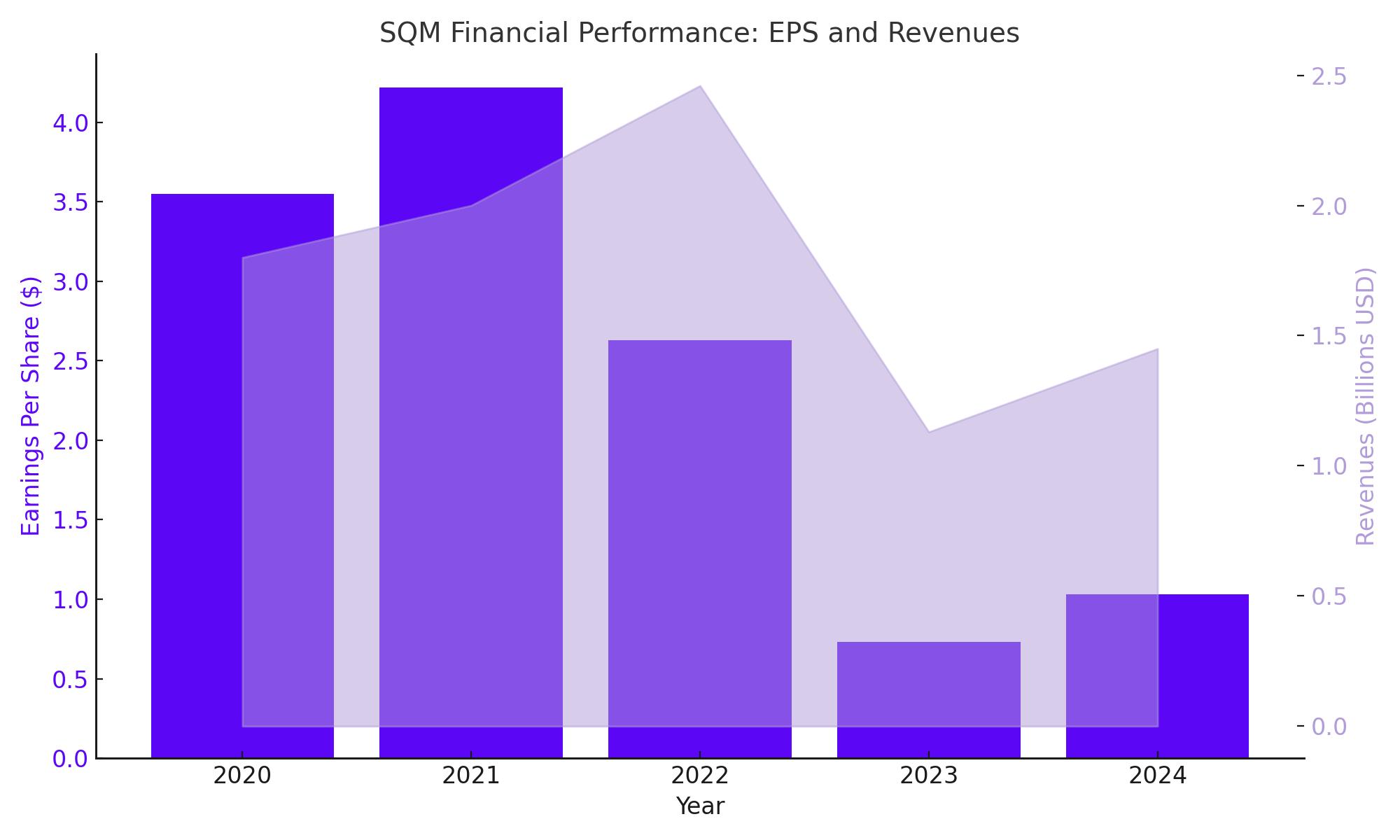

SQM’s recent earnings snapshot reveals a nuanced picture. For the March 2024 quarter, the company is projected to earn $0.73 per share, a stark contrast to the $2.63 recorded a year ago, depicting a 72.20% decline. This anticipated downturn is mirrored in the company's revenue forecasts, with a projected $1.13 billion for March 2024, starkly lower than the $2.46 billion year-over-year.

Earnings and Revenue Trajectories

The trajectory for SQM appears challenging with significant anticipated declines in both earnings and revenue through 2024. Analysts forecast a yearly revenue drop of 29.80% compared to the previous year, with earnings potentially shrinking by 39.60%. Despite these headwinds, the market projects a rebound in 2025, with earnings potentially growing by 40.80%, underscoring potential long-term recovery.

Valuation and Market Adaptability

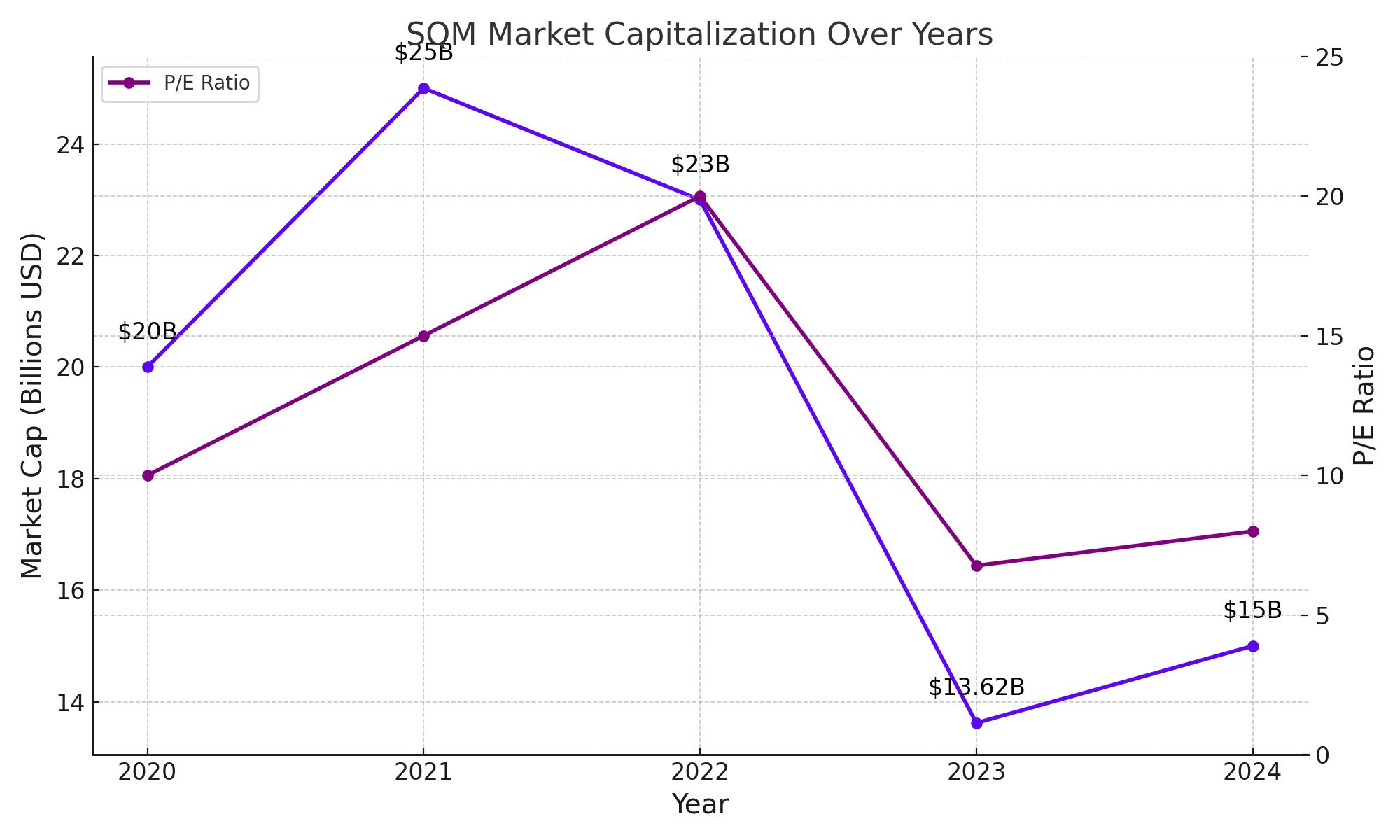

SQM's market capitalization has seen a fluctuation, currently standing at approximately $13.62 billion, down from a previous $23.15 billion, indicating market corrections and adjusted investor expectations. The enterprise value echoes this sentiment, with current figures at $15.76 billion. The P/E ratio, a critical measure of profitability, shows an adjustment to 6.77 from a higher historical average, suggesting a recalibration of market valuation in light of recent earnings adjustments.

Investor Considerations and Future Outlook

Investors eyeing SQM must consider its high beta of 1.11, which signals above-average market volatility. This is particularly poignant for risk-averse investors. Furthermore, the stock's performance over the past 52 weeks shows a decline of 32.62%, highlighting the need for cautious optimism when considering entry points into SQM’s stock.

Financial Resilience Amid Market Fluctuations

Despite the recent downturn in earnings and stock prices, SQM's robust balance sheet provides a cushion against market fluctuations. With a total cash reserve of $2.36 billion and a manageable debt-to-equity ratio of 81.64%, the company remains well-positioned to navigate economic uncertainties. Its ability to generate significant operational cash flow, despite recent challenges, underscores its financial resilience and operational prowess.

Dividend Policy and Shareholder Returns

SQM has maintained a commendable dividend policy, reflecting its commitment to returning value to shareholders. With a forward annual dividend rate of 5.02, yielding 10.40%, SQM stands out as an attractive option for income-focused investors. This robust dividend yield, coupled with a payout ratio of 71.29%, highlights the company's stability and its prioritization of shareholder returns, even during periods of reduced earnings.

Global Lithium Market Dynamics and SQM's Position

The global lithium market, while currently experiencing a downturn, is poised for recovery as demand for electric vehicles and energy storage systems continues to grow. SQM, with its strategic expansions and operational enhancements, is well-equipped to capitalize on this recovery. The company's efforts to boost lithium production capacity, particularly through its projects in Chile and Australia, position it to meet the anticipated increase in demand effectively.

Promising Outlook Amidst Lithium Market Revival

SQM's prospects for long-term growth are anchored in the anticipated rebound of the lithium market, which is expected to benefit significantly from the accelerating adoption of electric vehicles (EVs) and the expansion of renewable energy solutions. The company is actively boosting its lithium production capabilities, enhancing cost efficiencies, and capitalizing on high market demand. With lithium prices forecasted to stabilize and potentially increase as supply tightens and demand surges, SQM's strategic expansion efforts are timely.

Strategic Diversification as a Risk Mitigation Strategy

In addition to its lithium ventures, SQM's diversification into other critical minerals such as iodine and potassium helps buffer the company against the inherent volatility in lithium prices. This diversification not only stabilizes SQM’s revenue streams but also leverages growing markets for these minerals, driven by various industrial and agricultural applications.

Bullish Factors Supporting a Buy Recommendation

Robust Financial Health and Attractive Dividend Policy

Despite the challenges posed by current market conditions, SQM maintains a robust financial framework characterized by a strong balance sheet, significant cash reserves, and a manageable debt profile. The company’s solid financial health is further bolstered by an attractive dividend policy, with a forward annual dividend yield of 10.40% and a payout ratio of 71.29%. These factors make SQM a compelling choice for income-focused investors and underscore its resilience in navigating market downturns.

Strategic Positioning in a Growing Market

As the global market for EVs and renewable technologies matures, the demand for lithium is expected to rise sharply. SQM's strategic initiatives to expand its lithium production capacity are set to position it as a pivotal player in meeting this surging demand. The company’s investments in state-of-the-art extraction technologies and efficiency improvements are poised to enhance its competitive edge and profitability.

Investment Considerations: A Buy for the Resilient Investor

Given the expected recovery in the lithium market and SQM’s proactive strategies, the company presents a promising investment opportunity. Potential investors should consider SQM’s ability to leverage upcoming market expansions, its diversified product portfolio, and strong dividend returns. For those prepared to navigate the periodic fluctuations inherent in the commodity markets, investing in SQM could yield substantial long-term benefits, underscored by the company's strategic market positioning and steadfast commitment to delivering shareholder value.

That's TradingNEWS

Read More

-

Google Stock Price Forecast - AI Capex Shock, Cloud Breakout and What $313 Really Prices In

12.02.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast: XRP-USD Stuck Between $1.34 Support And $1.50 Ceiling

12.02.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: WTI Around $63 And Brent $68 Trapped Between Oversupply And Gulf Risk

12.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Jones Holds 50,000 While S&P 500 Steadies and Nasdaq Sinks on Cisco & AppLovin Rout, CPI Looms

12.02.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - GBPUSD=X Stalls Around 1.3630 as Weak UK GDP Meets Robust US Jobs Data

12.02.2026 · TradingNEWS ArchiveForex