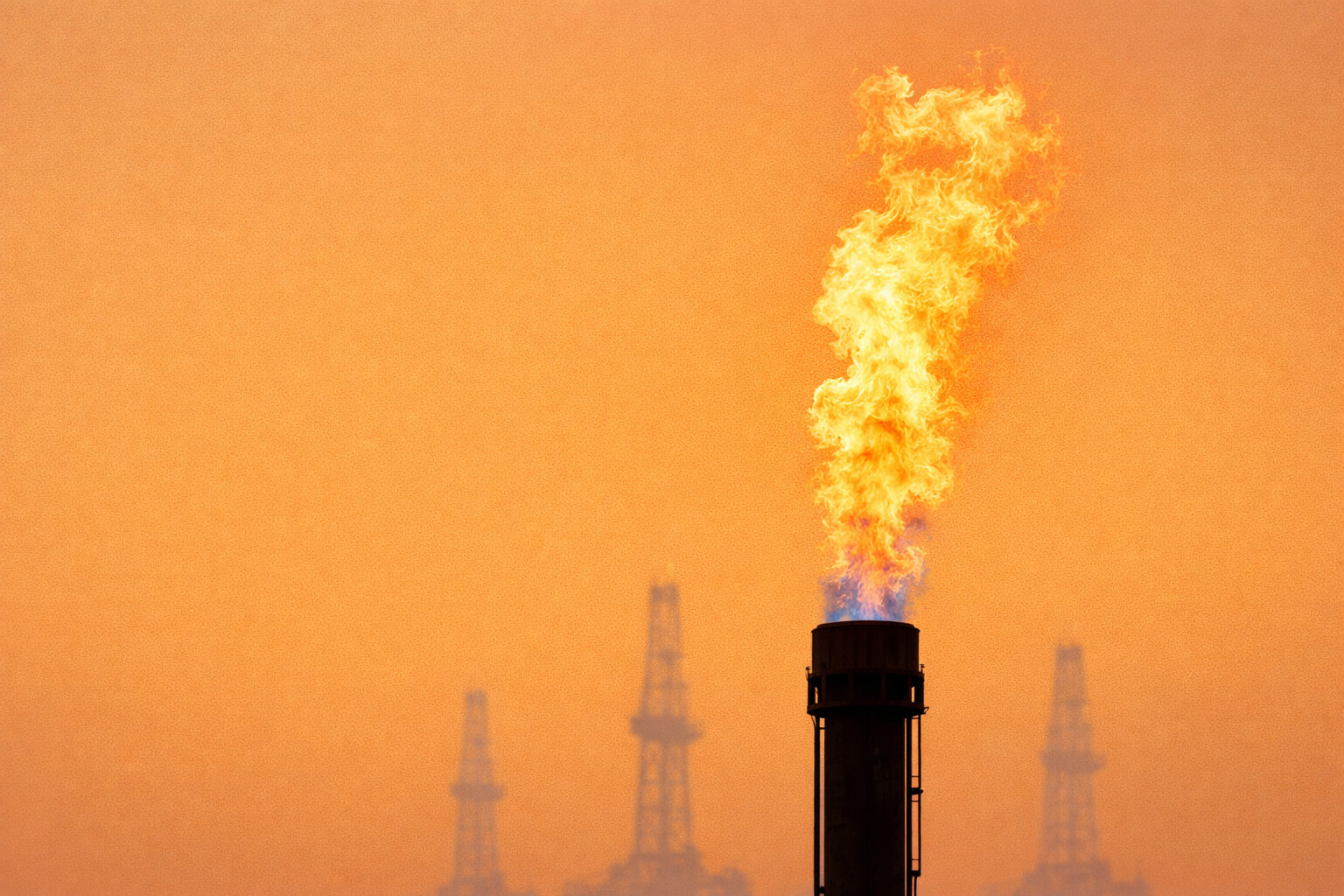

Natural Gas Price Jumps Above $6 as Arctic Blast Knocks U.S. Output to Two-Year Low

Front-month NG=F surges toward $6.90/mmBtu after freeze-offs cut Lower-48 production to ~92.6 bcf/d, LNG feedgas and EU stocks tighten, and a short-squeezed curve sends the February contract into a weather-driven spike | That's TradingNEWS

Natural Gas Price NG=F Blows Through $6 On Weather Shock

Front-Month NG=F Spike Versus A Skeptical Forward Curve

February U.S. natural gas futures NG=F have ripped into the $6.20–$6.95/mmBtu band, with an intraday high near $6.97/mmBtu and a daily move of roughly +31%. Over the last five sessions the front contract has surged about 89%, a classic squeeze at the very front of the curve. March gas, however, trades far lower around $3.70–$3.86/mmBtu, leaving a front-to-second-month spread of roughly $2.30–$3.20/mmBtu. That steep backwardation signals that traders are paying a huge premium only for immediate barrels, not for gas later in the season. With NG=F above $6.90 and March stuck below $4.00, the strip is effectively calling this move a short-lived, prompt-delivery dislocation, not a multi-month structural shift in U.S. pricing.

Freeze-Offs Slash U.S. Output And Turn NG=F Into A Weather Trade

The fundamental driver is a direct hit to supply. An Arctic blast has knocked U.S. production to a two-year low, with Lower-48 output sliding to about 92.6 bcf/d over the weekend before only partially recovering toward 95.5 bcf/d. That leaves production still close to 10% below normal flow, at the exact moment winter demand peaks. Freeze-offs — liquids and water in the stream turning solid and blocking flow — are hitting key basins in Texas, Louisiana and parts of the Midcontinent, forcing wells and gathering systems offline. When roughly one in ten produced molecules disappears overnight, the clearing price for NG=F has no choice but to reprice sharply higher until the system thaws.

Demand Skyrockets To 156 bcf/d As Power Grids And Pipelines Strain

On the consumption side, U.S. gas demand is tracking near 156 bcf/d this week, compared with a five-year January average around 137 bcf/d. That ~19 bcf/d demand uplift is colliding with constrained supply and limited short-term flexibility. Power markets are already flashing stress: PJM Interconnection logged roughly 21 GW of generation outages and moved into pre-emergency procedures, asking load to back off. At the same time pipelines into the Eastern seaboard are once again constrained, leaving the Northeast heavily dependent on how much gas the rest of the network can push through a historically tight corridor during sustained cold. The combination of 156 bcf/d of demand and sub-96 bcf/d of output justifies front-month NG=F above $6/mmBtu, but it does not automatically justify keeping the entire curve there once temperatures normalize.

LNG Feedgas, Europe And Asia: NG=F Becomes A Global Signal

Because the U.S. is now the largest LNG exporter, the domestic squeeze is bleeding straight into global pricing. Feedgas flows into U.S. LNG plants dropped sharply over the weekend as freeze-offs and pipeline issues cut available volumes, tightening the Atlantic Basin. European benchmark Dutch TTF gas extended its rally above €40–€43/MWh (roughly $13–$15/mmBtu), with EU storage sliding to about 46–48% of capacity, below the five-year seasonal norm. Asia faces its own heating demand spike, meaning every missing U.S. cargo matters. With NG=F near $6.50+, the U.S. hub is acting as the fulcrum of a globally interconnected gas system that now reacts in real time to U.S. wellhead and pipeline disruptions.

Storage Cushion: Why The NG=F Rally Looks More Event-Driven Than Structural

Despite the violent move in NG=F, the storage backdrop is not screaming crisis. U.S. inventories entered this cold snap 4.8% above last year and around 6.1% above the five-year average for mid-January. A large draw is coming on the next EIA report — the market is already braced for that — but the starting point is a surplus, not a deficit. To justify a durable Henry Hub regime above $6–$7/mmBtu, storage would need to be grinding toward critically low levels into late February and March, not sitting comfortably above historical norms. That mismatch between an elevated prompt price and still-healthy storage is exactly why several commodity desks describe this as a “strong but likely short-lived” weather rally rather than a lasting repricing of U.S. gas.

Read More

-

DGRO ETF Price Forecast: Is iShares’ Dividend Growth Fund Still a Buy Near $71?

26.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Trade Tightens as XRPI, XRPR and Bitwise XRP Slip with XRP-USD Near $1.90

26.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast - Oil Price Holds Near Highs: $61 WTI, $66 Brent As Storm Losses Offset Kazakh Restart

26.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Slides to 154: Intervention Chatter Replaces Dip-Buying Before Fed

26.01.2026 · TradingNEWS ArchiveForex

Contract Expiry, Shorts And Volatility: NG=F Becomes A Squeeze Machine

The calendar is amplifying every tick. The February NG=F contract expires this week, pulling liquidity forward into a contract dominated by physical players, hedgers and leveraged shorts who came into January positioned for mild winter and low volatility. The shock move — nearly +90% in five sessions — has all the hallmarks of a short squeeze: shorts forced to cover into thin order books while physical buyers scramble for near-term supply. With expiry imminent, even modest changes in weather forecasts or pipeline/production updates can force aggressive repricing as traders try to exit or roll positions before settlement. Until the February contract is off the board, NG=F remains a street fight between weather models and forced position-management rather than a calm, fundamentals-only market.

Curve, UNG And Producers: Who Actually Benefits From $6+ NG=F?

The steep backwardation is dictating who wins and who barely notices. The United States Natural Gas Fund (UNG), which holds a mix of front-month and later-dated futures, is up only around 4% while prompt NG=F is up 17–30% on the day. The reason is simple: exposure further out the curve, where prices are still anchored below $4/mmBtu, dilutes the impact of the front-month spike. Gas-heavy E&Ps like EQT and Antero Resources are showing modest single-digit gains because most of their volumes are hedged and their equity value reflects multi-year price expectations, not a one-week weather pop. LNG exporter Cheniere Energy has actually traded slightly lower, around -0.5% to -1%, as markets weigh lower feedgas, potential operational noise and higher spot input costs against strong global prices. The real beneficiaries of $6+ NG=F are short-horizon physical traders and volatility desks running regional and time-spread arbitrage, not long-term equity holders.

Cross-Asset Context: Natural Gas Surges While Oil And The Dollar Stay Measured

The natural gas spike is unfolding in a macro environment that is tense but not disorderly. Crude oil trades near $60–$61/bbl, gold has broken through $5,000/oz, and the dollar index hovers around 94–95. Equity indices are positive on the day, and there is no broad liquidation across risk assets. That pattern confirms that NG=F is reacting to a specific physical and weather shock, not a systemic financial panic. When oil is relatively subdued and only gas is dislocated, positioning is dominated by energy specialists, utilities and weather desks rather than macro tourists dumping risk across the board. As soon as the weather catalyst fades and infrastructure normalizes, those same specialists can unwind trades aggressively, reinforcing the idea that today’s pricing is event-driven rather than a permanent reset.

Natural Gas / NG=F Investment Stance: Short-Term Bearish, Tactical Sell Into Peak Freeze

Putting the numbers together, the stance on Natural Gas / NG=F is tactically bearish — effectively a Sell once the cold peak and February expiry are behind the market. Front-month NG=F near $6.20–$6.95/mmBtu is being held up by a temporary ~10% production loss, weather-driven demand around 156 bcf/d, and an expiry-driven short squeeze, while the curve beyond February still prices gas in the high-$3s/mmBtu. Storage sits 4.8% above last year and 6.1% above the five-year average, producers and LNG names are not being repriced as if $6 gas is sustainable, and global benchmarks are reacting in a way consistent with a sharp but finite U.S. disruption. The risk to this view is a second or extended Arctic blast that keeps output pinned near 92–95 bcf/d for weeks or triggers deeper infrastructure failures. Absent that, the current structure says Natural Gas / NG=F is a weather-driven spike to fade, not a new secular bull market to chase, and the higher it trades into the thaw and contract roll, the more asymmetric the downside becomes for late longs.