Alphabet's Financial Resilience: Unpacking Growth and AI Innovation

A deep dive into Alphabet Inc.'s strategic growth levers, including Google Cloud's profitability, AI advancements, and the broader implications for the tech ecosystem and investor strategies | That's TradingNEWS

Understanding Alphabet's Financial Dynamics: A Strategic Insight into Recent Performance and Future Prospects

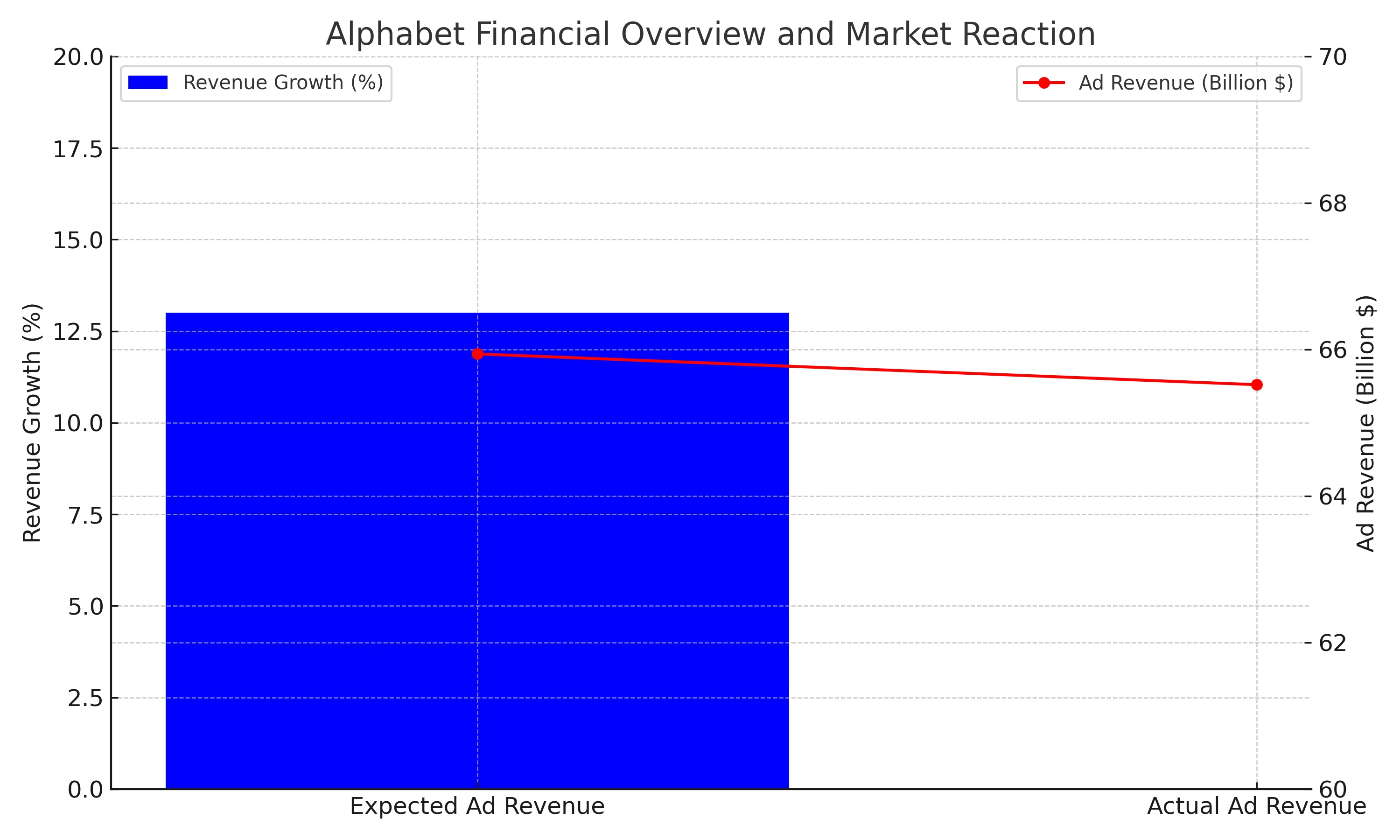

Alphabet's Financial Overview and Market Reaction

Alphabet Inc., the parent company of Google, has demonstrated resilience and strategic prowess in its latest quarterly financial results, despite the challenges posed by a dynamic digital advertising landscape. With a reported revenue surge to $86.31 billion, surpassing the $85.33 billion forecast by LSEG, Alphabet has solidified its position as a tech behemoth. This 13% revenue growth from the previous year marks the fastest quarter for revenue increase since early 2022, showcasing Alphabet's capacity to navigate market volatilities effectively. However, the stock experienced a 6% dip in extended trading due to ad revenue falling short of the anticipated $65.94 billion, settling at $65.52 billion.

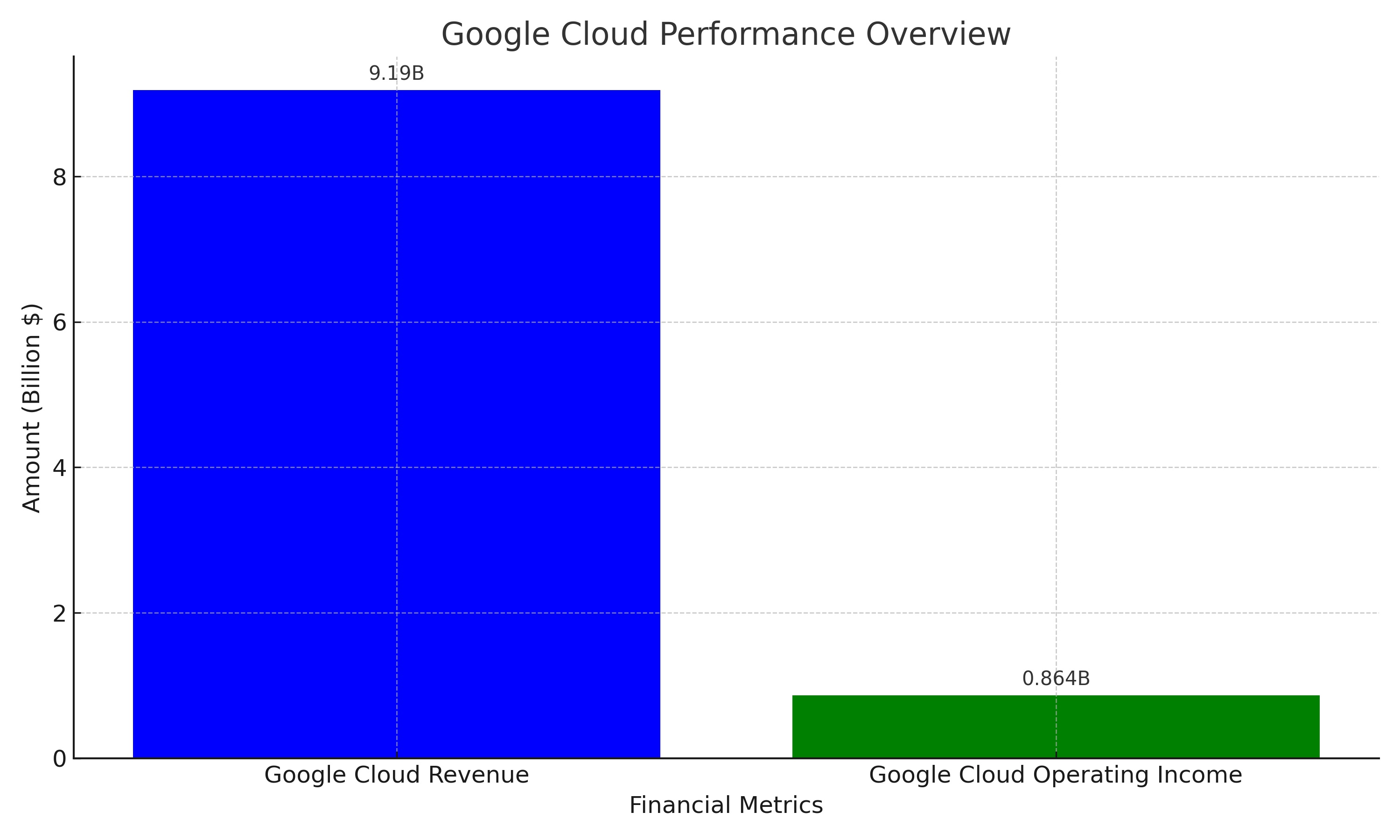

Google Cloud: A Beacon of Growth

A pivotal growth driver for Alphabet is its Google Cloud segment, which outperformed expectations with a revenue of $9.19 billion against the anticipated $8.94 billion. This 26% year-over-year growth underlines Google Cloud's accelerating traction in the competitive cloud market, finally turning a profit with a $864 million operating income, a stark contrast to the previous year's loss. This shift not only highlights Alphabet's strategic realignments but also its aggressive push against cloud giants like Amazon Web Services and Microsoft Azure.

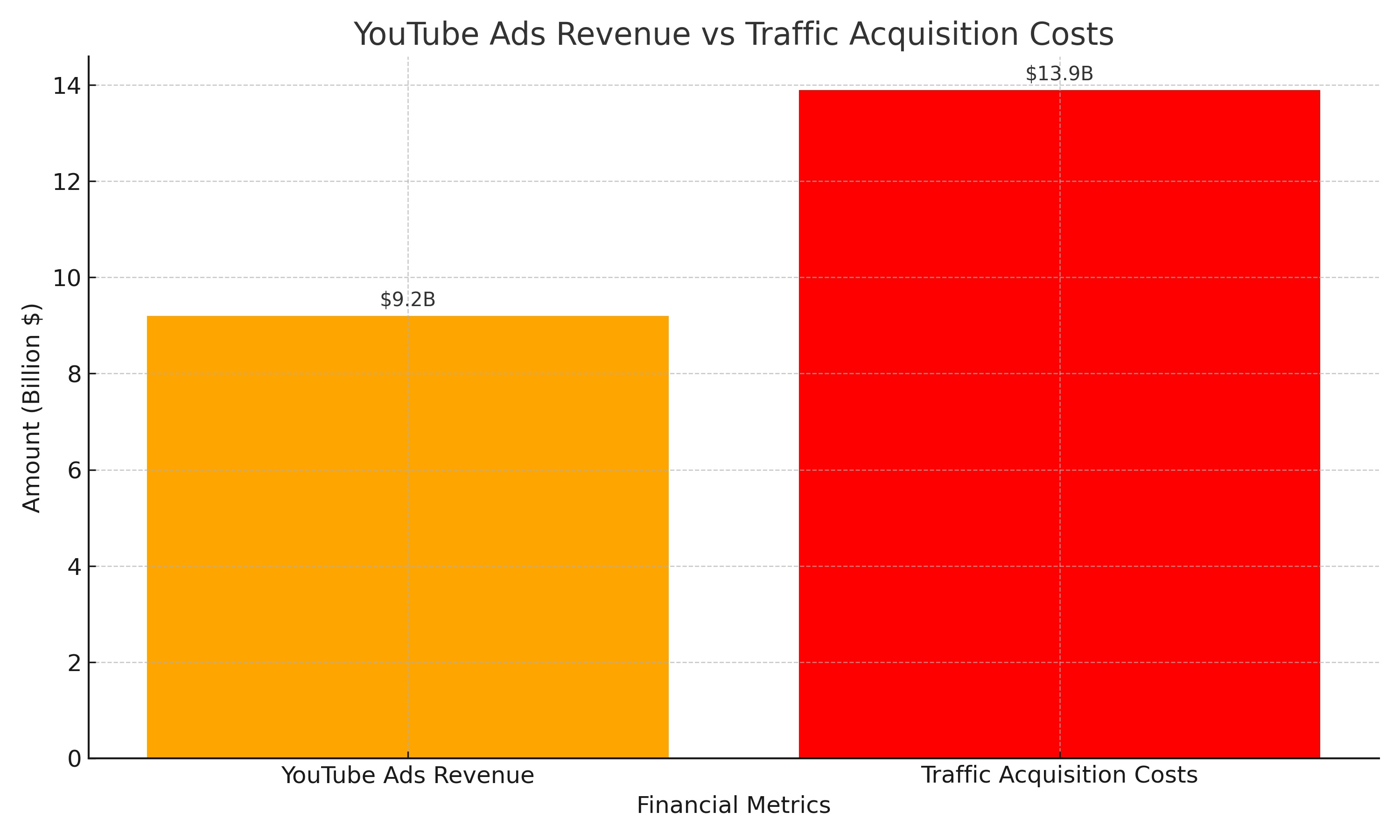

YouTube Ads and Traffic Acquisition Costs: A Mixed Bag

YouTube's ad revenue slightly missed expectations at $9.2 billion, a minor deviation that signals the platform's continued influence in digital media despite fierce competition from emerging platforms like TikTok. Meanwhile, Alphabet reported lower-than-expected traffic acquisition costs at $13.9 billion, indicating improved cost management and potentially higher margins.

Alphabet's AI Investments: Fueling Future Growth

Under CEO Sundar Pichai's leadership, Alphabet is doubling down on artificial intelligence (AI) investments, embedding generative AI tools across Google's product suite. The launch of the Gemini large language model signifies Alphabet's ambition to lead in AI innovation, promising to enhance customer applications through Google Cloud. These investments, however, come with a strategic cost, including workforce reductions and office exits, totaling charges of $3.9 billion for the year.

Insider Transactions and Stock Performance

Alphabet's financial strategies and AI investments are critical for investors analyzing insider transactions and stock performance. The company's commitment to innovation and strategic cost management can influence investor sentiment and stock valuation. For detailed insights into insider transactions, refer to Trading News' comprehensive analysis.

The Broader Tech Ecosystem: Microsoft, Amazon, and Meta

The tech landscape is witnessing a pivotal shift, with companies like Microsoft, Amazon, and Meta gearing up for their earnings releases. Microsoft's recent financials, despite exceeding expectations, also faced a lukewarm market response, indicating a broader trend of high investor expectations within the tech sector. The impending earnings from Amazon and Meta will further shape the competitive dynamics, particularly in cloud services and digital advertising.

Strategic Implications for Investors

For investors, Alphabet's latest financials underscore the importance of strategic diversification and AI investments in driving growth amidst market uncertainties. The company's robust performance in Google Cloud and strategic AI initiatives positions it well for future growth, despite short-term market reactions. As Alphabet navigates the evolving digital landscape, its strategic decisions will be crucial in sustaining growth and maintaining competitive edge.

Final Thoughts

Alphabet's journey through the latest quarter reveals a tech giant adeptly navigating the complexities of the digital advertising market, strategic AI investments, and cloud competition. While short-term market reactions reflect the volatile nature of tech investments, Alphabet's strategic positioning and growth drivers suggest a resilient outlook. For investors, understanding Alphabet's comprehensive financial and strategic dynamics is pivotal in assessing its long-term value proposition in the ever-evolving tech landscape.

Read More

-

QQQI ETF Price Forecast: $52.43, 14.22% Yield, Beating QQQ, $750B AI CapEx vs Fed Crash Stress Test

01.03.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Forecast: XRPI at $7.70, XRPR at $11.09, Weekly Inflows $9.55M, Cumulative $1.24B

01.03.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Forecast (NG1!, TTF): Hormuz Closure Threatens 20% of Global LNG, EU Storage at 31% — Buy

01.03.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Forecast: Yen Weakest Major at 158, Iran Safe-Haven Breaks Down on Energy Imports, Takaichi Election — Target 160

01.03.2026 · TradingNEWS ArchiveForex