Natural Gas Price Explodes Above $5 As Winter Storm Fern Rewrites The Winter Outlook

Henry Hub futures (NG=F) surge nearly 70% from early-January lows as Arctic cold, freeze-offs and record power prices collide, raising the stakes for the next EIA storage report and February weather models | That's TradingNEWS

Natural Gas Price Spike And Where NG=F Stands After Winter Storm Fern

Henry Hub Repricing From $3 To Above $5 Per MMBtu

U.S. Natural Gas futures at Henry Hub have flipped from a quiet winter trade into a full weather-driven repricing. The front-month NG=F contract is sitting around $5.27 per mmBtu, up roughly 4.6% on the latest session, after printing intraday highs near $5.65 earlier in the week. Only days ago, prompt gas was trading closer to the $3.10–$3.20 per mmBtu band, so the market has effectively added almost $2 of risk premium in a very short period, a move of roughly 60–70% on the contract. Large banks frame a “balanced-market” Natural Gas price near $3.50, with $4.00 already qualifying as “tight”; putting NG=F above $5.00 is the market saying explicitly that short-term fundamentals just shifted to stress mode, not comfort.

Weather Shock And Heating Demand As Primary Driver For Natural Gas

The immediate driver for the Natural Gas spike is the incoming Arctic pattern tied to Winter Storm Fern. The National Weather Service is flagging heavy snow, sleet and freezing rain from the Southern Rockies and Plains through the South and onto the East Coast, with “dangerous ice” and “frigid temperatures” across roughly the eastern two-thirds of the U.S. Forecasts show below-normal temperatures through at least early February, with heating degree days jumping toward the 580+ region versus a near-normal around 395, which is a massive incremental heating load. That demand shock lands directly on a system where gas is still the dominant fuel for home heating and a crucial marginal fuel for power. At the consumer level, gas utility prices were already running 10.8% higher year-over-year in December versus headline CPI at 2.7%; this front-month jump in NG=F will feed into that if the cold pattern refuses to break. The market is not speculating abstractly; it is repricing the fact that every additional day of this Arctic setup translates into higher residential and commercial burn for Natural Gas.

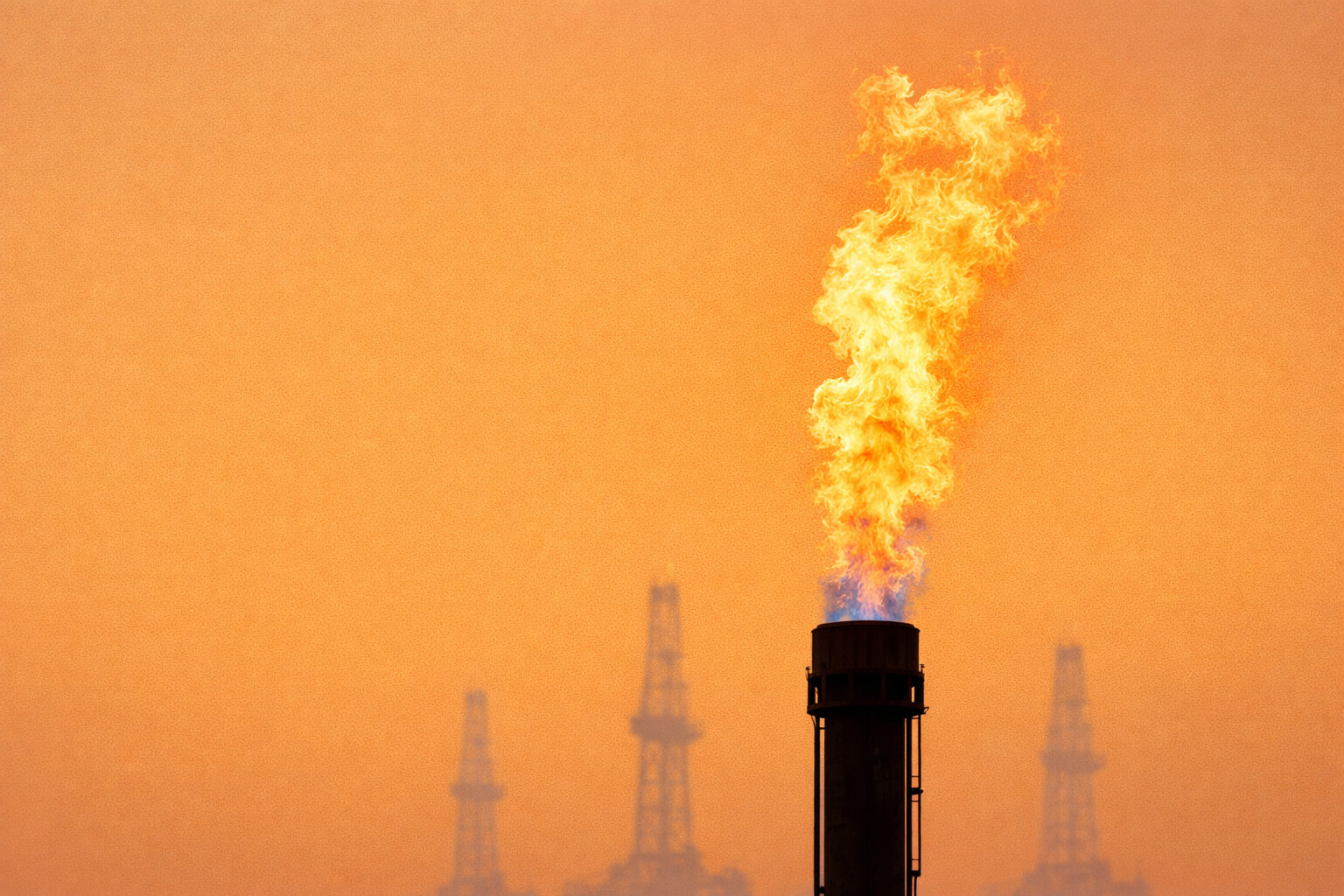

Freeze-Offs, Supply Disruptions And Why NG=F Is Trading A Risk Premium

The bullish pressure is not just from thermostats turning up, it is also from the risk that gas molecules simply cannot reach the market. Severe cold historically causes “freeze-offs,” where wells, gathering lines and other infrastructure become partially or fully inoperable. Past winter events have cut Natural Gas supply by 20–30 Bcf on the low end and 100–140 Bcf in extreme cases. Current vendor ranges for this storm are wide, from 20 Bcf to 200 Bcf of potential impact depending on how long sub-zero conditions persist in critical basins. Early estimates already point to around 3 Bcf per day of production temporarily offline heading into the core of the storm, with disruptions expected to peak around January 26. This is why NG=F is not just reacting to heating demand; the market is pricing a scenario where both sides of the balance sheet move against consumers at the same time, with higher demand and constrained supply. That combination justifies Henry Hub at $5+ even though long-term supply capacity has not structurally broken.

Grid Stress, Power Prices And The Embedded Value Of Natural Gas

The power market is confirming how central Natural Gas is in this setup. In PJM, the largest U.S. grid operator, spot power prices have already spiked beyond $3,000 per megawatt-hour as Winter Storm Fern tightens the system. At those levels, every dispatchable unit is forced onto the grid, including old, inefficient gas turbines that normally sit idle. When power trades above $3,000/MWh, the entire marginal cost stack is driven by fuel availability and deliverability, and in most regions that still means Natural Gas. For NG=F, this is important: grid operators are effectively telling you that gas-fired generation is the non-negotiable backstop when renewables, nuclear and coal are already maxed out. If there is any credible concern that gas cannot be delivered to the plants fast enough because of freeze-offs or pipeline bottlenecks, the prompt month must price in that risk, which is exactly what this spike above $5.00 per mmBtu represents.

Storage, Withdrawals And Why The Market Is Tight But Not Broken

Despite the aggressive move in Natural Gas futures, storage data do not yet signal an outright crisis. The latest EIA report shows a 120 Bcf withdrawal for the week ending January 16, taking working gas in storage down to roughly 3,065 Bcf. Even after that draw, inventories sit about 6% above their five-year average for this date. Before Winter Storm Fern entered the models, traders were generally assuming end-of-winter stocks in the 1.9–2.0 Tcf range. With the fresh cold and higher expected heating demand, that band has slipped toward 1.7 Tcf, which is tighter but not indicative of a 2014-style or 2021-style storage crisis on current information. This is why the back end of the curve has not followed the front month fully higher. The market is saying that if Fern is a one-off extreme and February reverts closer to normal, storage finishes the season leaner but manageable, allowing NG=F to gravitate back toward the $3.50–$4.00 band that large houses define as balanced-to-tight.

Production Capacity, Rig Counts And The Medium-Term Natural Gas Setup

On the production side, nothing in the data suggests that the Natural Gas industry is structurally under-supplied. The latest Baker Hughes count puts total U.S. oil and gas rigs around 544, with gas-directed rigs roughly 122. That is not a boom-era number, but with productivity gains and associated gas from oil plays, it is enough to keep output on a growth path. EIA projections still show U.S. gas production rising in 2026 even as their Henry Hub baseline has prices easing back over the year rather than holding at $5+. That is a critical constraint on the long-term bull case. If NG=F were to stay above $4.50–$5.00 per mmBtu well into the spring shoulder season, producers would lock in those prices via hedging and eventually add more rigs, reinforcing the ceiling on sustained high prices. The current futures structure — very strong front month, flatter outer months — reflects this reality: the market is paying for a winter shock, not a multi-year shortage.

Read More

-

Micron Stock Price Forecast: NASDAQ:MU Near $400 With AI Memory Boom Pointing to $450–$500 Upside

25.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Warning: XRPI And XRPR Under Pressure As XRP-USD Battles The $2 Line

25.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast - Oil Surge on Iran Tensions, But WTI (CL=F) and Brent (BZ=F) Remain Trapped in a Supply Glut

25.01.2026 · TradingNEWS ArchiveCommodities

-

SHLD ETF Price Near Record $78.47 as Defense Tech ETF Rides $3.6T Arms Supercycle

25.01.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast - USDJPY=X Price Dips Toward 155.7 As Rate Checks And BoJ Hawkish Turn Put 160 Ceiling At Risk

25.01.2026 · TradingNEWS ArchiveForex

Speculative Positioning, Short Squeeze Dynamics And NG=F Volatility

The violence of the recent move in Natural Gas is amplified by positioning, not just fundamentals. Managed money accounts came into this cold snap with short exposure in NG=F near 14-month highs, effectively leaning on a warm-winter thesis that worked earlier in the season. When models flipped rapidly to a deep Arctic outbreak and Winter Storm Fern, those shorts were forced to buy back into a thin, weather-driven market. That is how you get a day where Natural Gas jumps more than 17%, adding roughly $0.46 to trade around $3.16 per mmBtu, followed by an explosive three-day rally toward $5.00+ as the short squeeze accelerates. The same leverage applies on the way down. If temperature forecasts warm into mid-February, freeze-offs unwind and power demand recedes, the weather premium collapses and late bulls become the trapped side. For NG=F, the message is simple: this is a contract in a full volatility regime, not a slow-moving utility bond proxy.

Key Fundamental And Technical Zones For Natural Gas And NG=F

For decision-making, the key zones in Natural Gas are clearly defined by the interplay between fundamentals and pricing. On the upside, sustained closes for NG=F above the $5.50–$6.00 per mmBtu area would imply that the market is no longer just pricing Winter Storm Fern, but also either a second significant cold event, deeper-than-expected freeze-offs, or further deterioration in the storage trajectory toward levels below 1.6–1.7 Tcf by the end of winter. That would be a different regime, where rationing via price becomes a real discussion. On the downside, a decisive break back through the $4.00 per mmBtu handle would signal that much of the winter premium is being unwound. Below $4.00, the strip would be converging back toward the $3.50 “balanced” marker that Bank of America and others have emphasized, consistent with storage still above the five-year average and production normalizing as freeze-offs clear. The path that NG=F takes within this $4–6 band will be dominated by daily updates in weather models and EIA storage numbers.

Investment View On Natural Gas And NG=F: Tactical Buy, Strategic Hold

Putting all the pieces together, Natural Gas / NG=F is in a classic short-term squeeze environment: prompt prices around $5.27 per mmBtu, recent intraday spikes to $5.65, heating demand set to jump as Winter Storm Fern drives temperatures lower, freeze-offs already knocking out several Bcf per day, PJM power prices spiking past $3,000/MWh, and speculative shorts being forced to cover. Against that, storage is still 6% above the five-year average at 3,065 Bcf, end-of-winter estimates near 1.7 Tcf are tight but not catastrophic, rig counts are stable, and EIA still projects rising output and easing Henry Hub prices over 2026. On this mix, the stance is clear and has to be explicit. For traders with a high risk tolerance and the ability to monitor weather and positioning closely, NG=F at current levels is a tactical Buy, because the payoff remains skewed to the upside if the cold proves deeper, longer or more disruptive than currently priced, and if additional freeze-offs or grid stress force another leg higher. For medium-term directional investors, Natural Gas here is a strategic Hold rather than a fresh long; once this winter shock washes out, the same production capacity, storage buffer and forward curve shape that kept Henry Hub near $3.00–$3.50 before Fern will reassert themselves and can drag NG=F back into that range. The trade is therefore bullish in the very near term, but not justified as a long-duration structural bull call at $5+ without evidence of multiple storms, chronic supply failures or a meaningful break in the storage and production outlook.