TradingNEWS Analyzing - Is Meta a Buy Post-Q1 Earnings Plunge?

A comprehensive review of Meta's financial performance, strategic initiatives, and market dynamics post-Q1 2024 earnings | That's TradingNEWS

Analysis: META Stock Post-Q1 Earnings Plunge

Market Reaction - Why NASDAQ:META Stock Has Plunged ?

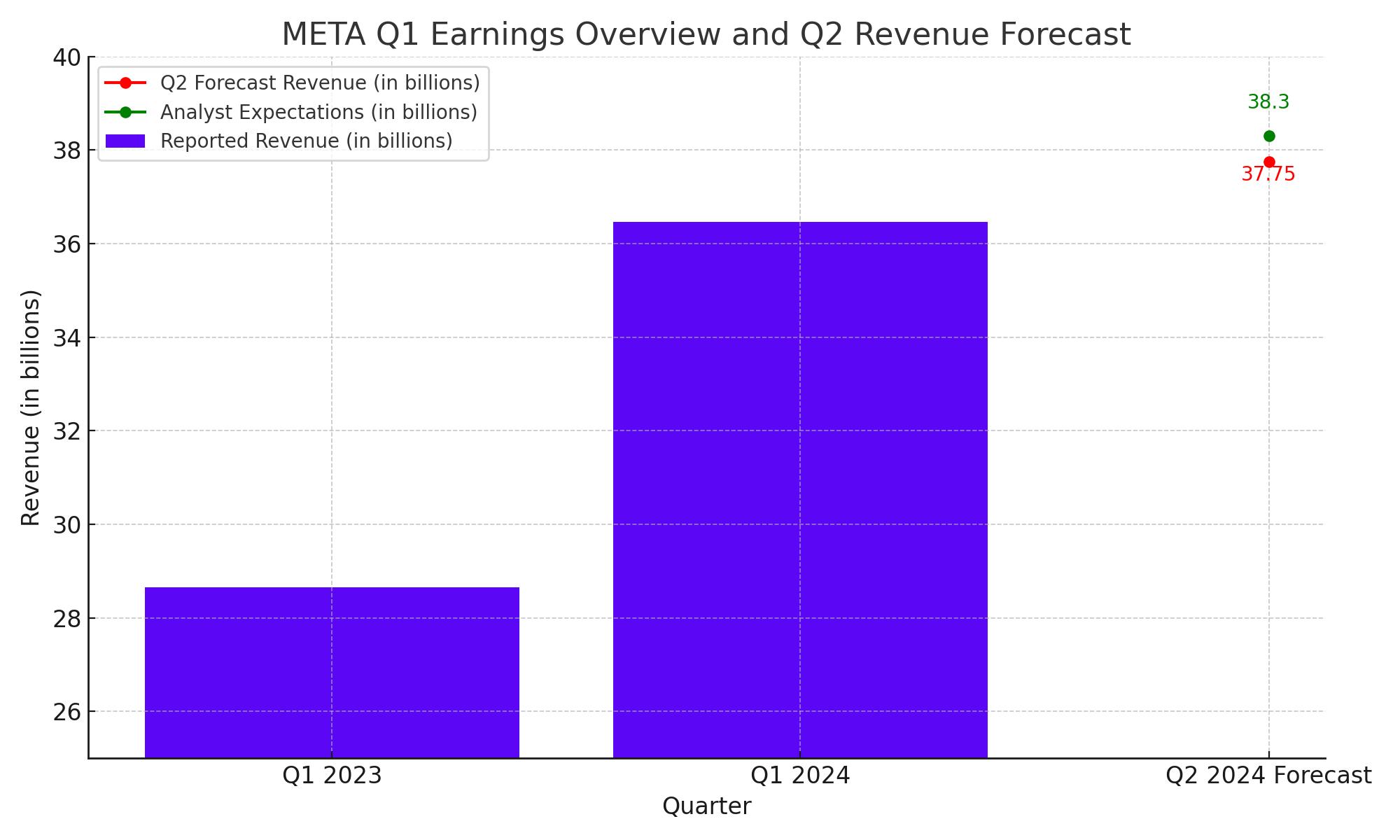

Meta Platforms, Inc. (NASDAQ:META) experienced a significant drop in its stock price, primarily due to its conservative revenue forecast for the second quarter of 2024, which disappointed market expectations. Despite reporting robust financial results for Q1 2024, including a 27% increase in revenue and a substantial rise in earnings per share, the company projected Q2 revenues to be between $36.5 billion and $39 billion. This forecast, with a midpoint of $37.75 billion, is below the analyst consensus of $38.3 billion. This cautious outlook, coupled with the announcement of increased capital expenditures for AI and mixed reality technologies, raised concerns about near-term profitability and the substantial investments in areas that have yet to prove financially beneficial. The combination of these factors led to a sharp 16% decline in Meta's stock price as investors adjusted their expectations based on the perceived risks and slower anticipated growth.

Comprehensive Review of Q1 Financial Performance

Meta Platforms, Inc. (NASDAQ:META) demonstrated remarkable financial performance in the first quarter of 2024, with earnings per share (EPS) climbing significantly to $4.71, outperforming the analysts' consensus estimate of $4.32. This represents a profound increase from the $2.20 per share reported in the same quarter the previous year. The company's revenue surged to $36.46 billion, up 27% from $28.65 billion in Q1 2023. This growth rate is the fastest the company has experienced since 2021, highlighting a robust recovery and expansion phase within its core business operations.

Detailed Examination of Cost Management and Efficiency

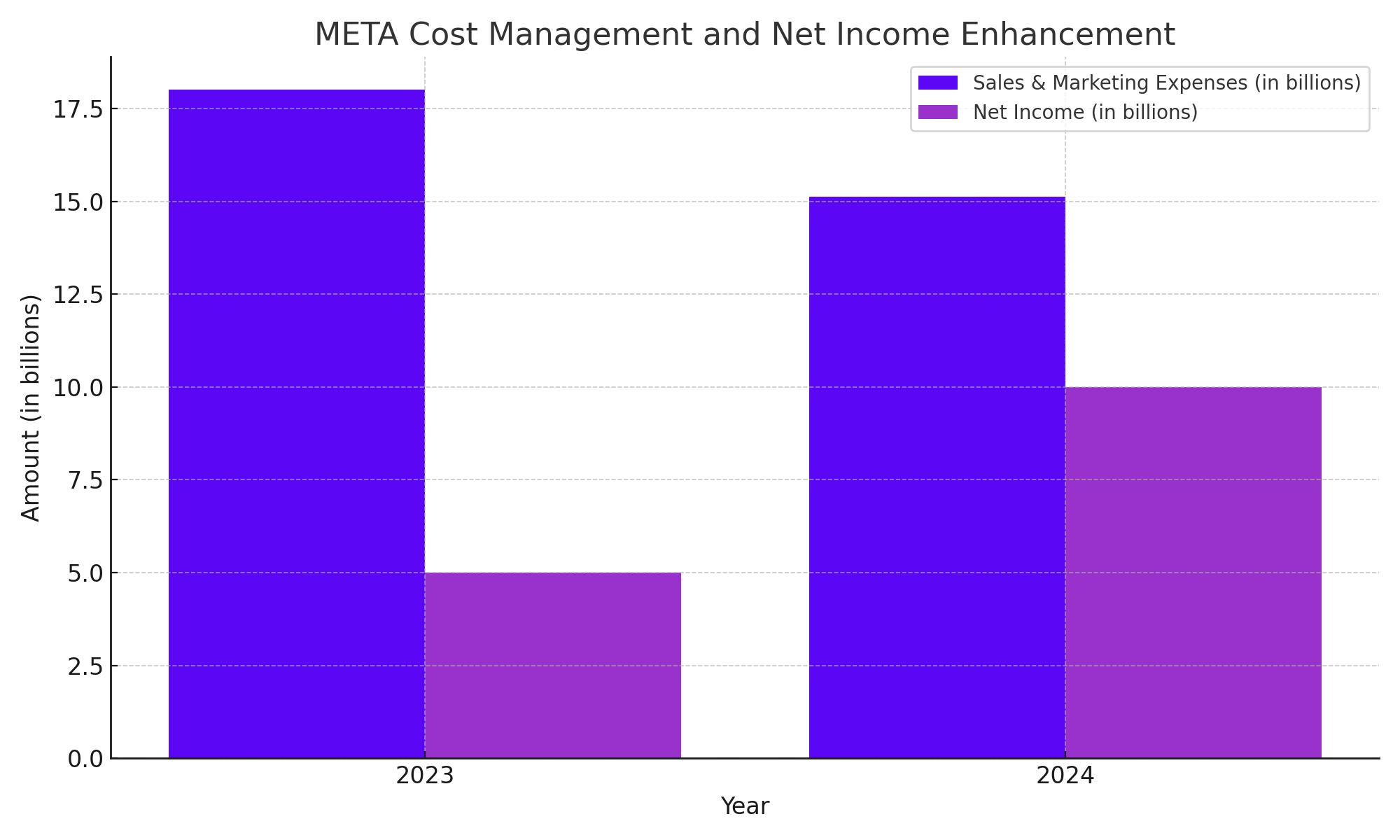

One of the highlights of Meta's Q1 report was its enhanced cost management strategies. The company successfully reduced its sales and marketing expenses by 16% compared to the previous year. This reduction played a critical role in doubling its net income, aligning with CEO Mark Zuckerberg’s initiative dubbed the "year of efficiency." This initiative, started in 2023, focused on streamlining operations and reducing workforce numbers, which saw a significant reduction in headcount by approximately 10%, leading to a leaner, more efficient organizational structure.

Strategic Investments and Future Outlook

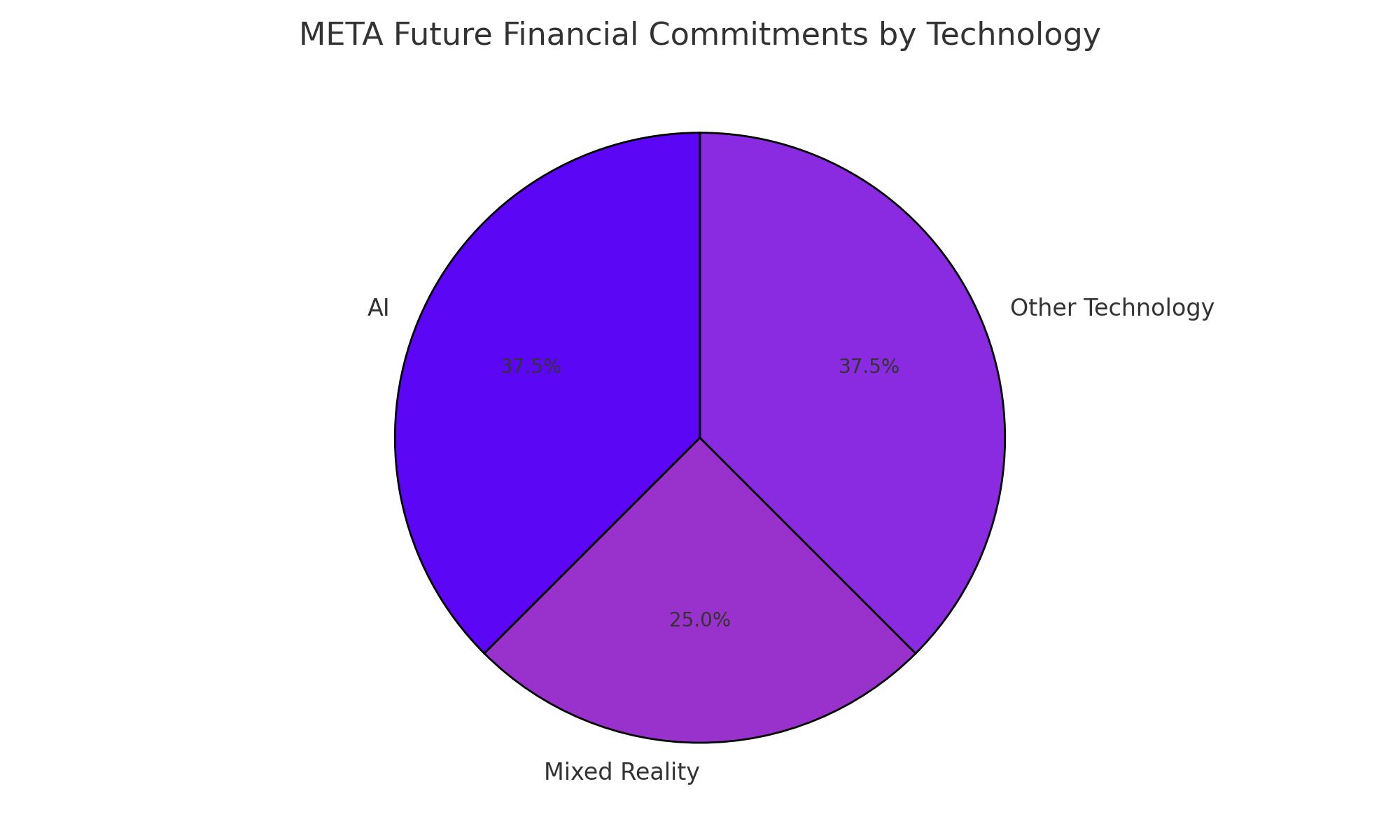

Despite the robust earnings, Meta's Q2 revenue forecast presents a cautious outlook, with projections ranging between $36.5 billion to $39 billion—slightly below the anticipated market expectation of $38.3 billion. This conservative forecast can be attributed to substantial ongoing and future investments in emerging technologies such as artificial intelligence (AI) and mixed reality. Zuckerberg underscored the company's commitment to these key areas, which, while not yet profitable, are expected to be crucial drivers of Meta's future growth. Reflecting this commitment, the company has adjusted its 2024 capital expenditures forecast to $35 billion to $40 billion, up from the initial projection of $30 billion to $37 billion.

Advertising Revenue Growth and User Engagement

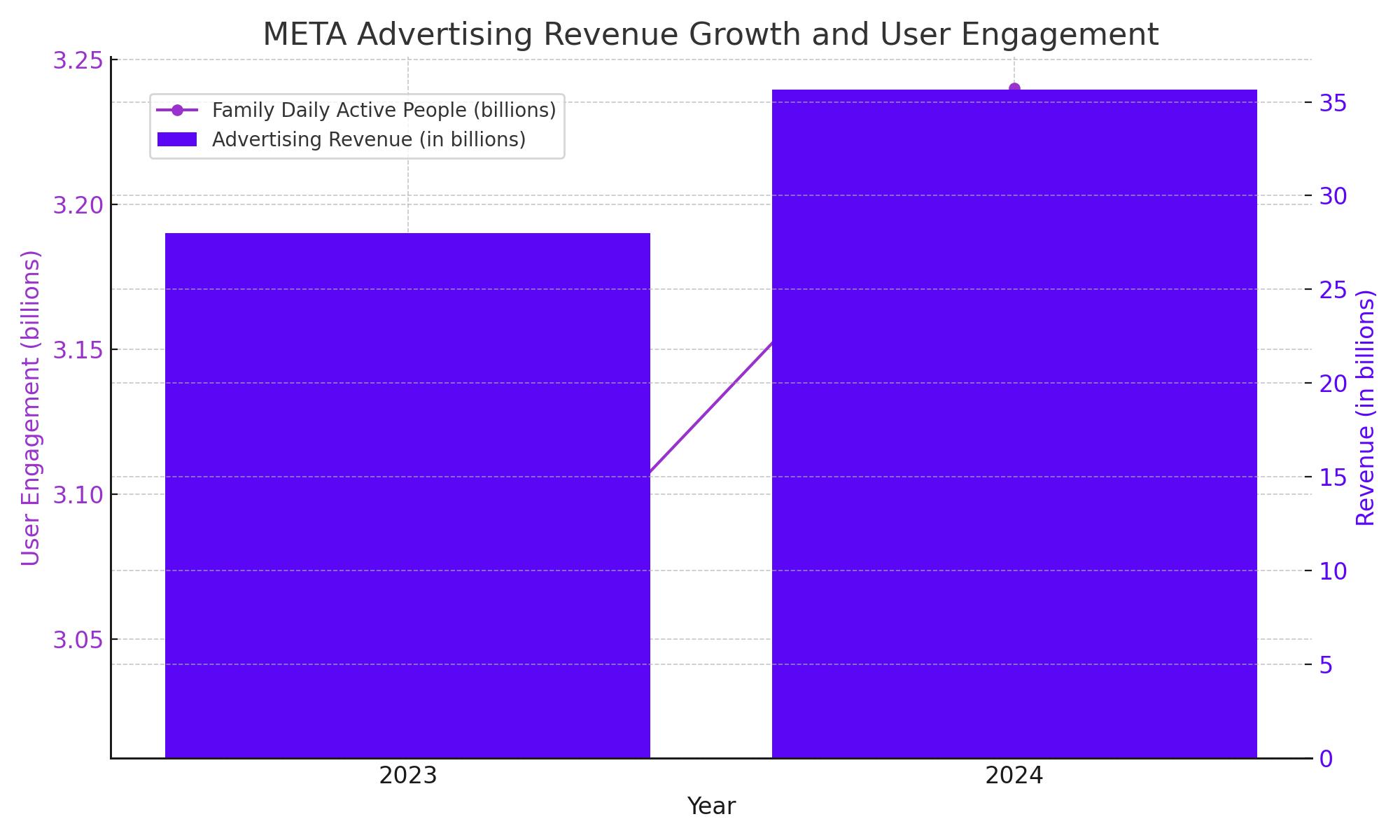

Meta's advertising revenue showed a significant increase, rising 27% to $35.64 billion in Q1. This growth was bolstered by the company's sophisticated AI-driven ad targeting technologies, which have enhanced the relevancy and effectiveness of ads displayed across its platforms. In terms of user engagement, Meta has shifted its reporting metrics to focus on "family daily active people," which reached 3.24 billion in March 2024, marking a 7% increase year-over-year. This metric offers insights into the broader engagement across all Meta platforms, rather than just focusing on individual products like Facebook or Instagram.

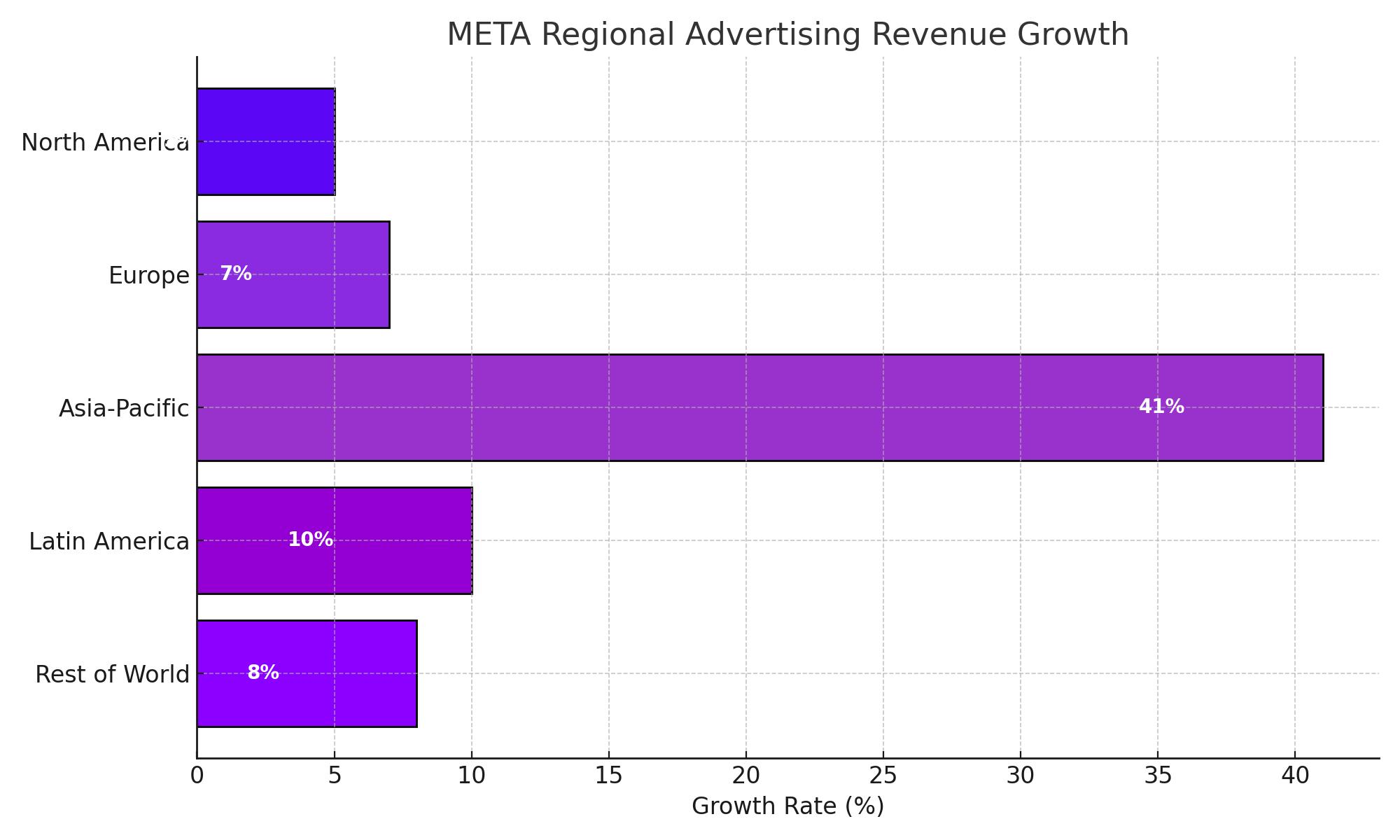

Regional Dynamics and Global Economic Influence

The Asia-Pacific region emerged as a standout performer with a 41% increase in ad revenue, propelled by robust gains in online commerce and gaming sectors. This regional performance is particularly vital as it provides a buffer against slower growth or potential downturns in other significant markets, especially given the ongoing uncertainties in Chinese advertising spend due to regulatory and economic factors.

Investor Sentiment and Stock Valuation

Post-Q1, Meta's stock valuation and investor sentiment have shown signs of strain, primarily due to the conservative revenue forecast and the extensive funds earmarked for future tech investments. Currently, Meta's price-to-earnings (PE) ratio stands at 25.51, with a forward PE of 22.52. These figures suggest a potentially attractive valuation in comparison to historical standards, yet investor apprehension remains due to anticipated heavy expenditures that might pressure short-term profitability but are deemed essential for long-term strategic growth.

Market Dynamics and Financial Outlook

Meta's strategic investment in AI and augmented reality technologies has significantly influenced its forward-looking financial projections. The company's anticipated capital expenditures of $35 billion to $40 billion highlight a robust commitment to infrastructure development essential for supporting advanced AI applications. This increase from the initial forecast of $30 billion to $37 billion underscores a vital shift in operational priorities, focusing heavily on technology that could revolutionize user interaction and ad delivery systems on its platforms.

Revenue Trends and Projections

The first-quarter revenue performance was strong, showing a 27% increase year-over-year, the fastest since 2021. This is indicative of Meta's ability to leverage its broad user base and sophisticated ad-targeting capabilities. However, the projected Q2 revenue of $36.5 billion to $39 billion, particularly the midpoint of $37.75 billion, presents a more conservative growth outlook of 18% year-over-year. This projection is slightly below the analysts’ average estimate of $38.3 billion, reflecting potential challenges in scaling revenue at the same explosive rate observed in previous quarters.

Advertising Revenue and Market Share

Meta’s advertising revenue, which accounts for the vast majority of the company’s income, showed a substantial increase of 27% to $35.64 billion in Q1. This growth is pivotal as it represents Meta's rebound in the digital ad market space. The increase in ad revenue is particularly notable against the backdrop of recovery from the adverse impacts of privacy changes initiated by Apple, which had previously dampened Meta's ad targeting effectiveness.

Global Economic Impact and Regional Performance

The financial outlook for Meta is also influenced by broader economic conditions, particularly in key markets like the Asia-Pacific region, which witnessed a 41% increase in advertising revenue. This region's performance is critical, given its role in compensating for slower growth or potential downturns in other areas. Furthermore, the ongoing economic stabilization and increased spending from Chinese discount retailers, despite concerns over reduced expenditure from China as the year progresses, remain vital factors to monitor.

Investment in Innovation and Cost Management

Meta’s focus on innovation, especially in AI and mixed reality, is a long-term strategy aimed at creating new revenue streams and enhancing user engagement. However, this comes with high upfront costs and uncertain payback periods, contributing to the cautious investor sentiment. Additionally, the company's effective cost management, as evidenced by a 16% reduction in sales and marketing expenses, has been crucial in boosting its net income amidst significant revenue growth.

User Engagement Metrics and Platform Growth

The shift in reporting metrics to "family daily active people," which was 3.24 billion in March 2024, up 7% from the previous year, offers a broader view of user engagement across all Meta platforms. This metric highlights the expansive reach of Meta's services and is critical for assessing the company’s ability to maintain user interest and engagement over time.

Investor Sentiment and Stock Valuation

Despite the strong financial performance, investor sentiment remains cautious, influenced by the conservative revenue outlook and the high capital expenditures planned for future technology investments. Meta's current PE ratio of 25.51 and a forward PE of 22.52 suggest a potentially attractive valuation, though the extensive investment in future technologies and the current market reaction suggest a bearish outlook in the short term.

Conclusion

Given the mixed signals of strong current performance versus cautious future revenue projections and significant investment in unproven technologies, the recommendation for Meta stock is a hold. Investors should monitor the company's ability to manage its ambitious investment strategies while maintaining robust revenue growth. This cautious approach balances the potential long-term gains from its strategic investments against the immediate financial uncertainties and market volatility.

That's TradingNEWS

Read More

-

Google Stock Price Forecast - AI Capex Shock, Cloud Breakout and What $313 Really Prices In

12.02.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast: XRP-USD Stuck Between $1.34 Support And $1.50 Ceiling

12.02.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: WTI Around $63 And Brent $68 Trapped Between Oversupply And Gulf Risk

12.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Jones Holds 50,000 While S&P 500 Steadies and Nasdaq Sinks on Cisco & AppLovin Rout, CPI Looms

12.02.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - GBPUSD=X Stalls Around 1.3630 as Weak UK GDP Meets Robust US Jobs Data

12.02.2026 · TradingNEWS ArchiveForex