Trading News S&P 500, Nasdaq Rally Amid Trade Truce: Is the Market Ready to Break Higher?

With inflation concerns and trade tensions easing, is this the right time to buy, or will Nvidia (NVDA) and other tech stocks lead the way? | That's TradingNEWS

S&P 500 Edges Up Despite Disappointing Consumer Sentiment Data

The S&P 500 (GSPC) continued its upward trajectory on Friday, advancing 0.3% as investors shrugged off the latest disappointing consumer sentiment data. Despite a pullback in consumer confidence, the index remains on track for a sharp weekly gain, having risen by 4.6% this week. The Dow Jones Industrial Average (DJI) gained 198 points, or 0.4%, while the Nasdaq Composite (IXIC) climbed 0.1%. This reflects the broader optimism in the markets, fueled by easing trade tensions between the U.S. and China after a 90-day truce agreement on tariffs. The Nasdaq has posted a stellar performance, up more than 6% for the week.

Tech Stocks Lead Market Rally

Tech stocks have been at the forefront of this rally, especially as the trade truce alleviated concerns about the negative impacts of tariffs on global supply chains. Scott Welch, Chief Investment Officer at Certuity, noted that while mega-cap tech stocks may not continue to dominate performance in the future, there is still ample room for diversification in a market experiencing higher volatility. Investors have recognized the potential risks associated with a narrow focus on large tech stocks and have embraced a more diversified approach, seeking opportunities in other sectors as well.

Market Reaction to Consumer Sentiment Data

The University of Michigan’s consumer sentiment survey revealed a notable decline, with the index falling to 50.8 in May from 52.2 in April, marking its second-lowest reading on record. The sharp drop in sentiment, fueled by rising inflation expectations, overshadowed the broader market optimism. Consumers now expect inflation to rise to 7.3% in the next year, up from 6.5% in April. This surge in inflation concerns could suggest that rising costs might become a more prominent issue, despite easing trade tensions.

Options Expiry Fuels Market Volatility

On Friday, options market activity added to the potential for increased volatility. Goldman Sachs estimated that over $2.8 trillion in notional options exposure would expire, marking the highest level for any May trading day. This large expiry could lead to unpredictable price movements, depending on how traders adjust their positions ahead of the expiration.

U.S. Tariffs and Trade Negotiations

President Donald Trump also addressed the ongoing tariff situation, stating that his administration would send letters to many countries in the next two to three weeks, detailing the new tariff rates that would apply to their imports. This move is part of the broader strategy to reshape global trade relations, as the U.S. continues to negotiate with various countries to assert more control over its import-export dynamics.

Stock Moves and Corporate News

Coinbase (COIN) experienced a 9% rally on Friday, recovering from previous losses after analysts dismissed concerns about the U.S. Securities and Exchange Commission's investigation into its user numbers. Wall Street analysts argued that the inquiry focused on a metric Coinbase hasn't used in over two years, and thus, the concerns were overblown.

Meanwhile, Galaxy Digital (GLXY) opened at $23.50 per share on the Nasdaq, following its direct listing. The stock briefly traded at $23.98 as the company prepares for growth, especially in the burgeoning sectors of cryptocurrency and artificial intelligence. Galaxy Digital’s valuation hinges on these two areas, as highlighted by CEO Mike Novogratz, who emphasized their importance for the company's future.

Merger and Acquisition Activity

Charter Communications (CHTR) surged more than 6% in premarket trading after announcing its $21.9 billion merger with Cox Communications, creating one of the largest broadband and cable providers in the U.S. This merger, which would bring together two of the biggest players in the cable industry, aims to provide a comprehensive package of broadband, TV, and mobile services to consumers. The deal is part of Charter's strategy to combat the decline in traditional cable TV subscriptions by bundling services and leveraging economies of scale.

Consumer Sentiment and Economic Outlook

While the stock market has rebounded strongly, consumer sentiment continues to dampen optimism. The University of Michigan's survey of consumer sentiment showed a sharp decline in expectations, with pessimism about inflation becoming more entrenched. The continued worry over inflation is partly driven by the U.S. administration's tariffs, which have put upward pressure on prices. As the U.S. consumer is increasingly concerned about rising costs, it is clear that while the stock market may be recovering, economic conditions are still uncertain.

Vistra Corp. Stock Surges

In the energy sector, Vistra Corp. (VST) saw a significant premarket jump of 3% following its announcement of the acquisition of seven natural gas facilities from Lotus Infrastructure Partners for $1.9 billion. This move diversifies Vistra’s natural gas fleet and adds approximately 4% to its earnings before interest, tax, depreciation, and amortization (EBITDA). These facilities, located in key energy markets like PJM and California, position Vistra well to take advantage of rising energy demand in those regions.

Novo Nordisk and CEO Shakeup

In the healthcare sector, Novo Nordisk (NVO) experienced a 4% dip in premarket trading after the announcement that CEO Lars Fruergaard Jørgensen would step down due to increasing competition in the obesity drug market, particularly from Eli Lilly (LLY). The company’s share price has fallen by 22% year-to-date, reflecting investor concerns about losing its market leadership in obesity treatments to competitors like Eli Lilly, whose Zepbound obesity drug has surpassed Wegovy in U.S. prescriptions since mid-March.

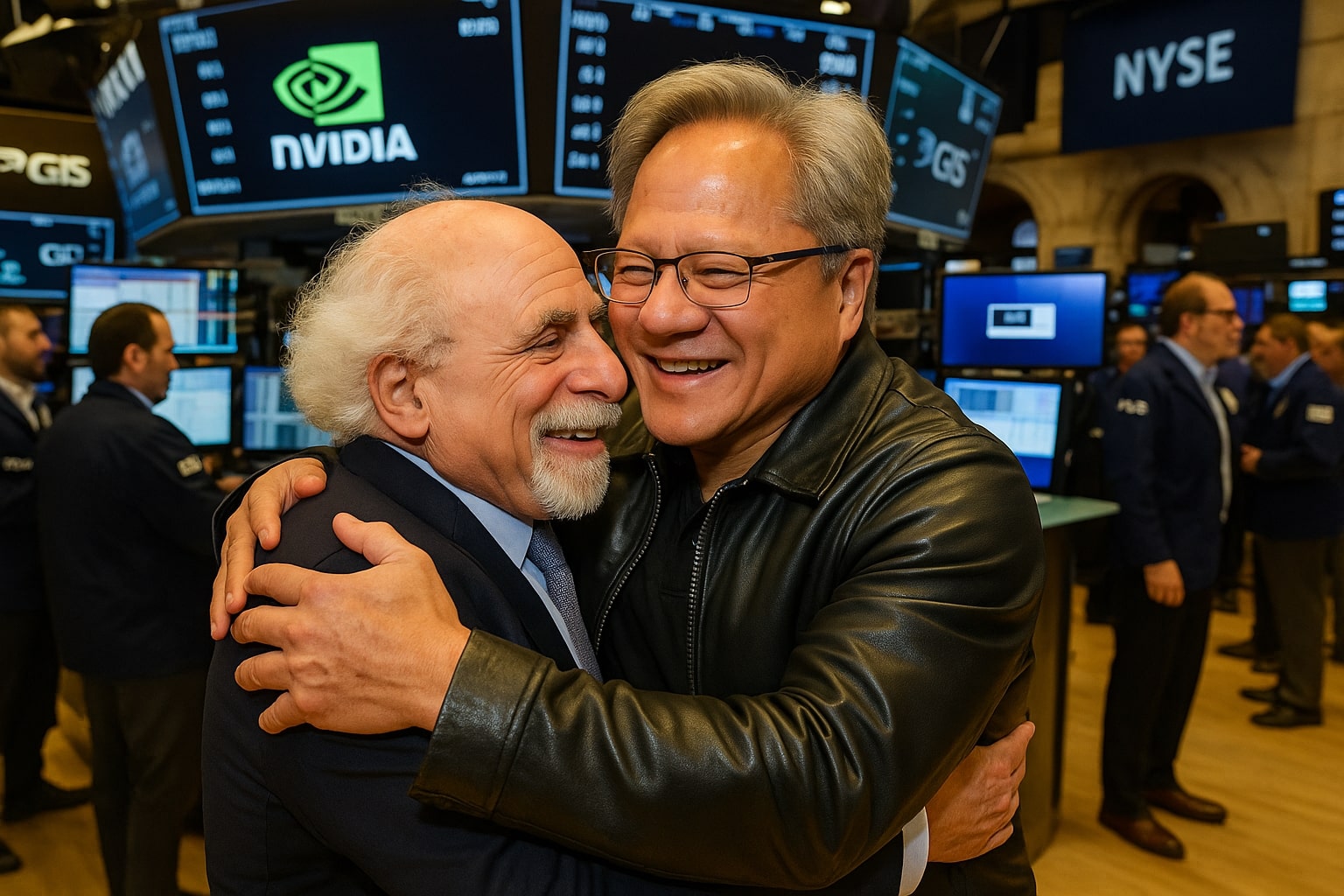

Nvidia’s Stock Surge

Nvidia (NVDA) continued its remarkable performance, surging over 15% this week, driven by optimism around deals that would send millions of Nvidia chips to the United Arab Emirates and Saudi Arabia. This boost in stock price was also a result of market confidence in the broader semiconductor sector, with Nvidia being one of the biggest beneficiaries of the growing demand for chips in industries like artificial intelligence and cryptocurrency mining.

Conclusion: Bullish or Bearish?

As of now, the market sentiment remains cautiously optimistic. The S&P 500 and other major indices have managed to recover significant ground this week, aided by the easing of U.S.-China trade tensions and strong performances in tech stocks. However, ongoing concerns about inflation, rising tariffs, and weak consumer sentiment suggest that volatility could remain a dominant feature in the market. For now, buying opportunities remain in select sectors such as tech and energy, while investors should be mindful of potential headwinds in consumer-driven sectors.

That's TradingNEWS

Read More

-

GPIQ ETF Price Forecast: Can a 10% Yield at $52 Survive the Next Nasdaq Selloff?

09.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Price Forecast: XRPI at $8.32, XRPR at $11.86 as $44.95M Inflows Defy BTC and ETH Outflows

09.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Forecast: Will The $3.00 Floor Hold After The $7 Winter Spike?

09.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Back Under 50K While S&P 500 and Nasdaq Push Higher as Gold Reclaims $5,000

09.02.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast: Can Bulls Clear 157.5 Without Triggering a 160 Intervention Line?

09.02.2026 · TradingNEWS ArchiveForex